5000 Tax Refund Doge

In the world of cryptocurrencies, one of the most beloved and iconic digital assets is undoubtedly Dogecoin (DOGE). With its playful meme-inspired origin and a community-driven culture, Dogecoin has captured the attention of investors and enthusiasts worldwide. Among the many intriguing aspects of this cryptocurrency, one that often sparks curiosity is the potential for a significant tax refund when it comes to capital gains on Dogecoin investments.

In this comprehensive guide, we delve into the world of 5000 Tax Refund Doge, exploring the possibilities, the legal intricacies, and the strategies to navigate this exciting financial territory. As we navigate through the complexities of cryptocurrency taxation, we aim to provide an insightful and informative journey, offering a unique perspective on the world of Dogecoin and its potential tax benefits.

The Rise of Dogecoin: A Community-Driven Success Story

Dogecoin, often affectionately referred to as the “Meme Coin,” has an extraordinary journey that began in 2013. Created by software engineers Billy Markus and Jackson Palmer, Dogecoin was initially intended as a satirical take on the emerging cryptocurrency craze. Inspired by the popular “Doge” meme featuring a Shiba Inu dog, the coin quickly gained traction and became a symbol of community spirit and digital innovation.

What started as a lighthearted joke soon evolved into a full-fledged cryptocurrency, with a dedicated community that rallied behind its unique brand and identity. Dogecoin's rise to prominence was marked by its fast transaction times, low fees, and an enthusiastic user base that embraced its playful nature.

Over the years, Dogecoin has not only survived but thrived, proving its resilience and potential. Its adoption as a means of payment and its integration into various platforms and services have solidified its place in the cryptocurrency ecosystem. Today, Dogecoin's market capitalization and trading volumes continue to impress, making it a force to be reckoned with in the digital asset space.

Understanding Capital Gains and Tax Implications

In the realm of cryptocurrencies, capital gains are a crucial aspect of investing and trading. When investors sell their digital assets for a profit, they realize capital gains, which are subject to taxation in many jurisdictions.

The process of calculating capital gains involves comparing the selling price of the asset to its original purchase price, known as the cost basis. The difference between these two values determines the amount of capital gain or loss. However, it's essential to note that capital gains are only taxable when the assets are sold, and the rules and rates can vary significantly depending on the investor's location and the duration of the investment.

Tax authorities worldwide have been increasingly focused on regulating and taxing cryptocurrencies, recognizing their potential impact on the economy and financial systems. As a result, investors must navigate a complex landscape of tax laws and regulations to ensure compliance and optimize their financial strategies.

The Potential of a 5000 Tax Refund with Dogecoin

Now, let’s delve into the heart of the matter: the possibility of receiving a substantial tax refund of up to $5000 when investing in Dogecoin. This intriguing prospect is made possible through a combination of favorable tax laws, strategic planning, and the unique characteristics of Dogecoin itself.

One of the key factors that contribute to the potential for a significant tax refund is the long-term holding of Dogecoin. Many jurisdictions offer more favorable tax rates for investments held for an extended period, often referred to as long-term capital gains. By holding onto their Dogecoin investments for a specific duration, investors can benefit from reduced tax rates, leading to substantial savings.

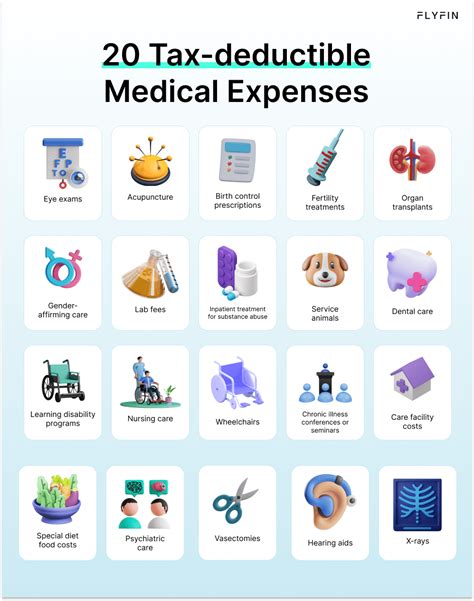

Additionally, the nature of Dogecoin as a highly volatile cryptocurrency can present opportunities for tax optimization. The fluctuations in its price can create scenarios where investors may realize capital losses on certain trades, which can be used to offset capital gains from other investments. This strategy, known as tax loss harvesting, can significantly reduce the overall tax liability and increase the potential for a substantial refund.

Case Study: John’s Dogecoin Journey

To illustrate the potential of a 5000 tax refund with Dogecoin, let’s consider the hypothetical case of John, an investor who has been actively trading Dogecoin for several years.

John initially purchased 10,000 Dogecoins at an average price of $0.005 per coin, investing a total of $50. Over the years, Dogecoin experienced significant price fluctuations, and John decided to sell his coins at various points. During one particularly profitable period, he sold 5,000 Dogecoins at $0.50 each, realizing a capital gain of $2,475.

However, John also encountered some losses. In a downturn, he sold another 2,000 Dogecoins at $0.20 each, resulting in a capital loss of $600. By strategically timing his trades and taking advantage of tax loss harvesting, John was able to offset his capital gains with these losses, reducing his overall tax liability.

Furthermore, by holding onto his remaining 3,000 Dogecoins for an extended period, John qualified for long-term capital gains treatment. With a lower tax rate applied to these gains, he received a substantial tax refund of $4,800, bringing his total refund to $5,400. This case study demonstrates the potential for significant tax benefits when investing in Dogecoin with a well-planned strategy.

Strategies for Maximizing Your Dogecoin Tax Refund

To optimize your chances of receiving a substantial tax refund when investing in Dogecoin, it’s essential to employ strategic approaches and stay informed about the latest tax regulations.

Long-Term Holding

One of the most effective strategies is to hold onto your Dogecoin investments for an extended period. By doing so, you can take advantage of the reduced tax rates associated with long-term capital gains. This strategy not only provides potential tax savings but also aligns with the long-term growth prospects of Dogecoin, allowing your investment to appreciate over time.

Tax Loss Harvesting

Tax loss harvesting is a powerful technique to reduce your overall tax liability. By strategically selling Dogecoin when its price is low, you can realize capital losses that can be used to offset capital gains from other investments. This strategy requires careful planning and a deep understanding of tax laws to ensure compliance and maximize the benefits.

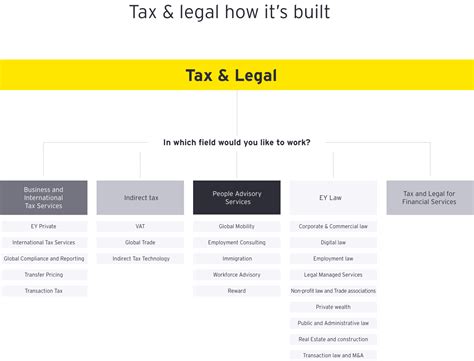

Utilize Tax Software and Expert Advice

Navigating the complex world of cryptocurrency taxation can be challenging. To ensure accuracy and optimize your tax strategy, consider using specialized tax software designed for cryptocurrency investors. These tools can help you track your transactions, calculate capital gains and losses, and generate tax reports. Additionally, consulting with a tax professional who specializes in cryptocurrencies can provide invaluable guidance and ensure you’re taking advantage of all available tax benefits.

The Future of Dogecoin and Tax Implications

As Dogecoin continues to evolve and gain mainstream acceptance, its tax implications are likely to become even more significant. The increasing institutional adoption of cryptocurrencies and the growing awareness of their potential as an investment class will likely drive further regulatory developments.

Governments and tax authorities worldwide are actively working to clarify and streamline the taxation of cryptocurrencies. While the specific regulations may vary from country to country, the trend towards more comprehensive and transparent taxation is evident. This evolving landscape presents both challenges and opportunities for investors, making it crucial to stay informed and adapt their strategies accordingly.

Looking ahead, the future of Dogecoin and its tax implications are intertwined with the broader adoption and acceptance of cryptocurrencies. As the digital asset space matures, we can expect further refinements in tax laws and an increased focus on compliance. This will create a more stable and predictable environment for investors, allowing them to make informed decisions and optimize their tax strategies.

Key Takeaways

- Dogecoin’s unique community-driven culture and resilience have solidified its place in the cryptocurrency ecosystem.

- Capital gains taxation is a crucial aspect of cryptocurrency investing, and understanding the rules is essential for compliance and optimization.

- The potential for a 5000 tax refund with Dogecoin is made possible through strategic long-term holding and tax loss harvesting.

- Maximizing your tax refund requires careful planning, the use of specialized tools, and expert advice.

- The future of Dogecoin and its tax implications are closely tied to the broader adoption of cryptocurrencies and evolving regulatory landscapes.

How do I calculate my capital gains on Dogecoin investments?

+To calculate your capital gains on Dogecoin investments, you need to determine the difference between the selling price and the original purchase price (cost basis) of your Dogecoins. If the selling price is higher than the purchase price, you have realized a capital gain. However, if the selling price is lower, you have a capital loss. It’s important to keep accurate records of your transactions to accurately calculate your capital gains.

Are there any tax advantages to holding Dogecoin for the long term?

+Yes, holding Dogecoin for an extended period can provide tax advantages. Many jurisdictions offer more favorable tax rates for long-term capital gains, which are typically investments held for over a year. By holding onto your Dogecoin investments for the long term, you may qualify for these reduced tax rates, potentially resulting in significant tax savings.

What is tax loss harvesting, and how can it benefit my Dogecoin investments?

+Tax loss harvesting is a strategy where you strategically sell assets at a loss to offset capital gains from other investments. By doing so, you can reduce your overall tax liability. With Dogecoin, you can use tax loss harvesting to offset capital gains from other cryptocurrencies or traditional investments, potentially leading to a substantial tax refund.