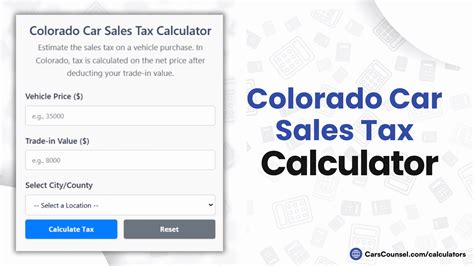

Colorado Tax Calculator

Welcome to the comprehensive guide to the Colorado Tax Calculator, a powerful tool designed to simplify the process of calculating taxes for residents and businesses in the Centennial State. In this article, we will delve into the intricacies of Colorado's tax system, explore the features and benefits of using a tax calculator, and provide you with the knowledge and insights needed to navigate the state's tax landscape with ease.

As one of the fastest-growing states in the nation, Colorado offers a dynamic business environment and a thriving economy. With its stunning natural beauty, outdoor recreation opportunities, and vibrant cultural scene, it's no wonder that many individuals and enterprises call Colorado home. However, understanding and managing taxes in this diverse state can be a complex task.

Understanding Colorado’s Tax Structure

Colorado’s tax system is a blend of state, local, and federal taxes, each with its own set of rules and regulations. The state levies various taxes, including income tax, sales tax, property tax, and excise taxes, to fund essential services and infrastructure. Let’s take a closer look at each of these tax categories and their implications.

Income Tax

Colorado imposes a progressive income tax, meaning that the tax rate increases as your income rises. The state offers multiple tax brackets, ranging from 4.55% to 5.30%, depending on your taxable income. This system ensures that higher-income earners contribute a larger proportion of their income to the state’s revenue.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $5,900 | 4.55% |

| $5,900 - $20,000 | 5.00% |

| $20,000 - $55,000 | 5.28% |

| Over $55,000 | 5.30% |

Additionally, Colorado allows taxpayers to claim deductions and credits, which can significantly reduce their taxable income. Common deductions include the standard deduction, which varies based on filing status, and itemized deductions for expenses such as mortgage interest, charitable contributions, and medical costs.

Sales and Use Tax

Colorado has a statewide sales and use tax rate of 2.9%, which applies to most retail transactions. However, this rate can vary depending on the jurisdiction, as local governments often impose additional sales taxes. For instance, the City and County of Denver have a sales tax rate of 8.312%, which includes the state rate and various local taxes.

Sales tax is collected by retailers and remitted to the state, with a portion allocated to local governments. It is important for businesses to understand the sales tax rates in the areas they operate in to ensure compliance and accurate tax collection.

Property Tax

Property taxes in Colorado are primarily assessed and collected at the local level. The state’s property tax system is based on the assessed value of real estate, which is determined by the county assessor. The tax rate varies across counties and can range from around 50 mills to over 100 mills.

Property taxes fund essential services such as public schools, fire protection, and local infrastructure. Homeowners and businesses can deduct property taxes paid from their federal income taxes, provided they itemize their deductions.

Excise Taxes

Colorado levies excise taxes on specific goods and services, such as tobacco products, alcohol, and motor fuels. These taxes are often imposed to generate revenue for specific purposes, such as healthcare, transportation, and environmental initiatives.

For instance, the state's tobacco tax is currently set at $2.64 per pack of cigarettes, while the excise tax on motor fuels varies based on the type of fuel and its intended use.

The Benefits of Using a Tax Calculator

Navigating Colorado’s tax landscape can be challenging, especially for those new to the state or those with complex financial situations. This is where a tax calculator becomes an invaluable tool. Let’s explore the advantages of using a Colorado Tax Calculator.

Accuracy and Precision

One of the primary benefits of using a tax calculator is the accuracy it provides. These calculators are designed to consider all relevant tax laws, regulations, and rates, ensuring that your tax calculations are precise. Whether you’re calculating income tax, sales tax, or property tax, the calculator will factor in the specific rates and brackets applicable to your situation.

By inputting your income, deductions, and other relevant data, the calculator will provide an estimated tax liability, helping you plan and budget effectively.

Simplified Tax Planning

Tax planning is a crucial aspect of financial management, and a tax calculator simplifies this process. With a calculator, you can quickly experiment with different scenarios and see the impact on your tax liability. For instance, you can adjust your deductions, contributions to retirement accounts, or investment strategies to optimize your tax position.

Additionally, tax calculators often provide insights into potential tax credits and incentives you may be eligible for. This information can help you maximize your tax refund or reduce your overall tax burden.

Compliance and Peace of Mind

Ensuring tax compliance is essential to avoid penalties and legal issues. A tax calculator can provide you with the confidence that you are meeting your tax obligations accurately. By using a calculator, you reduce the risk of errors that could lead to audits or late payment penalties.

Moreover, tax calculators often include features to help you track and organize your tax-related documents, making the process of filing taxes less stressful and more streamlined.

Access to Real-Time Tax Information

Tax laws and rates can change frequently, especially at the local level. A Colorado Tax Calculator ensures that you have access to the most up-to-date tax information. Whether there’s a change in state tax brackets or a new local sales tax rate, the calculator will reflect these updates, providing you with accurate calculations.

Key Features of a Colorado Tax Calculator

A robust Colorado Tax Calculator should offer a range of features to cater to the diverse needs of taxpayers. Here are some essential features to look for when choosing a tax calculator:

- Income Tax Calculator: This feature allows you to estimate your state and federal income tax liability based on your income, filing status, and deductions.

- Sales Tax Calculator: Calculate the sales tax on goods and services, taking into account the state and local tax rates applicable to your location.

- Property Tax Estimator: Estimate your property tax liability by inputting your property's assessed value and the local mill levy rate.

- Excise Tax Calculator: Calculate excise taxes on specific items like tobacco, alcohol, and motor fuels.

- Deduction and Credit Analysis: Identify potential deductions and credits you may be eligible for, such as the Child Tax Credit, Education Credits, or Mortgage Interest Deduction.

- Tax Bracket Comparison: Compare your current tax bracket with other brackets to understand the impact of income changes on your tax liability.

- Tax Return Estimator: Get an estimate of your total tax liability, including federal, state, and local taxes, to help with financial planning.

Tips for Effective Tax Calculation

While a tax calculator is a powerful tool, it’s essential to approach tax calculation with a strategic mindset. Here are some tips to ensure accurate and efficient tax calculations:

- Gather all relevant tax documents, such as W-2 forms, 1099s, and receipts, to ensure you have the necessary data for accurate calculations.

- Understand your filing status and choose the appropriate tax form, as this can significantly impact your tax liability.

- Keep track of deductions and credits throughout the year to maximize your tax savings.

- Consider consulting a tax professional for complex tax situations or if you have specific questions about your tax obligations.

- Regularly update your tax calculator with any changes in tax laws or personal financial circumstances to ensure the most accurate results.

Conclusion

In the dynamic and ever-changing world of taxes, a Colorado Tax Calculator is an indispensable tool for residents and businesses alike. By understanding Colorado’s tax structure and utilizing the features of a tax calculator, you can navigate the state’s tax landscape with confidence and precision. Whether you’re a seasoned taxpayer or new to the state, a tax calculator simplifies the process, ensures compliance, and helps you make informed financial decisions.

As you embark on your tax journey, keep in mind that tax laws are subject to change, and staying informed is key. With the right tools and knowledge, you can effectively manage your tax obligations and make the most of your hard-earned income.

Frequently Asked Questions

What is the Colorado Tax Calculator used for?

+The Colorado Tax Calculator is a tool used to estimate and calculate various taxes applicable in the state of Colorado. It helps individuals and businesses determine their tax liabilities for income tax, sales tax, property tax, and excise taxes.

How accurate are the calculations provided by the Colorado Tax Calculator?

+The accuracy of the Colorado Tax Calculator’s calculations depends on the accuracy of the input data provided by the user. It is designed to reflect the most up-to-date tax laws and regulations, ensuring precise calculations. However, it is essential to verify the results with official tax guides and consult a tax professional for complex situations.

Can the Colorado Tax Calculator help me plan my tax strategy?

+Absolutely! The Colorado Tax Calculator is an excellent tool for tax planning. By experimenting with different scenarios, you can see how changes in income, deductions, or investments impact your tax liability. This helps you make informed decisions to optimize your tax position.

Are there any limitations to using a tax calculator for Colorado taxes?

+While a tax calculator is a valuable resource, it is not a substitute for professional tax advice. Complex tax situations, such as business ownership, real estate transactions, or significant investments, may require the expertise of a certified tax professional.

How often should I update my tax calculator with new tax information?

+It is recommended to update your tax calculator annually, as tax laws and rates can change frequently. Additionally, if you experience significant life changes, such as a new job, marriage, or the purchase of a home, it’s advisable to update your calculator promptly to ensure accurate calculations.