Sales Tax For Columbus Ohio

When doing business in Columbus, Ohio, it's essential to understand the sales tax landscape. Sales tax is a critical component of any transaction, and for businesses operating in Columbus, it's crucial to navigate the tax system accurately to ensure compliance and avoid any legal pitfalls.

Unraveling the Columbus Sales Tax

Columbus, the vibrant capital city of Ohio, boasts a thriving business environment. With a diverse economy and a strong local presence, understanding the sales tax structure is key to success for both established businesses and newcomers.

The sales tax in Columbus, Ohio, is a combination of state, county, and city taxes, each contributing to the overall tax rate applicable to various goods and services. As of [current date], the sales tax rate in Columbus stands at 7.25%, which includes:

- The Ohio state sales tax rate of 5.75%.

- A 1% county sales tax, applicable in Franklin County, where Columbus is located.

- An additional 0.5% tax rate specific to the city of Columbus.

This cumulative tax rate applies to most tangible personal property and certain services provided within the city limits of Columbus. However, it's important to note that certain items, such as groceries and prescription drugs, are exempt from sales tax in Ohio.

Taxable Items and Exemptions

Understanding what is and isn’t taxable is crucial for businesses operating in Columbus. Here’s a breakdown of some common items and their sales tax status:

| Item Category | Taxable |

|---|---|

| Clothing and footwear | Taxable, unless specifically exempted (e.g., school uniforms) |

| Groceries | Exempt from sales tax |

| Restaurant meals | Taxable |

| Vehicle purchases | Taxable, with specific rates and exemptions for certain vehicles |

| Construction materials | Taxable, unless used for certain qualifying projects |

It's essential for businesses to stay updated on the latest tax laws and regulations to ensure accurate tax collection and compliance. The Ohio Department of Taxation provides comprehensive resources and guidelines for businesses to navigate the sales tax landscape effectively.

Sales Tax Registration and Compliance

Businesses operating in Columbus, Ohio, are required to register for a sales tax permit with the Ohio Department of Taxation. This process ensures that businesses can legally collect and remit sales tax to the state. The registration process involves completing the necessary forms, providing business details, and obtaining a unique tax identification number.

Once registered, businesses must collect sales tax from customers at the point of sale and remit the collected tax to the state on a regular basis. The frequency of tax remittance depends on the business's sales volume and can range from monthly to quarterly filings. Late or non-compliance with sales tax remittance can result in penalties and interest charges.

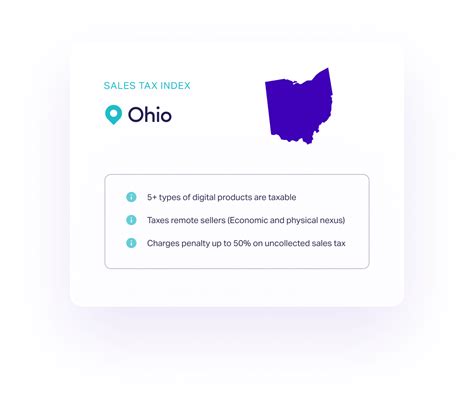

Sales Tax for Online Businesses

With the rise of e-commerce, understanding sales tax for online businesses is essential. Ohio, like many states, has specific rules for online sellers. If an online business has a physical presence or a significant economic nexus in Ohio, it is generally required to collect and remit sales tax on transactions with Ohio customers. This includes businesses with affiliates, warehouses, or a substantial number of sales in the state.

The concept of economic nexus, which considers a business's sales volume and transactions, has expanded the reach of sales tax obligations for online sellers. It's crucial for online businesses to understand their sales tax responsibilities and utilize tools like sales tax calculators and software to ensure accurate tax collection.

Sales Tax Audits and Appeals

Sales tax audits are a critical aspect of the tax system, ensuring compliance and fairness. The Ohio Department of Taxation conducts audits to verify businesses’ sales tax records and ensure accurate tax collection and remittance. During an audit, businesses must provide detailed sales records, tax returns, and supporting documentation.

If a business disagrees with the audit findings or wishes to challenge a tax assessment, it has the right to appeal. The appeals process involves a review by an independent administrative law judge, providing businesses with an opportunity to present their case and dispute any discrepancies. It's important for businesses to seek professional advice and guidance during the appeals process to ensure a fair and accurate outcome.

The Future of Sales Tax in Columbus

As the business landscape evolves, so does the sales tax system. Columbus, Ohio, is at the forefront of embracing technological advancements and streamlining tax processes. The state is actively working towards implementing modern tax collection methods, such as electronic filing and payment systems, to enhance efficiency and convenience for businesses.

Additionally, with the increasing complexity of e-commerce and the changing nature of business transactions, Ohio is exploring ways to adapt its sales tax system to accommodate these changes. This includes evaluating the impact of remote sellers and the potential for expanding sales tax obligations to capture revenue from online transactions.

The future of sales tax in Columbus looks towards a more integrated and digitalized system, ensuring fairness, simplicity, and compliance for businesses and consumers alike. As technology continues to shape the business environment, staying informed and adaptable will be key for businesses operating in Columbus.

What is the current sales tax rate in Columbus, Ohio?

+As of [current date], the sales tax rate in Columbus, Ohio, is 7.25%, which includes the state, county, and city sales taxes.

Are there any sales tax holidays in Columbus?

+Yes, Ohio occasionally offers sales tax holidays, typically for specific items like back-to-school supplies or energy-efficient appliances. These holidays provide a temporary reduction or exemption from sales tax for qualifying purchases.

How often do businesses need to remit sales tax in Columbus?

+The frequency of sales tax remittance depends on the business’s sales volume. Businesses with higher sales volumes may be required to remit taxes monthly, while others may remit quarterly. It’s important to consult the Ohio Department of Taxation for specific guidelines.