Sales Tax In Montana

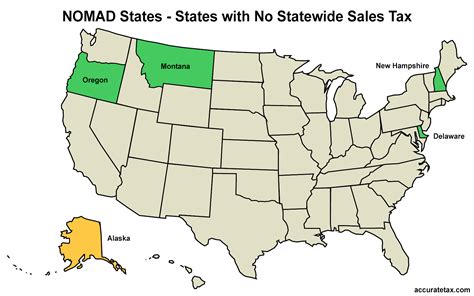

Montana, the Treasure State, is renowned for its majestic landscapes, vibrant cities, and unique tax structure. One of the most intriguing aspects of Montana's tax system is its approach to sales tax, which sets it apart from many other states. In this comprehensive guide, we will delve into the intricacies of sales tax in Montana, exploring its history, current regulations, and the impact it has on both businesses and consumers within the state.

The Historical Context of Sales Tax in Montana

The history of sales tax in Montana is a tale of evolution and adaptation. The state’s journey with sales tax began in the mid-20th century, with the first sales tax legislation enacted in 1935. This initial legislation imposed a 2% tax on retail sales, marking a significant step towards modern tax systems. However, the path to the current sales tax structure has been a complex one, shaped by various economic and political factors.

Over the years, Montana's sales tax has undergone several revisions and amendments. The tax rate has fluctuated, with periods of both increases and decreases, often in response to changing economic conditions and state budgetary needs. One notable period of reform was in the 1970s, when the state underwent a comprehensive tax restructuring, including adjustments to the sales tax rate and the introduction of various exemptions and incentives.

Additionally, Montana's sales tax has been influenced by its unique geographical and economic characteristics. The state's vast rural areas and diverse industries, from agriculture to tourism, have presented unique challenges and opportunities when it comes to tax policy. As a result, the state's sales tax regulations have been tailored to accommodate these specific needs, leading to a system that is both flexible and complex.

Understanding Montana’s Sales Tax System

Montana’s sales tax system operates on a destination-based principle, meaning the tax rate applied to a transaction is determined by the location where the product or service is consumed, not where it is sold. This is in contrast to origin-based systems, where the tax rate is set by the seller’s location. As a result, businesses in Montana must be well-versed in the sales tax rates of all counties and cities in the state, as these rates can vary significantly.

Currently, Montana imposes a state-wide sales tax rate of 4% on most retail sales. However, this is just the starting point, as local jurisdictions have the authority to levy additional taxes, resulting in a complex web of tax rates across the state. In some cases, these local taxes can be substantial, pushing the total sales tax rate well above the state average.

For instance, in the city of Billings, the state's largest city, the total sales tax rate stands at 6.5%, with a local tax rate of 2.5% added to the state's base rate. On the other hand, in rural areas like Jefferson County, the total sales tax rate is lower, at 5%, due to a more modest local tax supplement of 1%.

| Location | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Billings | 4% | 2.5% | 6.5% |

| Jefferson County | 4% | 1% | 5% |

Furthermore, Montana's sales tax regulations include a wide range of exemptions and special provisions. These exemptions are designed to support specific industries or social causes, and they can significantly impact the tax liability of businesses and consumers. For example, sales tax is not applied to most groceries, prescription drugs, and medical equipment, providing relief to consumers and certain businesses.

Exemptions and Special Provisions

Montana’s sales tax code includes a comprehensive list of exemptions and special provisions, which can be a boon for certain businesses and consumers. Here are some notable examples:

-

Groceries and Food: Most food items purchased for consumption off-premises are exempt from sales tax. This includes groceries, non-alcoholic beverages, and prepared foods sold in grocery stores.

-

Prescription Drugs: Sales of prescription drugs are exempt from sales tax, providing relief to healthcare providers and patients.

-

Farm Equipment: Sales of farm equipment, machinery, and supplies are exempt, supporting the state's agricultural industry.

-

Art and Cultural Events: Admission fees for art galleries, museums, and certain cultural events are exempt from sales tax, promoting cultural activities.

-

Veterinary Services: Sales tax does not apply to veterinary services, benefiting pet owners and animal care providers.

Compliance and Enforcement

Ensuring compliance with Montana’s sales tax regulations is a complex task, given the state’s diverse tax rates and exemption provisions. The Montana Department of Revenue is responsible for enforcing sales tax laws and ensuring businesses collect and remit the correct amounts. Non-compliance can result in penalties, interest charges, and even criminal prosecution in severe cases.

To assist businesses in navigating the state's sales tax system, the Department of Revenue provides a range of resources and guidelines. These include detailed sales tax rate maps, exemption certificates, and guidance on tax collection and remittance procedures. Additionally, the department offers a voluntary disclosure program, allowing businesses to come forward and correct past non-compliance without incurring penalties.

For consumers, understanding their rights and responsibilities under Montana's sales tax system is crucial. While the state's sales tax regulations can be complex, consumers can play a role in ensuring compliance by verifying the accuracy of sales tax charges on their receipts and reporting any suspected non-compliance to the Department of Revenue.

The Impact on Businesses and Consumers

Montana’s sales tax system has a significant impact on both businesses and consumers within the state. For businesses, the complexity of the tax system, with its varying rates and exemptions, can pose challenges in terms of tax compliance and administrative overhead. However, the state’s relatively low base sales tax rate and certain exemptions can provide a competitive advantage, especially for businesses in industries that are heavily taxed in other states.

For consumers, the varying sales tax rates across the state can lead to disparities in the cost of goods and services. While this can be seen as a disadvantage in some cases, it also provides an opportunity for consumers to make informed choices and potentially save money by shopping in areas with lower tax rates. Additionally, the state's exemptions on essential items like groceries and prescription drugs can provide much-needed relief to households, particularly those with lower incomes.

Case Study: Impact on Tourism

Montana’s unique sales tax structure has a significant impact on its thriving tourism industry. With a destination-based tax system, the state’s vibrant tourist destinations, such as Glacier National Park and Yellowstone National Park, benefit from higher sales tax rates, which can be a boon for local economies. These increased tax revenues can be reinvested into infrastructure and services that enhance the visitor experience, creating a positive feedback loop.

However, the varying tax rates can also present challenges for tourists, who may be surprised by the differences in sales tax rates across the state. Effective communication of these rates, particularly in popular tourist destinations, is essential to ensure visitors understand their financial obligations and can plan their budgets accordingly.

Future of Sales Tax in Montana

Looking ahead, the future of sales tax in Montana is likely to be shaped by a combination of economic, technological, and political factors. As the state’s economy continues to evolve, particularly with the rise of e-commerce and remote work, the sales tax system will need to adapt to ensure it remains fair and sustainable.

One potential area of focus is the increasing importance of online sales. With the rise of e-commerce, Montana's sales tax system will need to address the challenges of collecting sales tax on remote transactions. This may involve implementing new laws and technologies to ensure compliance, such as sales tax automation software and improved data-sharing between businesses and tax authorities.

Additionally, as the state's population and economy continue to grow, particularly in urban areas, the demand for services and infrastructure will increase. This may lead to calls for increased tax revenues, potentially resulting in higher sales tax rates or the introduction of new taxes. Balancing the need for increased revenues with the desire to maintain a competitive business environment will be a key challenge for policymakers.

Finally, the ongoing debate over the fairness and effectiveness of sales taxes is likely to continue. Critics of sales taxes argue that they are regressive, placing a disproportionate burden on lower-income households. In response, some states have implemented initiatives to reduce the impact of sales taxes on essential items or to provide tax credits to low-income households. Montana may need to consider similar measures to ensure its sales tax system remains equitable and supports the state's social and economic goals.

Conclusion

Montana’s sales tax system is a complex yet fascinating aspect of the state’s tax landscape. With its destination-based approach, varying local tax rates, and comprehensive list of exemptions, it presents both opportunities and challenges for businesses and consumers alike. As the state continues to evolve, so too will its sales tax regulations, ensuring they remain responsive to the needs of a dynamic economy and society.

How often are sales tax rates updated in Montana?

+

Sales tax rates in Montana are subject to periodic reviews and adjustments. The state legislature has the authority to change the state sales tax rate, which has historically been updated every few years. Local jurisdictions also have the power to modify their local sales tax rates, often in response to local budgetary needs or economic conditions.

Are there any special sales tax holidays in Montana?

+

Montana does not currently have designated sales tax holidays, unlike some other states. However, the state has implemented temporary sales tax exemptions or reduced rates for specific items or industries in the past, often as a means to stimulate the economy or support certain sectors.

How does Montana’s sales tax system handle online sales?

+

Montana’s sales tax system addresses online sales through the concept of “nexus.” If a business has a physical presence or sufficient connections to the state, such as through affiliates or remote employees, it is required to collect and remit sales tax on transactions with Montana residents. This is a complex area of tax law, and businesses should consult professional advice to ensure compliance.