St Johns County Real Estate Taxes

Welcome to our in-depth exploration of St. Johns County's real estate taxes, a topic of great interest to both seasoned investors and newcomers to the area. St. Johns County, located in the picturesque northeast region of Florida, is renowned for its stunning coastal scenery, vibrant communities, and thriving real estate market. As one of the fastest-growing counties in the state, it presents a compelling investment opportunity, but understanding the tax landscape is crucial for making informed decisions.

In this comprehensive guide, we'll delve into the intricacies of St. Johns County's real estate taxes, offering a detailed analysis that will empower you with the knowledge needed to navigate this dynamic market with confidence. From tax rates and assessment processes to exemptions and incentives, we'll cover every aspect, ensuring you have a comprehensive understanding of the financial implications of investing in this sought-after county.

The Fundamentals of St. Johns County Real Estate Taxes

St. Johns County, much like the rest of Florida, operates under a millage-based property tax system. This means that the tax rate, or millage rate, is expressed in mills, with one mill representing one-tenth of a dollar per $1,000 of the assessed value of the property. These millage rates are set annually by various taxing authorities, including the county, school board, and municipalities, to fund essential services and infrastructure development.

The assessed value of your property is a critical factor in determining your real estate tax liability. In St. Johns County, properties are typically assessed at a just value, which is the fair market value as determined by the county's Property Appraiser's Office. This value can fluctuate annually based on market conditions and any improvements made to the property. However, Florida offers a homestead exemption, which caps the annual increase in assessed value for homesteaded properties at 3% or the Consumer Price Index (CPI), whichever is less.

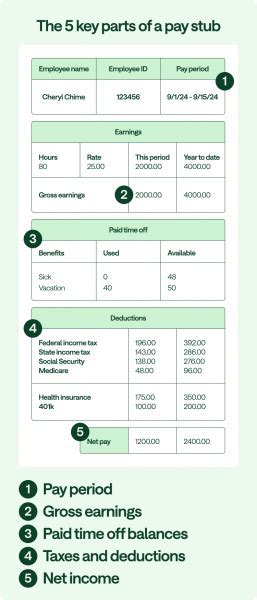

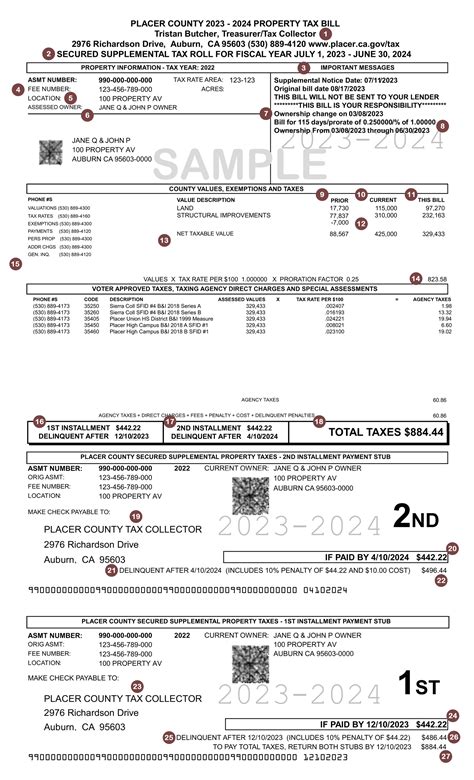

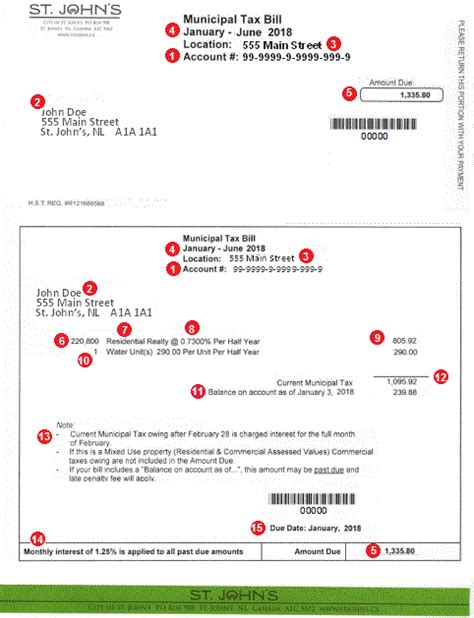

The formula for calculating your real estate taxes in St. Johns County is relatively straightforward. First, the county's millage rate is applied to the assessed value of your property. This initial calculation, known as the taxable value, is then subject to any applicable exemptions or discounts. The final amount is what you'll be responsible for paying as your real estate taxes for the year.

Understanding Millage Rates and Taxing Authorities

The millage rate is a critical component of your real estate tax bill, and it's essential to understand how it's determined. In St. Johns County, the millage rate is set by a combination of taxing authorities, each with its own budget requirements and responsibilities.

The primary taxing authority is the county government, which sets a millage rate to fund county operations, including public safety, infrastructure maintenance, and administrative services. Additionally, the St. Johns County School District has its own millage rate to support the local education system. Other taxing authorities, such as municipalities, water management districts, and special districts, may also set millage rates to finance their specific services and projects.

Each of these taxing authorities has a distinct role and responsibility in the community, and their millage rates are set independently. As a result, the overall millage rate for a property in St. Johns County is the sum of these individual rates. This means that properties located within the boundaries of multiple taxing authorities will have a higher overall millage rate and, consequently, higher real estate taxes.

| Taxing Authority | Millage Rate (Mills) |

|---|---|

| St. Johns County | 7.7000 |

| St. Johns County School Board | 7.7550 |

| City of St. Augustine | 6.7800 |

| St. Johns River Water Management District | 0.2000 |

| Other Special Districts | Varies |

It's important to note that millage rates can change from year to year as the taxing authorities adjust their budgets and financial needs. Therefore, it's crucial to stay informed about these changes, especially if you're considering a long-term investment in St. Johns County real estate.

Assessed Value and Property Appraisals

The assessed value of your property is a critical factor in determining your real estate tax liability. In St. Johns County, the Property Appraiser's Office is responsible for establishing this value, which is based on the fair market value of your property as of January 1st of the tax year.

The fair market value is determined through a comprehensive appraisal process that considers various factors, including recent sales of similar properties in the area, replacement costs, and the property's income-generating potential. This value can fluctuate annually, reflecting changes in the real estate market and any improvements or additions made to the property.

To ensure transparency and accuracy, the Property Appraiser's Office provides homeowners with a Notice of Proposed Property Taxes, which outlines the assessed value and the preliminary tax amount. This notice serves as an opportunity for homeowners to review the proposed assessment and, if necessary, dispute it through a formal appeals process.

Understanding the assessed value of your property is crucial for several reasons. Firstly, it directly impacts your real estate tax liability. Secondly, it can affect your eligibility for certain exemptions and discounts. And lastly, it provides a benchmark for future property value increases, especially for properties with the homestead exemption.

Exemptions and Incentives: Maximizing Your Tax Savings

St. Johns County offers a range of exemptions and incentives designed to reduce the tax burden on homeowners and encourage specific types of development. These exemptions can significantly impact your real estate tax liability, so it's essential to understand which ones you may be eligible for.

Homestead Exemption

The homestead exemption is one of the most significant tax breaks available to Florida residents. This exemption applies to the primary residence of a permanent Florida resident and permanently reduces the assessed value of the property by $50,000. For example, if your property has an assessed value of $300,000, the homestead exemption would reduce this value to $250,000 for tax purposes.

To qualify for the homestead exemption, you must meet certain criteria. You must be a permanent resident of Florida, and the property must be your primary residence. You must also apply for the exemption annually, typically by March 1st, to ensure you receive the benefit for the upcoming tax year.

The homestead exemption is particularly beneficial for long-term residents, as it provides a permanent reduction in the assessed value of their property. This means that even if the market value of your home increases over time, your taxable value will remain capped, ensuring more stable and predictable real estate taxes.

Additional Exemptions and Incentives

Beyond the homestead exemption, St. Johns County offers several other exemptions and incentives that can further reduce your tax liability. These include:

- Senior Exemption: Available to homeowners who are 65 years or older and have a household income below a certain threshold. This exemption provides a discount on the assessed value of the property, reducing the tax burden for senior citizens.

- Military Exemption: Active-duty military personnel and veterans can qualify for an exemption based on their service. This exemption can reduce the assessed value of their property, providing a financial benefit for those who have served our country.

- Agricultural Exemption: If your property is used for agricultural purposes, you may be eligible for an exemption based on its productive use. This can significantly reduce the assessed value of the land, making it a valuable incentive for farmers and landowners.

- Greenbelt Exemption: This exemption is designed to encourage the preservation of environmentally sensitive lands. If your property falls under this category, you may be eligible for a reduced assessment, providing an incentive for land conservation.

It's important to note that each of these exemptions has its own eligibility criteria and application process. Consulting with a tax professional or the St. Johns County Property Appraiser's Office can help you determine which exemptions you may qualify for and ensure you receive the full benefits.

The Impact of Real Estate Taxes on Investment Decisions

Understanding the real estate tax landscape is crucial for anyone considering an investment in St. Johns County. Real estate taxes can significantly impact the overall profitability of your investment, and it's essential to factor them into your financial analysis.

Cash Flow and Return on Investment (ROI)

When evaluating potential investment properties, it's crucial to consider the impact of real estate taxes on your cash flow and ROI. These taxes are a recurring expense that must be factored into your financial projections. Failing to account for them accurately can lead to unrealistic expectations and potential financial pitfalls.

For example, let's consider a rental property in St. Johns County. If you underestimate the real estate taxes, your projected cash flow may be higher than what you actually receive. This discrepancy can affect your ability to cover other expenses, such as maintenance, repairs, and property management fees. Additionally, it can impact your overall ROI, as the tax liability may eat into your profits more significantly than anticipated.

On the other hand, if you overestimate the real estate taxes, you may find that your investment is more profitable than initially projected. This can provide a buffer for unexpected expenses or allow for additional reinvestment into the property.

Tax Planning and Strategy

Understanding the real estate tax landscape in St. Johns County can also inform your tax planning and investment strategy. By staying informed about changes in millage rates and exemptions, you can make more strategic decisions about when to purchase or sell properties.

For instance, if you anticipate an increase in millage rates, you may want to consider purchasing a property before the new rates take effect. This can lock in a lower tax liability for the duration of your ownership, especially if you qualify for exemptions. Conversely, if you're considering selling a property, you may want to time the sale to take advantage of any temporary tax breaks or incentives.

Furthermore, understanding the tax implications can help you structure your investment portfolio more effectively. For example, you may choose to allocate a larger portion of your investment budget to properties that offer more significant tax breaks, such as those eligible for the homestead exemption or other incentives. This can enhance the overall profitability of your portfolio and reduce your tax liability.

Conclusion: Navigating the St. Johns County Real Estate Market with Confidence

St. Johns County offers a wealth of investment opportunities, from coastal retreats to vibrant urban developments. However, navigating the real estate market with confidence requires a deep understanding of the tax landscape. By comprehending the fundamentals of real estate taxes, including millage rates, assessed values, and exemptions, you can make more informed decisions and maximize your investment potential.

Throughout this guide, we've explored the key aspects of St. Johns County's real estate taxes, providing you with the knowledge needed to assess the financial implications of any property investment. From understanding the role of taxing authorities to maximizing tax savings through exemptions, you're now equipped to navigate this dynamic market with confidence.

Remember, staying informed about tax changes and consulting with tax professionals can further enhance your investment strategy. By incorporating this knowledge into your decision-making process, you can ensure that your investments in St. Johns County real estate are not only profitable but also aligned with your long-term financial goals.

How are millage rates determined in St. Johns County?

+Millage rates are set by various taxing authorities in St. Johns County, including the county government, school board, municipalities, and special districts. These authorities determine their budget needs and set millage rates accordingly. The overall millage rate for a property is the sum of these individual rates.

What is the homestead exemption, and how does it benefit homeowners in St. Johns County?

+The homestead exemption is a significant tax break for Florida residents. It reduces the assessed value of a homeowner’s primary residence by $50,000. This permanent reduction in assessed value ensures more stable and predictable real estate taxes for long-term residents.

How can I stay informed about changes in millage rates and tax laws in St. Johns County?

+You can stay informed by regularly checking the websites of the St. Johns County Property Appraiser’s Office and the county government. These sources provide updates on tax laws, millage rates, and any changes to exemptions or incentives. Additionally, consulting with a tax professional can ensure you have the latest information.

What is the role of the Property Appraiser’s Office in St. Johns County’s real estate tax system?

+The Property Appraiser’s Office is responsible for determining the assessed value of properties in St. Johns County. This value is based on the fair market value of the property as of January 1st of the tax year. The office also provides homeowners with a Notice of Proposed Property Taxes and handles appeals for assessed values.