Senior Tax Freeze Nj

The topic of Senior Tax Freeze in New Jersey is of great importance for older adults residing in the Garden State. This program, officially known as the Senior Citizen Homestead Rebate Program, offers eligible seniors a way to manage their property tax burdens, which can be particularly challenging on fixed incomes.

In this comprehensive guide, we will delve into the intricacies of the Senior Tax Freeze program, exploring its eligibility criteria, application process, benefits, and impact on the lives of New Jersey's senior citizens. We will also discuss the future prospects and potential changes to this vital program.

Understanding the Senior Tax Freeze Program

The Senior Tax Freeze, as the name suggests, aims to "freeze" the property taxes for eligible senior citizens, preventing them from facing increasing tax burdens year after year. This program is a critical tool for maintaining the financial stability and independence of seniors, especially in an era of rising property values and taxes.

The Homestead Rebate Program, as it is officially termed, provides a credit on the property tax bills of eligible seniors, ensuring that their tax liability remains constant, regardless of any increases in the assessed value of their property. This rebate is essentially a refund of the excess property taxes paid, calculated based on the difference between the current year's property tax and the "frozen" amount.

Eligibility Criteria

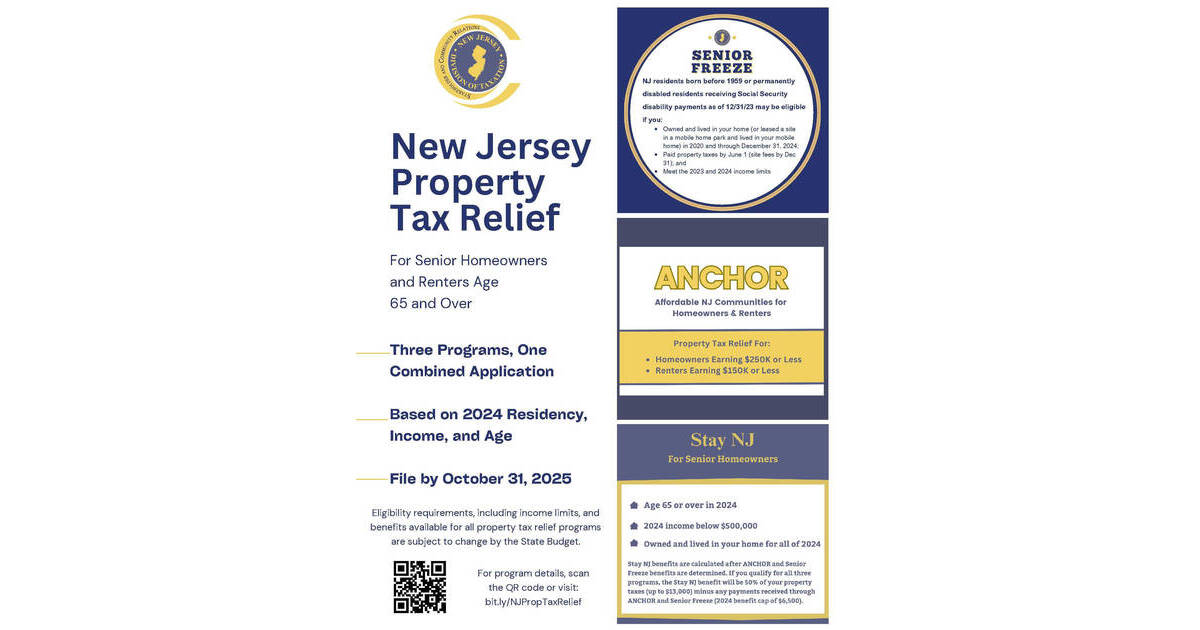

To be eligible for the Senior Tax Freeze, individuals must meet the following criteria:

- Age Requirement: The applicant must be 65 years of age or older by the tax year for which they are applying.

- Residency: Applicants must have been New Jersey residents for at least two years prior to the application year.

- Income Limit: The annual gross income of the applicant and their spouse (if married) must not exceed $150,000. This includes all sources of income such as wages, pensions, social security, and investments.

- Property Ownership: The applicant must own and occupy the property as their primary residence.

- Property Value: The assessed value of the property must not exceed $750,000. This value is determined by the county tax assessor.

It's important to note that eligibility is assessed on an annual basis, and seniors must reapply each year to maintain their tax freeze status.

Application Process

The application process for the Senior Tax Freeze program is relatively straightforward. Here's a step-by-step guide:

- Obtain the Application: Applications are typically available online through the New Jersey Division of Taxation's website or at local tax offices. Seniors can also request an application by mail.

- Complete the Application: The application requires personal and financial information, including income details, property details, and proof of residency. It's crucial to provide accurate and complete information to avoid delays or rejection.

- Submit the Application: Applications can be submitted online, by mail, or in person at designated drop-off locations. The deadline for submitting applications is typically in the spring, and it's essential to meet this deadline to be considered for the current tax year.

- Review and Approval: Once submitted, applications are reviewed by the Division of Taxation. If approved, seniors will receive a notice confirming their eligibility and the amount of their rebate.

Benefits and Impact

The Senior Tax Freeze program has a significant positive impact on the lives of eligible seniors in New Jersey. Here's a deeper look at the benefits:

Financial Stability

The primary benefit of the Senior Tax Freeze is financial stability. By freezing property taxes, seniors can budget more effectively, knowing that their tax liability will not increase despite rising property values. This is especially crucial for those living on fixed incomes, as it prevents unexpected tax increases from becoming a financial burden.

Preserving Homeownership

The program also encourages and supports homeownership among seniors. By alleviating the financial strain of increasing property taxes, the Senior Tax Freeze program makes it more feasible for seniors to continue living in their homes, rather than facing the difficult decision of selling due to unaffordable tax increases.

Community Stability

On a broader scale, the Senior Tax Freeze program contributes to community stability. By allowing seniors to remain in their homes, the program helps maintain the character and diversity of neighborhoods. This can have a positive impact on the social fabric of communities, as long-time residents are able to continue contributing to and being a part of their local communities.

Data Insights

According to recent data from the New Jersey Division of Taxation, the Senior Tax Freeze program has benefited a significant number of seniors across the state. In the 2022 tax year, over 140,000 seniors received a total of $280 million in rebates, with an average rebate amount of $1,993. These figures highlight the substantial financial relief provided by the program.

| Tax Year | Number of Beneficiaries | Total Rebates | Average Rebate |

|---|---|---|---|

| 2022 | 140,000 | $280,000,000 | $1,993 |

Future Prospects and Considerations

As New Jersey continues to grapple with rising property values and the increasing needs of its aging population, the future of the Senior Tax Freeze program is an important topic of discussion.

Potential Changes

While the program has been a vital tool for seniors, there are ongoing discussions about potential modifications to ensure its sustainability and effectiveness. Some proposed changes include:

- Income Limit Adjustments: Given the rising cost of living, there are suggestions to increase the income limit to allow more seniors to benefit from the program.

- Means Testing: Some advocate for a means-tested approach, where the rebate amount varies based on the senior's income level, ensuring that those with the greatest financial need receive the largest benefit.

- Automatic Enrollment: To streamline the process and reduce the administrative burden on seniors, there are proposals to automatically enroll eligible seniors based on existing data, rather than requiring annual applications.

Program Sustainability

Ensuring the long-term sustainability of the Senior Tax Freeze program is a critical consideration. With the state's budget constraints and the increasing demand for such programs, it is essential to explore innovative solutions to maintain and enhance the program's effectiveness. This may involve exploring alternative funding sources or reevaluating the program's structure to make it more efficient and cost-effective.

Conclusion

The Senior Tax Freeze program in New Jersey is a vital tool for maintaining the financial stability and independence of senior citizens. By freezing property taxes, the program provides a crucial safety net for seniors, allowing them to continue living in their homes and contributing to their communities. With ongoing discussions and potential changes on the horizon, the program's future looks promising, ensuring that New Jersey's seniors can continue to age with dignity and financial security.

How often do I need to reapply for the Senior Tax Freeze program?

+Eligible seniors must reapply for the program annually. The application period typically opens in the spring, and it’s crucial to meet the deadline to be considered for the current tax year.

Can I apply for the Senior Tax Freeze program if I’m married, but my spouse is not a senior?

+Yes, you can still apply if you meet the age requirement and your spouse does not. However, both your income and your spouse’s income will be considered when determining eligibility.

What happens if my income exceeds the limit during the tax year, but it was within the limit at the time of application?

+If your income exceeds the limit during the tax year, you may be required to repay a portion or all of the rebate you received. It’s important to accurately report your income and understand the program’s income requirements.