State Of Michigan Tax Return Status

For residents of the Great Lakes State, understanding the status of their Michigan tax returns is crucial. This guide will provide an in-depth analysis of the various stages of the Michigan tax return process, offering insights into what to expect at each step. Whether you're a taxpayer awaiting a refund or a business owner navigating the complexities of state tax compliance, this article will serve as a comprehensive resource.

The Journey of a Michigan Tax Return

The Michigan Department of Treasury is responsible for processing tax returns and ensuring compliance with state tax laws. Here’s a breakdown of the key stages in the life of a Michigan tax return.

Filing Your Return

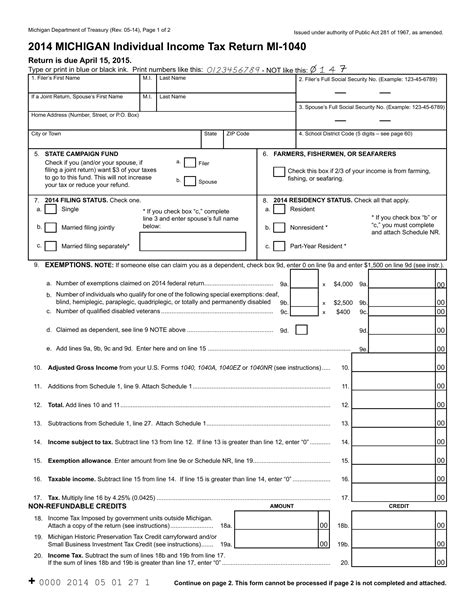

The filing process begins with taxpayers submitting their Form 1040 or the appropriate Michigan tax form. This step is critical, as it sets the tone for the entire tax journey. Accurate and timely filing is essential to avoid penalties and interest charges.

| Form | Description |

|---|---|

| Form 1040 | Standard federal tax form for individual income tax return. |

| Form 4768 | Used to apply for an automatic extension of time to file a tax return. |

| Form MI-1040 | Michigan's state tax form for individuals. |

| Form MI-2210 | Michigan's estimated tax payment voucher. |

For those seeking an extension, Form 4768 is available to provide additional time for filing. However, it's important to note that an extension to file does not extend the deadline for paying taxes owed.

Processing and Review

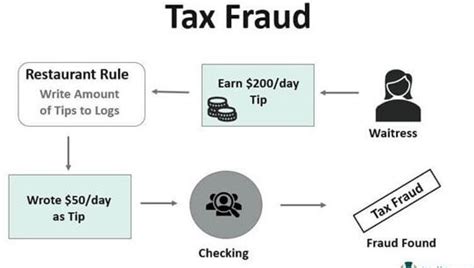

Once filed, the Michigan Department of Treasury initiates the processing phase. This stage involves a thorough review of the submitted information to ensure accuracy and compliance with state tax laws.

During the review process, the department may identify errors or discrepancies, prompting taxpayers to amend their returns or provide additional documentation. This step is crucial to maintain the integrity of the state's tax system.

Issuing Refunds

For taxpayers expecting a refund, the processing stage concludes with the issuance of the refund. The Michigan Department of Treasury offers several refund options, including direct deposit and check by mail.

Direct deposit is the fastest and most secure method, with refunds typically arriving within 2-3 weeks of filing. Taxpayers can opt for this method by providing their bank account information on their tax return.

For those who prefer a check, the Department mails the refund to the address provided on the tax return. However, this method may take 4-6 weeks or longer, depending on postal service delays.

Addressing Issues and Delays

Occasionally, tax returns may encounter issues or delays during processing. Common reasons for delays include missing or incorrect information, mathematical errors, or identity verification issues.

In such cases, the Department may send a notice to the taxpayer, requesting additional information or documentation. It's crucial to respond promptly to these notices to avoid further delays in processing.

Understanding Tax Return Status Updates

To stay informed about the status of their tax return, Michigan taxpayers can utilize the Department’s online tools and resources. These resources provide real-time updates and allow taxpayers to track the progress of their return.

Online Status Check

The Michigan Department of Treasury offers an online status check tool, accessible through their official website. Taxpayers can log in to their account and view the current status of their return, including any pending actions or issues.

This tool provides a convenient way to monitor the progress of the return and stay informed about any necessary steps to take. It's a valuable resource for taxpayers eager to receive their refund or address any processing delays.

Status Update Codes

When checking the status of their return, taxpayers may encounter various status update codes. These codes provide insights into the current stage of the return’s processing journey.

| Code | Description |

|---|---|

| R01 | Return received and being processed. |

| R02 | Return selected for further review. |

| R03 | Refund issued. |

| R04 | Return adjusted due to errors or discrepancies. |

| R05 | Return processed with no issues. |

| R06 | Return rejected due to missing or incorrect information. |

Understanding these codes can help taxpayers interpret the status of their return and take appropriate actions if needed.

Resolving Issues and Seeking Assistance

In the event of issues or questions, taxpayers can reach out to the Michigan Department of Treasury for assistance. The Department offers various support channels to help taxpayers navigate the tax process.

Customer Service Hotline

Taxpayers can call the Department’s customer service hotline to speak with a tax representative. The hotline is available during business hours, and taxpayers can receive personalized assistance with their specific tax queries.

The hotline number is 517-335-7630, and callers can expect to receive guidance on topics such as filing requirements, payment options, and refund status.

Online Support and Resources

In addition to the hotline, the Department’s website offers a wealth of online resources and support materials. These resources include:

- FAQs: A comprehensive list of frequently asked questions, covering a range of tax-related topics.

- Publications: Official guides and publications providing detailed information on tax laws and regulations.

- Forms: Access to all relevant tax forms and instructions for completion.

- Online Payment Portal: A secure platform to make tax payments and view payment history.

Taxpayer Advocate Service

For complex or unresolved issues, taxpayers can reach out to the Taxpayer Advocate Service (TAS). TAS is an independent organization within the IRS that assists taxpayers in resolving problems with the IRS.

TAS can help with issues such as delays in receiving refunds, proposed tax adjustments, or difficulties in communicating with the IRS. They aim to ensure that taxpayers are treated fairly and that their concerns are addressed promptly.

Future Implications and Tax Planning

Understanding the status of your Michigan tax return is not only crucial for the current tax season but also for future tax planning. By staying informed and proactive, taxpayers can avoid potential issues and ensure compliance with state tax laws.

Avoiding Penalties and Interest

One of the key benefits of staying updated on tax return status is the ability to avoid penalties and interest charges. By promptly addressing any issues or discrepancies, taxpayers can ensure they meet their tax obligations without incurring additional costs.

Additionally, being aware of refund timelines allows taxpayers to plan their finances accordingly, ensuring they have the necessary funds to cover any tax liabilities.

Planning for Future Tax Seasons

The insights gained from tracking tax return status can also inform future tax planning strategies. Taxpayers can analyze their previous returns to identify areas for improvement, such as maximizing deductions or credits.

By understanding the impact of various tax decisions, taxpayers can make more informed choices when filing their returns in subsequent years. This proactive approach can lead to better tax outcomes and potentially reduce the overall tax burden.

Conclusion

In conclusion, staying informed about the status of your Michigan tax return is essential for a smooth and stress-free tax journey. By leveraging the resources and tools provided by the Michigan Department of Treasury, taxpayers can navigate the complexities of state tax compliance with confidence.

From filing to processing and resolving issues, this guide has provided a comprehensive overview of the Michigan tax return process. By following the insights and tips offered here, taxpayers can ensure they meet their tax obligations while maximizing their refund potential.

When will I receive my Michigan tax refund?

+

The timeline for receiving a Michigan tax refund varies. If you choose direct deposit, you can expect to receive your refund within 2-3 weeks of filing. For check refunds, it may take 4-6 weeks or longer, depending on postal service delays.

What if my tax return is delayed due to errors or discrepancies?

+

In case of delays due to errors or discrepancies, the Michigan Department of Treasury may send a notice requesting additional information or documentation. Responding promptly to these notices is crucial to avoid further processing delays.

How can I track the status of my Michigan tax return online?

+

To track the status of your Michigan tax return online, you can log in to your account on the Michigan Department of Treasury’s official website. Here, you can view the current status of your return, including any pending actions or issues.

What should I do if I have issues or questions about my Michigan tax return?

+

If you encounter issues or have questions about your Michigan tax return, you can reach out to the Michigan Department of Treasury’s customer service hotline at 517-335-7630 during business hours. Additionally, their website offers a wealth of online resources and support materials.

Can I seek assistance from the Taxpayer Advocate Service for complex tax issues?

+

Yes, the Taxpayer Advocate Service (TAS) is an independent organization within the IRS that assists taxpayers in resolving complex tax issues. TAS can help with various matters, including delays in receiving refunds, proposed tax adjustments, or difficulties in communicating with the IRS.