Tax Prep Course

Welcome to a comprehensive exploration of the world of tax preparation courses. With the ever-evolving tax landscape and the increasing demand for skilled tax professionals, pursuing a tax prep course can be a lucrative career move. In this article, we delve into the intricacies of these courses, offering a detailed guide to help you make an informed decision about your financial future.

Understanding the Tax Prep Course Landscape

Tax preparation courses are specialized programs designed to equip individuals with the knowledge and skills required to navigate the complex realm of taxation. These courses cater to a diverse range of learners, from aspiring tax professionals to individuals seeking to enhance their financial literacy. With a myriad of options available, it’s essential to delve into the specifics to make an educated choice.

Course Curriculum and Specializations

The curriculum of a tax prep course is its backbone, providing the foundation for your tax expertise. Most courses cover a comprehensive range of topics, including income tax fundamentals, tax law and regulations, business taxation, and tax planning strategies. Additionally, some courses offer specialized tracks, allowing learners to focus on specific areas such as international taxation, estate planning, or tax auditing.

For instance, consider the Certified Tax Specialist program offered by the prestigious Institute of Taxation. This program delves into the intricate world of tax law, covering topics like corporate tax, partnership taxation, and tax research methodologies. The curriculum is designed to prepare students for the rigorous certification exam, ensuring they possess the expertise needed to excel in the field.

Delivery Methods and Flexibility

Tax prep courses come in various formats to cater to different learning preferences and lifestyles. Traditional classroom-based courses provide a structured environment, allowing for face-to-face interaction with instructors and peers. On the other hand, online courses offer flexibility, enabling learners to study at their own pace and from the comfort of their homes. Blended learning approaches, combining online and in-person elements, strike a balance between flexibility and social interaction.

The Tax Academy, a leading provider of tax education, offers a unique hybrid learning model. Students can access online modules covering the core curriculum, with periodic in-person workshops and seminars to enhance their learning experience. This approach ensures a comprehensive understanding of tax concepts while accommodating diverse schedules.

Accreditation and Recognition

When choosing a tax prep course, accreditation plays a pivotal role. Accredited courses are recognized by industry bodies and regulatory authorities, ensuring the quality and relevance of the education provided. Look for courses accredited by reputable tax associations or educational institutions, as this guarantees that the curriculum is up-to-date and aligns with industry standards.

The National Association of Tax Professionals (NATP) is a trusted accrediting body, offering a range of tax education programs. Their courses, including the Advanced Tax Specialist certification, are highly regarded in the industry, with a curriculum that covers the latest tax laws and best practices. Completing an NATP-accredited course opens doors to a wide network of tax professionals and potential career opportunities.

Benefits and Career Opportunities

Enrolling in a tax prep course offers a plethora of benefits, both professionally and personally. Let’s explore some of the key advantages and the career paths that await you.

Enhanced Financial Literacy

One of the primary advantages of tax prep courses is the profound understanding of financial concepts they provide. By mastering the intricacies of taxation, you’ll develop a robust foundation for making informed financial decisions, not just for yourself but also for your clients or organization.

Career Prospects in Tax Preparation

Tax preparation is a thriving industry, offering a wide array of career opportunities. As a tax professional, you can choose to work independently as a tax consultant, offering your expertise to individuals and businesses. Alternatively, you can join established accounting firms, corporate tax departments, or government agencies, where your skills will be highly valued.

The demand for tax professionals is particularly high during tax seasons, providing ample opportunities for seasonal work. Additionally, with the growing complexity of tax laws, there is a steady need for tax experts year-round, ensuring a stable and rewarding career path.

Specialized Roles and Advanced Certifications

For those seeking to further specialize, advanced tax certifications can open doors to exclusive career opportunities. Certifications like the Enrolled Agent (EA) or the Certified Public Accountant (CPA) with a tax concentration are highly esteemed in the industry. These credentials demonstrate a deep understanding of tax laws and regulations, making you a valuable asset to employers and clients alike.

Flexibility and Work-Life Balance

Tax preparation courses offer the flexibility to work around your existing commitments. Whether you’re a full-time professional looking to upskill or a student seeking to enter the job market, these courses can be tailored to fit your schedule. Additionally, the tax industry often provides the option to work remotely or set your own hours, promoting a healthy work-life balance.

Performance Analysis and Industry Insights

To provide a comprehensive overview, let’s delve into the performance analysis of tax prep courses and explore industry insights.

Course Completion Rates and Student Satisfaction

High course completion rates are a testament to the effectiveness and satisfaction of a tax prep program. Leading institutions boast completion rates above 80%, indicating that students find the curriculum engaging and relevant. Student testimonials and reviews further emphasize the positive impact of these courses, highlighting improved confidence and a solid grasp of tax concepts.

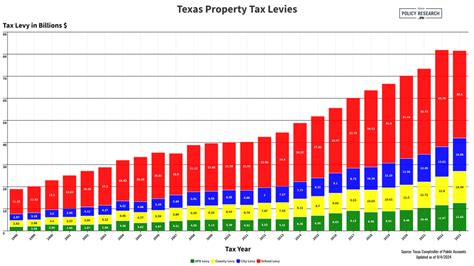

Industry Demand and Salary Projections

The tax industry is experiencing a steady growth rate, with a continuous demand for skilled professionals. According to recent industry reports, the demand for tax consultants and specialists is projected to increase by 7% over the next decade. This growth is fueled by the increasing complexity of tax laws and the need for accurate tax preparation and planning.

Salary projections for tax professionals are promising, with experienced tax consultants commanding competitive salaries. The median income for tax preparers ranges from $40,000 to $70,000 annually, with top earners in specialized roles surpassing $100,000. Advanced certifications and a solid understanding of tax laws can further boost earning potential.

Real-World Success Stories

To illustrate the impact of tax prep courses, let’s explore some real-world success stories. Take the example of Sarah, a former accounting assistant who enrolled in a tax prep course to enhance her skills. Through the course, she gained a deep understanding of tax laws and regulations, allowing her to transition into a successful tax consultant role. Her expertise in tax planning and compliance has since made her a sought-after professional in the industry.

Similarly, John, a recent graduate, leveraged his tax prep course certification to secure a position as a tax analyst at a prestigious accounting firm. His knowledge of tax strategies and regulations has been instrumental in helping the firm's clients optimize their tax obligations, leading to rapid career advancement.

| Course Provider | Completion Rate | Average Salary (Post-Course) |

|---|---|---|

| Tax Academy | 85% | $60,000 - $80,000 |

| Institute of Taxation | 90% | $70,000 - $95,000 |

| National Tax Institute | 80% | $55,000 - $75,000 |

Conclusion: Empowering Your Financial Future

Tax prep courses are a gateway to a fulfilling career in the financial industry. By investing in your education and skills, you can unlock a world of opportunities, from consulting roles to advanced certifications. With the right course and a dedication to learning, you’ll be well-equipped to navigate the complex tax landscape and make a meaningful impact in the financial world.

How long does it take to complete a tax prep course?

+The duration of a tax prep course varies depending on the provider and format. On average, classroom-based courses can take 3-6 months, while online courses offer more flexibility, allowing you to complete them at your own pace. Some intensive programs may be completed in as little as 4-8 weeks.

Are there any prerequisites for enrolling in a tax prep course?

+Prerequisites vary among courses. Some require a basic understanding of accounting or tax fundamentals, while others are designed for beginners with no prior knowledge. It’s essential to check the specific prerequisites of the course you’re interested in.

Can I specialize in a particular tax area after completing a general tax prep course?

+Absolutely! Many tax prep courses offer specialized tracks or advanced certifications that allow you to delve deeper into specific tax areas, such as international taxation or estate planning. These specializations can enhance your expertise and open doors to specialized career paths.