Tax Collector Gainesville

In the heart of Gainesville, Florida, a bustling city known for its vibrant student population and thriving businesses, the role of the Tax Collector holds significant importance. This position, often overlooked, plays a crucial role in the financial and administrative landscape of the community. The Tax Collector's office is not just a bureaucratic entity but a vital hub that connects citizens with their civic responsibilities and ensures the smooth functioning of the city's financial ecosystem.

The Role of the Tax Collector in Gainesville

The Tax Collector in Gainesville, Florida, serves as a pivotal figure, bridging the gap between the local government and the residents. This office is responsible for a myriad of financial transactions, each of which significantly impacts the city’s operations and development.

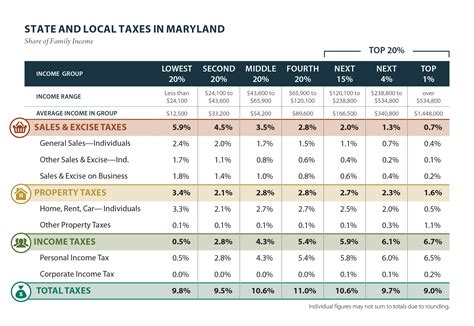

At the core of their duties, the Tax Collector collects various taxes, fees, and fines on behalf of the city. This includes property taxes, which are a major source of revenue for local governments. In Gainesville, property taxes contribute significantly to funding essential services like schools, emergency services, and infrastructure development. The Tax Collector's office ensures that these taxes are assessed fairly and collected efficiently, maintaining a balance between the needs of the city and the financial well-being of its residents.

Beyond property taxes, the Tax Collector also handles vehicle registration and titling. This process involves collecting fees, processing paperwork, and ensuring that vehicles on Gainesville's roads are registered and taxed appropriately. This not only generates revenue but also aids in keeping the city's transportation system organized and safe.

Specific Duties and Responsibilities

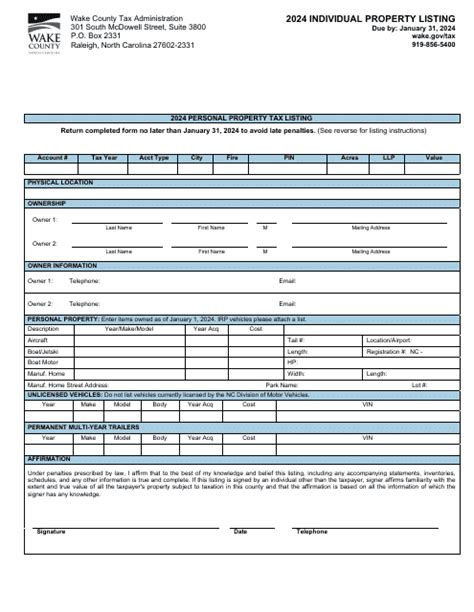

- Tax Assessment and Collection: The Tax Collector’s office assesses property values and determines the corresponding tax amounts. They send out tax notices, collect payments, and provide assistance to residents with tax-related queries.

- Vehicle Registration and Titling: This involves registering vehicles, issuing titles, and collecting the associated fees. The office also handles renewals, changes of address, and transfers of ownership.

- Processing Boat and Mobile Home Registrations: Similar to vehicle registration, the Tax Collector’s office registers and titles boats and mobile homes, collecting the necessary fees and maintaining records.

- Issuing Fishing and Hunting Licenses: For outdoor enthusiasts, the Tax Collector’s office is the go-to place for fishing and hunting licenses. These licenses contribute to the state’s conservation efforts and provide access to recreational activities.

- Business Tax Receipts: Businesses operating within Gainesville are required to obtain a Business Tax Receipt (BTR). The Tax Collector’s office processes these applications, collects the fees, and ensures compliance with local regulations.

The Tax Collector's office also plays a crucial role in providing information and resources to the community. They offer assistance with tax payment plans, answer queries about tax assessments, and provide guidance on various tax-related matters. Additionally, they collaborate with other city departments and state agencies to ensure efficient service delivery and compliance with regulations.

The Impact on Gainesville’s Economy and Community

The Tax Collector’s office has a profound impact on Gainesville’s economic landscape and community development. The revenue generated through various tax collections funds essential services, such as education, public safety, and infrastructure projects. This ensures that the city can invest in its future and provide a high quality of life for its residents.

By efficiently managing tax collections, the Tax Collector's office contributes to Gainesville's financial stability and credibility. This, in turn, attracts businesses and investors, fostering economic growth and job creation. The office's role in business tax receipts is particularly significant, as it encourages and supports entrepreneurship within the city.

Community Engagement and Outreach

The Tax Collector’s office actively engages with the Gainesville community through various initiatives. They participate in local events, providing information and assistance to residents. This outreach helps build trust and ensures that residents understand their financial obligations and the importance of timely tax payments.

Additionally, the office offers online services and resources, making it convenient for residents to access information and conduct transactions remotely. This digital approach not only enhances efficiency but also caters to the diverse needs of the community, including those with busy schedules or limited mobility.

A Look into the Future: Technological Advancements and Innovations

As technology continues to evolve, the Tax Collector’s office in Gainesville is exploring innovative ways to enhance its services. The adoption of digital platforms and online systems is expected to revolutionize tax collection and administration, making processes more efficient and user-friendly.

One significant development is the potential integration of blockchain technology. This could enhance security and transparency in tax records, ensuring that transactions are tamper-proof and easily verifiable. Additionally, machine learning algorithms could be employed to improve tax assessment accuracy and efficiency.

Potential Challenges and Opportunities

While technological advancements offer immense potential, they also present challenges. The Tax Collector’s office must navigate issues related to data privacy, cybersecurity, and ensuring that all residents have equal access to digital services. However, with careful planning and strategic implementation, these challenges can be overcome, leading to a more efficient and inclusive tax collection system.

Furthermore, the office can leverage technology to provide personalized services, offering tailored tax advice and assistance based on individual circumstances. This could enhance taxpayer satisfaction and foster a positive relationship between the Tax Collector's office and the community.

Conclusion: The Tax Collector’s Office as a Vital Community Resource

The Tax Collector’s office in Gainesville, Florida, is more than just a revenue-generating entity. It is a vital community resource, connecting residents with their civic duties and ensuring the city’s financial stability. Through efficient tax collection and administration, the office contributes to the city’s economic growth, development, and overall well-being.

As Gainesville continues to thrive, the Tax Collector's office will remain at the forefront, adapting to new technologies and innovations to better serve the community. Their dedication to transparency, efficiency, and community engagement will continue to shape the city's financial landscape, ensuring a bright and prosperous future for Gainesville and its residents.

What services does the Tax Collector’s office offer in Gainesville, Florida?

+The Tax Collector’s office in Gainesville offers a wide range of services, including property tax assessment and collection, vehicle registration and titling, business tax receipt issuance, fishing and hunting license sales, and more. They provide assistance with tax payments, offer online services, and engage with the community through various outreach programs.

How does the Tax Collector’s office contribute to Gainesville’s economy and community development?

+The Tax Collector’s office plays a crucial role in funding essential services through tax collections. This revenue supports education, public safety, and infrastructure projects, contributing to Gainesville’s economic growth and community development. The office also encourages entrepreneurship by handling business tax receipts.

What technological advancements are being explored by the Tax Collector’s office in Gainesville?

+The Tax Collector’s office is exploring the integration of blockchain technology to enhance security and transparency in tax records. They are also considering the use of machine learning algorithms to improve tax assessment accuracy. These innovations aim to make tax collection more efficient and user-friendly.