Tax Rate In San Jose

The tax system in San Jose, California, plays a crucial role in the city's economic landscape and is an essential aspect for both residents and businesses to understand. San Jose, being the largest city in the Bay Area, boasts a thriving technology industry and a diverse economic base. The city's tax structure, which includes various taxes such as income tax, sales tax, property tax, and business taxes, significantly impacts the financial obligations of its residents and businesses. This article delves into the intricacies of the tax rate in San Jose, providing a comprehensive understanding of its components, how it compares to other regions, and its implications for the local economy.

Unraveling the Tax Structure in San Jose

San Jose's tax system is a multifaceted arrangement that contributes significantly to the city's revenue generation and funding of essential services. Here's a breakdown of the key taxes that residents and businesses encounter in San Jose:

Income Tax

San Jose residents are subject to both state and federal income taxes. The California state income tax has a progressive structure with rates ranging from 1% to 12.3%, depending on an individual's or business's taxable income. The city of San Jose itself does not impose an additional income tax, aligning with many other municipalities in California.

For federal income tax, the Internal Revenue Service (IRS) determines the tax brackets and rates, which can vary annually. In 2023, the federal income tax rates range from 10% to 37%, with taxpayers placed in brackets based on their taxable income.

| California State Income Tax Rates | Federal Income Tax Rates (2023) |

|---|---|

| 1% to 12.3% | 10% to 37% |

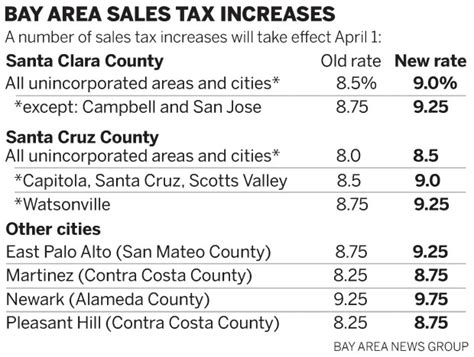

Sales and Use Tax

Sales tax in San Jose consists of both state and local components. The California state sales tax is set at 7.25%, with additional local sales taxes varying by jurisdiction. In San Jose, the city sales tax is 0.5%, resulting in a combined sales tax rate of 7.75% for most purchases. This tax is applied to the sale of tangible goods and certain services.

Additionally, San Jose levies a use tax on the storage, use, or consumption of property purchased from out-of-state vendors. This tax ensures that purchases made online or from remote sellers are taxed, aligning with the sales tax rate. The use tax is particularly important for online shoppers, as it ensures equitable taxation regardless of where the purchase is made.

| Sales and Use Tax Rates in San Jose |

|---|

| State Sales Tax: 7.25% |

| Local Sales Tax (San Jose): 0.5% |

| Combined Sales Tax: 7.75% |

Property Tax

Property taxes in San Jose, like in the rest of California, are primarily assessed at the county level. Santa Clara County, which includes San Jose, has a 1% property tax rate, which is applied to the taxable value of the property. This value is determined by the county assessor and is often lower than the market value due to Proposition 13, a state law that limits property tax increases.

However, it's important to note that there are additional property-related taxes and assessments that can vary by jurisdiction. These may include special assessments for infrastructure projects, Mello-Roos taxes for community services, and other local levies. These additional taxes can significantly impact the overall property tax burden for San Jose residents and businesses.

| Property Tax Rates in Santa Clara County (San Jose) |

|---|

| Base Property Tax Rate: 1% |

| Additional Assessments: Varies by Jurisdiction |

Business Taxes

San Jose imposes various taxes on businesses operating within its boundaries. The San Jose Business Tax, also known as the Business License Tax, is an annual tax levied on most businesses, with rates based on the type and nature of the business. The tax rate can vary significantly, with some businesses paying a flat fee, while others are assessed based on gross receipts or employee headcount.

Additionally, San Jose businesses are subject to the California Franchise Tax, which is a tax on the privilege of doing business in the state. The tax rate for corporations is progressive, starting at 1.5% for net income up to $250,000 and increasing to 8.84% for net income over $250,000. Partnerships and limited liability companies (LLCs) are taxed at a flat rate of 8.84%.

| Business Taxes in San Jose |

|---|

| San Jose Business Tax: Varies by Business Type |

| California Franchise Tax: Progressive Rates (1.5% to 8.84%) for Corporations, Flat Rate (8.84%) for Partnerships and LLCs |

Comparative Analysis: San Jose Tax Rates vs. Other Regions

When comparing San Jose's tax rates to those of other major cities, both within California and across the United States, it's evident that San Jose's tax structure is relatively moderate to high. Here's a comparative analysis:

Income Tax

San Jose's income tax rates, which are aligned with California's progressive tax system, are generally higher than many other states. For instance, Texas and Florida have no state income tax, while states like Washington and Nevada have no income tax for individuals but do tax businesses.

In comparison to other high-tax states, San Jose's income tax rates are competitive. For example, New York's top income tax rate is 8.82%, while California's is 12.3%. However, it's important to consider the overall cost of living and other factors when comparing tax burdens.

Sales Tax

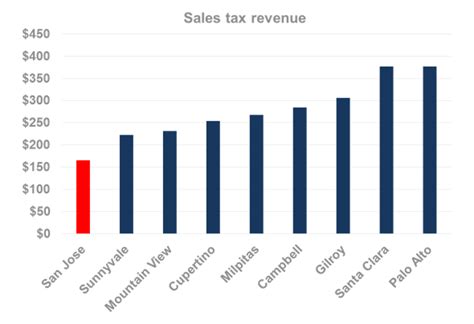

San Jose's combined sales tax rate of 7.75% is on the higher end of the spectrum when compared to other major U.S. cities. For instance, Seattle, Washington, has a sales tax rate of 6.5%, while Los Angeles, California, has a slightly lower rate of 7.25%. However, it's important to note that sales tax rates can vary significantly within a state, and local jurisdictions often have the authority to impose additional sales taxes.

Property Tax

San Jose's property tax rates, as determined by Santa Clara County, are relatively moderate when compared to other counties in California. For example, Los Angeles County has a property tax rate of 1.1925%, which is slightly higher than San Jose's 1% rate. However, it's essential to consider the differences in property values and the impact of Proposition 13, which limits property tax increases, when making comparisons.

Business Taxes

San Jose's business tax structure, which includes the San Jose Business Tax and the California Franchise Tax, is relatively complex and can vary significantly based on the type of business. While the business tax rates are generally competitive with other major cities, the California Franchise Tax can be a significant burden for corporations with high net incomes.

In comparison to other states, California's business tax climate is often viewed as less favorable due to the state's high corporate tax rate and various business-related fees and assessments. However, California's robust economy and large market size often offset these tax considerations for many businesses.

Impact of Tax Rates on San Jose's Economy

The tax rates in San Jose have a profound impact on the city's economic landscape and the financial decisions of its residents and businesses. Here's a deeper look at how tax rates influence various aspects of San Jose's economy:

Residential Real Estate

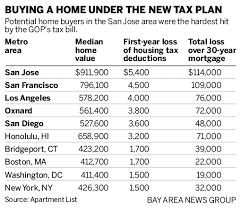

San Jose's relatively high property tax rates, influenced by the state's Proposition 13, can impact the affordability of homeownership. While Proposition 13 provides stability for long-term homeowners by limiting property tax increases, it can make it more challenging for first-time buyers to enter the housing market, especially in a competitive market like San Jose.

Additionally, the use of supplemental property taxes, often imposed when a property is sold or transferred, can significantly increase the cost of real estate transactions. These taxes, which are calculated based on the increased value of the property, can add thousands of dollars to the overall cost of purchasing a home in San Jose.

Business Operations

The combination of San Jose's business taxes, including the San Jose Business Tax and the California Franchise Tax, can influence a business's decision to locate or expand in the city. While San Jose's thriving technology sector and skilled workforce are significant draws, the tax burden can be a consideration, especially for smaller businesses or those with narrow profit margins.

Furthermore, the complexity of California's tax system, with various local, state, and federal taxes, can be a challenge for businesses, particularly those new to the region. Effective tax planning and compliance are crucial for businesses to manage their tax obligations efficiently.

Consumer Spending

San Jose's sales tax rate of 7.75% can impact consumer spending habits. While sales tax is often a factor in purchasing decisions, particularly for big-ticket items, San Jose's relatively high rate can encourage consumers to shop online or in neighboring cities with lower sales tax rates. This dynamic can impact local businesses, especially those relying on in-person sales.

However, it's important to note that San Jose's thriving economy and diverse business landscape often offset the impact of sales tax on consumer spending. The city's strong job market and high disposable income levels can contribute to robust consumer spending, despite the relatively high sales tax rate.

Economic Development

The tax revenue generated by San Jose's tax structure is a critical component of the city's economic development efforts. The city uses these funds to invest in infrastructure, public services, and initiatives that support business growth and job creation. For instance, tax revenue can be directed towards initiatives like workforce development programs, small business support, and incentives to attract new industries.

Furthermore, San Jose's tax rates, particularly the business taxes, can influence the city's ability to compete for new businesses and investments. While high tax rates can be a deterrent, the city's strong economic foundation and strategic tax incentives can help attract and retain businesses, ensuring continued economic growth and development.

Frequently Asked Questions

What is the average property tax rate in San Jose for 2023?

+The average property tax rate in San Jose for 2023 is 1%, which is the base rate set by Santa Clara County. However, it’s important to note that additional assessments and taxes can significantly impact the overall property tax burden, and these vary by jurisdiction.

Are there any tax incentives or breaks for businesses in San Jose?

+Yes, San Jose offers various tax incentives and breaks to attract and support businesses. These can include enterprise zone tax credits, research and development tax credits, and sales tax exemptions for certain manufacturing activities. The city also provides tax incentives for businesses that create jobs and invest in the local community.

How does San Jose’s sales tax rate compare to surrounding cities in the Bay Area?

+San Jose’s sales tax rate of 7.75% is on the higher end when compared to some neighboring cities in the Bay Area. For instance, Oakland has a sales tax rate of 8.75%, while San Francisco has a slightly lower rate of 8.5%. However, it’s important to note that sales tax rates can vary within a city, and additional local taxes may apply.

Are there any tax breaks for first-time homebuyers in San Jose?

+Yes, California offers a First-Time Homebuyer’s Tax Credit, which can provide a tax credit of up to $2,000 for qualified first-time homebuyers. Additionally, San Jose may have local initiatives or programs to support first-time homebuyers, so it’s advisable to consult with a tax professional or the city’s housing department for the latest information.

What is the impact of Proposition 13 on property taxes in San Jose?

+Proposition 13, a state law, limits property tax increases to 2% per year or the rate of inflation, whichever is lower. This provides stability for long-term homeowners in San Jose but can make it more challenging for first-time buyers to enter the housing market due to the potential for significant supplemental property taxes when a property is sold or transferred.