Washington Alcohol Tax

Welcome to this comprehensive exploration of the Washington Alcohol Tax, a critical aspect of the state's fiscal policy and regulatory framework for the alcohol industry. This article aims to delve into the intricacies of this tax, its historical context, its impact on various stakeholders, and its role in shaping the alcohol landscape in Washington.

Unraveling the Washington Alcohol Tax: A Comprehensive Overview

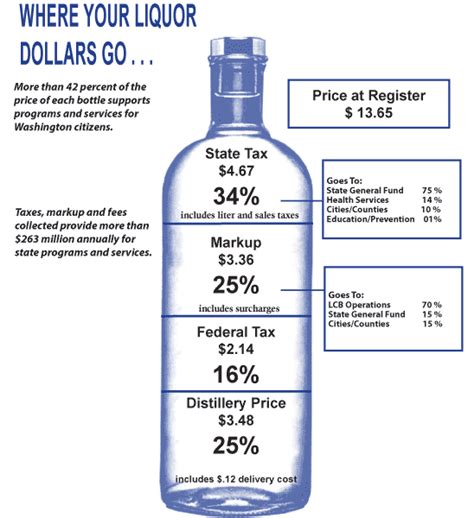

The Washington Alcohol Tax is a vital component of the state’s revenue generation strategy, serving as a key source of funding for various public services and initiatives. This tax, levied on the production, distribution, and sale of alcoholic beverages, plays a pivotal role in regulating the alcohol industry and ensuring a stable revenue stream for the state government.

With a long history dating back to the early 20th century, the Washington Alcohol Tax has undergone significant transformations to adapt to the evolving nature of the alcohol industry and the changing societal attitudes towards alcohol consumption. Today, it stands as a complex yet indispensable part of the state's fiscal landscape, influencing everything from the prices of alcoholic beverages to the availability of resources for alcohol-related programs and services.

Historical Context and Evolution of the Tax

The roots of the Washington Alcohol Tax can be traced back to the post-Prohibition era, when the state government sought to re-establish control over the alcohol industry and generate revenue to support public welfare. The initial tax structure was relatively straightforward, with a flat rate applied to all alcoholic beverages based on their volume or alcohol content.

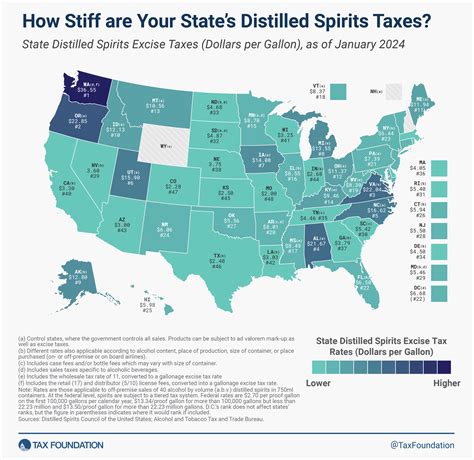

Over the decades, however, the tax has evolved to become more nuanced and targeted. The state has introduced varying tax rates for different types of alcoholic beverages, such as beer, wine, and spirits, recognizing the distinct characteristics and market dynamics of each category. This differentiation allows for a more precise impact on consumer behavior and industry practices.

Furthermore, the Washington Alcohol Tax has also been subject to periodic adjustments to keep pace with inflation and changing economic conditions. These adjustments ensure that the tax remains a reliable and consistent revenue source, enabling the state to maintain its commitment to essential public services and infrastructure development.

Revenue Generation and Allocation

The Washington Alcohol Tax is a significant contributor to the state’s general fund, providing a stable and predictable revenue stream that supports a wide range of public services. A substantial portion of the tax revenue is allocated to critical areas such as education, healthcare, and law enforcement, ensuring that these sectors receive adequate funding to meet the needs of the state’s residents.

Additionally, a dedicated portion of the alcohol tax revenue is earmarked for specific programs related to alcohol education, prevention, and treatment. These initiatives aim to mitigate the social and health impacts associated with alcohol consumption, promoting responsible drinking behaviors and providing support for those struggling with addiction.

| Alcohol Tax Revenue Allocation (FY 2023) | Percentage |

|---|---|

| General Fund | 60% |

| Alcohol Education and Prevention Programs | 20% |

| Law Enforcement and Public Safety | 10% |

| Other Designated Programs | 10% |

Impact on Alcohol Industry and Consumers

The Washington Alcohol Tax directly influences the operations and strategies of alcohol producers, distributors, and retailers. By imposing a tax on the production and sale of alcoholic beverages, the state incentivizes industry players to optimize their supply chains and pricing strategies to mitigate the tax’s impact on their bottom line.

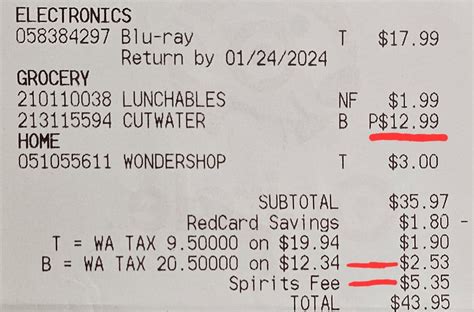

For consumers, the tax translates into higher prices for alcoholic beverages, with the degree of impact varying based on the beverage type and the consumer's purchasing power. However, it is essential to recognize that the tax is not merely a revenue-generation tool; it also serves as a mechanism to discourage excessive alcohol consumption and promote responsible drinking behaviors.

Regulatory and Policy Considerations

Beyond revenue generation, the Washington Alcohol Tax plays a crucial role in shaping the regulatory landscape for the alcohol industry. By adjusting tax rates and implementing targeted policies, the state can influence industry practices, promote competition, and protect public health and safety.

For instance, the state may choose to implement higher tax rates on certain types of alcoholic beverages known to be associated with health risks or social issues, such as high-alcohol content spirits. Conversely, lower tax rates on beverages like low-alcohol beers or wines could be employed to encourage the consumption of less potent alternatives.

Moreover, the tax structure can also be used to support local businesses and promote sustainability. By offering tax incentives or reduced rates for small-scale producers or environmentally conscious practices, the state can foster a more diverse and resilient alcohol industry while encouraging sustainable production and distribution methods.

Analyzing the Tax’s Performance and Future Implications

The Washington Alcohol Tax has proven to be a resilient and adaptable mechanism for revenue generation and industry regulation. However, as with any policy, ongoing analysis and evaluation are essential to ensure its continued effectiveness and alignment with the evolving needs of the state and its residents.

Performance Analysis and Future Projections

The state government conducts regular performance assessments of the alcohol tax, analyzing its impact on revenue generation, industry dynamics, and public health outcomes. These assessments provide valuable insights into the tax’s effectiveness and identify areas where adjustments may be necessary to optimize its performance.

Historical data suggests that the Washington Alcohol Tax has consistently contributed a significant portion of the state's revenue, with a steady growth trend over the years. This stability is a testament to the tax's resilience and its ability to adapt to changing economic conditions and consumer preferences.

Looking ahead, the tax is projected to maintain its position as a reliable revenue source, with anticipated growth aligned with the overall economic trajectory of the state. However, the state government must remain vigilant in monitoring emerging trends, such as the rising popularity of craft breweries and distilleries, to ensure that the tax structure remains equitable and supports the diverse landscape of the alcohol industry.

Addressing Emerging Challenges and Opportunities

The alcohol industry is subject to a myriad of challenges and opportunities, many of which are influenced by societal trends and technological advancements. As such, the Washington Alcohol Tax must be agile enough to adapt to these evolving dynamics to maintain its relevance and effectiveness.

One key challenge is the growing prevalence of online alcohol sales, which can bypass traditional distribution channels and tax collection mechanisms. The state must explore innovative strategies, such as collaboration with online platforms or the development of digital tax collection systems, to ensure that these sales are appropriately taxed and regulated.

Additionally, the rise of sustainable and environmentally conscious consumer preferences presents an opportunity for the Washington Alcohol Tax to incentivize and support sustainable practices within the alcohol industry. By offering tax incentives or reduced rates for producers adopting eco-friendly methods or reducing their carbon footprint, the state can promote a more sustainable and responsible alcohol industry.

Conclusion: A Balanced Approach for a Vibrant Future

The Washington Alcohol Tax is a complex yet essential policy tool, playing a pivotal role in shaping the state’s fiscal health, regulatory environment, and social welfare. By striking a delicate balance between revenue generation, industry regulation, and public health considerations, the tax has the potential to drive positive outcomes for all stakeholders involved.

As the state looks to the future, a proactive and adaptive approach to alcohol tax policy is essential. By staying attuned to emerging trends, technological advancements, and societal shifts, the Washington Alcohol Tax can continue to serve as a dynamic and effective mechanism for promoting a vibrant, responsible, and sustainable alcohol industry.

How is the Washington Alcohol Tax calculated and applied to different types of alcoholic beverages?

+The Washington Alcohol Tax is calculated based on the volume or alcohol content of the beverage. Different rates are applied to beer, wine, and spirits, with variations depending on factors such as alcohol strength and container size. For example, beer is taxed at a rate of $0.26 per gallon, while wine and spirits have separate rates based on their alcohol content.

What are the key challenges faced by the alcohol industry due to the Washington Alcohol Tax?

+The alcohol industry faces challenges such as increased production and distribution costs, which can impact their profitability. Additionally, the tax can influence consumer behavior, leading to shifts in demand and the need for businesses to adapt their strategies to remain competitive.

How does the Washington Alcohol Tax contribute to public welfare and social programs?

+A significant portion of the tax revenue is allocated to critical public services, including education, healthcare, and law enforcement. Additionally, specific programs related to alcohol education, prevention, and treatment receive dedicated funding, promoting responsible drinking behaviors and providing support for those in need.