Maryland State Tax Calculator

Welcome to our comprehensive guide on the Maryland State Tax Calculator. Understanding tax obligations is crucial, especially when it comes to managing your finances effectively. This article aims to provide an in-depth analysis of the tax landscape in Maryland, offering valuable insights and practical tools to help individuals and businesses navigate their tax responsibilities.

The Maryland Tax System: A Comprehensive Overview

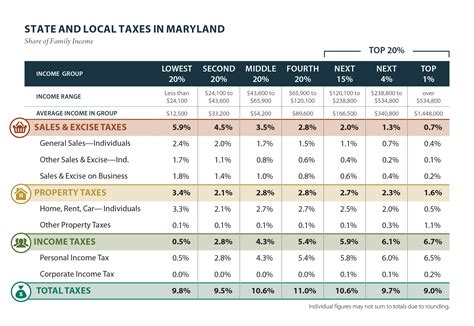

Maryland, known as the Old Line State, boasts a robust economy and a diverse tax system. The state’s tax policies play a significant role in shaping the financial landscape for residents and businesses alike. In this section, we delve into the intricacies of Maryland’s tax structure, shedding light on the various components that contribute to the overall tax burden.

Income Tax: Unraveling the Structure

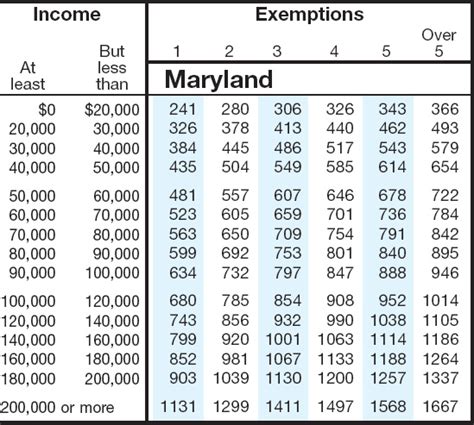

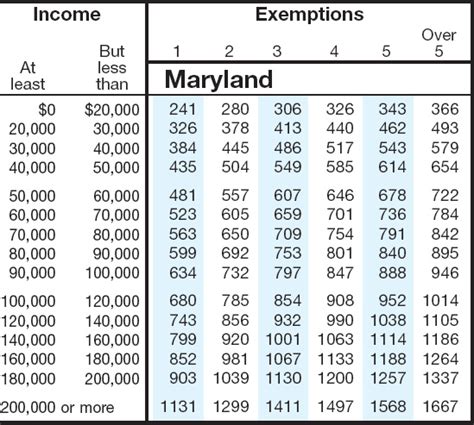

One of the key aspects of Maryland’s tax system is its income tax. The state imposes a progressive income tax, meaning that as your income increases, so does the tax rate. This ensures a fair and equitable approach to taxation. Currently, Maryland has five tax brackets, ranging from 2.5% to 5.75%, each applicable to different income levels.

Let’s take a closer look at the income tax brackets for Maryland’s fiscal year 2023:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | Up to 1,000</td> <td>2.5%</td> </tr> <tr> <td>2</td> <td>1,001 - 2,000</td> <td>3%</td> </tr> <tr> <td>3</td> <td>2,001 - 3,000</td> <td>4%</td> </tr> <tr> <td>4</td> <td>3,001 - 100,000</td> <td>4.75%</td> </tr> <tr> <td>5</td> <td>Above 100,000 | 5.75% |

These tax brackets are subject to change annually, so it's essential to stay updated with the latest tax rates to accurately calculate your income tax liability.

Sales and Use Tax: A Dynamic Duo

Maryland also imposes a sales and use tax, which is a common feature in many state tax systems. The sales tax is applicable to the purchase of goods and certain services within the state, while the use tax comes into play when goods are purchased outside Maryland but used or consumed within the state.

The current sales and use tax rate in Maryland is 6%, which is applied to most transactions. However, there are certain exemptions and special tax rates for specific items, such as food, clothing, and prescription drugs. These exemptions aim to alleviate the tax burden on essential items and promote consumer affordability.

Property Tax: A Local Perspective

Property tax is another crucial component of Maryland’s tax system. Unlike income and sales tax, which are state-wide taxes, property tax is assessed and collected by local jurisdictions, such as counties and municipalities. The property tax rates can vary significantly across different regions within the state.

Property tax is typically calculated based on the assessed value of your property. The assessed value is determined by local assessors, who consider factors like location, size, and market conditions. It’s important to note that property tax rates can change annually, and property owners should stay informed about any updates to avoid surprises.

Other Taxes and Fees

Maryland, like many other states, has a range of additional taxes and fees that contribute to its overall tax revenue. These include but are not limited to:

- Motor Vehicle Taxes: Taxes on vehicle registration and fuel consumption.

- Excise Taxes: Taxes on specific goods and services, such as tobacco, alcohol, and certain luxury items.

- Business Taxes: Various taxes and fees applicable to businesses, including corporate income tax, franchise tax, and unemployment insurance tax.

- Estate and Inheritance Taxes: Taxes on the transfer of property upon death.

Calculating Your Maryland State Taxes

Now that we have a comprehensive understanding of Maryland’s tax system, let’s explore how to calculate your state tax obligations accurately. The process involves a series of steps, and we will guide you through each one, ensuring a seamless and accurate calculation.

Step 1: Determine Your Taxable Income

The first step in calculating your Maryland state taxes is to determine your taxable income. This is the amount of income that is subject to state income tax after all applicable deductions and exemptions have been taken into account.

To calculate your taxable income, you need to consider various factors, including your total income from all sources, such as wages, salaries, business income, investments, and any other taxable income. It’s crucial to accurately report all sources of income to avoid underreporting and potential penalties.

Step 2: Choose the Right Tax Form

Maryland offers different tax forms based on your filing status and income level. The most common forms are the Maryland Form 502 for individual taxpayers and Maryland Form 500 for businesses. These forms guide you through the process of calculating your tax liability and claiming any applicable deductions and credits.

It’s important to select the appropriate form based on your circumstances. For instance, if you are a single filer with no dependents and a straightforward income structure, you may use the Form 502-EZ, a simplified version of the regular Form 502. However, if your tax situation is more complex, with multiple sources of income or deductions, the regular Form 502 would be more suitable.

Step 3: Calculate Your Income Tax

Using the selected tax form, you can now calculate your income tax liability. The process involves applying the appropriate tax rate to your taxable income, based on the tax brackets mentioned earlier. Remember, the tax rates and brackets may change annually, so it’s crucial to use the most up-to-date information.

Let’s consider an example to illustrate the calculation. Suppose you are a single filer with a taxable income of 45,000 for the fiscal year 2023. Using the income tax brackets, we can calculate your tax liability as follows:</p> <table> <tr> <th>Tax Bracket</th> <th>Income Range</th> <th>Tax Rate</th> <th>Tax Calculation</th> </tr> <tr> <td>1</td> <td>Up to 1,000 2.5% 25 (1,000 x 0.025)</td> </tr> <tr> <td>2</td> <td>1,001 - 2,000</td> <td>3%</td> <td>30 (1,000 x 0.03) 3 2,001 - 3,000 4% 40 (1,000 x 0.04)</td> </tr> <tr> <td>4</td> <td>3,001 - 45,000</td> <td>4.75%</td> <td>2,112.50 (42,000 x 0.0475) Total Tax $2,177.50

In this example, your total income tax liability for the fiscal year 2023 would be $2,177.50.

Step 4: Consider Deductions and Credits

Maryland offers a range of deductions and tax credits that can reduce your tax liability. These include standard deductions, itemized deductions, and various tax credits for specific circumstances, such as the Maryland Earned Income Tax Credit and the Maryland College Investment Plan Credit.

It’s crucial to review all available deductions and credits to ensure you are taking full advantage of any tax-saving opportunities. Consult the applicable tax forms and guidelines to understand the eligibility criteria and calculation methods for each deduction or credit.

Step 5: Calculate Other Taxes

Apart from income tax, you may have other tax obligations, such as sales and use tax, property tax, or business taxes. Each of these taxes has its own calculation methods and applicable rates. Ensure you understand the specific rules and regulations for each type of tax to accurately calculate your liability.

For instance, if you own a business in Maryland, you may need to calculate and remit various business taxes, including corporate income tax, franchise tax, and unemployment insurance tax. These calculations often involve complex formulas and may require professional assistance.

Utilizing the Maryland State Tax Calculator

To simplify the tax calculation process and ensure accuracy, Maryland provides an online tax calculator tool. This user-friendly calculator allows taxpayers to input their relevant information and instantly receive an estimated tax liability.

The Maryland State Tax Calculator is a valuable resource for individuals and businesses alike. It offers a quick and convenient way to estimate tax obligations, providing taxpayers with a clear understanding of their potential tax liabilities before filing their returns.

Key Features of the Maryland State Tax Calculator

- Income Tax Calculation: The calculator estimates your income tax liability based on your taxable income, filing status, and applicable tax rates.

- Sales and Use Tax Estimation: It provides an estimate of your sales and use tax liability, taking into account the applicable tax rate and any exemptions.

- Property Tax Information: While the calculator does not directly calculate property tax, it offers resources and links to help you understand the property tax assessment process and locate your local tax assessor’s office.

- Business Tax Calculation: For businesses, the calculator offers tools and resources to estimate various business taxes, such as corporate income tax and franchise tax.

- Deduction and Credit Estimation: It provides information on available deductions and credits, helping taxpayers estimate their potential tax savings.

Using the Calculator: A Step-by-Step Guide

- Visit the Official Website: Access the Maryland State Tax Calculator through the official Maryland Department of Revenue website.

- Select Your Tax Type: Choose the type of tax you wish to calculate, such as income tax, sales tax, or business tax.

- Input Your Information: Enter the required details, including your income, filing status, deductions, and any other relevant information.

- Review and Confirm: Carefully review the estimated tax liability and ensure the information is accurate and up-to-date.

- Download or Print: The calculator provides the option to download or print the estimated tax calculation for your records.

Filing Your Maryland State Taxes

Once you have calculated your tax liability and understood your obligations, it’s time to file your Maryland state taxes. The filing process involves completing the appropriate tax forms, attaching any necessary supporting documentation, and submitting your return to the Maryland Department of Revenue.

Key Considerations for Filing

- Filing Deadlines: Be aware of the filing deadlines for Maryland state taxes. The specific deadline may vary based on your filing status and circumstances. Generally, the deadline is April 15th, but it’s essential to verify the exact date for your situation.

- Payment Options: Maryland offers various payment options, including electronic funds transfer (EFT), credit card payments, and traditional check or money order payments. Choose the method that suits your preference and financial situation.

- Filing Status: Understand your filing status, whether you are filing as an individual, joint filer, head of household, or business entity. This determination affects the tax forms you need to complete and the deductions and credits you may claim.

- Documentation: Gather all necessary documentation, such as W-2 forms, 1099 forms, business records, and any other supporting documents to substantiate your income, deductions, and credits.

Online Filing: A Convenient Option

Maryland encourages taxpayers to file their state taxes electronically, as it offers a faster and more secure process. The state provides an online filing system, known as eFile Maryland, which allows taxpayers to complete and submit their tax returns online.

eFile Maryland offers a user-friendly interface, guiding taxpayers through the filing process step by step. It also provides real-time error checking, ensuring that your return is accurate and complete before submission.

Paper Filing: Traditional Approach

For those who prefer a traditional approach or have complex tax situations, paper filing is also an option. You can download the necessary tax forms from the Maryland Department of Revenue website, complete them manually, and mail them to the appropriate address.

Paper filing may take longer to process, and there is a higher risk of errors or delays. However, it provides an alternative for those who are not comfortable with online filing or have specific requirements.

Maryland State Tax Tips and Strategies

Understanding the Maryland tax system and accurately calculating your tax obligations are crucial, but there are also strategies and tips to help you optimize your tax situation and potentially reduce your tax liability.

Maximize Deductions and Credits

Maryland offers a range of deductions and tax credits that can significantly reduce your tax burden. It’s essential to explore all available options and ensure you are taking full advantage of these tax-saving opportunities.

Some common deductions and credits include the Maryland Earned Income Tax Credit, which provides a tax credit for low- to moderate-income earners, and the Maryland College Investment Plan Credit, which offers a credit for contributions to eligible college savings plans.

Optimize Your Filing Status

Your filing status plays a significant role in determining your tax liability and the deductions and credits you can claim. It’s important to choose the filing status that best aligns with your circumstances and maximizes your tax benefits.

Consider whether you qualify as a single filer, joint filer, head of household, or a qualifying widow(er). Each status has its own set of rules and eligibility criteria, so it’s crucial to understand the implications of each option.

Minimize Taxable Income

Reducing your taxable income is a strategic way to lower your tax liability. There are various legal methods to achieve this, such as contributing to tax-advantaged retirement accounts, such as 401(k) plans or IRAs. These contributions reduce your taxable income and provide tax benefits in the long run.

Additionally, consider timing your income and expenses strategically. For instance, if you have the flexibility to control the timing of income or deductions, you may be able to optimize your tax situation by spreading income over multiple tax years or taking advantage of tax deductions in the current year.

Seek Professional Advice

Tax laws and regulations can be complex, and it’s not uncommon for taxpayers to encounter situations that require expert guidance. Seeking advice from a tax professional, such as a Certified Public Accountant (CPA) or a tax attorney, can provide valuable insights and ensure compliance with the latest tax regulations.

A tax professional can help you navigate complex tax situations, optimize your tax strategy, and identify potential tax-saving opportunities. They can also assist with preparing and filing your tax returns, ensuring accuracy and minimizing the risk of errors or audits.

Maryland State Tax: Future Outlook and Implications

As we look ahead, it’s essential to consider the future implications and potential changes to Maryland’s tax system. The state’s tax policies are subject to ongoing review and revision, influenced by economic trends, political decisions, and societal needs.

Economic Impact and Tax Revenues

Maryland’s tax system plays a crucial role in generating revenue for the state, which is essential for funding public services, infrastructure, and social programs. The state’s economic performance and tax policies are interconnected, as economic growth can lead to increased tax revenues, while tax policies can influence economic activity.