Dakota County Real Estate Taxes Mn

Welcome to a comprehensive guide on Dakota County's real estate taxes, an essential topic for homeowners, investors, and anyone interested in the Minnesota real estate market. In this expert-driven article, we'll delve into the specifics of real estate taxes in Dakota County, exploring the tax rates, assessment processes, payment methods, and the impact these taxes have on property owners. By the end of this article, you'll have a clear understanding of the tax landscape in this vibrant county and the steps you can take to manage your real estate tax obligations effectively.

Understanding Dakota County Real Estate Taxes

Real estate taxes, often referred to as property taxes, are a significant component of homeownership and investment in Dakota County, Minnesota. These taxes are levied on both residential and commercial properties and play a crucial role in funding essential public services and infrastructure. Understanding the intricacies of real estate taxes is vital for property owners, as it directly impacts their financial planning and overall cost of ownership.

Dakota County, with its vibrant communities and diverse real estate market, has a unique tax structure that varies across different regions and property types. In this section, we'll explore the key aspects of real estate taxes in Dakota County, shedding light on the factors that influence tax rates and the processes involved in tax assessment and collection.

Tax Assessment Process

The assessment process in Dakota County is a systematic evaluation of property values, which forms the basis for determining real estate tax rates. The County Assessor’s office plays a pivotal role in this process, ensuring fair and accurate assessments. Here’s a step-by-step breakdown of how the assessment process works:

- Data Collection: The County Assessor gathers data on recent property sales, construction costs, and market trends. This information is crucial for establishing the market value of properties.

- Physical Inspections: In some cases, the Assessor's office conducts physical inspections of properties to verify their condition and any improvements made. This step ensures that the assessed value aligns with the property's actual state.

- Value Determination: Using the collected data and inspection findings, the Assessor calculates the market value of each property. This value is a critical factor in determining the property's tax liability.

- Notice of Valuation: Once the assessment is complete, property owners receive a notice of valuation, which outlines the assessed value and provides an opportunity for review and appeal.

- Appeal Process: If property owners believe their assessed value is inaccurate, they can initiate an appeal. The appeal process allows for a thorough review and potential adjustment of the assessed value.

| Assessment Timeline | Key Dates |

|---|---|

| Data Collection | January - March |

| Physical Inspections | Varies by Property |

| Notice of Valuation | April - May |

| Appeal Deadline | June - July |

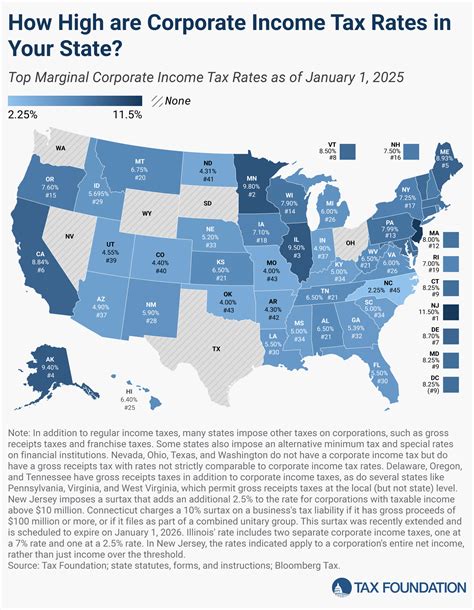

Tax Rates and Levies

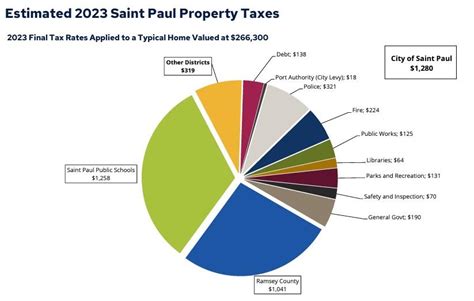

The real estate tax rate in Dakota County is determined by a combination of factors, including the assessed value of the property and the tax levies set by various taxing jurisdictions. Here’s a breakdown of how tax rates are calculated and who is responsible for setting them:

- County Tax Rate: Dakota County itself sets a tax rate, which is applied to the assessed value of properties within its boundaries. This rate is typically determined by the County Board of Commissioners and is used to fund county-wide services and initiatives.

- Municipal Tax Rates: Cities and townships within Dakota County also have the authority to levy taxes. Each municipality sets its own tax rate, which is applied to properties located within its jurisdiction. These taxes fund local services such as police, fire, and public works.

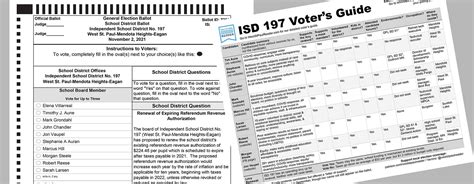

- School District Tax Rates: School districts play a significant role in real estate taxation. They set tax rates to fund public education. Properties within the boundaries of a particular school district are subject to that district's tax rate.

- Special Taxing Districts: In some cases, special taxing districts, such as water management districts or regional transportation authorities, may also levy taxes. These districts are established to address specific regional needs and their tax rates are included in the overall tax burden.

| Taxing Jurisdiction | Tax Rate (Estimated) |

|---|---|

| Dakota County | 0.95% |

| City of Apple Valley | 0.78% |

| Burnsville School District | 1.32% |

| Water Management District | 0.12% |

The actual tax rates can vary based on the property's location and specific taxing jurisdictions. It's important for property owners to understand the breakdown of tax rates to accurately estimate their real estate tax obligations.

Managing Real Estate Tax Obligations

Understanding your real estate tax obligations is just the first step; effectively managing these taxes is crucial for maintaining a healthy financial relationship with your property. Here, we’ll explore strategies and best practices to ensure smooth tax payments and minimize potential financial burdens.

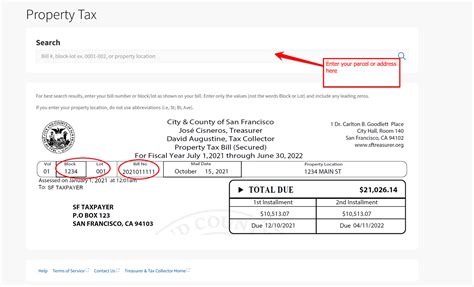

Payment Methods and Due Dates

Dakota County offers a range of convenient payment methods to accommodate different preferences and financial situations. Property owners can choose from the following options to settle their real estate tax obligations:

- Online Payments: The Dakota County Treasurer's Office provides an online payment portal, allowing property owners to make secure payments using a credit or debit card. This method is convenient and can be accessed 24/7.

- Electronic Funds Transfer (EFT): Property owners can set up automatic payments through their bank accounts. This method ensures timely payments and eliminates the need for manual checks.

- Mail-In Payments: Traditional mail-in payments are also accepted. Property owners can send checks or money orders to the designated address, ensuring they are received by the due date.

- In-Person Payments: For those who prefer face-to-face transactions, the Treasurer's Office offers in-person payment options at their designated locations. This method allows for immediate confirmation of payment.

It's crucial to note that real estate taxes are typically due in two installments, with specific due dates determined by the taxing jurisdiction. Missing these deadlines can result in penalties and interest charges, so staying informed and planning ahead is essential.

Strategies for Effective Tax Management

Managing real estate taxes effectively involves more than just making timely payments. Here are some strategies and best practices to help property owners optimize their tax management:

- Understand Your Tax Bill: Carefully review your tax bill to ensure accuracy. Pay attention to the assessed value, tax rates, and any special assessments or credits applied. Understanding your tax bill is the first step in identifying potential issues or opportunities for savings.

- Stay Informed about Tax Changes: Tax rates and assessments can fluctuate from year to year. Stay updated on any changes in tax policies or assessments to anticipate potential increases or decreases in your tax obligations.

- Utilize Tax Credits and Exemptions: Dakota County, like many jurisdictions, offers tax credits and exemptions to eligible property owners. These can include homestead credits, senior citizen discounts, or exemptions for certain types of properties. Take advantage of these opportunities to reduce your tax burden.

- Consider Payment Plans: If you anticipate difficulty in making a tax payment, don't hesitate to reach out to the Treasurer's Office. They may offer payment plans or extended due dates to accommodate your financial situation.

- Appeal Assessments: If you believe your property's assessed value is inaccurate, you have the right to appeal. The appeal process allows you to challenge the assessment and potentially reduce your tax liability. Consult with a tax professional or the Assessor's office for guidance.

Impact of Real Estate Taxes on Property Owners

Real estate taxes are a significant financial consideration for property owners, impacting their overall cost of ownership and investment returns. Understanding the impact of these taxes is crucial for making informed decisions about purchasing, selling, or managing properties in Dakota County.

Financial Planning and Budgeting

Real estate taxes are a recurring expense that must be factored into a property owner’s financial plan. Here’s how these taxes influence financial considerations:

- Monthly Budgeting: Real estate taxes are typically paid annually or semi-annually, but they should be considered in your monthly budget. Planning for these expenses ensures you have sufficient funds available when payments are due.

- Mortgage Considerations: When taking out a mortgage, real estate taxes are often included in the monthly payment. Lenders may require escrow accounts to ensure timely tax payments, which adds to the overall cost of borrowing.

- Investment Returns: For investment properties, real estate taxes are a significant operating expense. Investors must carefully calculate the impact of these taxes on their rental income and overall return on investment.

Property Value and Market Trends

Real estate taxes are closely tied to property values and market trends. Here’s how they influence the real estate landscape in Dakota County:

- Property Value Impact: Real estate taxes are calculated based on the assessed value of a property. When property values increase, tax obligations tend to rise as well. This direct correlation can influence a property owner's decision to sell or hold onto their investment.

- Market Trends and Sales: Real estate taxes can impact the overall attractiveness of a property to potential buyers. Buyers often consider tax obligations when evaluating properties, especially in areas with high tax rates. Property owners should be mindful of this factor when pricing their homes for sale.

- Investment Strategies: Real estate investors must consider tax implications when developing investment strategies. High tax rates may discourage investment in certain areas, while low tax rates can be an attractive incentive for investors.

Conclusion

Navigating the world of real estate taxes in Dakota County requires a deep understanding of the assessment process, tax rates, and payment methods. By staying informed and actively managing their tax obligations, property owners can ensure a smooth relationship with their local taxing authorities. This comprehensive guide has provided insights into the specifics of Dakota County real estate taxes, empowering homeowners and investors to make informed decisions and effectively manage their financial responsibilities.

Frequently Asked Questions

How often are real estate taxes assessed in Dakota County?

+

Real estate taxes are assessed annually in Dakota County. The assessment process typically begins in January and continues through the spring, with notices of valuation sent to property owners by late spring or early summer.

Can I appeal my property’s assessed value if I believe it’s inaccurate?

+

Yes, property owners have the right to appeal their assessed value if they believe it is incorrect. The appeal process is typically open for a limited time, usually from late spring to early summer. It’s important to gather supporting evidence and follow the appeal procedures outlined by the County Assessor’s office.

Are there any tax exemptions or credits available for homeowners in Dakota County?

+

Dakota County offers several tax exemptions and credits to eligible homeowners. These include the Homestead Credit, which reduces the taxable value of a primary residence, and exemptions for seniors and veterans. It’s important to research and understand the eligibility criteria for these programs.

What happens if I miss the real estate tax payment deadline?

+

Missing the real estate tax payment deadline can result in late fees, penalties, and interest charges. It’s crucial to stay informed about payment due dates and consider setting up automatic payments or reminders to avoid these additional expenses.

How can I estimate my real estate tax obligations for a property I’m considering purchasing?

+

To estimate your real estate tax obligations for a potential purchase, you can use online tax estimators or consult with a real estate professional or tax advisor. They can provide insights into the tax rates and assessment values for the specific property and help you make an informed decision.