Alabama Income Tax

Alabama's income tax system is a crucial component of the state's revenue generation and plays a significant role in shaping its economic landscape. Understanding the intricacies of Alabama's income tax laws is essential for individuals and businesses operating within the state. This comprehensive guide aims to delve into the specifics of Alabama's income tax, providing an in-depth analysis of its structure, rates, deductions, and implications for taxpayers.

Unraveling Alabama’s Income Tax Structure

Alabama’s income tax system operates on a graduated rate structure, meaning that the tax rate increases as taxable income rises. This progressive taxation approach ensures that individuals and businesses with higher incomes contribute a larger proportion of their earnings to the state’s revenue.

The current income tax rates in Alabama are as follows:

| Taxable Income Bracket | Tax Rate |

|---|---|

| $0 - $500 | 2% |

| $501 - $3,000 | 4% |

| $3,001 - $5,000 | 5% |

| $5,001 and above | 6% |

These rates are applicable for both individual and corporate taxpayers. It's important to note that Alabama's income tax system is separate from federal income taxes, and individuals must calculate and report their state and federal taxes independently.

Taxable Income and Exemptions

Alabama defines taxable income as the total income earned within the state, excluding certain exemptions and deductions. The state allows for personal exemptions, which reduce the taxable income for individuals and families. For the 2023 tax year, the personal exemption amount is set at 3,000 for single filers and 6,000 for joint filers.

Additionally, Alabama offers a standard deduction of $4,000 for single filers and $8,000 for joint filers. Taxpayers can opt for the standard deduction or itemize their deductions, choosing the method that results in a lower taxable income.

Income Sources and Taxation

Alabama’s income tax applies to various sources of income, including wages, salaries, bonuses, and commissions. Self-employment income, investment earnings, and capital gains are also subject to taxation. The state’s tax laws treat different income streams differently, and understanding these distinctions is crucial for accurate tax reporting.

For instance, Alabama has a hall income tax, which specifically targets income derived from mineral royalties and similar sources. This tax is imposed at a rate of 12%, separate from the general income tax rates. Additionally, Alabama imposes a severance tax on the production and sale of natural resources, further contributing to the state's revenue stream.

Deductions and Credits: Navigating Alabama’s Tax Relief

Alabama provides a range of deductions and tax credits to alleviate the tax burden for eligible taxpayers. These incentives aim to promote economic growth, encourage investment, and support specific sectors or individuals.

Common Deductions

- Medical Expenses: Alabama allows taxpayers to deduct qualifying medical and dental expenses that exceed a certain threshold. This deduction can be beneficial for individuals with substantial healthcare costs.

- Property Taxes: Property owners in Alabama can deduct a portion of their property taxes from their taxable income, providing some relief on this significant expense.

- Charitable Contributions: Charitable donations made to eligible organizations are deductible, encouraging taxpayers to support charitable causes while reducing their tax liability.

Tax Credits

Alabama offers a variety of tax credits to incentivize specific activities or support vulnerable populations. Some notable tax credits include:

- Low-Income Tax Credit: Aimed at providing relief to low-income individuals and families, this credit reduces the tax liability for those with limited financial means.

- Research and Development Tax Credit: Businesses engaged in research and development activities can claim this credit, promoting innovation and technological advancement in the state.

- Historic Preservation Tax Credit: This credit encourages the preservation and restoration of historic properties, contributing to Alabama's cultural heritage.

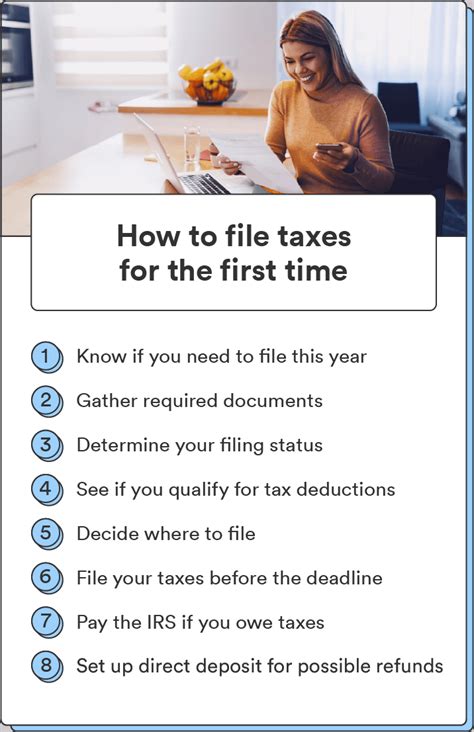

Compliance and Reporting: Navigating Alabama’s Tax Landscape

Navigating Alabama’s tax system requires adherence to specific reporting requirements and compliance with state tax laws. Failure to comply can result in penalties and interest charges, impacting a taxpayer’s financial well-being.

Tax Filing Deadlines

Individual taxpayers in Alabama must file their state income tax returns by April 18th each year. For corporate taxpayers, the deadline is March 15th. It’s essential to note that these deadlines may vary for specific circumstances, such as extensions or special filing situations.

Payment Options and Withholding

Alabama offers various payment options for taxpayers, including electronic funds transfer, credit card payments, and traditional check or money order methods. Employers are required to withhold income taxes from employee wages, ensuring a steady stream of revenue for the state.

Tax Amendments and Refunds

If a taxpayer discovers errors or omissions in their tax return, they can file an amended return to correct the mistakes. Alabama’s tax authority, the Department of Revenue, processes these amendments and issues refunds if applicable. It’s crucial to handle amendments promptly to avoid potential penalties.

Economic Impact and Future Prospects

Alabama’s income tax system plays a pivotal role in the state’s economic landscape. The revenue generated from income taxes contributes significantly to funding public services, infrastructure development, and social programs.

As Alabama continues to evolve economically, the state's tax policies are likely to adapt to meet the changing needs of its residents and businesses. Future reforms may include adjustments to tax rates, expansions of tax credits, or alterations to the tax structure to encourage investment and foster economic growth.

Staying informed about Alabama's income tax laws and their potential changes is essential for individuals and businesses to optimize their financial strategies and contribute effectively to the state's economic prosperity.

What is the current income tax rate for individuals in Alabama?

+

The current income tax rate for individuals in Alabama is 6% for taxable income above 5,000. However, there are lower rates for income brackets below 5,000, ranging from 2% to 5%.

Are there any tax credits available in Alabama for individuals or businesses?

+

Yes, Alabama offers various tax credits to incentivize specific activities. Some common credits include the Low-Income Tax Credit, Research and Development Tax Credit, and the Historic Preservation Tax Credit.

What are the key deductions allowed in Alabama’s income tax system?

+

Alabama allows deductions for medical expenses, property taxes, and charitable contributions. These deductions can significantly reduce taxable income and lower an individual’s or business’s tax liability.