Bellingham Sales Tax

Welcome to Bellingham, Washington, a vibrant city nestled in the picturesque Pacific Northwest. As you explore the diverse businesses and attractions that Bellingham has to offer, it's important to understand the city's sales tax system and how it impacts your purchases. Sales tax can be a complex topic, but with the right information, you can navigate it with ease. This comprehensive guide will provide you with all the details you need to understand Bellingham's sales tax, including its rates, exemptions, and how it affects different industries and products.

Understanding Bellingham’s Sales Tax

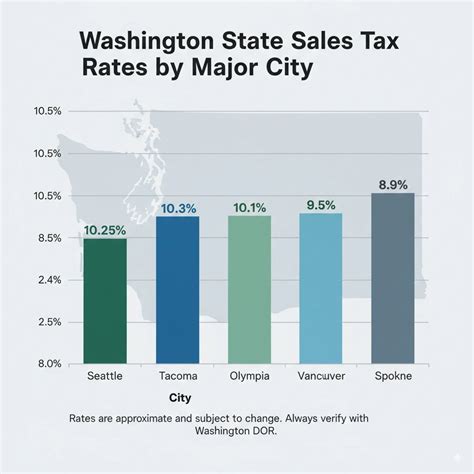

Bellingham, like many cities in Washington state, operates under a comprehensive sales tax system that applies to a wide range of goods and services. The sales tax in Bellingham is a combination of state, county, and city taxes, each with its own rate. Understanding these rates and how they are applied is crucial for both consumers and businesses.

The current sales tax rate in Bellingham is 10.50%, which is comprised of the following:

- State Sales Tax: 6.5%

- Whatcom County Sales Tax: 2.0%

- Bellingham City Sales Tax: 2.0%

This rate is subject to change, so it's always a good idea to check with the Washington State Department of Revenue for the most up-to-date information. Sales tax is calculated based on the total purchase price, including any applicable discounts or promotions.

Sales Tax Exemptions in Bellingham

While the sales tax in Bellingham applies to a wide range of goods and services, there are certain items that are exempt. These exemptions can vary depending on the state and local laws, so it’s important to stay informed.

Some common exemptions in Bellingham include:

- Grocery items (including non-prepared foods)

- Prescription medications

- Residential rent (although there are some exceptions for short-term rentals)

- Most medical devices and equipment

- Certain agricultural products

- Educational materials and textbooks

It's worth noting that even though these items are exempt from sales tax, businesses may still charge a separate fee or service charge. It's always a good idea to inquire about the pricing structure before making a purchase.

Impact on Different Industries

The sales tax in Bellingham affects various industries differently. Some industries may have specific exemptions or additional taxes applied, while others operate under the standard sales tax rate.

| Industry | Additional Taxes/Exemptions |

|---|---|

| Restaurant and Catering | A separate 10% restaurant meal tax is applied to prepared meals and catering services. This tax is in addition to the standard sales tax. |

| Hotels and Lodging | A 9.5% hotel/motel tax is applied to the cost of rooms in hotels, motels, and similar accommodations. This tax is exclusive of the standard sales tax. |

| Construction and Remodeling | Construction materials and equipment are generally subject to the standard sales tax rate. However, certain items like building permits may have additional fees. |

| Retail | Retail businesses in Bellingham operate under the standard sales tax rate. However, they must ensure proper tax collection and reporting to comply with state and local regulations. |

Sales Tax and Online Purchases

With the rise of e-commerce, it’s important to understand how sales tax applies to online purchases in Bellingham. When you purchase goods online, the sales tax is typically calculated based on the shipping destination. This means that if you are a Bellingham resident, the sales tax rate of 10.50% would apply to your online purchases.

However, there are some online retailers that may not collect sales tax, especially if they do not have a physical presence in Washington state. In such cases, it becomes the responsibility of the buyer to remit the appropriate sales tax to the state. This is known as "use tax," and it ensures that all purchases, whether online or in-store, are taxed fairly.

Sales Tax Compliance and Reporting

Sales tax compliance is a crucial aspect for businesses operating in Bellingham. Failure to collect and remit sales tax accurately can result in penalties and legal consequences. Here are some key considerations for businesses:

- Registration: All businesses that sell taxable goods or services in Bellingham must register with the Washington State Department of Revenue to obtain a business license and a sales tax permit.

- Collection: Businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This includes online sales, where applicable.

- Reporting: Sales tax collected must be reported to the Department of Revenue on a regular basis, typically monthly or quarterly. Timely and accurate reporting is essential to avoid penalties.

- Remittance: The sales tax collected must be remitted to the Department of Revenue by the due date. Late payments can incur interest and penalties.

It's important for businesses to maintain proper records and use reliable sales tax software to ensure compliance. Staying up-to-date with any changes in sales tax regulations is also crucial to avoid non-compliance issues.

Sales Tax Audits

The Washington State Department of Revenue may conduct sales tax audits to ensure businesses are complying with sales tax regulations. These audits can be random or triggered by certain activities, such as a significant increase in sales or changes in business operations.

During an audit, the Department of Revenue will review a business's sales records, tax returns, and other financial documents to verify the accuracy of sales tax reporting and collection. It's important for businesses to cooperate fully during an audit and provide all the necessary information.

Being prepared for a sales tax audit can help businesses avoid penalties and potential legal issues. Regularly reviewing sales tax records and ensuring compliance with the latest regulations is a best practice.

Future of Sales Tax in Bellingham

The sales tax landscape is constantly evolving, and Bellingham is no exception. As the city continues to grow and attract new businesses, the sales tax system may undergo changes to adapt to the changing economic climate.

One potential area of change is the increase in remote work and online sales. With more people working remotely and shopping online, the traditional brick-and-mortar sales tax model may need to be reevaluated. This could lead to the implementation of new tax structures or the expansion of existing ones to capture revenue from these emerging trends.

Additionally, as Bellingham continues to develop its tech industry and attract innovative startups, there may be discussions around sales tax incentives or exemptions to encourage economic growth and job creation. These incentives could take the form of tax breaks for certain industries or tax credits for businesses that meet specific criteria.

Another aspect to consider is the potential for sales tax automation. As technology advances, there may be opportunities to streamline the sales tax collection and reporting process, making it more efficient for businesses and reducing the risk of errors. This could involve the integration of sales tax software with e-commerce platforms or the development of innovative tax collection methods.

Overall, the future of sales tax in Bellingham is likely to be shaped by the city's economic growth, changing consumer behavior, and technological advancements. By staying informed and adapting to these changes, both consumers and businesses can navigate the sales tax system with confidence and ensure compliance with the latest regulations.

Are there any sales tax holidays in Bellingham?

+

Washington state does not observe sales tax holidays, so there are no specific days where sales tax is waived in Bellingham. However, some businesses may offer promotional sales or discounts throughout the year.

How often do sales tax rates change in Bellingham?

+

Sales tax rates in Bellingham can change periodically, usually as a result of legislative actions or budget decisions. It’s important to stay updated with the Washington State Department of Revenue for the latest information.

What happens if I make a mistake in my sales tax reporting?

+

If you discover a mistake in your sales tax reporting, it’s important to correct it as soon as possible. You can amend your tax return and remit any additional tax owed, along with any applicable penalties and interest. Contacting the Department of Revenue for guidance is recommended.