Tax Multiplier

Welcome to a comprehensive exploration of the tax multiplier, a concept that lies at the heart of economic policy and fiscal analysis. This article aims to unravel the complexities surrounding the tax multiplier, shedding light on its mechanisms, implications, and real-world applications. By understanding the tax multiplier, we can grasp the intricate relationship between taxation, economic growth, and the overall health of an economy.

Unraveling the Tax Multiplier

The tax multiplier is a powerful economic concept that reveals the impact of changes in taxation on an economy’s output and income. It is a fundamental tool used by economists and policymakers to assess the effectiveness of tax policies and their potential consequences. The tax multiplier is a measure of how a change in taxes affects the equilibrium level of income or output in an economy, taking into account the complex interactions between consumers, businesses, and government entities.

At its core, the tax multiplier highlights the interconnectedness of various economic agents and the ripple effects that taxation can have on an economy. When taxes are adjusted, whether through increases or decreases, it sets off a chain reaction that influences consumer spending, business investment, and government spending patterns. This dynamic relationship is what gives the tax multiplier its significance and makes it a critical consideration in economic decision-making.

For instance, consider a scenario where a government decides to implement a tax cut. The initial impact is a boost in disposable income for consumers, as they now have more money to spend or save. This increased income leads to a rise in consumer spending, which in turn stimulates economic activity. Businesses experience higher demand for their goods and services, potentially leading to increased production and hiring. The positive effects can continue as businesses invest in expansion, further contributing to economic growth.

Understanding the Multiplicative Effect

The tax multiplier operates through a multiplicative effect, where the initial change in taxes has a magnified impact on the economy. This magnification occurs due to the circular flow of income and expenditure within an economy. When consumers spend more due to tax cuts, it creates a ripple effect that benefits businesses, who then have incentives to invest and hire more workers. This increased economic activity leads to further spending and a potential boost in tax revenues for the government.

However, the tax multiplier is not a straightforward concept, as its magnitude and direction can vary based on numerous factors. The size of the multiplier depends on the specific economic conditions, the type of tax change, and the behavior of economic agents. For example, in a recessionary period, a tax cut may have a larger multiplier effect as consumers are more likely to spend the additional income, thereby stimulating economic recovery.

| Multiplier Type | Description |

|---|---|

| Income Tax Multiplier | Measures the impact of changes in income taxes on disposable income and subsequent spending. |

| Corporate Tax Multiplier | Analyzes the effect of corporate tax changes on business investment and economic growth. |

| Indirect Tax Multiplier | Evaluates the influence of indirect taxes, such as sales tax, on consumer spending and market dynamics. |

Factors Influencing the Tax Multiplier

The tax multiplier is influenced by a multitude of factors, each playing a critical role in determining its magnitude and direction. Understanding these factors is essential for economists and policymakers to make informed decisions regarding tax policy.

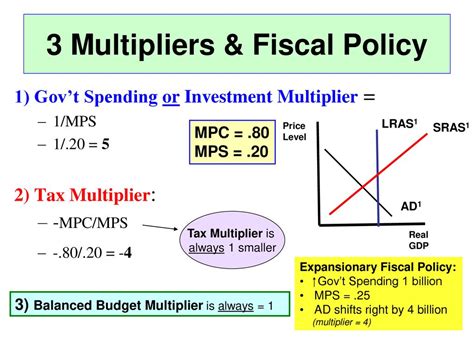

Marginal Propensity to Consume (MPC)

The Marginal Propensity to Consume (MPC) is a key determinant of the tax multiplier. MPC represents the proportion of additional income that consumers choose to spend rather than save. A higher MPC implies that consumers are more likely to spend the extra income gained from tax cuts, leading to a larger multiplier effect. Conversely, a lower MPC may result in a smaller multiplier as consumers save a larger portion of their additional income.

Marginal Propensity to Save (MPS)

On the flip side, the Marginal Propensity to Save (MPS) reflects the portion of additional income that consumers choose to save. A higher MPS indicates that consumers are more inclined to save a larger share of their extra income, potentially reducing the multiplier effect. Understanding the interplay between MPC and MPS is crucial for assessing the overall impact of tax changes on consumer spending and economic activity.

Time Horizon and Expectations

The time horizon and expectations of economic agents also play a significant role in shaping the tax multiplier. In the short run, consumers and businesses may have a more immediate response to tax changes, leading to a rapid adjustment in spending and investment patterns. However, in the long run, expectations and adaptive behavior come into play, potentially dampening or amplifying the multiplier effect. For instance, if consumers expect future tax increases, they may choose to save more, reducing the multiplier’s impact.

Tax Structure and Design

The structure and design of the tax system itself can influence the tax multiplier. Different types of taxes, such as income taxes, corporate taxes, or indirect taxes, can have varying impacts on consumer behavior and business decisions. For instance, a progressive income tax system may have a different multiplier effect compared to a flat tax system, as the distribution of tax burden differs.

Economic Conditions

The overall economic conditions at the time of tax changes can significantly impact the tax multiplier. In a robust economy with low unemployment and high consumer confidence, a tax cut may have a more pronounced multiplier effect as consumers feel more inclined to spend. Conversely, in a recession or economic downturn, the multiplier effect may be muted as consumers adopt more cautious spending behaviors.

Applications of the Tax Multiplier

The tax multiplier finds practical applications in various economic contexts, providing insights that guide policy decisions and economic analysis. Understanding the tax multiplier allows economists and policymakers to evaluate the potential outcomes of tax changes and their implications for economic growth and stability.

Economic Stimulus and Recovery

One of the primary applications of the tax multiplier is in economic stimulus and recovery efforts. During economic downturns or recessions, governments often implement tax cuts or incentives to boost economic activity. By analyzing the tax multiplier, policymakers can estimate the potential impact of these measures on consumer spending, business investment, and overall economic growth. A well-timed and appropriately designed tax policy can leverage the multiplier effect to accelerate economic recovery.

For instance, consider a scenario where a government implements a temporary tax cut during a recession. By understanding the tax multiplier, policymakers can assess the potential increase in consumer spending and the subsequent rise in economic activity. This analysis aids in determining the magnitude and duration of the tax cut required to stimulate the economy effectively.

Budgetary Planning and Fiscal Policy

The tax multiplier is a crucial tool for budgetary planning and fiscal policy formulation. Governments rely on tax revenues to fund public spending and maintain fiscal balance. By understanding the tax multiplier, policymakers can estimate the potential impact of tax changes on government revenues. This information is vital for making informed decisions regarding tax rates, exemptions, and incentives, ensuring that the fiscal policy aligns with the desired economic outcomes.

For example, when considering a tax increase to address a budget deficit, policymakers can use the tax multiplier to assess the potential impact on economic growth. A careful analysis can help determine the optimal tax rate that balances the need for revenue generation with the potential negative impact on economic activity.

International Trade and Tax Competition

In the era of globalized economies, the tax multiplier takes on a new dimension in the context of international trade and tax competition. Countries often engage in tax competition to attract foreign investment and businesses. By understanding the tax multiplier, governments can assess the potential impact of tax changes on their competitiveness in the global market. This analysis aids in making strategic decisions regarding tax rates and incentives to foster economic growth and attract foreign investment.

Evaluating Tax Reform Proposals

When proposing tax reforms, the tax multiplier serves as a valuable tool for evaluating the potential economic outcomes. By analyzing the tax multiplier, policymakers and economists can assess the impact of proposed tax changes on different sectors of the economy. This analysis provides insights into the distributional effects, the potential impact on income inequality, and the overall economic growth implications. A comprehensive understanding of the tax multiplier allows for informed discussions and debates surrounding tax reform proposals.

Challenges and Considerations

While the tax multiplier is a powerful concept, it is not without its challenges and limitations. Understanding these considerations is essential for a nuanced interpretation of the tax multiplier and its implications.

Assumptions and Simplifications

The tax multiplier is based on certain assumptions and simplifications that may not hold true in real-world scenarios. For instance, the multiplier assumes a closed economy, ignoring the potential impact of international trade and capital flows. Additionally, it assumes a static and linear relationship between taxes and economic activity, which may not accurately reflect the complex dynamics of real economies.

Behavioral Responses and Expectations

The behavior of economic agents, such as consumers and businesses, plays a crucial role in shaping the tax multiplier. However, predicting these behaviors accurately can be challenging. Consumer responses to tax changes may vary based on individual circumstances, expectations, and adaptive behavior. Similarly, businesses may react differently to tax changes, depending on their industry, market position, and strategic goals. Understanding these behavioral responses is essential for accurate estimation of the tax multiplier.

Feedback Loops and Dynamic Interactions

The tax multiplier operates within a dynamic system where various economic agents interact and influence each other. These interactions create feedback loops that can amplify or dampen the multiplier effect. For example, an increase in consumer spending due to tax cuts may lead to higher business profits, which in turn encourages further investment and hiring. However, if businesses face capacity constraints or supply-side issues, the multiplier effect may be limited. Understanding these dynamic interactions is crucial for a comprehensive analysis of the tax multiplier.

Time Horizon and Long-Term Effects

The time horizon over which the tax multiplier operates is a critical consideration. In the short run, the multiplier effect may be more pronounced as consumers and businesses respond rapidly to tax changes. However, in the long run, the effects may dissipate as economic agents adjust their behavior and expectations. Long-term effects can be influenced by factors such as technological advancements, demographic shifts, and policy changes. A comprehensive analysis of the tax multiplier should consider both short-term and long-term implications.

Conclusion

In conclusion, the tax multiplier is a vital concept in economic analysis, offering insights into the intricate relationship between taxation and economic growth. By understanding the tax multiplier, economists and policymakers can assess the potential impact of tax changes on consumer spending, business investment, and overall economic activity. This knowledge empowers decision-makers to formulate effective tax policies that promote economic stability and growth.

The tax multiplier's applications extend across various economic contexts, from economic stimulus and recovery to budgetary planning and tax reform evaluations. However, it is essential to recognize the challenges and limitations associated with the concept, including assumptions, behavioral responses, and dynamic interactions. By navigating these complexities, policymakers can harness the power of the tax multiplier to drive positive economic outcomes.

As economies continue to evolve and face new challenges, the tax multiplier remains a fundamental tool for understanding the intricate dynamics of taxation. By embracing a comprehensive and nuanced understanding of the tax multiplier, policymakers can navigate the complexities of economic policy, ensuring that tax systems contribute to the overall well-being and prosperity of societies.

What is the tax multiplier, and why is it important?

+The tax multiplier is an economic concept that measures the impact of changes in taxes on an economy’s output and income. It is important as it helps economists and policymakers understand the potential consequences of tax policies and their effect on economic growth and stability.

How does the tax multiplier work?

+The tax multiplier operates through a multiplicative effect. When taxes are adjusted, it influences consumer spending, business investment, and government spending patterns, creating a ripple effect that impacts the overall economy.

What factors influence the tax multiplier?

+The tax multiplier is influenced by factors such as the marginal propensity to consume (MPC), marginal propensity to save (MPS), time horizon and expectations, tax structure and design, and overall economic conditions.

How is the tax multiplier applied in real-world scenarios?

+The tax multiplier is used in economic stimulus and recovery efforts, budgetary planning, international trade and tax competition, and evaluating tax reform proposals. It provides insights into the potential outcomes of tax changes and guides policy decisions.

What are the challenges and considerations associated with the tax multiplier?

+The tax multiplier has assumptions and simplifications that may not hold true in real-world scenarios. Behavioral responses, feedback loops, and time horizon considerations are also important factors to consider when interpreting the tax multiplier.