Tax

Www.acgov.org Property Tax

Property taxes are an essential aspect of homeownership, and understanding the process can help you navigate the system with confidence. Whether you’re a new homeowner or seeking to optimize your tax obligations, this comprehensive guide will shed light on the key aspects of property taxation.

<h2>Understanding Property Tax Assessment</h2>

<p>Property tax assessment is the process by which the government determines the value of your property for tax purposes. This value, known as the <strong>assessed value</strong>, serves as the basis for calculating your property tax liability. The assessment takes into account various factors, including:</p>

<ul>

<li><strong>Market Value:</strong> The current market value of your property is a crucial consideration. It reflects the price at which your property would likely sell in an open market.</li>

<li><strong>Property Characteristics:</strong> The size, age, location, and any unique features of your property are taken into account. These factors influence the overall assessment.</li>

<li><strong>Local Real Estate Trends:</strong> Property assessors consider the trends in the local real estate market. Rapidly rising property values in your area may lead to an increase in your assessed value.</li>

</ul>

<p>It's important to note that the assessed value may not always align with the market value of your property. This discrepancy can impact your tax liability and is worth understanding.</p>

<h3>Factors Influencing Property Assessment</h3>

<p>Property assessment is a complex process, and several factors come into play. Here's a breakdown of some key considerations:</p>

<ul>

<li><strong>Sales Comparison Approach:</strong> Assessors often compare your property to similar ones that have recently sold in your area. This method helps determine the fair market value.</li>

<li><strong>Income Approach:</strong> If your property generates income, such as rental income, assessors may use the income approach to estimate its value. This method considers the property's potential to generate revenue.</li>

<li><strong>Cost Approach:</strong> The cost approach estimates the value of your property by considering the cost of constructing a similar property today, minus any depreciation.</li>

</ul>

<h2>Appealing Your Property Tax Assessment</h2>

<p>If you believe your property's assessed value is inaccurate or unfair, you have the right to appeal. The process of appealing your assessment involves gathering evidence and presenting a strong case to the appropriate authority. Here's a step-by-step guide:</p>

<ol>

<li><strong>Research and Gather Information:</strong> Start by thoroughly researching recent property sales in your area. Look for properties similar to yours that have sold for significantly lower prices. This information will be crucial in building your case.</li>

<li><strong>Identify Assessment Errors:</strong> Carefully review your assessment notice for any potential errors. Common mistakes include incorrect property details, such as the size or number of rooms, or outdated information.</li>

<li><strong>Document Your Findings:</strong> Compile all the evidence you've gathered, including property sales data, photos, and any documentation supporting your claim. Organize this information in a clear and concise manner.</li>

<li><strong>File an Appeal:</strong> Follow the procedures outlined by your local tax authority to file an appeal. Typically, you'll need to submit a formal request, along with your supporting evidence, within a specified timeframe.</li>

<li><strong>Prepare for a Hearing:</strong> If your appeal is accepted, you may be invited to attend a hearing. Prepare your arguments and be ready to present your case confidently. Consider seeking professional advice if needed.</li>

</ol>

<p>Remember, appealing your assessment requires careful preparation and a solid understanding of the process. It's essential to approach the appeal with a well-thought-out strategy.</p>

<h3>Tips for a Successful Appeal</h3>

<p>Maximizing your chances of a successful appeal often involves these key strategies:</p>

<ul>

<li><strong>Engage Professional Help:</strong> Consider hiring a property tax consultant or attorney who specializes in assessment appeals. Their expertise can be invaluable in navigating the complex legal and procedural aspects.</li>

<li><strong>Stay Organized:</strong> Keep all your documents and evidence organized and easily accessible. This will make it simpler to refer to them during the appeal process.</li>

<li><strong>Be Proactive:</strong> Don't wait until the last minute to start your appeal. Begin gathering evidence and preparing your case as soon as you receive your assessment notice.</li>

</ul>

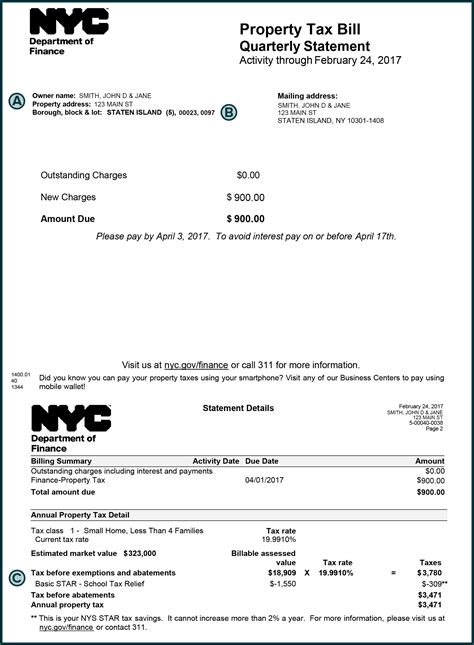

<h2>Property Tax Payment Options and Deadlines</h2>

<p>Understanding your payment options and deadlines is crucial to avoid penalties and maintain a positive relationship with the tax authority. Here's an overview:</p>

<h3>Payment Methods</h3>

<ul>

<li><strong>Online Payment:</strong> Many tax authorities offer convenient online payment options. You can make secure payments through their website using your bank account or credit card.</li>

<li><strong>Mail-In Payment:</strong> If you prefer a traditional approach, you can mail your tax payment along with the provided remittance slip. Ensure you allow sufficient time for processing.</li>

<li><strong>In-Person Payment:</strong> Some jurisdictions provide the option to pay your taxes in person at designated tax offices. This method may be more time-consuming but offers a personal touch.</li>

</ul>

<h3>Payment Deadlines</h3>

<p>Property tax deadlines vary depending on your location. It's crucial to stay informed about the specific dates applicable to your area. Missing a deadline can result in late fees and penalties.</p>

<h3>Penalty Fees and Interest</h3>

<p>Late payments typically incur penalty fees and interest. These additional charges can quickly accumulate, so it's best to avoid them by staying on top of your payment schedule.</p>

<h2>Managing Your Property Tax Obligations</h2>

<p>Effectively managing your property tax obligations involves more than just making timely payments. Here are some strategies to consider:</p>

<ul>

<li><strong>Budgeting:</strong> Incorporate property taxes into your monthly or annual budget. This ensures you're prepared to meet your obligations without financial strain.</li>

<li><strong>Explore Deductions and Credits:</strong> Research available tax deductions and credits that may apply to your situation. These can help reduce your overall tax liability.</li>

<li><strong>Consider Escrow Accounts:</strong> If you have a mortgage, discuss the option of an escrow account with your lender. This account can be used to set aside funds for property taxes and insurance, ensuring timely payments.</li>

</ul>

<h3>The Impact of Property Tax on Homeownership</h3>

<p>Property taxes play a significant role in the overall cost of homeownership. Understanding their impact can help you make informed decisions:</p>

<ul>

<li><strong>Long-Term Planning:</strong> Property taxes are a recurring expense, so including them in your long-term financial plans is essential. Consider their impact on your retirement or investment strategies.</li>

<li><strong>Home Value Appreciation:</strong> Property taxes are often based on the assessed value of your home. As your property's value increases, your tax liability may also rise.</li>

<li><strong>Local Infrastructure and Services:</strong> Property taxes contribute to funding essential services and infrastructure in your community. They support schools, public safety, and local development.</li>

</ul>

<h2>Stay Informed and Proactive</h2>

<p>Navigating the world of property taxes requires staying informed and proactive. Regularly review your assessment notices, explore available resources, and seek professional advice when needed. By understanding the process and your rights, you can effectively manage your property tax obligations and make the most of your homeownership journey.</p>

<h2>Frequently Asked Questions</h2>

<div class="faq-section">

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>How often are property assessments conducted?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Property assessments are typically conducted annually or every few years, depending on the jurisdiction. Regular assessments ensure that property values are accurately reflected in the tax system.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I negotiate my property tax assessment?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While assessments are based on objective criteria, you have the right to appeal if you believe the assessed value is inaccurate. Presenting a strong case with supporting evidence can lead to a successful negotiation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I miss the property tax payment deadline?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Missing the payment deadline may result in late fees, penalties, and potential legal consequences. It's essential to stay informed about the deadlines and make timely payments to avoid additional charges.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax benefits associated with property ownership?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, property ownership often comes with tax benefits. You may be eligible for deductions on your federal or state income taxes, such as mortgage interest deductions or property tax deductions. Consult a tax professional for guidance.</p>

</div>

</div>

</div>

</div>