2025 Tax Computation Worksheet

Welcome to our comprehensive guide on the 2025 Tax Computation Worksheet. As we navigate the complexities of tax season, it's crucial to have a clear understanding of the tools and processes involved. This article aims to provide an in-depth analysis of the 2025 Tax Computation Worksheet, offering insights and guidance to ensure a seamless and accurate tax filing experience. Let's delve into the world of tax computation and explore the intricacies of this essential financial document.

Understanding the 2025 Tax Computation Worksheet

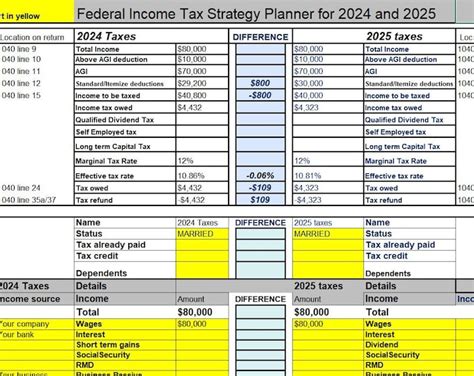

The 2025 Tax Computation Worksheet is a vital component of your tax preparation journey. It serves as a detailed roadmap, guiding you through the calculation of your taxable income, deductions, credits, and ultimately, your tax liability for the year 2025. This worksheet is designed to simplify the often daunting task of tax computation, providing a structured framework to ensure precision and accuracy.

By utilizing this worksheet, taxpayers can systematically input their financial information, ranging from income sources to eligible deductions and credits. This step-by-step process ensures that no stone is left unturned, and all relevant factors are considered in the tax computation. Whether you're a seasoned taxpayer or a first-time filer, the 2025 Tax Computation Worksheet offers a user-friendly approach to navigating the complexities of tax laws and regulations.

Key Features and Benefits

- Structured Format: The worksheet provides a well-organized layout, guiding taxpayers through each step of the computation process. This structured approach minimizes the risk of errors and ensures a comprehensive overview of your financial situation.

- Income Categorization: The worksheet allows for the categorization of various income sources, including wages, self-employment earnings, investments, and more. This enables taxpayers to account for all forms of income accurately.

- Deduction and Credit Analysis: With dedicated sections for deductions and credits, the worksheet facilitates a thorough examination of eligible expenses and tax-saving opportunities. This includes deductions for medical expenses, charitable contributions, and various tax credits, such as the Child Tax Credit or the Earned Income Tax Credit.

- Interactive Calculations: The 2025 Tax Computation Worksheet incorporates interactive calculations, automatically computing tax liabilities and providing real-time adjustments as taxpayers input their data. This dynamic feature simplifies the tax computation process, ensuring accurate results without the need for manual calculations.

Navigating the Worksheet: A Step-by-Step Guide

To make the most of the 2025 Tax Computation Worksheet, it’s essential to follow a systematic approach. Here’s a detailed breakdown of the key steps involved in utilizing this valuable tool.

Step 1: Gather Relevant Documents

Before you begin, ensure you have all the necessary documentation at hand. This includes W-2 forms for wages, 1099 forms for independent contracting or investment income, and any other income-related documents. Additionally, gather records of your expenses, such as medical bills, charitable donation receipts, and records of qualifying tax credits.

Step 2: Input Personal Information

Start by entering your personal details, including your full name, Social Security Number, and filing status (single, married filing jointly, etc.). This foundational information sets the stage for the subsequent computations.

Step 3: Calculate Total Income

Utilize the worksheet’s dedicated sections to input your various income sources. This includes wages, salaries, tips, self-employment earnings, and any other taxable income. The worksheet will guide you through the process, ensuring that all income is accounted for accurately.

Step 4: Itemize Deductions and Credits

Explore the deductions and credits section of the worksheet. Here, you can input eligible deductions, such as medical expenses, state and local taxes, and mortgage interest. Additionally, claim any applicable tax credits, including the Child Tax Credit or the Credit for Other Dependents. The worksheet provides clear instructions and examples to assist you in maximizing your tax benefits.

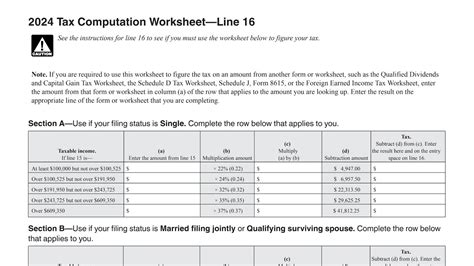

Step 5: Compute Tax Liability

Once you’ve entered all relevant information, the worksheet will automatically calculate your tax liability based on your income, deductions, and credits. This dynamic feature provides an instant snapshot of your tax obligations, helping you understand your financial position.

Step 6: Review and Verify

Take the time to review the computed results. Ensure that all entries are accurate and reflect your financial situation truthfully. Double-check the calculations and verify that the tax liability aligns with your expectations. If any discrepancies arise, review the worksheet thoroughly to identify and rectify any errors.

Maximizing Tax Benefits: Tips and Strategies

To make the most of your tax computation process, consider the following tips and strategies. These insights can help you optimize your tax situation and potentially reduce your tax liability.

Explore Tax-Advantaged Accounts

Consider contributing to tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or Health Savings Accounts (HSAs). These accounts offer tax benefits, allowing you to save for retirement or healthcare expenses while reducing your taxable income.

Optimize Deductions and Credits

Review the eligibility criteria for various deductions and credits. For instance, if you have qualifying medical expenses, ensure you claim the Medical Expense Deduction. Similarly, if you have eligible dependents, explore the Child Tax Credit and the Credit for Other Dependents to maximize your tax savings.

Take Advantage of Tax Credits for Education

If you or your dependents are pursuing higher education, consider claiming the American Opportunity Tax Credit or the Lifetime Learning Credit. These credits can significantly reduce your tax liability and provide financial support for educational expenses.

Plan for Retirement Contributions

Maximize your retirement savings by contributing to employer-sponsored retirement plans, such as 401(k)s or 403(b)s. These contributions are often tax-deductible, allowing you to reduce your taxable income and save for your retirement simultaneously.

Future Implications and Tax Planning

As we look ahead to the tax landscape of 2025, it’s essential to consider the potential implications and opportunities for tax planning. While specific tax laws and regulations may evolve, certain strategies remain relevant and can help you optimize your financial position.

Stay Informed on Tax Law Changes

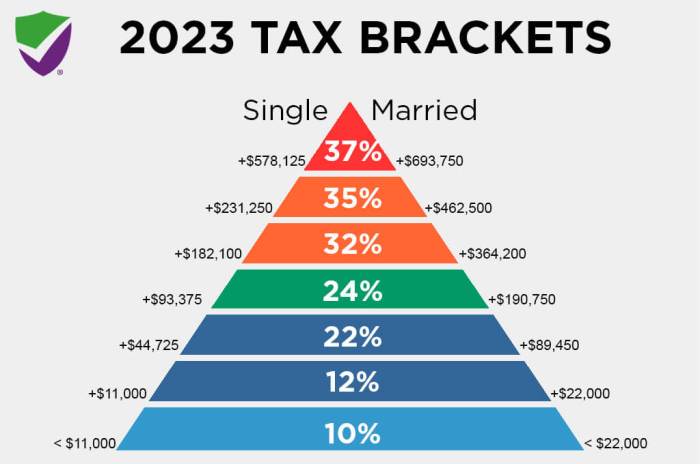

Keep abreast of any changes in tax laws and regulations. Stay updated on modifications to tax brackets, deductions, and credits to ensure your tax computation remains accurate and compliant with the latest guidelines.

Consider Long-Term Tax Strategies

Engage in long-term tax planning by reviewing your financial goals and objectives. Consider strategies such as tax-efficient investing, estate planning, and charitable giving to optimize your tax situation over the long haul. Consulting with a financial advisor or tax professional can provide valuable insights tailored to your specific circumstances.

Explore Tax-Efficient Investment Options

Evaluate tax-efficient investment options, such as municipal bonds or tax-exempt mutual funds. These investments can provide competitive returns while offering tax advantages, helping you maximize your after-tax income.

| Tax Computation Worksheet | Tax Planning |

|---|---|

| Accurate income calculation | Maximizing tax-advantaged accounts |

| Claiming eligible deductions | Exploring tax credits for education |

| Interactive tax liability computation | Long-term tax strategy development |

What is the purpose of the 2025 Tax Computation Worksheet?

+The 2025 Tax Computation Worksheet is designed to assist taxpayers in calculating their taxable income, deductions, credits, and ultimately, their tax liability for the year 2025. It provides a structured framework to ensure an accurate and comprehensive tax computation.

How do I access the 2025 Tax Computation Worksheet?

+The 2025 Tax Computation Worksheet can be obtained from official government websites or through reputable tax preparation software providers. Ensure you download the latest version to stay up-to-date with any tax law changes.

Can I use the 2025 Tax Computation Worksheet for previous tax years?

+No, the 2025 Tax Computation Worksheet is specific to the tax year 2025. It is essential to use the appropriate worksheet for the relevant tax year to ensure compliance with the latest tax laws and regulations.

What if I have multiple sources of income? How do I input them accurately?

+If you have multiple income sources, the 2025 Tax Computation Worksheet provides dedicated sections for each type of income. Ensure you input all income sources accurately, including wages, self-employment earnings, investment income, and any other taxable income.

Are there any tax-saving strategies I can employ while using the worksheet?

+Absolutely! While using the 2025 Tax Computation Worksheet, explore tax-advantaged accounts, maximize eligible deductions and credits, and consider tax-efficient investment options. These strategies can help reduce your taxable income and optimize your tax situation.