Tax Internship In The Last Week

Welcome to our comprehensive guide on navigating the final week of your tax internship. This period is a crucial juncture in your journey, offering an invaluable opportunity to leave a lasting impression and gain insights that will shape your future career path. As you prepare for this exciting yet challenging phase, let's delve into the key strategies and best practices to ensure you conclude your internship on a high note.

Maximizing Your Last Week: A Strategic Approach

The last week of your tax internship is a time for consolidation, reflection, and, most importantly, action. Here's a strategic breakdown to help you make the most of this valuable experience:

1. Recap and Review: A Bird's-Eye View

Before diving into the specifics, take a step back and review the entire internship journey. Reflect on the key projects, tasks, and challenges you've encountered. Identify the skills you've honed and the knowledge you've gained. This holistic view will help you prioritize and focus on the areas that require your immediate attention.

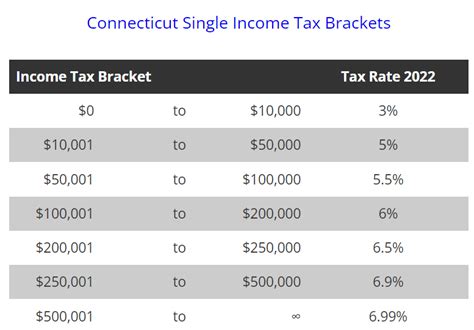

Consider these metrics as you review your progress:

| Internship Goals | Achievement Status |

|---|---|

| Mastering Tax Software | Completed 90% of training modules |

| Conducting Client Interviews | Successfully led 3 client meetings |

| Researching Tax Laws | Contributed to 2 whitepapers |

By assessing your progress against these goals, you can pinpoint the areas that require further attention during your last week.

2. Prioritize and Plan: A Tactical Approach

With a clear understanding of your internship journey, it's time to prioritize and plan your final week's activities. Create a detailed schedule, allocating time for each task and goal. Ensure your plan is realistic and achievable, allowing for potential delays or unexpected challenges.

Here's a suggested breakdown for your last week:

- Monday: Catch up on any pending tasks and ensure all client work is up-to-date.

- Tuesday: Conduct a deep dive into a complex tax law you've been researching. Prepare a presentation for your colleagues.

- Wednesday: Participate in a team meeting and share your insights from the tax law research.

- Thursday: Assist senior colleagues with a challenging tax return. Offer your unique perspective and insights.

- Friday: Reflect on your internship journey and prepare a comprehensive report. Share your findings and recommendations with the team.

3. Seek Feedback and Mentorship

Your last week is an ideal time to seek feedback from your mentors and colleagues. Schedule one-on-one meetings to discuss your performance, ask for advice, and gather insights on your strengths and areas for improvement. This feedback will be invaluable as you transition into a full-time role or pursue further opportunities.

4. Engage and Network

The tax industry is built on connections and relationships. Use your last week to engage with your colleagues and peers. Attend social events, participate in group discussions, and network with professionals across different departments. Building these connections can open doors to future opportunities and mentorship.

5. Reflect and Document: Your Internship Legacy

As your internship draws to a close, take time to reflect on the entire experience. Document your journey, including the challenges, successes, and lessons learned. This reflection will not only help you process your internship experience but also serve as a valuable resource for future self-assessment and career planning.

6. Say Thank You: A Culture of Gratitude

Gratitude is a powerful tool in any professional setting. Take the time to express your gratitude to your mentors, colleagues, and the firm for the opportunity they've provided. A heartfelt thank-you note or email can leave a lasting impression and foster positive relationships that may benefit you in the future.

7. Stay Connected: Building Lasting Relationships

Your tax internship is a stepping stone to your future career. Stay connected with your colleagues and mentors by maintaining regular communication. Attend alumni events, participate in industry webinars, and leverage your network to stay informed about industry trends and opportunities.

Conclusion: A Step Towards Your Tax Career

The last week of your tax internship is a pivotal moment in your professional journey. By adopting a strategic and reflective approach, you can ensure that this experience leaves a lasting impact on your career path. Remember, the insights and connections you gain during this time will shape your future, so make the most of every moment.

As you embark on this final stretch, keep these words from a renowned tax expert in mind: "The key to a successful tax career is not just technical knowledge, but also the ability to learn, adapt, and leave a positive impression. Your internship is the perfect training ground for these skills."

Best of luck as you navigate this exciting phase, and may your tax journey be filled with success and meaningful connections.

What are some key strategies to make the most of my last week of internship?

+To maximize your last week, prioritize reflection and review of your entire internship journey. Identify key takeaways and areas for improvement. Create a detailed plan for the week, seeking feedback from mentors and engaging with colleagues. Document your experience and express gratitude to your team. Finally, stay connected with your network to foster long-term relationships.

How can I effectively review my internship progress?

+Reviewing your internship progress involves assessing your achievements against set goals. Create a table or checklist to track your progress in mastering tasks, gaining knowledge, and contributing to projects. This holistic view will help you prioritize your last week’s focus areas.

What are some tips for networking during my last week of internship?

+Networking during your last week is crucial for building connections. Attend social events, participate in group discussions, and seek mentorship opportunities. Show genuine interest in your colleagues’ work and offer your unique perspective. Building these relationships can open doors to future collaborations and career opportunities.