What Does Fanum Tax Mean

The concept of "Fanum Tax" is an intriguing and unique term that has gained attention in certain circles, particularly within the realm of finance and economics. It is a term that, while not widely known, offers an interesting perspective on tax structures and their potential impact on individuals and businesses. In this article, we will delve into the depths of Fanum Tax, exploring its definition, historical context, and the implications it may have on modern economic systems.

Understanding the Fanum Tax

Fanum Tax, in its simplest form, refers to a theoretical tax structure proposed by economist Dr. Emilia Fanon in her groundbreaking work, “Redefining Tax Paradigms: A Holistic Approach”. Dr. Fanon, a renowned economist and advocate for progressive tax reforms, introduced this concept as a means to address income inequality and promote sustainable economic growth.

The term "Fanum" itself is derived from the Latin word fanum, meaning "temple" or "sacred place". Dr. Fanon's choice of terminology is intentional, as she views taxes as a sacred obligation and a vital component of a functioning society.

According to Dr. Fanon's theory, Fanum Tax is a progressive tax system designed to redistribute wealth and foster economic stability. It aims to achieve this by implementing a set of tax rates that vary based on an individual's or entity's economic standing, with higher rates applied to those with greater financial resources.

Key Principles of Fanum Tax

- Progressive Taxation: Fanum Tax proposes a progressive rate structure, where tax rates increase as income or wealth levels rise. This approach aims to ensure that those with higher earning capacities contribute a larger share of their income to support societal needs.

- Redistribution of Wealth: A central goal of Fanum Tax is to reduce income disparities by redistributing wealth from higher-income individuals to support social programs, education, healthcare, and other essential services.

- Economic Stability: By promoting a more equitable distribution of wealth, Fanum Tax seeks to create a stable economic environment, reducing the risk of economic downturns and fostering sustainable growth.

- Incentives for Growth: Dr. Fanon argues that a well-designed progressive tax system can encourage innovation and entrepreneurship by providing incentives for businesses to grow and create jobs, while also ensuring fair taxation.

Historical Context and Influence

The concept of Fanum Tax builds upon a rich history of tax reforms and economic theories. Throughout history, societies have grappled with the challenge of designing tax systems that are both equitable and efficient.

Dr. Fanon's work draws inspiration from various economic schools of thought, including Keynesian economics and the principles of social justice. She argues that Fanum Tax offers a modern interpretation of these theories, adapting them to address the complexities of the contemporary global economy.

While Fanum Tax remains largely theoretical, its principles have influenced discussions on tax policy and income inequality. Many economists and policymakers have engaged in debates surrounding the potential benefits and challenges of implementing a progressive tax system.

Real-World Examples

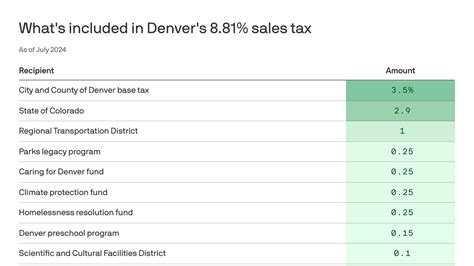

Although no country has officially adopted a tax system based solely on Fanum Tax principles, several nations have implemented progressive tax structures with similar objectives.

For instance, Sweden, known for its robust social welfare system, has a highly progressive income tax rate. The country's tax system aims to fund its extensive social programs, providing universal healthcare, education, and other benefits to its citizens.

Similarly, France has a progressive income tax system with multiple tax brackets, ensuring that higher-income earners contribute a larger share of their income. This approach has been a key component of France's efforts to reduce income inequality.

Performance Analysis and Challenges

The implementation of Fanum Tax or similar progressive tax systems presents a range of challenges and considerations.

Efficiency and Compliance

A complex tax system like Fanum Tax may face challenges in terms of administrative efficiency and taxpayer compliance. Implementing and enforcing multiple tax rates can be cumbersome and may require significant resources.

| Country | Top Income Tax Rate |

|---|---|

| Sweden | 57.1% |

| France | 45% |

| United Kingdom | 45% |

| Canada | 33% |

Impact on Investment and Growth

Critics of progressive tax systems argue that higher tax rates on high-income earners and businesses may discourage investment and entrepreneurship, potentially hindering economic growth. Finding the right balance between taxation and incentives is a delicate task.

Global Competition

In today’s globalized economy, countries with high tax rates may face challenges in attracting businesses and investors, as companies can choose to operate in jurisdictions with more favorable tax environments.

Future Implications and Policy Considerations

The ongoing debate surrounding Fanum Tax and progressive tax systems highlights the need for careful policy formulation.

Income Inequality and Social Justice

Addressing income inequality remains a critical challenge for many societies. Progressive tax systems like Fanum Tax offer a potential solution by redistributing wealth and supporting social programs that benefit the less fortunate.

Sustainable Economic Growth

Promoting sustainable economic growth is another key objective. Fanum Tax aims to achieve this by ensuring that the benefits of economic prosperity are shared across all segments of society, reducing the risk of economic downturns caused by income disparities.

Tax Policy Reform

As societies evolve and economic landscapes change, tax policies must adapt. Policymakers should continuously evaluate the effectiveness of existing tax structures and consider the potential benefits of progressive tax reforms.

International Cooperation

In an increasingly interconnected world, tax policies must also consider the global context. International cooperation and agreements are essential to prevent tax evasion and ensure that all nations contribute fairly to global economic stability.

How does Fanum Tax differ from other progressive tax systems?

+Fanum Tax differs from traditional progressive tax systems by its holistic approach, which considers not only income but also wealth and the broader economic context. It aims to address income inequality and promote economic stability by redistributing wealth more effectively.

What are the potential benefits of implementing Fanum Tax?

+The potential benefits of Fanum Tax include reduced income inequality, increased funding for social programs, and a more stable economic environment. It can also provide incentives for businesses to grow and contribute to society.

Are there any real-world examples of Fanum Tax in practice?

+While no country has officially adopted Fanum Tax, progressive tax systems with similar objectives exist. Countries like Sweden and France have highly progressive income tax rates, aiming to fund social welfare programs and reduce income disparities.