Are Taxes And Inflation The Same

Taxes and inflation are two distinct economic concepts that often come into play when discussing personal finance, investments, and the overall health of an economy. While they may seem unrelated at first glance, there are some intriguing connections and impacts that arise from their interplay. Understanding these concepts is crucial for individuals, businesses, and governments alike, as they shape financial decisions and influence economic policies.

This article aims to delve into the depths of taxes and inflation, exploring their definitions, mechanics, and the intricate relationship that exists between them. By unraveling these economic phenomena, we can gain valuable insights into their individual and collective effects on our financial well-being and the broader economy.

Understanding Taxes: A Comprehensive Overview

Taxes are mandatory financial charges imposed by governments on individuals and entities within their jurisdiction. These charges serve as a primary source of revenue for governments, enabling them to fund public services, infrastructure development, social welfare programs, and various other expenditures. The imposition and collection of taxes are governed by complex legal frameworks and administrative processes, ensuring fairness and compliance.

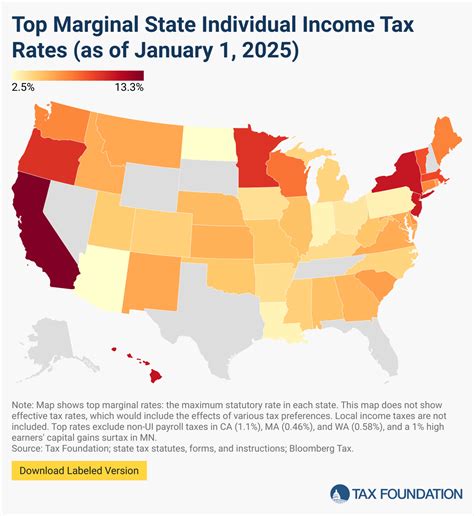

Tax systems vary significantly across countries, each with its own unique set of rules, rates, and exemptions. Common types of taxes include income tax, sales tax, value-added tax (VAT), property tax, and corporate tax, among others. The design and implementation of tax policies are shaped by a multitude of factors, including economic goals, social priorities, and political ideologies.

For individuals, taxes can have a direct impact on disposable income, savings, and investment decisions. Understanding tax brackets, deductions, and credits is essential for optimizing personal financial strategies. Similarly, businesses must navigate complex tax landscapes to minimize their tax liabilities and maximize profitability.

Tax Policies and Economic Growth

Tax policies play a pivotal role in shaping economic growth and development. Governments use tax incentives and reforms to stimulate investment, encourage entrepreneurship, and promote economic sectors deemed strategic. Conversely, tax increases or changes can have significant implications for businesses and individuals, potentially impacting their financial decisions and overall economic behavior.

For instance, a reduction in corporate tax rates can make a country more attractive to foreign investors, leading to increased capital inflows and job creation. On the other hand, high income tax rates may discourage work effort and incentivize tax avoidance, impacting the overall productivity of an economy.

The Role of Taxes in Redistribution

Taxation is a powerful tool for governments to address income inequality and promote social welfare. Progressive tax systems, where higher income earners pay a larger proportion of their income in taxes, are designed to redistribute wealth and provide financial support to vulnerable populations. These tax revenues fund social safety nets, healthcare systems, and educational initiatives, fostering social cohesion and economic stability.

Demystifying Inflation: Causes and Effects

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. It erodes the purchasing power of money, meaning each unit of currency buys fewer goods and services. While moderate inflation is often considered healthy for an economy, high or volatile inflation rates can have detrimental effects, leading to economic instability and uncertainty.

The causes of inflation are multifaceted and can be categorized into two main types: demand-pull inflation and cost-push inflation.

- Demand-Pull Inflation: This occurs when aggregate demand for goods and services exceeds the economy's capacity to supply them. As demand outstrips supply, producers can raise prices, leading to inflation. Factors contributing to demand-pull inflation include rapid economic growth, expansionary monetary policies, and government spending.

- Cost-Push Inflation: On the other hand, cost-push inflation arises when the costs of production increase, forcing producers to raise prices to maintain profit margins. This can be triggered by factors such as rising wages, higher raw material costs, or increased taxes on production inputs. Supply disruptions, such as those caused by natural disasters or geopolitical tensions, can also contribute to cost-push inflation.

The effects of inflation are far-reaching and can impact various aspects of the economy and individual finances. For savers, inflation erodes the value of their savings over time. Similarly, it reduces the real return on investments, particularly those with fixed rates of interest. Borrowers, however, may benefit from inflation as it reduces the real value of their debt over time.

Inflation and Monetary Policy

Central banks play a crucial role in managing inflation through monetary policy. By manipulating interest rates and controlling the money supply, central banks can influence inflation rates. A common strategy is to raise interest rates when inflation is high to cool down the economy and reduce demand. Conversely, lowering interest rates can stimulate economic activity and curb deflationary pressures.

Central banks often set inflation targets, aiming for a moderate and stable rate of inflation to foster economic growth and price stability. For example, the European Central Bank (ECB) targets an inflation rate close to, but below, 2% over the medium term.

Inflation’s Impact on Economic Decision-Making

Inflation can significantly influence economic decision-making by businesses and consumers. For businesses, inflation affects their cost structures and pricing strategies. Rising costs may necessitate passing on higher prices to consumers, potentially impacting demand and market share. Additionally, businesses must consider the real value of their assets and liabilities when making investment decisions, taking into account the eroding effect of inflation on their financial statements.

Consumers, too, are impacted by inflation. Rising prices can reduce their purchasing power, leading to changes in consumption patterns and financial planning. Understanding inflation expectations and trends is crucial for making informed financial decisions, such as when to make large purchases, invest in assets, or adjust savings and investment strategies.

The Interplay Between Taxes and Inflation

While taxes and inflation are distinct concepts, they are interconnected in various ways. The relationship between these two economic phenomena can have significant implications for individuals, businesses, and the overall economy.

Taxes as a Tool to Combat Inflation

Tax policies can be employed as a tool to combat inflation. For instance, increasing taxes on specific goods or services can help curb excessive demand, thereby reducing price pressures. Additionally, tax incentives can be used to encourage the production of essential goods, increasing supply and alleviating inflationary pressures.

During periods of high inflation, governments may also adjust tax brackets to account for the erosion of purchasing power. This ensures that taxpayers are not pushed into higher tax brackets solely due to inflation, maintaining the fairness and progressivity of the tax system.

Inflation’s Impact on Tax Revenues

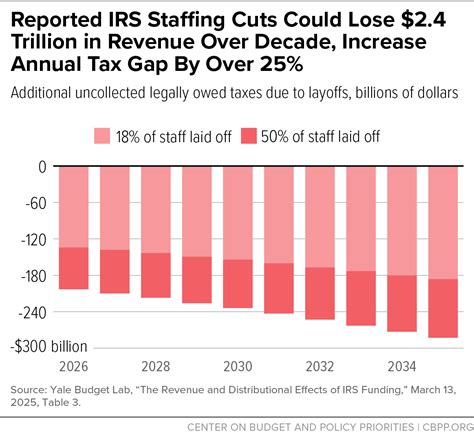

Inflation can have a significant impact on government tax revenues. As prices rise, the nominal value of taxable income and assets also increases. However, the real value of this income or assets may remain unchanged or even decrease due to the eroding effect of inflation. This can lead to a decrease in the real tax revenue collected by governments, impacting their ability to fund public services and meet fiscal targets.

Furthermore, inflation can distort the tax base, as some taxpayers may shift their income or assets into tax-advantaged vehicles to mitigate the effects of inflation on their wealth. This can result in a loss of tax revenue for governments and a need for policy adjustments to maintain fiscal sustainability.

Taxes and Inflation: A Complex Relationship

The relationship between taxes and inflation is complex and dynamic. While taxes can be used as a tool to manage inflation, they also interact with inflation in ways that can impact tax revenues and the overall economy. Understanding this intricate relationship is essential for policymakers, businesses, and individuals to make informed decisions and navigate the economic landscape effectively.

As we navigate the complexities of taxes and inflation, it becomes evident that these economic forces are deeply intertwined. By unraveling their individual and collective impacts, we can make more informed financial decisions, shape economic policies, and contribute to a more stable and prosperous economy.

Frequently Asked Questions

How do taxes impact economic growth and development?

+Tax policies can significantly influence economic growth and development. Lower corporate tax rates, for instance, can attract foreign investment and create jobs. Conversely, high income tax rates may discourage work effort and entrepreneurship. Taxes also fund critical infrastructure and social programs, contributing to long-term economic stability and development.

What are the primary causes of inflation?

+Inflation is primarily caused by either demand-pull factors (high demand outpacing supply) or cost-push factors (increased production costs). Rapid economic growth, expansionary monetary policies, and government spending can lead to demand-pull inflation. Cost-push inflation can arise from rising wages, higher raw material costs, or supply disruptions.

How do central banks manage inflation through monetary policy?

+Central banks use monetary policy tools, such as interest rates and money supply control, to manage inflation. During high inflation, they may raise interest rates to curb demand and cool down the economy. Conversely, lower interest rates can stimulate economic activity and address deflationary pressures. Central banks often set inflation targets to guide their monetary policy decisions.

What is the impact of inflation on personal finances?

+Inflation can reduce the purchasing power of individuals, impacting their savings and investment returns. It may also influence consumption patterns and financial planning decisions. Understanding inflation expectations is crucial for making informed choices about when to make large purchases, invest, or adjust savings strategies.