San Jose Tax

San Jose, California, is a vibrant city known for its thriving tech industry, diverse culture, and bustling urban life. However, alongside its dynamic growth, San Jose also boasts a robust tax system that plays a crucial role in shaping the city's economic landscape. Understanding the intricacies of San Jose's tax structure is essential for residents, businesses, and investors alike. In this comprehensive guide, we will delve into the various aspects of San Jose's tax landscape, exploring its unique features, rates, and implications.

Unraveling the San Jose Tax System

San Jose’s tax system is a complex network of federal, state, and local regulations, each with its own set of rules and implications. As one of the largest cities in California, San Jose has developed a sophisticated tax framework to support its extensive public services, infrastructure, and community development initiatives. This article aims to shed light on the key components of San Jose’s tax structure, offering valuable insights for anyone navigating the city’s financial landscape.

Property Taxes: A Foundation of San Jose’s Revenue

Property taxes form the backbone of San Jose’s revenue generation. The city’s robust property tax system is a significant contributor to its economic stability and development. Here’s a closer look at how property taxes work in San Jose:

Assessment and Rates

Property taxes in San Jose are determined by the assessed value of a property and the applicable tax rate. The Santa Clara County Assessor’s Office is responsible for assessing property values, which are then used to calculate the tax liability. The tax rate, also known as the tax rate area (TRA), is set by the county and varies depending on the location of the property within San Jose.

The tax rate consists of two components: the general tax rate and any additional special taxes or assessments. The general tax rate is applied to all properties and is used to fund essential city services such as police, fire protection, and general administration. Special taxes and assessments are levied for specific purposes, such as funding local improvements or supporting local schools.

| Property Type | Assessment Method | Tax Rate (Example) |

|---|---|---|

| Residential Properties | Annual reassessment at 1% or market value, whichever is lower | 1.05% |

| Commercial Properties | Annual reassessment at full market value | 1.25% |

| Agricultural Lands | Assessed based on productive value | 0.60% |

It's important to note that property tax rates in San Jose can vary significantly depending on the specific location and characteristics of the property. Factors such as neighborhood, property size, and improvements can all influence the final tax assessment.

Tax Bill and Payment Options

Property owners in San Jose receive an annual tax bill, known as the Secure and Fair Elections (SAFE) Tax Bill, which outlines the assessed value of their property, the applicable tax rate, and the total amount due. The tax bill also provides information on payment options and due dates.

San Jose offers various payment methods, including online payment through the city's official website, mail-in payments, and in-person payments at designated locations. Property owners have the flexibility to choose the most convenient option for them.

Appeals and Exemptions

If a property owner believes that their property has been incorrectly assessed, they have the right to appeal the assessment. The Santa Clara County Assessment Appeals Board handles such appeals, providing a process for property owners to dispute their assessed value. The appeals process ensures that property taxes are fair and accurate.

Additionally, San Jose offers certain exemptions and reductions to eligible property owners. These include homeowner's exemptions, which reduce the assessed value of a primary residence, and exemptions for senior citizens, disabled veterans, and other qualifying individuals. These exemptions aim to provide financial relief to specific groups within the community.

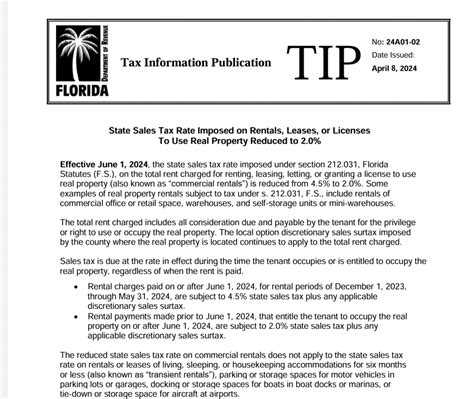

Sales and Use Taxes: Generating Revenue for San Jose

Sales and use taxes are another critical component of San Jose’s tax system, contributing to the city’s overall revenue stream. These taxes are applied to the sale of goods and services and are an essential source of funding for various public initiatives.

Sales Tax Structure

Sales taxes in San Jose are a combination of state and local taxes. The state of California imposes a base sales tax rate, which is then supplemented by local taxes set by San Jose and Santa Clara County. The total sales tax rate in San Jose reflects this combination, varying slightly depending on the specific location within the city.

The sales tax rate is applied to the retail price of goods and services sold within San Jose. It is collected by businesses and remitted to the state and local authorities. The revenue generated from sales taxes is used to fund a wide range of public services, including transportation, education, healthcare, and public safety.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| San Jose (City) | 1.00% |

| Santa Clara County | 0.75% |

| Total Sales Tax Rate (Example) | 9.00% |

Use Taxes and Exemptions

Use taxes are applied to the purchase of goods or services made outside of San Jose but used or consumed within the city. This tax ensures that businesses and individuals pay their fair share of taxes, even if the transaction occurs outside of the city limits. Use taxes are often used to level the playing field for local businesses that compete with out-of-state or online retailers.

San Jose offers certain exemptions from sales and use taxes for specific entities and transactions. These exemptions include sales to qualified nonprofit organizations, certain agricultural purchases, and sales made to government entities. Understanding these exemptions is crucial for businesses to ensure compliance and take advantage of any applicable tax breaks.

Compliance and Enforcement

The California Department of Tax and Fee Administration (CDTFA) is responsible for enforcing sales and use tax compliance in San Jose. Businesses are required to register with the CDTFA, collect the appropriate taxes from customers, and remit these taxes to the state and local authorities on a regular basis. Failure to comply with sales and use tax regulations can result in penalties and legal consequences.

Business Taxes: Supporting Economic Growth

San Jose’s business tax system is designed to support the city’s thriving business community while generating revenue for essential public services. The city offers a range of business tax options, catering to the diverse needs of its entrepreneurial ecosystem.

Business License Tax

The Business License Tax is a key component of San Jose’s business tax structure. It is an annual tax levied on businesses operating within the city limits. The tax is based on the gross receipts of the business, with rates varying depending on the industry and the nature of the business activities.

The Business License Tax is calculated using a graduated rate structure, with higher rates applied to businesses with higher gross receipts. This ensures that businesses contribute to the city's revenue in proportion to their scale of operations. The revenue generated from this tax is used to fund vital city services, such as public safety, infrastructure development, and economic development initiatives.

| Business Type | Tax Rate (Example) |

|---|---|

| Retail Businesses | 0.18% - 0.36% of gross receipts |

| Professional Services | 0.18% - 0.36% of gross receipts |

| Manufacturing | 0.18% - 0.36% of gross receipts |

| Other Businesses | Varies based on industry and revenue |

Transitional Tax

San Jose also imposes a Transitional Tax on certain businesses, particularly those that are newly established or expanding their operations within the city. This tax is designed to provide a revenue stream during the initial stages of a business’s growth, when it may not yet be generating significant profits.

The Transitional Tax is calculated based on the square footage of the business's physical location and the applicable tax rate. It is typically levied for a limited period, after which the business transitions to the regular Business License Tax. This tax aims to support the city's economic development by encouraging business growth and expansion.

| Business Type | Transitional Tax Rate (Example) |

|---|---|

| Retail Businesses | $0.10 per square foot |

| Office Spaces | $0.08 per square foot |

| Industrial Properties | $0.05 per square foot |

Business Tax Exemptions and Incentives

San Jose offers a range of tax exemptions and incentives to attract and support businesses. These incentives aim to encourage economic growth, job creation, and innovation within the city. Some common tax incentives include:

- Research and Development Tax Credit: Businesses engaged in research and development activities may be eligible for tax credits, reducing their overall tax liability.

- Manufacturing Exemption: Certain manufacturing businesses may be exempt from the Business License Tax, providing a significant cost savings.

- Economic Development Incentives: The city offers various incentives to businesses that create jobs, invest in local communities, or support sustainable practices.

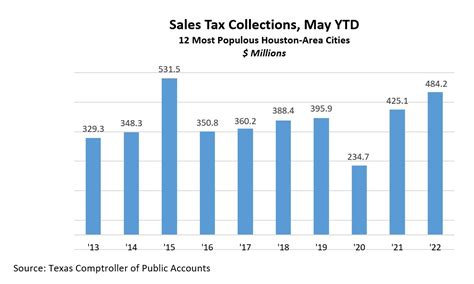

Understanding Tax Rates and Revenues

San Jose’s tax system is a complex interplay of various tax types and rates, each contributing to the city’s overall revenue stream. By understanding these rates and their implications, residents, businesses, and investors can make informed decisions and effectively manage their tax obligations.

Tax Rate Analysis

San Jose’s tax rates are influenced by a variety of factors, including state and local regulations, economic conditions, and the city’s financial needs. The city’s tax structure is designed to be progressive, with higher rates applied to higher income levels and larger businesses. This approach ensures that those who can afford it contribute more to the city’s revenue.

Property taxes, sales and use taxes, and business taxes each have their own rate structures and assessment methods. While these rates may seem straightforward, it's important to consider the cumulative impact of these taxes on individuals and businesses. San Jose's tax rates are generally competitive compared to other major cities in California, making it an attractive location for residents and businesses alike.

Revenue Generation and Allocation

The revenue generated from San Jose’s tax system is a critical component of the city’s budget. This revenue is allocated to fund a wide range of public services, infrastructure projects, and community development initiatives. The city’s budget process involves careful planning and prioritization to ensure that tax revenues are utilized effectively and efficiently.

A significant portion of San Jose's tax revenue is allocated to essential services such as public safety, education, transportation, and social services. These areas are crucial for maintaining the city's quality of life and supporting its diverse population. Additionally, revenue is allocated to capital projects, such as infrastructure upgrades, park development, and affordable housing initiatives.

| Revenue Source | Estimated Revenue (FY 2023) |

|---|---|

| Property Taxes | $1.2 billion |

| Sales and Use Taxes | $350 million |

| Business Taxes | $200 million |

| Other Revenues | $250 million |

| Total Estimated Revenue | $1.9 billion |

Budget Transparency and Accountability

San Jose takes pride in its commitment to budget transparency and accountability. The city publishes detailed budget reports and financial statements, providing residents and stakeholders with access to information on revenue sources, allocations, and expenditures. This transparency fosters trust and allows for informed public engagement in the budget process.

The city's budget is subject to rigorous oversight and review by independent auditors, ensuring that tax revenues are utilized responsibly and in accordance with legal and ethical standards. San Jose's dedication to transparency and accountability contributes to its reputation as a well-managed and fiscally responsible city.

Navigating Tax Compliance and Resources

Navigating San Jose’s tax system can be complex, especially for individuals and businesses new to the city. However, San Jose provides a range of resources and support to help taxpayers understand their obligations and ensure compliance.

Tax Compliance and Resources

The City of San Jose’s official website serves as a valuable resource for taxpayers, offering comprehensive information on tax rates, due dates, payment options, and compliance requirements. The website provides user-friendly guides and tools to help taxpayers navigate the tax system with ease.

Additionally, the city offers a dedicated tax assistance program, providing support and guidance to residents and businesses. This program includes workshops, seminars, and one-on-one consultations to address specific tax-related queries and concerns. Taxpayers can access this assistance through the city's official channels or by contacting the relevant tax offices.

Tax Professionals and Advisors

For more complex tax situations or for those seeking expert advice, San Jose has a thriving community of tax professionals and advisors. These professionals, including accountants, tax attorneys, and financial advisors, have extensive knowledge of San Jose’s tax system and can provide tailored guidance to individuals and businesses.

Tax professionals can assist with tax planning, compliance, and filing, ensuring that taxpayers meet their obligations and take advantage of available tax benefits. They can also provide strategic advice on tax-efficient business operations and help navigate the city's tax incentives and exemptions.

Online Resources and Tools

San Jose recognizes the importance of digital resources in simplifying tax processes. The city’s official website offers a range of online tools and calculators to assist taxpayers. These tools include:

- Property Tax Calculator: A user-friendly calculator that estimates property tax liabilities based on assessed value and applicable tax rates.

- Sales Tax Estimator: A tool that helps businesses and consumers estimate sales tax amounts for various transactions.

- Business Tax Lookup: A database that provides information on business tax rates, exemptions, and registration requirements.

These online resources, combined with the city's comprehensive website, make it easier for taxpayers to understand their obligations and navigate the tax system efficiently.

The Future of San Jose’s Tax System

As San Jose continues to thrive and evolve, its tax system will play a pivotal role in shaping the city’s future. The city’s leadership and policymakers are actively engaged in discussions and initiatives to ensure that the tax system remains fair