State Of Michigan Taxes

Taxation is a fundamental aspect of any state's financial structure, and the State of Michigan is no exception. With a diverse economy and a range of industries, Michigan's tax system plays a crucial role in funding public services, infrastructure development, and economic initiatives. This article delves into the intricacies of Michigan's tax landscape, exploring the various types of taxes, their rates, and how they impact individuals and businesses within the state.

Understanding Michigan’s Tax Structure

The State of Michigan employs a comprehensive tax system designed to generate revenue for the state’s operations and public expenditures. This system encompasses a range of taxes, each tailored to different aspects of the state’s economy and societal needs. Here’s an overview of the key components of Michigan’s tax structure:

Individual Income Tax

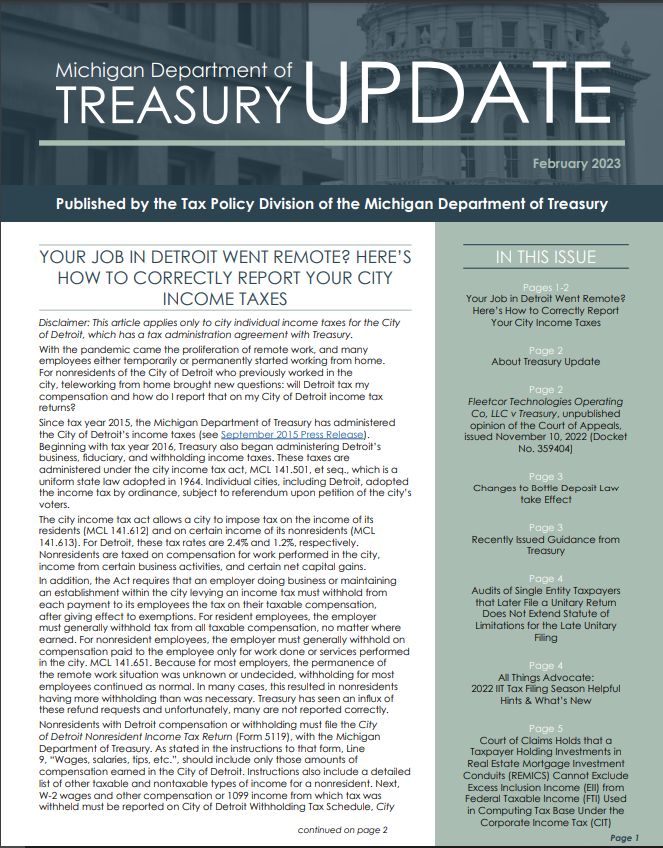

One of the primary sources of revenue for the state is the Individual Income Tax. Michigan’s income tax system operates on a flat rate basis, meaning all taxable income is taxed at a uniform rate. Currently, the state income tax rate in Michigan stands at 4.25%, making it relatively competitive compared to other states. However, it’s important to note that local income taxes can vary, with some municipalities imposing additional income tax rates.

The state offers a personal exemption of 4,600 for single filers and 9,200 for joint filers, which helps reduce the tax burden on individuals with lower incomes. Additionally, Michigan provides various tax credits, such as the Homestead Property Tax Credit and the Michigan Earned Income Tax Credit, to further alleviate the tax burden on eligible residents.

Corporate Income Tax

Businesses operating within Michigan are subject to Corporate Income Tax, which is imposed on the net income of corporations and limited liability companies (LLCs). The corporate income tax rate in Michigan is set at 6%, making it a significant source of revenue for the state. However, the state also offers various tax incentives and credits to attract and support businesses, such as the Michigan Business Tax Credit and the Michigan Strategic Fund initiatives.

To ensure fairness, Michigan has implemented a combined reporting system for corporate income tax, allowing related companies to file a single tax return. This system helps prevent tax avoidance and ensures that corporations pay their fair share.

Sales and Use Tax

Michigan imposes a Sales and Use Tax on the retail sale, lease, or rental of tangible personal property and some services. The state sales tax rate is set at 6%, with local municipalities having the authority to levy additional sales taxes, resulting in a combined rate that can vary across the state. The sales tax applies to a wide range of goods and services, including clothing, electronics, and restaurant meals.

To promote economic development, Michigan offers certain sales tax exemptions for specific industries and products. For instance, sales tax is not applicable to groceries, prescription drugs, and some manufacturing inputs.

Property Tax

Property taxes are a significant source of revenue for local governments in Michigan. The state’s property tax system is administered by local authorities, with tax rates varying across counties and municipalities. The average property tax rate in Michigan hovers around 1.5% of the taxable value of the property, which is typically 50% of the assessed value.

Michigan offers various property tax credits and exemptions to eligible homeowners, including the Homestead Property Tax Credit and the Principal Residence Exemption. These incentives aim to make homeownership more affordable for residents.

Other Taxes

In addition to the aforementioned taxes, Michigan levies several other taxes to generate revenue and support specific initiatives. These include:

- Intangibles Tax: Taxed on certain financial instruments and transactions.

- Use Tax: Applied to goods and services purchased out-of-state but used in Michigan.

- Estate Tax: Imposed on the transfer of property upon an individual’s death.

- Fuel Taxes: Levied on gasoline, diesel, and other fuels to fund road infrastructure.

Impact on Individuals and Businesses

Michigan’s tax structure has a profound impact on both individuals and businesses within the state. For individuals, the combination of income tax, sales tax, and property tax can significantly influence their financial planning and budgeting. The availability of tax credits and exemptions can provide much-needed relief, especially for low- and middle-income households.

Businesses, on the other hand, face a complex web of taxes, including corporate income tax, sales tax, and various industry-specific taxes. The state’s tax incentives and credits can be a crucial factor in business decision-making, influencing where companies choose to locate and operate.

Tax Incentives and Economic Development

Michigan has implemented a range of tax incentives and programs to attract businesses and foster economic growth. These initiatives often target specific industries, such as manufacturing, technology, and renewable energy, offering reduced tax rates, tax credits, and other financial benefits.

For instance, the Michigan Business Development Program provides tax credits and grants to businesses that create new jobs or invest in research and development. Similarly, the Michigan Strategic Fund offers tax abatements and incentives to encourage business expansion and job creation.

Challenges and Opportunities

While Michigan’s tax system provides a stable revenue stream for the state, it also presents challenges. The reliance on a flat income tax rate can lead to a heavier tax burden on middle- and low-income earners compared to states with progressive tax systems. Additionally, the variability of local sales and property tax rates can create complexities for businesses operating across multiple jurisdictions.

However, the state’s commitment to economic development and its diverse tax incentives create opportunities for businesses to thrive. By leveraging these incentives, companies can reduce their tax liabilities and invest in growth, innovation, and job creation.

Future Implications and Potential Reforms

As Michigan’s economy continues to evolve, the state’s tax system will need to adapt to changing circumstances and emerging trends. Here are some potential implications and reforms that could shape Michigan’s tax landscape in the future:

Income Tax Reform

There have been ongoing discussions about implementing a progressive income tax system in Michigan. Such a system would tax higher incomes at higher rates, potentially reducing the tax burden on lower- and middle-income earners. This reform could make Michigan’s tax system more equitable and in line with many other states.

Sales Tax Expansion

As consumer behavior shifts towards online shopping, Michigan may consider expanding its sales tax base to include more online transactions. This could involve working with major online retailers to collect and remit sales tax, ensuring a fair tax burden for both brick-and-mortar and online businesses.

Property Tax Reform

Property taxes are a critical source of revenue for local governments, but they can also be a significant burden for homeowners. Michigan may explore reforms to make property taxes more equitable and manageable. This could involve reassessing property values more frequently or implementing measures to limit property tax increases.

Tax Simplification

With a complex web of taxes and varying local rates, Michigan could benefit from tax simplification efforts. Standardizing tax rates and reducing the number of taxes could make the system more efficient and less burdensome for taxpayers and businesses.

Embracing Digital Economy

As the digital economy continues to grow, Michigan may need to adapt its tax system to accommodate new business models and technologies. This could involve revisiting tax policies related to e-commerce, digital services, and the sharing economy to ensure fair taxation and support innovation.

| Tax Type | Rate | Key Features |

|---|---|---|

| Individual Income Tax | 4.25% | Flat rate, personal exemptions, tax credits |

| Corporate Income Tax | 6% | Combined reporting, tax incentives |

| Sales and Use Tax | 6% (state), varies locally | Sales tax exemptions, use tax |

| Property Tax | ~1.5% (average) | Varies locally, property tax credits |

What is the current Individual Income Tax rate in Michigan?

+The current Individual Income Tax rate in Michigan is 4.25%.

Are there any sales tax exemptions in Michigan?

+Yes, Michigan offers sales tax exemptions for groceries, prescription drugs, and certain manufacturing inputs.

How do property taxes work in Michigan?

+Property taxes in Michigan are administered by local governments and vary across counties and municipalities. The average property tax rate is around 1.5% of the taxable value.

What tax incentives are available for businesses in Michigan?

+Michigan offers various tax incentives, including the Michigan Business Development Program and the Michigan Strategic Fund, which provide tax credits and grants to businesses that invest in job creation and economic development.

Are there any plans for tax reform in Michigan?

+Yes, there are ongoing discussions about implementing a progressive income tax system and expanding the sales tax base to include more online transactions. These reforms aim to make the tax system more equitable and adaptable to the digital economy.