Tn Tax Calculator

The Tennessee Tax Calculator is a valuable tool designed to assist individuals and businesses in accurately estimating their tax obligations within the state of Tennessee. This calculator, provided by the Tennessee Department of Revenue, plays a crucial role in helping taxpayers navigate the state's tax system, which encompasses various types of taxes such as sales and use tax, business tax, and income tax.

Understanding the Tennessee Tax System

Tennessee’s tax system is characterized by its unique features, including a focus on a flat income tax rate and a strong reliance on sales tax. The state’s tax structure can be complex, especially for those new to the area or those with specific tax situations, such as small businesses or freelancers.

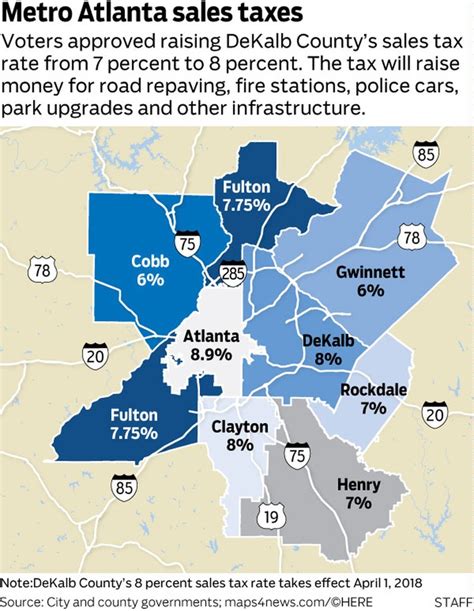

For instance, consider the case of a small business owner in Nashville who is looking to expand their operations. They would need to understand not only the state's sales tax rate, which is 7% as of 2024, but also the local tax rates, which can vary across counties and municipalities. This complexity highlights the importance of having a reliable tax calculator.

The Features and Benefits of the Tn Tax Calculator

The Tn Tax Calculator is a user-friendly online tool that offers a range of features to assist taxpayers. Here are some key benefits:

Income Tax Calculation

Tennessee imposes a flat income tax rate of 6% on all taxable income. The Tn Tax Calculator allows users to input their gross income and provides an estimate of their tax liability after deductions and exemptions. This feature is particularly useful for individuals who are self-employed or have multiple sources of income.

Sales and Use Tax Estimation

Sales tax in Tennessee can be complicated due to varying rates across different jurisdictions. The Tn Tax Calculator takes into account the state’s base sales tax rate, local tax rates, and any applicable special taxes. By inputting the purchase amount and location, users can quickly estimate the total tax they will owe.

For example, a resident of Memphis purchasing a new laptop would face a total sales tax rate of 9.25%, which includes the state's base rate of 7% and a local rate of 2.25%. The Tn Tax Calculator provides an accurate estimate of this tax, ensuring that taxpayers are prepared for their financial obligations.

Business Tax Calculations

Tennessee businesses are subject to various taxes, including franchise and excise taxes. The Tn Tax Calculator offers a section dedicated to business taxes, allowing entrepreneurs to estimate their tax liability based on their business structure and revenue.

| Business Structure | Estimated Tax Rate |

|---|---|

| Sole Proprietorship | 6% of net income |

| Partnership | 6% of net income, distributed among partners |

| Corporation | 6% of net income, plus franchise and excise taxes |

Real-Time Tax Updates

The Tn Tax Calculator is regularly updated to reflect any changes in tax laws and rates. This ensures that taxpayers receive accurate and current information, which is especially critical during tax season or when there are legislative updates.

How to Use the Tn Tax Calculator

Utilizing the Tn Tax Calculator is straightforward and accessible. Here’s a step-by-step guide:

- Access the Tn Tax Calculator through the Tennessee Department of Revenue's official website.

- Select the type of tax you wish to calculate: income tax, sales tax, or business tax.

- For income tax, input your gross income, deductions, and any relevant tax credits.

- For sales tax, enter the purchase amount and the location where the purchase was made.

- For business tax, choose your business structure and provide details about your revenue and expenses.

- Review the calculated tax estimate and adjust any inputs as needed.

- Save or print the tax estimate for your records.

Tips for Optimizing Your Tax Strategy

While the Tn Tax Calculator provides a valuable estimate, it’s important to remember that it’s a tool and not a substitute for professional tax advice. Here are some tips to enhance your tax planning:

- Stay informed about tax law changes. Tennessee's tax laws can evolve, so it's crucial to stay updated.

- Consider your personal or business tax situation and consult with a tax professional for tailored advice.

- Keep accurate records of income, expenses, and deductions to ensure you can maximize your tax benefits.

- Explore tax-saving strategies, such as taking advantage of deductions and credits specific to Tennessee.

The Impact of Tennessee’s Tax Structure on Economic Development

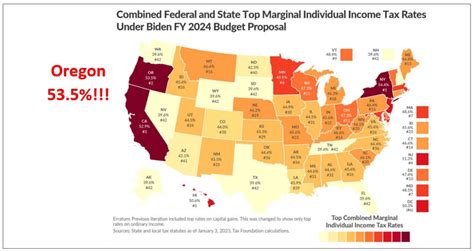

Tennessee’s tax system, particularly its flat income tax rate, has been a subject of debate among economists and policymakers. Some argue that a flat tax rate promotes economic growth by simplifying the tax code and reducing the burden on businesses and high-income earners. Others suggest that a progressive tax system would be more equitable and provide additional revenue for public services.

Regardless of the ongoing discussions, Tennessee's tax structure has played a role in attracting businesses and fostering economic development. The state's competitive tax environment, combined with its strategic location and pro-business policies, has contributed to its reputation as a favorable destination for investment and entrepreneurship.

Conclusion

The Tn Tax Calculator is a powerful tool that empowers Tennessee residents and businesses to navigate the state’s tax landscape with confidence. By offering accurate estimates and real-time updates, it simplifies the process of tax planning and compliance. As Tennessee continues to evolve its tax policies, tools like the Tn Tax Calculator will remain essential for taxpayers seeking clarity and efficiency in their financial obligations.

What are the tax rates in Tennessee for 2024?

+As of 2024, Tennessee has a flat income tax rate of 6%, while the sales tax rate varies across jurisdictions but typically ranges from 7% to 9.75%.

How often is the Tn Tax Calculator updated?

+The Tn Tax Calculator is regularly updated to reflect any changes in tax laws and rates. Updates are typically made within a few days of any legislative changes.

Can I use the Tn Tax Calculator for business tax estimates?

+Absolutely! The Tn Tax Calculator has a dedicated section for business tax calculations, allowing you to estimate your tax liability based on your business structure and revenue.