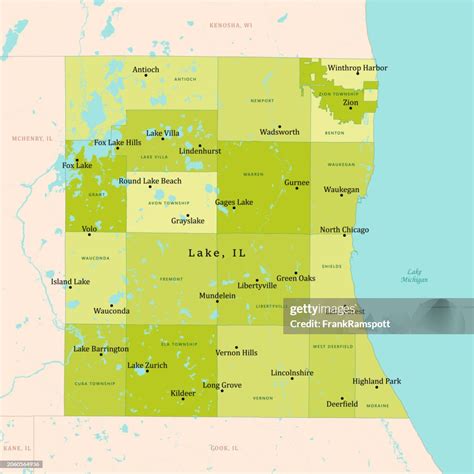

Lake County Il Taxes

In Lake County, Illinois, property taxes play a significant role in funding various local services and infrastructure. As residents and property owners navigate the tax landscape, understanding the intricacies of Lake County's tax system becomes essential. This comprehensive guide aims to provide an in-depth analysis of Lake County Il Taxes, offering insights into tax rates, assessment processes, payment options, and more.

Understanding Lake County’s Tax Structure

Lake County’s tax system operates within the broader framework of Illinois’ property tax laws. The county’s taxing districts, including municipalities, townships, and special districts, rely on property taxes to finance essential services such as education, public safety, transportation, and environmental initiatives.

Tax Rates and Assessment

Lake County’s tax rates are established by each taxing district based on their budgetary needs and the assessed value of properties within their jurisdiction. The assessment process involves evaluating properties to determine their fair market value, which forms the basis for tax calculations.

Key factors influencing tax rates include:

- Property type (residential, commercial, industrial)

- Location within the county

- Assessment levels set by the Lake County Assessor’s Office

- Individual taxing district’s budget requirements

Lake County utilizes a three-year assessment cycle, with reassessments conducted every three years. This process ensures that property values remain up-to-date and that tax burdens are distributed fairly among property owners.

| Assessment Year | Taxable Value |

|---|---|

| 2022 | $120 billion |

| 2023 | $125 billion (estimated) |

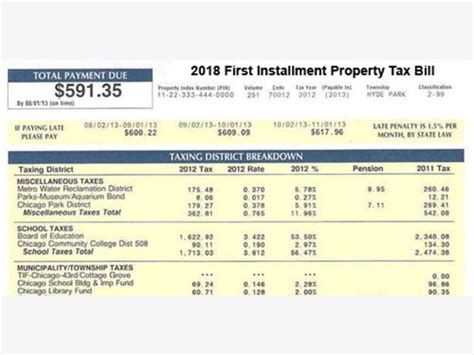

Tax Rates and Levy

Tax rates in Lake County are expressed as a percentage of the assessed value. Each taxing district sets its tax rate independently, resulting in varying tax rates across the county. The tax rate, when applied to the assessed value, determines the tax levy, which represents the total amount of taxes to be collected by the district.

For example, if a residential property in a particular township has an assessed value of $250,000 and the tax rate is 5%, the tax levy for that property would be calculated as follows:

| Assessed Value | Tax Rate | Tax Levy |

|---|---|---|

| $250,000 | 5% | $12,500 |

This tax levy represents the amount owed by the property owner to the taxing district.

Tax Payment Options

Lake County offers a range of payment options to accommodate different preferences and circumstances. Property owners can choose from the following methods to settle their tax obligations:

- Online Payment: Secure online platform for convenient tax payments using credit/debit cards or e-check.

- Mail-in Payment: Traditional method of sending checks or money orders via postal service to the designated tax office.

- In-Person Payment: Visit the Lake County Treasurer’s Office to make payments in person.

- Payment Plans: For eligible taxpayers, the county offers installment plans to spread out tax payments over a specified period.

Navigating Tax Exemptions and Appeals

Lake County provides certain tax exemptions to eligible property owners, offering financial relief and ensuring fairness in the tax system. Understanding the available exemptions and the appeal process is crucial for taxpayers.

Common Tax Exemptions

Lake County offers various exemptions, including:

- Homestead Exemption: Provides a reduction in the assessed value for primary residences, benefiting homeowners.

- Senior Citizen Exemption: Offers tax relief to elderly residents based on age and income criteria.

- Veteran’s Exemption: Recognizes the service of veterans by providing property tax exemptions.

- Agricultural Exemption: Supports agricultural activities by exempting certain lands from taxation.

To qualify for these exemptions, property owners must meet specific criteria and complete the necessary application process.

The Appeal Process

Property owners who believe their assessment is inaccurate or unfair have the right to appeal. The Lake County Board of Review oversees the appeal process, which involves the following steps:

- Filing an appeal within the designated timeframe.

- Providing evidence and supporting documentation to substantiate the appeal.

- Attending a hearing (if applicable) to present the case.

- Awaiting the Board’s decision, which may result in a reduction, increase, or no change in the assessment.

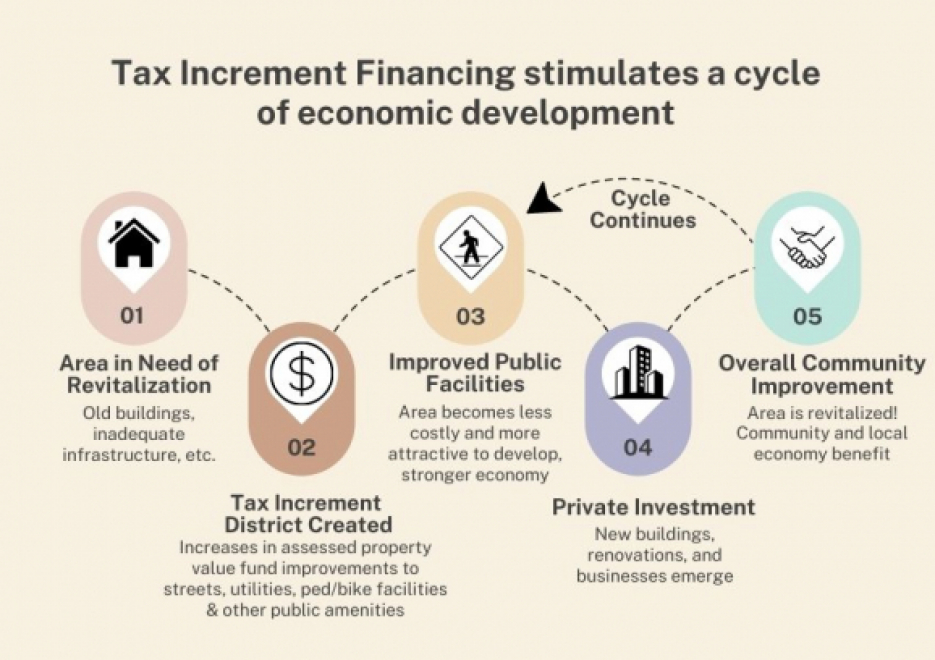

Tax Incentives and Programs

Lake County aims to promote economic growth and support various initiatives through tax incentives and special programs. These programs offer benefits to specific industries, homeowners, and community projects.

Economic Development Incentives

To attract businesses and stimulate economic activity, Lake County offers tax incentives such as:

- Tax Increment Financing (TIF): Allows for the capture of increased property tax revenue to fund infrastructure improvements in designated TIF districts.

- Enterprise Zones: Provides tax breaks and incentives to businesses operating within designated zones, fostering job creation and economic development.

Homeowner Assistance Programs

Lake County recognizes the importance of homeownership and offers programs to assist residents, including:

- First-Time Homebuyer Programs: Provides financial support and resources to help individuals achieve homeownership.

- Property Tax Deferral Programs: Offers relief to eligible seniors and individuals with disabilities by deferring property tax payments.

Community Development Initiatives

Lake County collaborates with local communities to enhance infrastructure and services. Tax dollars contribute to initiatives such as:

- Park and recreation improvements

- Road and transportation projects

- Environmental conservation efforts

- Support for local schools and educational programs

Lake County’s Taxing Districts and Budgets

Lake County’s tax system is decentralized, with multiple taxing districts operating within the county. Understanding the financial landscape of these districts provides insights into how tax revenues are allocated and utilized.

Major Taxing Districts

Lake County encompasses various taxing districts, including cities, villages, townships, and special districts. Some of the notable taxing districts include:

- City of Waukegan: A major urban center with a diverse tax base.

- Lake County Forest Preserve District: Dedicated to preserving natural areas and providing recreational opportunities.

- Lake County Township High School District 113: Responsible for funding high school education in certain areas.

- Community College District 502: Provides resources for higher education.

Budget Allocation and Priorities

Each taxing district allocates its tax revenues based on its specific needs and priorities. Common budget allocations include:

- Public safety (police, fire, emergency services)

- Education (elementary, high school, community college)

- Infrastructure maintenance and improvements

- Health and social services

- Cultural and recreational programs

The budgetary decisions of these districts directly impact the services and facilities available to Lake County residents.

Future Outlook and Tax Policy

As Lake County continues to evolve, its tax policies and practices may undergo changes to address emerging needs and challenges. Staying informed about potential tax reforms and initiatives is essential for property owners and residents.

Potential Tax Reforms

Discussions around tax reform in Lake County may include:

- Exploring alternatives to property taxes, such as income or sales taxes, to alleviate the burden on homeowners.

- Implementing measures to ensure equitable tax distribution across different property types and locations.

- Streamlining the assessment and appeal processes to enhance efficiency and transparency.

Community Engagement and Transparency

Lake County encourages community engagement and transparency in its tax processes. Residents can stay informed and participate in discussions through various channels, including:

- Town hall meetings

- Public forums

- Online platforms and social media

- Direct communication with elected officials and tax authorities

Conclusion: A Comprehensive Approach to Tax Management

Lake County Il Taxes present a complex yet vital aspect of the local economy and community well-being. By understanding the tax system, navigating exemptions, and staying informed about initiatives and reforms, property owners can actively participate in the financial health of their community.

As Lake County continues to adapt and evolve, its tax policies will remain a crucial element in shaping the future of the county. Through a combination of efficient tax collection, strategic investments, and community engagement, Lake County strives to create a sustainable and prosperous environment for its residents.

FAQ

What is the average property tax rate in Lake County, IL?

+

The average property tax rate in Lake County, IL, varies depending on the specific taxing district. As of [date], the average rate ranges from approximately [rate 1]% to [rate 2]%, with some districts having lower or higher rates based on their budgetary needs.

How often are property taxes due in Lake County?

+

Property taxes in Lake County are typically due in two installments. The first installment is due on or before March 1st, while the second installment is due on or before July 1st of each year. It is essential to stay updated with the specific due dates for your taxing district.

Can I apply for a tax exemption in Lake County?

+

Yes, Lake County offers various tax exemptions to eligible property owners. Common exemptions include the Homestead Exemption, Senior Citizen Exemption, and Veteran’s Exemption. To apply, you must meet the specific criteria and submit the required application forms by the designated deadline.

What happens if I miss a property tax payment in Lake County?

+

If you miss a property tax payment in Lake County, you may incur late fees and interest charges. It is important to contact the Lake County Treasurer’s Office as soon as possible to discuss your options and avoid potential penalties. They can guide you through the process of making late payments or arranging a payment plan.

How can I appeal my property assessment in Lake County?

+

To appeal your property assessment in Lake County, you must file an appeal with the Lake County Board of Review within the designated timeframe. The appeal process involves providing evidence and supporting documentation to substantiate your claim. It is advisable to seek professional guidance or consult with the Board of Review for a comprehensive understanding of the appeal requirements.