Washington Dc Tax Rate

Understanding the tax landscape of Washington, D.C., is crucial for residents, businesses, and investors alike. With a unique position as a federal district, Washington D.C. has its own set of tax regulations that differ from those of the surrounding states. This article aims to provide an in-depth analysis of the tax rates and structures in the District of Columbia, offering valuable insights into the financial obligations and opportunities within the city.

Washington D.C.: A Tax Overview

Washington, D.C., known for its rich history and cultural diversity, also boasts a robust economy. The city’s tax system plays a significant role in supporting its growth and development. From personal income taxes to business-related levies, the tax landscape in D.C. is designed to balance revenue generation with economic incentives.

Personal Income Tax Rates

One of the key aspects of Washington D.C.’s tax structure is its progressive personal income tax system. This means that taxpayers are subject to different rates based on their income brackets. As of the latest tax year, the District has four income tax brackets with rates ranging from 4.0% to 8.75%. Here’s a breakdown of the brackets:

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 4.0% |

| $10,001 - $40,000 | 6.0% |

| $40,001 - $60,000 | 7.85% |

| Over $60,000 | 8.75% |

It's important to note that these rates are subject to change annually, so it's advisable to refer to the official District of Columbia tax guidelines for the most current information.

Business Taxes and Incentives

Washington D.C. recognizes the importance of fostering a business-friendly environment. As such, the city offers a range of tax incentives and structures to attract and support enterprises. One notable aspect is the Business Improvement District (BID) tax, which varies depending on the location and nature of the business. BIDs are designed to enhance commercial areas and provide additional services, with the tax funds going towards these improvements.

Additionally, D.C. provides incentives for certain industries and businesses. For instance, the Opportunity Zone Program offers tax benefits to investors who contribute to economically distressed areas. This program aims to stimulate development and create jobs in specific neighborhoods.

Sales and Use Taxes

Sales and use taxes are another significant component of Washington D.C.’s tax system. The standard sales tax rate in the District is 6%, which applies to most goods and services. However, certain items, such as groceries and prescription drugs, are exempt from this tax. It’s worth noting that there are additional taxes for specific products, such as the 10% tax on prepared foods.

The District also imposes a Use Tax on goods purchased from out-of-state retailers, ensuring that all purchases are subject to taxation. This is particularly relevant for online shopping, where the use tax ensures fairness and revenue generation.

Tax Strategies and Planning

Navigating the tax landscape in Washington D.C. can be complex, especially for those new to the city or those with unique financial situations. Here are some strategies and considerations to keep in mind:

- Research and Stay Informed: The tax regulations in D.C. can evolve, so it's crucial to stay updated with the latest guidelines and any potential changes. This includes understanding the city's unique tax codes and how they might impact your financial obligations.

- Utilize Tax Credits and Deductions: D.C. offers various tax credits and deductions, such as the Earned Income Tax Credit and deductions for healthcare expenses. Exploring these options can help reduce your overall tax liability.

- Consider Professional Tax Services: For complex financial situations or if you're unsure about your tax obligations, engaging a certified public accountant (CPA) or tax advisor can provide valuable guidance and ensure compliance.

- Explore Business Incentives: If you're a business owner, understanding the available incentives and programs in D.C. can lead to significant savings. From tax abatements to grant opportunities, there are numerous ways to reduce your tax burden and support your business's growth.

Conclusion: A Dynamic Tax Landscape

Washington D.C.’s tax system is a crucial aspect of the city’s economic framework. With its progressive income tax structure, diverse business incentives, and unique tax programs, the District offers a complex yet rewarding tax environment. By understanding these regulations and utilizing available resources, individuals and businesses can navigate the tax landscape effectively, contributing to the city’s vibrant economy.

Stay Informed, Stay Compliant

Tax regulations are subject to change, and staying informed is essential. The District’s tax authorities provide regular updates and resources to help taxpayers navigate the system. By staying compliant and leveraging available opportunities, residents and businesses can thrive in Washington D.C.’s dynamic tax landscape.

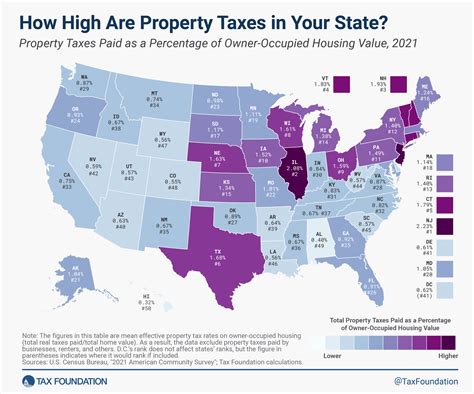

What is the average property tax rate in Washington D.C.?

+The average effective property tax rate in Washington D.C. is approximately 0.56%, which is lower than the national average. However, property values in the city can vary significantly, so it’s advisable to calculate your specific property tax based on your location and the assessed value of your property.

Are there any tax breaks for seniors or veterans in D.C.?

+Yes, Washington D.C. offers several tax relief programs for seniors and veterans. These include the Homestead Deduction, which reduces the taxable value of a homeowner’s primary residence, and the Senior Citizen/Disabled Citizen Tax Relief Program, which provides a credit for qualifying individuals.

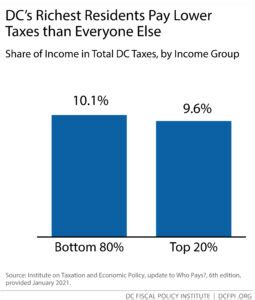

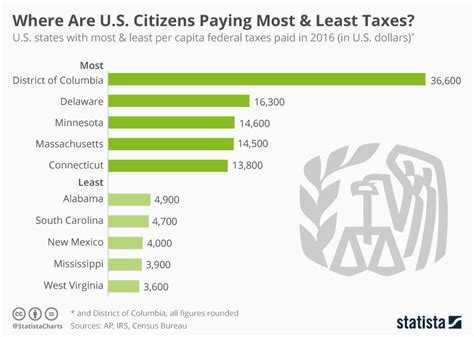

How does Washington D.C. compare to neighboring states in terms of tax rates?

+Washington D.C.’s tax rates are generally higher than those of neighboring states like Maryland and Virginia. However, the District offers a more comprehensive range of services and infrastructure, which contributes to the higher tax burden. It’s important to consider the overall cost of living and the benefits provided by the city when comparing tax rates.