Tax Evasion Attorney

Tax evasion is a serious matter, and when individuals or businesses find themselves facing allegations or investigations, seeking legal representation from a specialized tax evasion attorney becomes crucial. These attorneys play a pivotal role in navigating the complex world of tax laws, ensuring compliance, and defending their clients' rights. In this comprehensive article, we will delve into the expertise and services offered by tax evasion attorneys, highlighting their importance in the legal landscape.

Understanding Tax Evasion and Its Legal Implications

Tax evasion, a deliberate act to avoid paying taxes owed, is considered a criminal offense in many jurisdictions. It encompasses various activities, including underreporting income, overstating deductions, failing to file tax returns, or engaging in complex schemes to conceal financial assets. The consequences of tax evasion can be severe, ranging from hefty fines and penalties to criminal charges and imprisonment.

The complexity of tax laws, combined with the ever-changing regulatory environment, makes tax evasion a nuanced area of legal practice. Tax evasion attorneys are well-versed in these intricacies, providing invaluable guidance and representation to individuals and entities facing tax-related challenges.

The Role of a Tax Evasion Attorney

A tax evasion attorney serves as a vital advocate and advisor, offering a range of specialized services to assist clients in resolving tax-related issues. Their expertise extends beyond mere legal knowledge; it encompasses a deep understanding of tax laws, regulations, and the tax collection process.

Legal Representation and Defense

When individuals or businesses are under investigation or charged with tax evasion, a tax evasion attorney steps in to provide robust legal representation. They work diligently to gather evidence, prepare a strategic defense, and negotiate on their clients’ behalf. The attorney’s goal is to protect the client’s rights, minimize penalties, and, if possible, resolve the matter without the need for a trial.

In cases where a trial is inevitable, tax evasion attorneys showcase their expertise in the courtroom. They present a strong defense, challenging the prosecution's evidence and arguing for a fair outcome. Their extensive knowledge of tax laws and procedural rules gives them an edge in navigating the complex legal landscape.

Tax Planning and Compliance

Prevention is often the best strategy when it comes to tax evasion. Tax evasion attorneys offer proactive tax planning services to help clients avoid potential legal pitfalls. They assist in structuring financial affairs to ensure compliance with tax laws, minimizing the risk of audits, and maximizing tax efficiency.

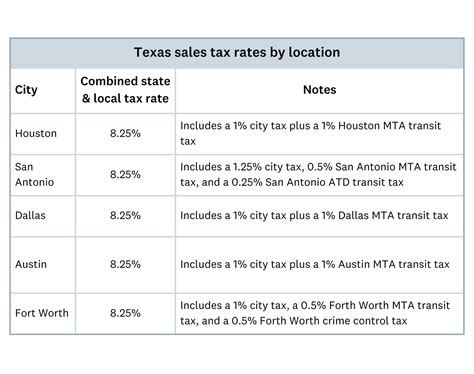

By providing tailored tax planning advice, these attorneys help clients understand their obligations and navigate the complex web of tax regulations. This includes guidance on income reporting, deductions, credits, and international tax considerations. With their expertise, clients can make informed decisions and maintain a compliant financial posture.

Audit Representation and Resolution

Audits by tax authorities can be stressful and time-consuming. Tax evasion attorneys specialize in representing clients during audits, ensuring a smooth and efficient process. They work closely with the client and the tax authorities to gather and present relevant documentation, clarify misunderstandings, and resolve any discrepancies.

In cases where an audit results in additional tax liabilities, the attorney negotiates with the tax authorities to minimize penalties and interest. They strive to reach a fair resolution, helping clients avoid unnecessary financial burdens.

Voluntary Disclosure and Amnesty Programs

Some jurisdictions offer voluntary disclosure programs or amnesty initiatives for taxpayers who have failed to comply with tax laws. These programs provide an opportunity for individuals to come forward, disclose their non-compliance, and potentially reduce penalties. Tax evasion attorneys are well-versed in these programs, guiding clients through the disclosure process and maximizing the benefits available.

By making a voluntary disclosure, clients can avoid criminal charges and demonstrate their willingness to cooperate, which may lead to more favorable outcomes. Tax evasion attorneys play a crucial role in navigating the complexities of these programs and ensuring that their clients receive the best possible resolution.

Choosing the Right Tax Evasion Attorney

Selecting a tax evasion attorney is a critical decision. Here are some key considerations to keep in mind when choosing the right legal representative:

- Experience and Expertise: Look for an attorney with extensive experience in tax law and a proven track record of handling tax evasion cases. Their expertise should encompass both criminal defense and tax-related matters.

- Specialization: Choose an attorney who specializes in tax evasion or tax litigation. These attorneys have a deep understanding of the nuances involved and can provide specialized advice and representation.

- Reputation and References: Research the attorney's reputation within the legal community and among past clients. Seek references and testimonials to ensure they have a strong reputation for ethical and effective representation.

- Communication and Accessibility: Tax evasion cases can be complex and stressful. Choose an attorney who communicates clearly, responds promptly to your inquiries, and keeps you well-informed throughout the process.

- Fees and Cost Structure: Discuss the attorney's fee structure upfront. Understand the costs involved and ensure they align with your budget. Some attorneys may offer flexible payment options or work on a contingency basis, depending on the nature of the case.

Real-World Example: A Case Study

Let’s illustrate the importance of a tax evasion attorney with a hypothetical case study:

Imagine a small business owner, John, who has been facing financial difficulties due to the economic downturn. To stay afloat, he made some questionable decisions regarding his tax obligations, underreporting his income and failing to pay the full amount owed. As a result, he found himself under investigation by the tax authorities.

John, realizing the severity of the situation, sought the expertise of a renowned tax evasion attorney, Ms. Davis. Ms. Davis, with her extensive experience in tax law, immediately began gathering evidence and building a strong defense strategy. She advised John on the best course of action, helping him understand the potential consequences and guiding him through the legal process.

Through her meticulous preparation and persuasive arguments, Ms. Davis successfully negotiated a reduced penalty with the tax authorities. John was able to avoid criminal charges and pay a reasonable settlement, allowing him to focus on rebuilding his business and ensuring future compliance.

This case study showcases the vital role a tax evasion attorney plays in protecting their client's rights, minimizing penalties, and providing a pathway to resolution.

Conclusion: The Importance of Legal Guidance

Tax evasion is a complex and serious matter, and seeking the expertise of a specialized tax evasion attorney is crucial for individuals and businesses facing tax-related challenges. These attorneys provide invaluable legal representation, tax planning advice, and audit support, ensuring their clients’ rights are protected and their financial affairs remain compliant.

Whether it's navigating the complexities of tax laws, defending against allegations, or resolving audits, tax evasion attorneys offer a critical service in the legal field. Their expertise and dedication to their clients' well-being make them an indispensable resource for anyone facing tax-related issues.

What are the potential consequences of tax evasion?

+Tax evasion can lead to severe consequences, including substantial fines, penalties, and even criminal charges resulting in imprisonment. The specific penalties vary depending on the jurisdiction and the severity of the offense.

How can a tax evasion attorney help with tax planning?

+Tax evasion attorneys provide strategic tax planning advice to help clients structure their financial affairs in a compliant manner. They ensure that clients maximize deductions, credits, and other tax benefits while minimizing the risk of audits or legal issues.

Are there any benefits to voluntary disclosure programs?

+Voluntary disclosure programs offer taxpayers an opportunity to come forward and disclose their non-compliance. These programs often provide reduced penalties and a chance to resolve tax issues without facing criminal charges. Tax evasion attorneys can guide clients through the process, maximizing the benefits available.