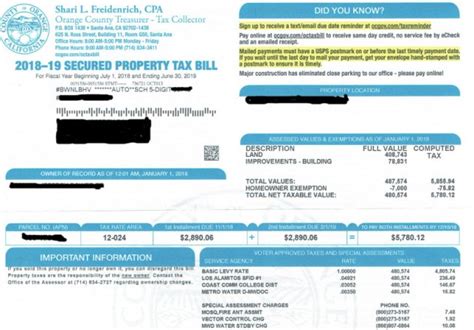

Orange County Tax Collector Ca

The Orange County Tax Collector (OCTC) is a vital government entity in the vibrant and bustling Orange County, Florida. As one of the most populous counties in the state, Orange County plays a crucial role in Florida's economy and community life. The Tax Collector's office, headed by the elected Tax Collector, serves as a key administrative body, managing a range of financial and regulatory responsibilities that significantly impact the lives of residents and businesses alike.

This article aims to delve into the diverse functions and responsibilities of the Orange County Tax Collector, exploring its historical evolution, current operations, and future prospects. By understanding the critical role this office plays, we can appreciate the intricate workings of local government and its impact on our daily lives.

A Historical Perspective: The Evolution of the Orange County Tax Collector

The office of the Tax Collector in Orange County, Florida, has a rich history that reflects the county's growth and development. Established in the early 20th century, the role of the Tax Collector was primarily focused on collecting property taxes and ensuring compliance with state tax laws.

Over the decades, the responsibilities of the OCTC have expanded significantly. With the rapid growth of Orange County, especially after World War II, the Tax Collector's office had to adapt to handle a broader range of duties. This period saw the introduction of new tax laws and regulations, such as the implementation of vehicle registration and licensing, which added to the OCTC's portfolio.

The 1970s and 1980s brought further changes. As the county's population exploded with the rise of tourism and the influx of new residents, the Tax Collector's office had to streamline its processes to efficiently serve a larger constituency. During this time, the OCTC began to utilize new technologies, such as computer systems, to manage the increasing volume of transactions and information.

The 21st century has seen the OCTC continue to evolve, adopting digital technologies to provide more efficient and accessible services. Online platforms now allow residents to pay taxes, register vehicles, and access various other services from the comfort of their homes. This digital transformation has not only improved convenience but has also enhanced transparency and accountability in the tax collection process.

Core Responsibilities and Services Offered by the Orange County Tax Collector

The Orange County Tax Collector plays a multifaceted role, offering a wide array of services to residents and businesses. Here's an overview of its core responsibilities:

Tax Collection and Administration

The primary function of the OCTC is the collection and administration of various taxes. This includes property taxes, which are a significant source of revenue for the county and are used to fund essential services like schools, fire departments, and infrastructure projects. The OCTC ensures timely collection and accurate distribution of these taxes, in compliance with state and local laws.

The office also collects other types of taxes, such as tangible personal property taxes, which are levied on certain types of business assets, and tourist development taxes, which are collected from visitors to fund tourism-related projects and infrastructure.

Vehicle Registration and Titling

The OCTC is responsible for registering vehicles and issuing titles in Orange County. This process involves verifying ownership, collecting registration fees, and ensuring that vehicles meet the necessary safety and emission standards. The office also processes title transfers, registrations for new vehicles, and renewals for existing vehicles.

Driver License and Identification Services

While the primary responsibility for issuing driver licenses lies with the Florida Department of Highway Safety and Motor Vehicles (FLHSMV), the OCTC acts as an agent for FLHSMV, providing a range of driver license and identification services. This includes issuing or renewing driver licenses, state ID cards, and specialty licenses like hunting and fishing licenses.

Boat Registration and Titling

Similar to vehicle registration, the OCTC handles the registration and titling of boats in Orange County. This involves collecting registration fees, verifying ownership, and ensuring compliance with safety and environmental regulations.

Business Tax Receipts

Businesses operating in Orange County are required to obtain a Business Tax Receipt, often referred to as an occupational license. The OCTC is responsible for issuing these receipts, which are necessary for a business to legally operate within the county. The office ensures that businesses are registered and pay the appropriate fees, which contribute to the county's revenue.

Community Outreach and Education

The OCTC also plays an important role in community outreach and education. The office provides resources and information to help residents and businesses understand their tax obligations and navigate the various services offered. This includes offering workshops, seminars, and online resources to ensure that taxpayers are well-informed and compliant.

Performance Analysis and Future Prospects

The Orange County Tax Collector's office has consistently demonstrated its commitment to efficient and effective service delivery. Here's a look at its performance and some insights into its future trajectory:

Performance Metrics

| Metric | Performance |

|---|---|

| Tax Collection Efficiency | The OCTC consistently achieves high collection rates, ensuring that the county receives its due revenues in a timely manner. |

| Customer Satisfaction | Surveys indicate high levels of satisfaction with the services provided by the OCTC, particularly in recent years with the introduction of online services. |

| Response Time | The office maintains quick response times for inquiries and services, with most transactions processed within a few business days. |

| Error Rate | The OCTC maintains a low error rate, ensuring accuracy in tax calculations and document processing. |

Future Initiatives and Challenges

Looking ahead, the OCTC faces both opportunities and challenges. With the continued growth of Orange County, the office will need to adapt to handle an increasing volume of transactions. This includes investing in new technologies to streamline processes and enhance security measures to protect taxpayer data.

The OCTC also has an opportunity to further enhance its online services, making them more user-friendly and accessible. This could include the introduction of mobile apps and further integration with other government services, creating a seamless experience for taxpayers.

Additionally, the office will need to navigate changes in tax laws and regulations, ensuring compliance while also providing clear guidance to taxpayers. This will require a dedicated team of professionals who are well-versed in the evolving tax landscape.

In conclusion, the Orange County Tax Collector's office plays a critical role in the administration and financial management of the county. Its historical evolution, current operations, and future prospects demonstrate a commitment to serving the community efficiently and effectively. As Orange County continues to grow and evolve, the OCTC will remain a vital part of the county's infrastructure, ensuring the smooth functioning of local government and the delivery of essential services.

How can I pay my taxes to the Orange County Tax Collector?

+

You can pay your taxes to the OCTC through various methods, including online payment through their website, by mail, in person at one of their offices, or via telephone. The OCTC offers convenient payment options to ensure taxpayers can choose the method that best suits their needs.

What services does the OCTC provide for businesses operating in Orange County?

+

The OCTC provides a range of services for businesses, including issuing Business Tax Receipts (occupational licenses), collecting taxes on business assets (tangible personal property taxes), and offering guidance on tax obligations and compliance. They also provide resources and support for businesses navigating the various tax and regulatory requirements.

How can I obtain a driver’s license or state ID through the OCTC?

+

To obtain a driver’s license or state ID through the OCTC, you’ll need to visit one of their offices and bring the required documents, such as proof of identity, Social Security number, and residency. The OCTC acts as an agent for the Florida Department of Highway Safety and Motor Vehicles, providing these services on their behalf. Appointments are often required, so it’s best to check their website for specific requirements and availability.

What is the role of the OCTC in vehicle registration and titling?

+

The OCTC is responsible for registering vehicles and issuing titles in Orange County. This includes verifying ownership, collecting registration fees, and ensuring that vehicles meet the necessary safety and emission standards. They also process title transfers, registrations for new vehicles, and renewals for existing vehicles.