Sales Tax Houston Tx

Sales tax is an essential component of the revenue system for many states and cities in the United States, and it plays a significant role in funding public services and infrastructure. In the city of Houston, Texas, sales tax is a vital source of income for both the state and local governments. Understanding the intricacies of sales tax in Houston is crucial for businesses, consumers, and policymakers alike. This comprehensive article will delve into the specifics of sales tax in Houston, covering its rates, structure, exemptions, and its impact on the local economy.

The Sales Tax Landscape in Houston

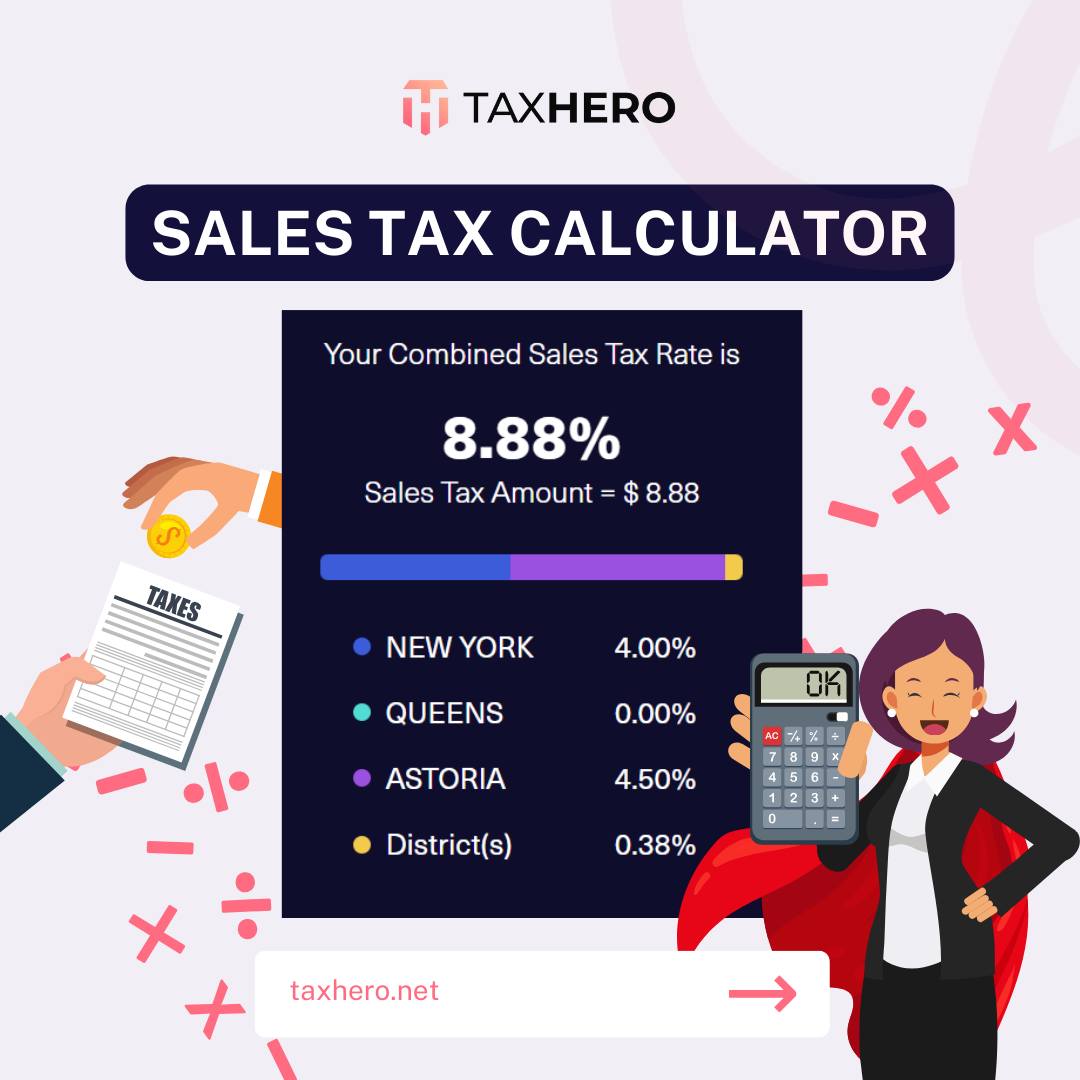

Houston, being the largest city in Texas and one of the most populous in the nation, has a complex sales tax system that contributes to the state’s overall economic growth. The sales tax in Houston is composed of several layers, including state, county, and city taxes, each with its own unique rate and purpose.

State Sales Tax

The state of Texas imposes a uniform sales tax rate across the state, currently set at 6.25%. This rate is applied to most retail sales of tangible personal property and some services. The state sales tax is a significant source of revenue for Texas, helping to fund various public services such as education, healthcare, and transportation infrastructure.

County Sales Tax

In addition to the state sales tax, Houston is located in Harris County, which also levies its own sales tax. The Harris County sales tax is set at 1%, bringing the total county and state sales tax to 7.25% for most transactions within the county limits. This additional tax is often used to fund specific county-wide projects and initiatives.

| Taxing Entity | Sales Tax Rate |

|---|---|

| State of Texas | 6.25% |

| Harris County | 1% |

| Total (State + County) | 7.25% |

City Sales Tax

Houston, as a major metropolitan city, has the authority to impose its own sales tax to support local initiatives and infrastructure. The Houston city sales tax is set at 1.25%, which, when combined with the state and county rates, results in a total sales tax rate of 8.5% for most purchases within the city limits. This city-specific tax is often used to fund local projects, such as public transportation improvements, parks, and community development programs.

| Taxing Entity | Sales Tax Rate |

|---|---|

| State of Texas | 6.25% |

| Harris County | 1% |

| City of Houston | 1.25% |

| Total (State + County + City) | 8.5% |

Sales Tax Exemptions and Special Considerations

While the standard sales tax rates apply to most transactions, there are certain exemptions and special cases to consider in Houston. Understanding these nuances is crucial for businesses and consumers alike to ensure compliance and take advantage of any applicable tax breaks.

Exemptions for Certain Goods and Services

Texas, and by extension Houston, offers sales tax exemptions for specific types of goods and services. These exemptions are designed to promote certain industries or provide relief to consumers in specific situations. Some common exemptions include:

- Groceries and Food Items: Most unprepared food items, including produce, meat, dairy, and baked goods, are exempt from sales tax in Texas. This exemption extends to food sold in grocery stores and restaurants.

- Prescription Medications: Sales tax is not applied to prescription drugs, ensuring that essential healthcare items are more affordable for consumers.

- Manufacturing Machinery and Equipment: To support the state’s manufacturing sector, sales tax is waived on purchases of machinery and equipment used in manufacturing processes.

- Certain Agricultural Supplies: Farmers and agricultural businesses can benefit from exemptions on sales tax for items such as seeds, feed, and fertilizer.

Special Rates for Specific Industries

In addition to general exemptions, certain industries in Houston may be subject to special sales tax rates or structures. For instance, the hospitality industry often has unique tax considerations. Restaurants and hotels may have specific tax rates or requirements, such as the collection of a hotel occupancy tax in addition to the standard sales tax.

Online Sales and Remote Sellers

With the rise of e-commerce, the collection of sales tax on online purchases has become a critical issue. In Houston, as in many other jurisdictions, online retailers and remote sellers are required to collect and remit sales tax on transactions with customers in the state. This ensures that online businesses contribute to the local tax base and helps level the playing field between brick-and-mortar and online retailers.

Impact of Sales Tax on Houston’s Economy

The sales tax system in Houston has a significant impact on the local economy, influencing consumer behavior, business operations, and overall economic growth. Understanding these effects is essential for policymakers and businesses to make informed decisions and adapt to changing economic conditions.

Influencing Consumer Spending

Sales tax can act as a disincentive for consumers, affecting their purchasing decisions. In Houston, the relatively high sales tax rate of 8.5% can impact consumer spending habits. Consumers may choose to shop online or in neighboring areas with lower tax rates to save on their purchases. On the other hand, some consumers may view the tax as a necessary contribution to local development and be more willing to support local businesses.

Impact on Businesses

For businesses in Houston, sales tax is a critical consideration in their financial planning and operations. Companies must factor in the sales tax rate when setting their prices, as well as when calculating their revenue and profit margins. Additionally, businesses are responsible for collecting and remitting sales tax to the appropriate taxing authorities, which requires a robust accounting and compliance system.

Furthermore, businesses may need to navigate the complexities of different tax rates across various jurisdictions. For instance, a company with operations both within and outside Houston may need to account for different tax rates and ensure compliance with each jurisdiction's regulations. This can add administrative burden and complexity to business operations.

Revenue Generation and Public Services

The sales tax in Houston is a vital source of revenue for both the state and local governments. The funds generated from sales tax are used to support a wide range of public services, including education, healthcare, public safety, and infrastructure development. For example, sales tax revenue can be directed towards improving local roads, enhancing public transportation, or funding community development projects.

By contributing to these public services, sales tax plays a crucial role in enhancing the quality of life for Houston residents and fostering economic growth. The revenue generated ensures that the city can invest in its future, attract businesses and talent, and maintain its position as a leading economic hub in Texas and the United States.

Conclusion

The sales tax system in Houston is a complex yet essential component of the city’s economic landscape. From the state and county rates to the city-specific tax, each layer contributes to the overall tax burden and revenue generation. Understanding the intricacies of sales tax, including exemptions and special considerations, is crucial for businesses and consumers to navigate the system effectively.

Moreover, the impact of sales tax extends beyond revenue generation. It influences consumer behavior, shapes business strategies, and funds critical public services that drive economic growth and improve the well-being of Houston residents. As the city continues to evolve and adapt to changing economic conditions, a thorough understanding of its sales tax system will remain a key factor in its success and prosperity.

What is the total sales tax rate in Houston, including all applicable taxes?

+The total sales tax rate in Houston is 8.5%, which includes the state sales tax of 6.25%, the county tax of 1%, and the city tax of 1.25%.

Are there any special tax rates for specific industries in Houston?

+Yes, certain industries, such as hospitality (hotels and restaurants), may be subject to additional or specific tax rates, such as hotel occupancy tax. It’s important to consult with tax professionals or refer to official tax guides for industry-specific information.

How does Houston’s sales tax compare to other major cities in Texas?

+Houston’s sales tax rate of 8.5% is higher than some other major cities in Texas, such as Dallas (8.25%) and Austin (8.25%). This variation in tax rates can impact consumer behavior and business strategies, as some consumers may choose to shop in areas with lower tax rates.

What are the consequences for businesses that fail to collect and remit sales tax in Houston?

+Businesses that fail to comply with sales tax regulations can face significant penalties, including fines, interest charges, and even legal action. It is crucial for businesses to establish robust tax collection and remittance systems to ensure compliance and avoid such consequences.