Washington B And O Tax

In the realm of taxation, understanding the intricacies of specific taxes is crucial, especially when they impact businesses and individuals alike. One such tax that holds significance in the state of Washington is the Business and Occupation (B&O) tax. This article aims to delve into the depths of the Washington B&O tax, exploring its nature, implications, and the unique characteristics that set it apart from other taxation systems.

Unraveling the Washington B&O Tax

The Business and Occupation tax, often abbreviated as B&O tax, is a state-level tax levied on the privilege of doing business within the boundaries of Washington. It stands as a critical component of the state’s revenue generation, playing a pivotal role in funding various public services and initiatives. The tax is unique in its approach, as it is not solely based on income or profits, but rather on the gross receipts or proceeds derived from various business activities.

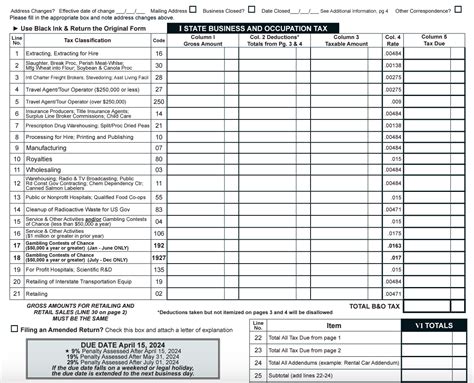

The B&O tax is a multifaceted system, consisting of multiple tax classifications or rates, each tailored to specific business activities. These classifications ensure that the tax burden is distributed fairly across different industries, considering the unique nature of their operations and revenue streams. Here's a glimpse into the key classifications and their implications:

Service and Other Activities Classification

This classification encompasses a wide range of service-oriented businesses, including consulting, legal services, healthcare providers, and more. The tax rate for this category is typically lower compared to other classifications, recognizing the often smaller profit margins associated with service-based enterprises.

| Classification | Tax Rate |

|---|---|

| Service and Other Activities | 0.471% on gross receipts |

Retail Sales Classification

Businesses engaged in the sale of tangible goods fall under this classification. The tax rate for retail sales is designed to capture a portion of the revenue generated from these transactions. It is worth noting that this classification often attracts additional taxes and regulations, given the consumer-facing nature of these businesses.

| Classification | Tax Rate |

|---|---|

| Retail Sales | 0.484% on gross receipts |

Manufacturing Classification

Manufacturing businesses, which transform raw materials into finished products, are subject to a separate tax classification. The tax rate for manufacturing aims to incentivize and support this crucial sector of the economy, often offering competitive rates to encourage investment and growth.

| Classification | Tax Rate |

|---|---|

| Manufacturing | 0.484% on gross proceeds of manufacturing |

Wholesale Sales Classification

Wholesale businesses, engaged in the bulk sale of goods to retailers, are subject to a distinct tax classification. The tax rate for wholesale sales is designed to capture a portion of the revenue generated from these transactions, often at a slightly lower rate compared to retail sales.

| Classification | Tax Rate |

|---|---|

| Wholesale Sales | 0.448% on gross receipts |

Real Estate Sales Classification

Businesses involved in the sale or exchange of real estate properties fall under this classification. The tax rate for real estate sales is specifically tailored to capture a portion of the significant revenue generated from these transactions, contributing to the state’s revenue stream.

| Classification | Tax Rate |

|---|---|

| Real Estate Sales | 1.5% on gross receipts |

Public Utility Classification

Public utility companies, providing essential services such as electricity, water, and telecommunications, are subject to a dedicated tax classification. The tax rate for public utilities is often higher compared to other classifications, reflecting the critical nature of these services and the infrastructure investments required.

| Classification | Tax Rate |

|---|---|

| Public Utility | 2.9% on gross income |

Tax Exemptions and Credits

The Washington B&O tax system recognizes the diverse nature of businesses and their contributions to the economy. As such, it offers a range of tax exemptions and credits to encourage certain economic activities and support specific industries. These exemptions and credits can significantly reduce the tax burden for eligible businesses, fostering growth and innovation.

For instance, the Research and Development (R&D) tax credit incentivizes businesses to invest in research and innovation, offering a credit against B&O tax liabilities. Similarly, the High-Tech Manufacturing Tax Credit aims to attract and support high-tech manufacturing businesses, providing a competitive edge in a rapidly evolving industry.

Compliance and Reporting

Ensuring compliance with the B&O tax regulations is crucial for businesses operating in Washington. The tax reporting process involves submitting accurate and timely tax returns, typically on a quarterly or annual basis, depending on the business’s tax liability and revenue.

The Washington Department of Revenue provides comprehensive resources and guidelines to assist businesses in understanding their tax obligations. These resources include tax guides, forms, and even online tools to simplify the tax filing process. Additionally, the department offers support and assistance to taxpayers, ensuring a smooth and efficient compliance journey.

Conclusion

The Washington B&O tax is a complex yet vital component of the state’s taxation landscape. Its multifaceted nature, with multiple tax classifications and rates, ensures a fair and balanced approach to revenue generation. By recognizing the unique characteristics of different industries, the B&O tax system encourages economic growth, supports local businesses, and contributes to the overall prosperity of the state.

As businesses navigate the complexities of the B&O tax, it is essential to stay informed, seek professional guidance, and leverage the resources provided by the Washington Department of Revenue. With a thorough understanding of the tax system and its implications, businesses can not only comply with their tax obligations but also capitalize on the opportunities presented by the tax exemptions and credits available.

How often do businesses need to file B&O tax returns in Washington?

+The frequency of B&O tax return filings depends on the business’s tax liability and revenue. Most businesses file quarterly, but some may be required to file annually. It’s essential to consult the Washington Department of Revenue’s guidelines for accurate information.

Are there any businesses exempt from the B&O tax in Washington?

+Yes, certain businesses may be exempt from the B&O tax, such as non-profit organizations, charitable entities, and some agricultural activities. However, the specific criteria for exemption vary, so it’s advisable to consult the relevant tax guidelines.

How can businesses stay updated on B&O tax changes and regulations in Washington?

+Businesses can stay informed by regularly visiting the Washington Department of Revenue’s website, where they provide updates, news, and resources related to tax changes and regulations. Additionally, subscribing to their email updates and following relevant industry associations can be beneficial.