Butte County Property Tax

Welcome to a comprehensive guide on Butte County Property Tax. This article will delve into the intricacies of property taxes in Butte County, California, providing valuable insights for homeowners, investors, and anyone interested in understanding the tax landscape. With a focus on the unique characteristics of Butte County, we aim to demystify the property tax process and offer expert advice.

Understanding Butte County Property Taxes

Property taxes are an essential part of homeownership and play a significant role in the financial obligations of residents. In Butte County, the property tax system operates within the framework set by the state of California, but it also has its own distinct features and assessment practices. Let’s explore the key aspects of property taxes in this vibrant county.

Assessment and Valuation

The assessment process in Butte County begins with the Butte-Glenn County Assessor’s Office. This office is responsible for determining the assessed value of each property within the county. The assessed value is a crucial factor in calculating property taxes, as it serves as the basis for tax rates and potential exemptions.

The Assessor's Office employs a combination of market analysis, property inspections, and sales data to arrive at an accurate assessment. This process ensures that property values are fair and reflect the current real estate market conditions. Homeowners can access their property's assessed value through the Butte-Glenn County Assessor's website, which provides detailed information on assessment practices and property records.

Butte County follows the Proposition 13 guidelines, a constitutional amendment that limits the annual increase in assessed value to no more than 2% or the inflation rate, whichever is lower. This ensures stability and predictability for homeowners, as their property taxes cannot increase drastically from one year to the next.

| Assessment Methodology | Description |

|---|---|

| Market Value Approach | The assessor analyzes recent sales of similar properties to determine the fair market value. |

| Income Approach | For income-producing properties, the assessor estimates potential rental income and expenses to determine value. |

| Cost Approach | The assessor considers the replacement cost of the property, subtracting depreciation, to arrive at a value. |

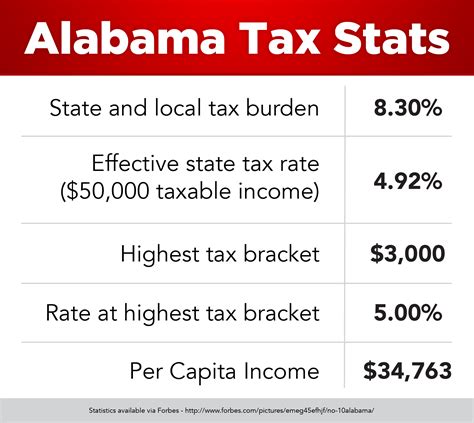

Tax Rates and Calculations

Property taxes in Butte County are calculated based on the assessed value of a property and the applicable tax rates. The tax rate is determined by a combination of factors, including the county’s general tax rate, special assessments, and any applicable voter-approved bonds or overrides.

The general tax rate in Butte County is set by the Butte County Board of Supervisors. This rate is applied uniformly to all taxable properties within the county. Additionally, there may be special assessments for services like fire protection, road maintenance, or infrastructure improvements. These assessments are levied by local agencies and are included in the overall property tax bill.

To calculate the property tax due, the assessed value is multiplied by the applicable tax rate. For example, if a property has an assessed value of $300,000 and the tax rate is 1.2%, the annual property tax would be $3,600.

Homeowners can access their tax rates and understand the breakdown of their property tax bill by visiting the Butte County Treasurer-Tax Collector's website. This resource provides detailed information on tax rates, assessment dates, and payment deadlines.

Exemptions and Relief Programs

Butte County offers a range of exemptions and relief programs to help eligible homeowners manage their property tax obligations. These programs aim to provide financial assistance to specific groups and promote homeownership.

- Homestead Exemption: This exemption reduces the assessed value of a primary residence by up to $100,000. It provides a significant tax savings for homeowners and is especially beneficial for those on fixed incomes.

- Senior Citizen Exemption: Senior citizens who meet certain income and residency requirements may qualify for a partial or full exemption on their property taxes. This program aims to support seniors in maintaining their homes as they age.

- Disabled Veteran Exemption: Disabled veterans may be eligible for an exemption of up to $150,000 on their primary residence. This exemption recognizes the sacrifices made by veterans and provides much-needed relief.

- Property Tax Postponement Program: Low-income seniors, blind, or disabled homeowners may postpone the payment of their property taxes until the property is sold or transferred. This program offers a safety net for those who may struggle with financial obligations.

It's important for homeowners to explore these exemption programs and understand their eligibility criteria. The Butte County Tax Assessor's Office provides detailed information on each program and assists homeowners in navigating the application process.

Navigating the Property Tax Process

Understanding the property tax process in Butte County is essential for effective financial planning and homeownership. Here are some key steps and considerations to keep in mind.

Assessment Notices and Appeals

Homeowners in Butte County receive annual assessment notices, which detail the assessed value of their property. These notices are typically mailed out in March or April. It is crucial to review these notices carefully, as they provide valuable information about the assessed value and any changes from the previous year.

If a homeowner believes that their property's assessed value is inaccurate or unfair, they have the right to appeal. The assessment appeal process allows homeowners to present evidence and argue for a lower assessed value. The Butte County Assessment Appeals Board reviews these appeals and makes decisions based on the presented evidence.

The appeal process typically involves completing an application, gathering supporting documentation, and attending a hearing. It's important to prepare a strong case and seek professional advice if needed. The Butte County Assessor's Office provides guidance and resources for homeowners navigating the appeal process.

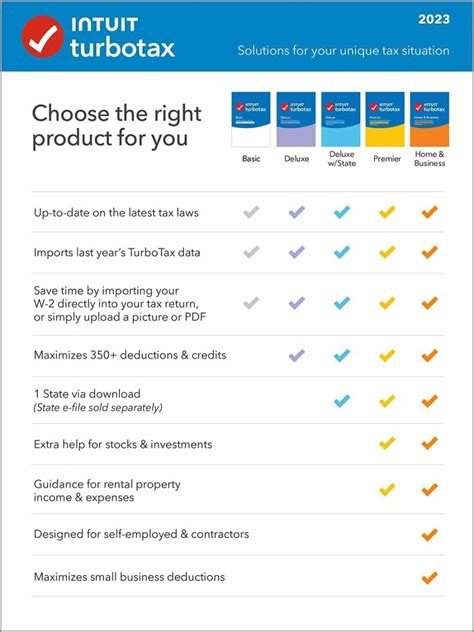

Payment Options and Deadlines

Property taxes in Butte County are due in two installments. The first installment is typically due in November, and the second installment is due in February. Homeowners have the option to pay their taxes in full or in two installments. It’s crucial to stay aware of the payment deadlines to avoid penalties and interest charges.

The Butte County Treasurer-Tax Collector offers various payment methods, including online payment, phone payment, and in-person payment at designated locations. Homeowners can also set up automatic payments to ensure timely payment without the worry of missed deadlines.

It's worth noting that property taxes are a lien on the property, and failure to pay can result in penalties and even the possibility of tax default proceedings. Therefore, staying informed and organized with tax payments is essential.

Tax Benefits and Strategies

Understanding the tax landscape in Butte County can lead to strategic decisions that optimize tax obligations. Here are some considerations:

- Home Improvements: Certain home improvements, such as energy-efficient upgrades or accessibility modifications, may qualify for tax credits or deductions. Researching these incentives can lead to tax savings.

- Property Transfers: When buying or selling a property, understanding the tax implications is crucial. In Butte County, there may be transfer taxes or recording fees involved. Consulting with a real estate professional or tax advisor can help navigate these complexities.

- Investment Properties: Investors with rental properties in Butte County should be aware of the additional tax considerations. Income from rental properties is taxable, and proper record-keeping is essential. Consulting a tax professional can help maximize deductions and minimize tax liability.

Staying informed about tax laws and seeking professional advice can lead to smarter financial decisions and potential tax savings.

Conclusion: Empowering Homeowners in Butte County

Property taxes are an essential aspect of homeownership, and understanding the process in Butte County empowers homeowners to make informed decisions. From assessment and valuation to tax calculations and exemption programs, each step contributes to the financial stability of homeowners in the county.

By providing detailed information and expert guidance, this guide aims to demystify property taxes and offer practical advice. Remember, staying informed, seeking professional advice when needed, and taking advantage of available resources are key to navigating the property tax landscape successfully. Butte County offers a supportive environment for homeowners, and with the right knowledge, managing property taxes becomes a manageable part of homeownership.

Frequently Asked Questions

How often are property values reassessed in Butte County?

+

Property values in Butte County are reassessed every year. The Assessor’s Office continuously monitors the real estate market and adjusts values accordingly. This annual assessment ensures that property taxes remain fair and up-to-date.

Can I contest my property’s assessed value if I disagree with it?

+

Yes, homeowners have the right to appeal their property’s assessed value if they believe it is inaccurate. The assessment appeal process allows for a formal review of the assessed value. It’s important to gather evidence and present a strong case to support your appeal.

What happens if I miss the property tax payment deadline?

+

Missing the property tax payment deadline can result in penalties and interest charges. It’s important to stay informed about payment deadlines and take advantage of the available payment options to avoid any financial repercussions.

Are there any tax breaks or incentives for energy-efficient homes in Butte County?

+

Yes, Butte County offers tax credits and incentives for homeowners who invest in energy-efficient upgrades. These incentives can include tax deductions for solar panels, energy-efficient appliances, and other qualified improvements. Consulting with a tax professional can help you explore these opportunities.

Can I receive assistance with property taxes if I’m a low-income senior or disabled homeowner?

+

Yes, Butte County provides relief programs for low-income seniors, blind, and disabled homeowners. These programs include the Property Tax Postponement Program, which allows eligible homeowners to postpone property tax payments until the property is sold or transferred. It’s important to review the eligibility criteria and apply for these programs if you qualify.