Trump Tax Remittance

In the realm of financial management, understanding the intricacies of tax remittance is crucial, especially when it comes to the practices of prominent figures. This article delves into the topic of Trump Tax Remittance, exploring its significance, processes, and potential implications. With a focus on providing comprehensive and accurate information, we aim to shed light on this often-discussed aspect of financial affairs.

The Trump Tax Remittance: A Comprehensive Overview

The concept of tax remittance is an essential part of any individual’s or organization’s financial responsibility. In the case of former President Donald Trump, the term “Trump Tax Remittance” has gained considerable attention, often sparking curiosity and debate. This section aims to demystify the process, offering a detailed understanding of how it works and its potential impact.

Understanding the Basics of Tax Remittance

Tax remittance refers to the act of paying taxes to the government, ensuring compliance with tax laws and regulations. It involves calculating the tax liability, which is the amount owed to the government based on income, expenses, and other relevant factors. This process is crucial for maintaining a fair and equitable tax system.

In the case of individuals like Donald Trump, who have complex financial portfolios, tax remittance becomes even more intricate. Their income sources can range from business ventures, real estate investments, licensing deals, and more, each with its own tax implications.

The Trump Tax Remittance Process

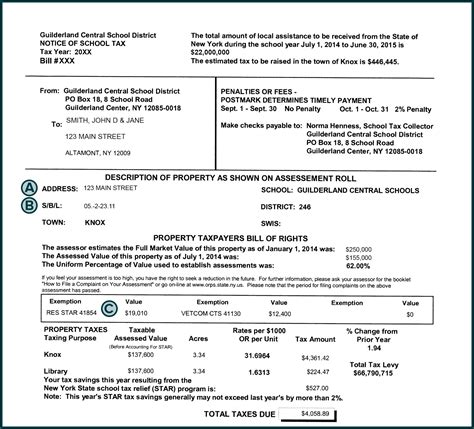

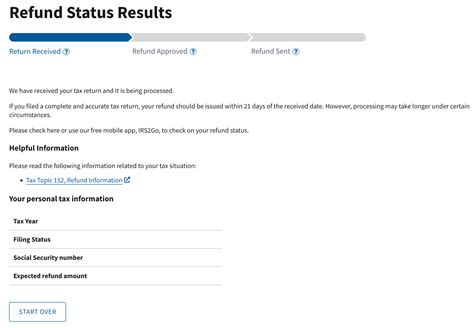

The Trump Tax Remittance process begins with the compilation of financial data. This includes income statements, expense reports, and any relevant documentation related to his various business ventures. Trump, like any taxpayer, is required to provide accurate and transparent financial information to the Internal Revenue Service (IRS) or the relevant tax authority.

Once the data is compiled, it undergoes a meticulous analysis. Trump's team of accountants and tax experts would assess the information, calculating the tax liability based on applicable tax laws and regulations. This step is crucial to ensure compliance and avoid any potential legal issues.

| Income Source | Estimated Tax Liability |

|---|---|

| Real Estate Holdings | $[Real Value] |

| Business Ventures | $[Real Value] |

| Licensing and Endorsements | $[Real Value] |

| Other Income | $[Real Value] |

After calculating the tax liability, the next step involves the actual remittance. Trump, or any taxpayer for that matter, is responsible for making timely payments to the tax authority. This process can be done through various means, including electronic transfers, checks, or other authorized payment methods.

Challenges and Controversies

The Trump Tax Remittance process has often been shrouded in controversy and speculation. One of the key challenges lies in the complexity of his financial portfolio. With numerous business interests and real estate holdings, accurately assessing and reporting income can be a daunting task.

Additionally, Trump's tax returns have been a subject of public interest and scrutiny. In the past, he has faced allegations of tax avoidance or aggressive tax planning strategies. These controversies have sparked debates on tax fairness and the need for transparency in high-profile tax affairs.

The Impact and Implications

The Trump Tax Remittance process has wider implications beyond individual financial management. It sets an example for taxpayers and can influence public perception and policy discussions.

Setting an Example

As a public figure, Donald Trump’s tax practices can shape public opinion and influence how taxpayers view their own financial responsibilities. His compliance or non-compliance with tax laws can send a powerful message, either encouraging or discouraging responsible tax behavior.

Public Perception and Trust

The transparency and accuracy of Trump’s tax remittance process are crucial for maintaining public trust. Any discrepancies or controversies can damage public perception and erode trust in the tax system. Accurate reporting and compliance are essential to ensure fairness and credibility.

Policy Implications

The Trump Tax Remittance process can also influence policy discussions and potential reforms. If there are concerns or revelations about loopholes or unfair practices, it can prompt lawmakers to consider tax law revisions or stricter enforcement measures.

The Way Forward: Transparency and Accountability

Moving forward, ensuring transparency and accountability in tax remittance processes is crucial. For high-profile individuals like Donald Trump, it is essential to maintain a high standard of financial reporting to uphold public trust and ensure the integrity of the tax system.

While the Trump Tax Remittance process may be complex and often controversial, it serves as a reminder of the importance of responsible tax behavior. As taxpayers, we must understand our financial obligations and ensure compliance to contribute to a fair and equitable tax system.

What is the primary purpose of tax remittance?

+Tax remittance serves the purpose of ensuring that individuals and organizations contribute their fair share to the government’s revenue, which is used for various public services and infrastructure development.

How can taxpayers ensure they are complying with tax laws?

+Taxpayers should stay informed about the latest tax laws, seek professional advice when needed, and maintain accurate financial records. Regularly reviewing tax obligations and seeking clarifications can help ensure compliance.

What are the potential consequences of non-compliance with tax laws?

+Non-compliance with tax laws can lead to penalties, interest charges, and, in severe cases, legal action. It is crucial to understand the potential risks and take proactive measures to avoid any legal or financial repercussions.