Walmart Tax Exempt

Walmart, the multinational retail giant, has been a prominent player in the global retail landscape for decades. With its vast network of stores and online presence, Walmart caters to millions of customers worldwide. One aspect of Walmart's operations that often sparks curiosity and raises questions is its tax exemption status. In this comprehensive article, we will delve into the intricacies of Walmart's tax-exempt status, exploring the reasons behind it, its implications, and how it affects consumers and the retail industry as a whole.

Understanding Walmart’s Tax Exempt Status

Walmart, officially named Wal-Mart Stores, Inc., holds a unique position in the retail industry with its tax-exempt status. This status is not a blanket exemption but rather a result of specific criteria and circumstances that allow certain entities within the Walmart group to operate tax-free.

The tax-exempt status primarily applies to Walmart's charitable foundations and nonprofit entities, which are separate legal entities from the company's retail operations. These foundations and nonprofits are dedicated to supporting various social and community causes, often focusing on education, healthcare, and environmental initiatives.

The Role of Walmart’s Charitable Foundations

Walmart’s charitable endeavors are primarily driven by its two main foundations: the Walmart Foundation and the Walmart Foundation Fund, Inc. These organizations are responsible for distributing grants, funding community projects, and supporting various initiatives aligned with Walmart’s corporate social responsibility (CSR) goals.

The Walmart Foundation, established in 2008, has made significant contributions to disaster relief efforts, women's economic empowerment, and community development. It has collaborated with renowned organizations like the American Red Cross and has been a prominent supporter of education programs, aiming to improve access to quality education for underserved communities.

The Walmart Foundation Fund, Inc., on the other hand, focuses on environmental sustainability and conservation. It funds projects related to renewable energy, waste reduction, and water conservation, showcasing Walmart's commitment to environmental stewardship.

Tax-Exempt Status and Its Benefits

The tax-exempt status of Walmart’s charitable foundations brings several advantages. Firstly, it allows these entities to retain more funds for their charitable purposes, as they are not subject to corporate income taxes. This financial flexibility enables them to allocate resources more efficiently and have a greater impact on the causes they support.

Furthermore, the tax-exempt status provides Walmart with a strong platform for corporate social responsibility. By channelling resources into charitable initiatives, Walmart enhances its reputation as a responsible corporate citizen. This not only boosts its public image but also attracts like-minded partners and stakeholders who align with its values.

| Foundation | Focus Areas |

|---|---|

| Walmart Foundation | Disaster Relief, Education, Women's Empowerment |

| Walmart Foundation Fund, Inc. | Environmental Sustainability, Renewable Energy, Conservation |

Implications for Consumers and the Retail Industry

While Walmart’s tax-exempt status primarily pertains to its charitable endeavors, it indirectly influences consumers and the retail industry as a whole.

Impact on Consumer Experience

For consumers, Walmart’s tax-exempt status may not have an immediate impact on their shopping experience. The tax-exempt nature of the company’s charitable foundations does not directly affect the prices of products sold in Walmart stores or on its e-commerce platform.

However, the charitable initiatives funded by Walmart's tax-exempt entities can indirectly benefit consumers. For instance, grants allocated to local community projects may improve infrastructure, enhance educational opportunities, or provide access to essential services, ultimately contributing to a better quality of life for consumers in those areas.

Retail Industry Dynamics

Within the retail industry, Walmart’s tax-exempt status can be viewed as a strategic advantage. By investing in charitable causes and showcasing its commitment to social responsibility, Walmart strengthens its brand image and gains a competitive edge.

Additionally, Walmart's charitable initiatives can foster stronger community relationships, which can translate into increased customer loyalty and market share. This strategic approach to corporate social responsibility allows Walmart to differentiate itself and appeal to a broader range of consumers who value ethical and sustainable business practices.

Tax Considerations for Walmart’s Retail Operations

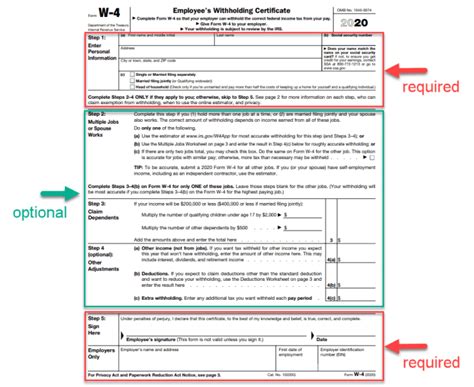

It’s important to note that while Walmart’s charitable foundations are tax-exempt, its retail operations are not. Walmart, like other large retailers, is subject to corporate income taxes on its profits. These tax obligations are a significant consideration for the company, as they impact its financial health and overall profitability.

Walmart's tax obligations extend beyond corporate income taxes. It must also comply with various sales taxes, property taxes, and other levies imposed by local, state, and federal governments. These taxes are an integral part of the company's financial strategy and are factored into its pricing and operational decisions.

The Future of Walmart’s Tax-Exempt Status

As Walmart continues to evolve and adapt to changing market dynamics, its tax-exempt status is likely to remain a crucial aspect of its corporate strategy. The company’s commitment to corporate social responsibility and its focus on community engagement are key components of its long-term sustainability.

Walmart's tax-exempt entities will likely continue to play a vital role in funding charitable initiatives and supporting communities. As the company expands its presence globally, its charitable foundations can help address local needs and build stronger relationships with diverse communities.

Moreover, Walmart's tax-exempt status may encourage other businesses to follow suit, leading to a broader trend of corporate social responsibility and charitable contributions within the retail industry. This shift could create a more sustainable and socially conscious business landscape, benefiting both businesses and the communities they serve.

Conclusion

Walmart’s tax-exempt status is a unique aspect of its corporate structure, primarily benefiting its charitable foundations and nonprofit entities. While this status does not directly impact consumers’ shopping experiences, it indirectly influences the retail industry and the communities Walmart serves.

By leveraging its tax-exempt status for charitable purposes, Walmart strengthens its brand, gains a competitive edge, and contributes to the well-being of communities worldwide. As Walmart continues to grow and adapt, its commitment to corporate social responsibility through tax-exempt entities will likely remain a cornerstone of its long-term success and sustainability.

Does Walmart’s tax-exempt status mean consumers pay lower prices?

+No, Walmart’s tax-exempt status primarily applies to its charitable foundations and does not directly impact consumer prices. The tax exemption allows these foundations to retain more funds for charitable purposes, but it does not affect the pricing of products sold in Walmart stores.

How does Walmart’s tax-exempt status affect its competition in the retail industry?

+Walmart’s tax-exempt status gives it a strategic advantage in terms of corporate social responsibility. By investing in charitable causes, Walmart enhances its brand image and attracts consumers who value ethical business practices. This can lead to increased market share and a stronger competitive position.

What are the main focus areas of Walmart’s charitable foundations?

+Walmart’s charitable foundations primarily focus on disaster relief, education, women’s empowerment, environmental sustainability, and conservation. They distribute grants and support community projects aligned with these causes.