Sales Tax In Missouri For Vehicles

The Complex Landscape of Sales Tax in Missouri: A Guide for Vehicle Purchases

When it comes to buying a vehicle in Missouri, understanding the sales tax landscape is crucial. The state’s tax system for vehicle purchases is intricate, with varying rates and regulations that can impact your overall cost. This guide aims to demystify the process, providing a comprehensive overview to ensure you’re well-informed before making your next automotive investment.

Understanding Missouri's Sales Tax Structure

Missouri, like many states, imposes a sales tax on the purchase of vehicles. This tax is collected by the state and often includes additional local taxes, creating a complex system that can vary depending on your specific location within the state. The sales tax is calculated as a percentage of the purchase price, with some states also levying additional fees and surcharges.

In Missouri, the sales tax rate for vehicles is not a flat percentage across the state. Instead, it is determined by a combination of state and local taxes, which can result in significant variations depending on the county where the purchase is made. This is a key consideration for buyers, as it can impact the overall cost of the vehicle and should be factored into the decision-making process.

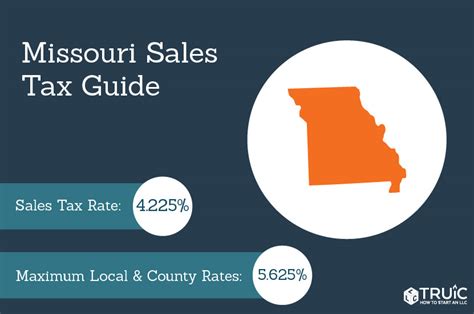

Statewide Sales Tax Rate

The statewide sales tax rate in Missouri is 4.225%, which includes the state’s general sales tax of 4.225%. This rate is applied uniformly across the state, serving as a baseline for vehicle purchases. However, it’s important to note that this is just the starting point, as local taxes can significantly alter the total tax liability.

Local Sales Tax Rates

In addition to the statewide sales tax, Missouri allows local jurisdictions to impose their own sales taxes. These local taxes can vary significantly from one county to another, adding a layer of complexity to the sales tax landscape. For instance, in the city of St. Louis, the local sales tax rate is 3.225%, bringing the total sales tax rate to 7.45% (4.225% state tax + 3.225% local tax). In contrast, in Jackson County, the local sales tax rate is 2%, resulting in a total sales tax rate of 6.225% (4.225% state tax + 2% local tax).

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| St. Louis City | 3.225% | 7.45% |

| Jackson County | 2% | 6.225% |

| Other Counties | Varies | Varies |

These local taxes are often used to fund specific initiatives or infrastructure projects, adding an additional layer of complexity to the tax system. As a result, it’s crucial for vehicle buyers to be aware of the local tax rates in their area to accurately estimate their tax liability.

Calculating Sales Tax on Vehicle Purchases

Calculating the sales tax on a vehicle purchase in Missouri involves a few key steps. First, determine the total purchase price of the vehicle, including any additional fees or charges. Then, apply the appropriate sales tax rate, which is a combination of the statewide rate and the local rate for your specific county.

For example, if you’re purchasing a vehicle in St. Louis City, with a purchase price of $30,000, the sales tax calculation would be as follows:

\[ \begin{equation*} 30,000 \text{ (purchase price)} \times 0.0745 \text{ (total sales tax rate)} = \text{\textdollar} 2,235 \text{ (sales tax amount)} \end{equation*} \]

So, the total sales tax liability for this purchase would be \text{\textdollar} 2,235. This amount is in addition to the purchase price, bringing the total cost of the vehicle to \text{\textdollar} 32,235.

It’s important to note that the sales tax rate can vary significantly depending on your location, so it’s crucial to verify the specific rate for your county to ensure an accurate calculation.

Exemptions and Special Considerations

Missouri, like many states, offers certain exemptions and special considerations when it comes to sales tax on vehicle purchases. These exemptions can provide significant savings for eligible buyers and are worth exploring.

Trade-In Allowance

One common exemption is the trade-in allowance, which reduces the taxable value of your new vehicle purchase. In Missouri, when you trade in your old vehicle, the value of the trade-in is deducted from the purchase price of the new vehicle for sales tax purposes. This can result in substantial savings, especially if your trade-in has a significant value.

For instance, if you’re purchasing a new vehicle for \text{\textdollar} 30,000 and your trade-in vehicle has a value of \text{\textdollar} 10,000, the taxable value of the new vehicle would be \text{\textdollar} 20,000. This reduced taxable value can lead to significant savings, especially in counties with higher sales tax rates.

Military Exemptions

Missouri offers certain sales tax exemptions for military personnel. Active-duty military members and their spouses are exempt from paying sales tax on the purchase of a vehicle, provided they have lived in Missouri for less than 12 months and have a valid military order showing a permanent change of station to Missouri. This exemption can provide substantial savings for military families, especially when combined with other military benefits.

Leased Vehicles

For leased vehicles, the sales tax is typically calculated based on the monthly lease payments, rather than the full purchase price. This means that you pay sales tax on each monthly payment, which can be more manageable for some buyers. However, it’s important to note that the total sales tax liability may be higher over the life of the lease compared to a one-time payment for a purchased vehicle.

The Impact of Sales Tax on Vehicle Purchasing Decisions

The sales tax rate in Missouri can have a significant impact on vehicle purchasing decisions. Buyers often have to factor in the tax liability when comparing prices and making their final choice. For instance, a vehicle with a lower sticker price in a county with a high sales tax rate may end up costing more than a similar vehicle with a higher sticker price in a county with a lower tax rate.

It’s crucial for buyers to consider the total cost of the vehicle, including sales tax, when making their decision. This ensures that they’re not surprised by hidden tax expenses and can make an informed choice based on their budget and preferences.

Future Implications and Considerations

The sales tax landscape in Missouri, like in many states, is subject to change. Local governments may adjust their tax rates to fund specific projects or initiatives, which can impact the total sales tax liability for vehicle purchases. Additionally, the state may also consider changes to its sales tax system, which could affect the statewide rate or the way sales tax is calculated for vehicles.

Staying informed about these potential changes is crucial for both buyers and sellers. Buyers can ensure they’re aware of any shifts in tax liability, while sellers can stay updated on potential impacts to their business.

Conclusion

Understanding the sales tax system in Missouri is essential for anyone considering a vehicle purchase in the state. The varying rates and regulations can significantly impact the overall cost, making it crucial to be well-informed before making a decision. This guide provides a comprehensive overview, ensuring buyers are equipped with the knowledge to navigate the complex landscape of sales tax in Missouri.

FAQ

How often do local sales tax rates change in Missouri?

+

Local sales tax rates in Missouri can change periodically, often to fund specific projects or initiatives. These changes are typically announced in advance and are usually effective at the beginning of a new fiscal year. It’s important to stay updated on any proposed changes, especially if you’re planning a significant purchase.

Are there any online tools to calculate the sales tax for vehicle purchases in Missouri?

+

Yes, there are several online calculators and tools available that can help estimate the sales tax on a vehicle purchase in Missouri. These tools often require the purchase price and the specific county or city where the purchase is being made to provide an accurate estimate. It’s always a good idea to verify the calculated amount with the seller or a tax professional.

What happens if I purchase a vehicle from a private seller in Missouri?

+

When purchasing a vehicle from a private seller in Missouri, you are still responsible for paying the applicable sales tax. The seller will typically provide you with a bill of sale, and you will need to register the vehicle and pay the sales tax at your local licensing office. It’s important to ensure you have all the necessary documentation to complete the transaction.

Are there any programs or incentives in Missouri to reduce the sales tax burden for vehicle purchases?

+

Missouri does offer certain programs and incentives to reduce the sales tax burden for specific groups of buyers. For instance, veterans, active-duty military, and disabled individuals may be eligible for sales tax exemptions or reductions. It’s worth researching these programs to see if you qualify for any benefits.

Can I negotiate the sales tax rate when purchasing a vehicle in Missouri?

+

The sales tax rate in Missouri is a set percentage based on state and local laws, and it is typically not negotiable. However, you may be able to negotiate other aspects of the purchase, such as the vehicle price or additional fees, which can indirectly impact the overall cost of the vehicle.