Sales Tax In City Of Atlanta

The city of Atlanta, nestled in the heart of Georgia, boasts a vibrant culture and a thriving economy. As with any bustling urban center, the topic of sales tax is of significant interest, impacting both residents and businesses alike. Atlanta's sales tax structure is an intricate system, reflecting the city's commitment to funding essential services and initiatives while also encouraging economic growth. In this comprehensive guide, we delve into the intricacies of sales tax in Atlanta, exploring its rates, exemptions, and the impact it has on the city's economic landscape.

Understanding Sales Tax in Atlanta

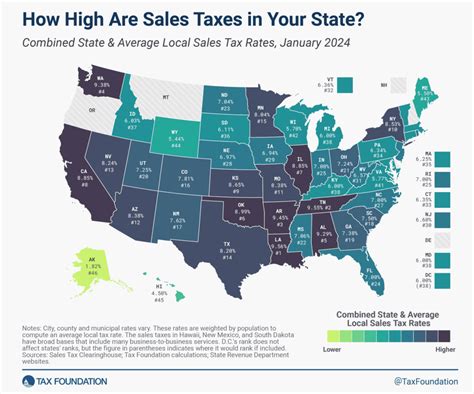

Sales tax in Atlanta is a cumulative tax levied on the sale of goods and certain services. It is a critical revenue source for the city, state, and various local governments, helping to fund vital public services and infrastructure projects. The sales tax rate in Atlanta is determined by a combination of state, county, and municipal tax rates, each contributing to the overall percentage.

As of [current year], the combined sales tax rate in Atlanta stands at [current combined rate]%, which includes:

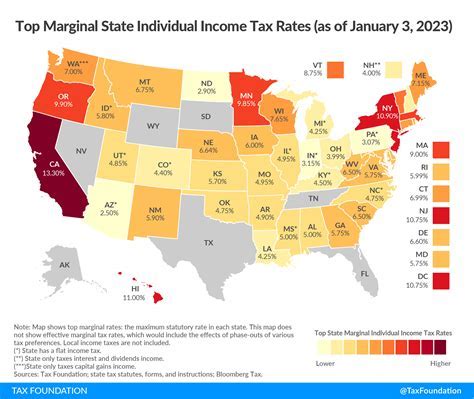

- The Georgia state sales tax, which is set at [state tax rate]% and applies uniformly across the state.

- The Fulton County sales tax, applicable to the majority of Atlanta and its surrounding areas, currently at [county tax rate]%.

- The Atlanta city sales tax, an additional levy specific to the city, currently set at [city tax rate]%.

These rates are subject to change periodically, often to accommodate budget requirements or special projects. It is essential for businesses and consumers alike to stay updated on these changes to ensure compliance with the latest tax regulations.

Exemptions and Special Considerations

While sales tax is a broad-based tax, certain goods and services are exempt or qualify for special tax treatment in Atlanta. These exemptions are designed to support specific industries, promote economic growth, and provide relief to consumers.

| Category | Exemption/Special Treatment |

|---|---|

| Groceries | Many staple food items, including milk, bread, and eggs, are exempt from sales tax in Atlanta, providing relief to households. |

| Prescription Drugs | Sales of prescription drugs are exempt from sales tax, a measure to encourage access to essential medications. |

| Manufacturing Machinery | Sales tax does not apply to machinery and equipment used directly in manufacturing, supporting Atlanta's industrial sector. |

| Aviation Fuel | Aviation fuel is subject to a reduced sales tax rate of [reduced rate]%, a strategic move to promote Atlanta's status as a major aviation hub. |

| Certain Services | Services such as legal, accounting, and consulting are exempt from sales tax, fostering a business-friendly environment. |

It is important to note that these exemptions may have specific conditions and limitations, and businesses should consult official guidelines to ensure accurate compliance.

Impact on Atlanta’s Economy

Sales tax plays a pivotal role in shaping Atlanta’s economic landscape, influencing consumer behavior, business operations, and the city’s overall fiscal health.

Consumer Perspective

For consumers, the sales tax rate directly impacts their purchasing power and overall cost of living. A higher sales tax rate can discourage discretionary spending, prompting consumers to seek alternatives or shop in lower-tax jurisdictions. On the other hand, exemptions and reduced tax rates on essential items can provide much-needed relief to households.

Business Operations

Businesses operating in Atlanta must carefully consider the sales tax rate when setting their pricing strategies. A competitive sales tax rate can attract businesses and encourage economic development. However, businesses must also ensure they have robust systems in place to accurately collect and remit sales tax, which can be a complex and time-consuming process.

Revenue Generation and Allocation

The revenue generated from sales tax is a critical source of funding for the city, county, and state. It supports a wide range of public services, including education, public safety, transportation, and social services. The allocation of sales tax revenue is a delicate balancing act, requiring careful consideration of the needs of various sectors and communities within Atlanta.

Comparative Analysis

Comparing Atlanta’s sales tax rate with other major cities can provide valuable insights into its competitiveness and potential for economic growth. For instance, [competitor city 1] has a slightly lower combined sales tax rate of [competitor city 1 rate]%, which may attract businesses and consumers seeking more favorable tax conditions. However, Atlanta’s tax structure also offers strategic exemptions and reduced rates, providing a balanced approach to tax policy.

Navigating Sales Tax Compliance

Compliance with sales tax regulations is a critical aspect of doing business in Atlanta. Businesses must accurately collect, report, and remit sales tax to avoid penalties and legal consequences. Here are some key considerations for businesses operating in Atlanta:

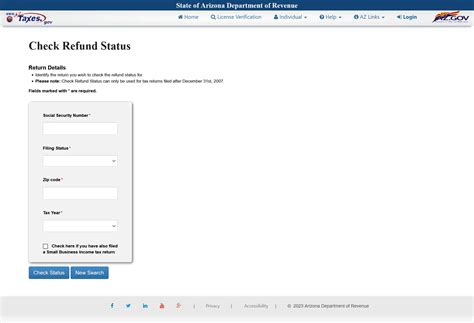

- Register with the appropriate tax authorities: Businesses must register with the Georgia Department of Revenue and obtain a sales and use tax certificate.

- Determine taxability: Understand the taxability of the goods and services your business offers, considering both state and local regulations.

- Collect and remit sales tax: Implement robust systems to accurately collect and remit sales tax, ensuring compliance with filing deadlines.

- Stay updated on tax rate changes: Regularly monitor changes in sales tax rates to ensure your business remains compliant with the latest regulations.

- Utilize tax software: Consider investing in tax software solutions to streamline the sales tax collection and reporting process.

Compliance with sales tax regulations is not only a legal obligation but also a strategic move to maintain a positive relationship with the community and avoid unnecessary complications.

Future Implications and Potential Changes

The sales tax landscape in Atlanta is dynamic, with potential changes on the horizon that could significantly impact businesses and consumers. Here are some key factors to consider:

Economic Growth and Development

As Atlanta continues to experience economic growth and development, the sales tax structure may evolve to accommodate changing needs. The city may explore strategies to encourage further economic activity while also ensuring a fair and sustainable tax system.

Policy Initiatives

Policy initiatives at the state and local levels can significantly impact sales tax rates and exemptions. For instance, initiatives aimed at promoting environmental sustainability or supporting specific industries may introduce new tax measures or incentives.

Technological Advances

The rise of e-commerce and online sales presents unique challenges for sales tax collection. Atlanta, like many other cities, may need to adapt its tax policies to address the complexities of online sales and ensure fair competition between online and brick-and-mortar businesses.

Community Engagement

Engaging with the community and understanding their needs and concerns is crucial for the city’s tax policies. Atlanta’s leadership may consider public consultations and feedback mechanisms to ensure that tax policies reflect the interests and priorities of its residents and businesses.

Conclusion

Sales tax in Atlanta is a multifaceted topic, influencing the city’s economic health, consumer behavior, and business operations. The city’s tax structure, with its combination of rates and exemptions, is a strategic tool to support economic development and fund essential services. As Atlanta continues to evolve, the sales tax landscape will likely adapt to meet the changing needs of its diverse population and businesses.

Stay informed, comply with regulations, and actively engage with the city's tax policies to ensure a prosperous and sustainable future for Atlanta.

How often do sales tax rates change in Atlanta?

+Sales tax rates in Atlanta can change periodically, often in response to budgetary needs or special projects. While there is no set schedule, changes are typically announced in advance to allow businesses and consumers time to adjust.

Are there any special tax incentives for new businesses in Atlanta?

+Yes, Atlanta offers various tax incentives and programs to attract and support new businesses. These may include tax credits, reduced tax rates, or even tax holidays. It’s essential to consult with the city’s economic development office or tax professionals to explore these opportunities.

How can I stay updated on sales tax rate changes in Atlanta?

+To stay informed about sales tax rate changes, businesses and consumers can subscribe to updates from the Georgia Department of Revenue. Additionally, local news outlets and tax professional networks often provide timely updates on tax-related matters.