Alabama State Tax Refund Status

The Alabama State Tax Refund Status is a topic that concerns many residents of the state, especially during tax season. Understanding how to check the status of your tax refund is crucial to staying informed and ensuring a smooth process. This comprehensive guide will walk you through the steps, provide insights, and offer valuable information to make the process as transparent and efficient as possible.

Navigating the Alabama Tax Refund Process

The Alabama Department of Revenue handles state tax refunds, and their efficient system ensures a timely process. However, staying informed about the status of your refund is essential, especially if you’re expecting a significant amount or have specific financial obligations.

The process typically begins with the submission of your tax return, which can be done online or through traditional paper methods. Once the department receives your return, they initiate a series of checks and validations to ensure accuracy and compliance with state tax laws.

Online Tax Refund Status Inquiry

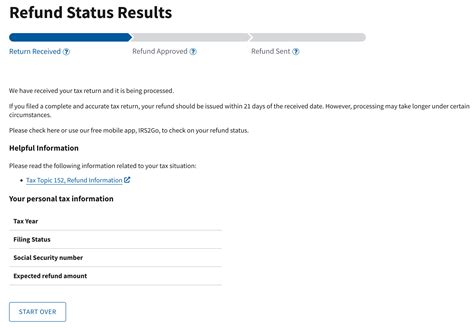

The most convenient way to check your Alabama State Tax Refund Status is through the department’s official website. Here’s a step-by-step guide:

-

Visit the Alabama Department of Revenue website at https://myalabama.revenue.alabama.gov/MyAlabama. This is the official portal for managing your tax-related affairs.

-

On the homepage, you'll find a section dedicated to Taxpayer Access Point (TAP). Click on the link that says "Check My Refund". This will direct you to the refund status inquiry page.

-

On this page, you'll need to enter specific details to access your refund information. These typically include your Social Security Number, Date of Birth, and the Tax Year for which you're inquiring.

-

After entering the required information, click on the "Submit" button. The system will process your request and display the current status of your refund.

The online system provides real-time updates, so you'll receive the most accurate information available. It's a quick and efficient way to stay informed without the need for phone calls or physical visits to tax offices.

Estimated Refund Timelines

Understanding the typical timeline for Alabama State Tax Refunds can help manage expectations. Here’s a breakdown:

| Submission Method | Estimated Refund Time |

|---|---|

| E-file with Direct Deposit | Within 7-10 business days |

| Paper Return with Direct Deposit | Within 4-6 weeks |

| Paper Return with Check | Up to 8 weeks |

These timelines are estimates and may vary based on individual circumstances and the complexity of your tax return. It's always a good idea to plan accordingly and allow for some buffer time, especially if you're awaiting a refund for financial obligations.

Common Issues and Troubleshooting

While the process is generally straightforward, there may be instances where you encounter issues with your Alabama State Tax Refund Status. Here are some common scenarios and potential solutions:

-

Refund Delays: If your refund is taking longer than expected, it could be due to various reasons. Common causes include errors or discrepancies in your tax return, missing information, or additional reviews required by the department. In such cases, it's advisable to contact the Alabama Department of Revenue for further guidance.

-

Incorrect Information: Ensure that the details you provide for your refund status inquiry are accurate. Mistakes in Social Security Numbers, dates, or tax years can lead to incorrect information. Double-check your entries to avoid such errors.

-

Technical Issues: Occasionally, the online system may experience technical glitches or downtime. If you encounter such issues, try again after some time or consider contacting the technical support team for assistance.

Staying informed and proactive can help mitigate potential issues and ensure a smooth refund process.

Conclusion: Staying Informed, Staying Empowered

Checking your Alabama State Tax Refund Status is an essential part of managing your financial affairs. By understanding the process, utilizing the online tools provided by the Alabama Department of Revenue, and being aware of potential issues, you can navigate the refund process with confidence. Stay informed, and don’t hesitate to reach out to the department for assistance if needed.

Frequently Asked Questions

Can I check my refund status without an online account?

+Yes, you can check your refund status without an online account. Simply visit the Alabama Department of Revenue website and click on the “Check My Refund” link. You’ll be prompted to enter your personal details to access the status.

What if my refund status shows “Pending” for an extended period?

+If your refund status remains “Pending” for an extended period, it’s advisable to contact the Alabama Department of Revenue. They can provide specific insights into your refund’s progress and offer guidance on potential next steps.

Are there any fees associated with checking my refund status online?

+No, there are no fees associated with checking your refund status online. The Alabama Department of Revenue provides this service free of charge to ensure transparency and accessibility for taxpayers.

Can I track my refund if I filed a paper return?

+Yes, you can track your refund status even if you filed a paper return. The online system is designed to accommodate both electronic and traditional filing methods. Simply enter your details as prompted to access the status.

What should I do if I think there’s an error in my refund amount?

+If you suspect an error in your refund amount, it’s important to contact the Alabama Department of Revenue promptly. They can investigate the issue and provide guidance on resolving any discrepancies.