Tax Rate Nevada Las Vegas

In the vibrant city of Las Vegas, nestled within the state of Nevada, tax rates play a crucial role in shaping the financial landscape for both residents and businesses. Understanding the tax structure is essential for individuals and enterprises looking to navigate the economic environment effectively. Let's delve into the specifics of tax rates in Las Vegas, exploring the various categories and their implications.

Tax Structure in Nevada: An Overview

Nevada, known for its diverse economy and pro-business policies, boasts a unique tax structure that differs from many other states in the US. The state’s tax system is designed to attract businesses and foster economic growth, making it an attractive destination for investors and entrepreneurs.

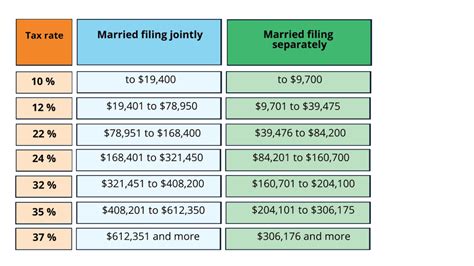

One of the most notable aspects of Nevada's tax system is the absence of a personal income tax. This means that individuals residing in Nevada do not have to pay state income tax on their earnings. This tax-free environment has been a significant draw for many high-net-worth individuals and businesses seeking to minimize their tax liabilities.

However, it's important to note that while Nevada does not impose a personal income tax, it does have other forms of taxation in place to generate revenue. These taxes contribute to the state's infrastructure, public services, and overall economic development.

Tax Rates in Las Vegas: A Detailed Breakdown

Las Vegas, the entertainment capital of the world, offers a dynamic tax environment that reflects its vibrant economy. Here’s a comprehensive look at the tax rates applicable in Las Vegas:

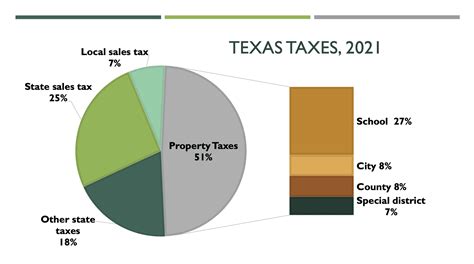

Sales and Use Tax

The sales and use tax is a significant revenue generator for the state and local governments. In Las Vegas, the sales tax rate is composed of both state and local components. As of the latest information available, the state sales tax rate stands at 4.6%, while the local sales tax rate varies depending on the jurisdiction. The combined sales tax rate in Las Vegas can range from 7.75% to 8.375%, depending on the specific location within the city.

| Sales Tax Component | Tax Rate |

|---|---|

| State Sales Tax | 4.6% |

| Local Sales Tax | Varies (7.75% - 8.375%) |

| Total Sales Tax (Combined) | 7.75% - 8.375% |

It's important for businesses operating in Las Vegas to be aware of the specific sales tax rate applicable to their location, as this can impact their pricing strategies and overall profitability.

Property Tax

Property tax is another crucial component of Nevada’s tax system. The property tax rate in Las Vegas, like other areas in the state, is set by the local governing bodies, typically the county or municipality. The property tax rate can vary significantly depending on the location and the assessed value of the property.

In Clark County, which encompasses Las Vegas and its surrounding areas, the property tax rate is 1.1697% for residential properties and 1.3897% for commercial properties as of the most recent information. These rates are applied to the assessed value of the property, which is determined by the county assessor's office.

It's worth noting that Nevada offers various tax incentives and abatement programs to attract businesses and promote economic development. These programs can significantly reduce the effective property tax rate for eligible businesses, making Nevada an even more attractive destination for commercial enterprises.

Gaming Tax

Las Vegas, synonymous with the gaming industry, imposes a gaming tax on casinos and gaming establishments. This tax is a significant revenue stream for the state and is used to fund various public services and infrastructure projects. The gaming tax rate in Las Vegas is 6.75% of the gross gaming revenue.

The gaming tax is an essential aspect of the state's tax structure, as it contributes to the overall economic health and stability of Nevada. It is worth considering for businesses operating in the gaming industry, as it directly impacts their financial planning and operations.

Business License Tax

In addition to the above taxes, Las Vegas imposes a business license tax on various types of businesses operating within the city. The business license tax is calculated based on the gross receipts or revenue generated by the business. The tax rate varies depending on the type of business and its gross receipts.

For example, businesses with gross receipts exceeding $4 million are subject to a 5.8% business license tax rate. This tax is an important revenue source for the city, ensuring that businesses contribute to the local economy and infrastructure development.

The Impact of Tax Rates on the Las Vegas Economy

The tax rates in Las Vegas have a profound impact on the city’s economic landscape. The absence of a personal income tax has been a significant factor in attracting high-net-worth individuals and businesses, contributing to the city’s thriving economy. The diverse tax structure, including sales tax, property tax, and gaming tax, provides a stable revenue stream for the state and local governments, enabling them to invest in infrastructure and public services.

Furthermore, the tax incentives and abatement programs offered by Nevada have played a crucial role in attracting businesses and fostering economic growth. These incentives have encouraged businesses to establish themselves in the state, creating job opportunities and driving economic development.

Conclusion: Navigating the Tax Landscape in Las Vegas

Understanding the tax rates and structure in Las Vegas is essential for individuals and businesses looking to thrive in this dynamic city. The absence of a personal income tax, coupled with a diverse range of other taxes, creates a unique financial environment. By navigating the tax landscape effectively, businesses can minimize their tax liabilities and contribute to the thriving economy of Las Vegas.

As the city continues to evolve and attract new investments, staying informed about tax rates and regulations is crucial for long-term success. Las Vegas offers a wealth of opportunities, and with a well-planned tax strategy, individuals and businesses can maximize their financial potential while contributing to the vibrant economic ecosystem of the city.

How do the tax rates in Las Vegas compare to other major cities in the US?

+Las Vegas’s tax structure, particularly the absence of a personal income tax, sets it apart from many other major cities in the US. While cities like New York or California impose high personal income taxes, Las Vegas offers a tax-free environment for individuals. However, it’s important to consider the overall tax burden, including sales tax and property tax, which can vary significantly between cities.

Are there any tax incentives or abatements available for businesses in Las Vegas?

+Yes, Nevada offers a range of tax incentives and abatements to attract businesses and promote economic development. These incentives can significantly reduce the effective tax rate for eligible businesses, making it an attractive destination for commercial enterprises. It’s recommended to consult with tax professionals or local economic development agencies to explore these opportunities.

How does the gaming tax rate in Las Vegas compare to other gaming destinations in the US?

+The gaming tax rate in Las Vegas, at 6.75%, is relatively competitive compared to other major gaming destinations in the US. For example, Atlantic City imposes a gaming tax of 8.5%, while some Native American reservations have negotiated lower tax rates. Las Vegas’s gaming tax rate contributes significantly to the state’s revenue and infrastructure development.