Property Tax Estimator Michigan

In the state of Michigan, property taxes are an essential component of local government revenue, playing a crucial role in funding vital public services and infrastructure. The property tax system in Michigan is complex, with various factors influencing the tax rate and overall amount owed by property owners. Understanding this system is key to managing financial obligations and planning effectively. This article delves into the intricacies of property tax estimation in Michigan, providing a comprehensive guide for homeowners, investors, and anyone interested in the state's real estate market.

Understanding Property Tax in Michigan

Property tax, or ad valorem tax, is a levy imposed on real estate properties based on their assessed value. In Michigan, the property tax system is primarily administered at the local level, with taxes collected by counties, cities, townships, and school districts. The tax revenue generated is then utilized to fund local services such as education, public safety, transportation, and more.

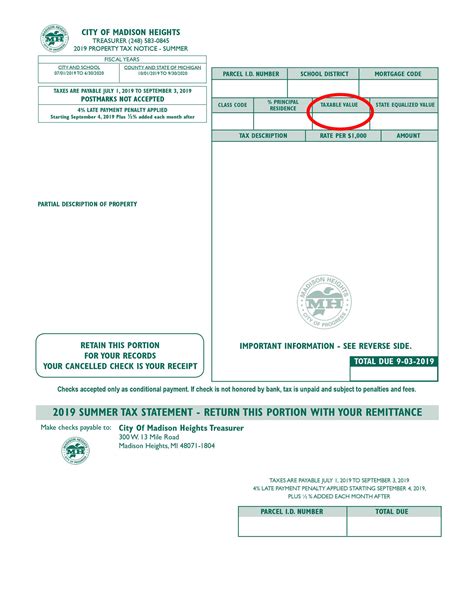

The property tax rate in Michigan is expressed as a millage rate, where one mill is equivalent to $1 for every $1,000 of a property's taxable value. For instance, if a property has a taxable value of $100,000 and the millage rate is 20 mills, the annual property tax due would be $2,000.

The millage rate is determined by the local government bodies, with different rates applied for various purposes. This could include a general fund millage for general operations, a dedicated millage for specific projects or services, and a limited tax levy for schools. The total millage rate is the sum of these individual rates, which can vary significantly across different localities in Michigan.

| Taxing Authority | Millage Rate |

|---|---|

| County General Fund | 10 Mills |

| City Operations | 15 Mills |

| School District | 18 Mills |

| Special Projects (e.g., Library) | 5 Mills |

| Total Millage Rate | 53 Mills |

In addition to the millage rate, property taxes in Michigan are influenced by several other factors, including the state's Headlee Amendment. This amendment caps the property tax rate at the rate in effect when the property was purchased, unless voters approve a higher rate. It also requires a re-vote if a government entity wishes to increase the rate beyond the inflation rate.

Furthermore, Michigan offers several property tax exemptions and credits, such as the Homestead Property Tax Credit and the Principal Residence Exemption (PRE), which can significantly reduce the taxable value of a property and thus the property tax liability.

Estimating Property Tax in Michigan

Estimating property tax in Michigan involves several steps, each of which can be complex and influenced by various factors. Here’s a comprehensive guide to estimating property taxes in the state:

Step 1: Determining Assessed Value

The first step in estimating property tax is to determine the assessed value of the property. In Michigan, the assessed value is typically 50% of the property’s true cash value (TCV), which is the price the property would sell for in an open market.

The TCV is determined by local assessors who conduct regular property assessments. These assessments take into account factors such as the property's location, size, age, condition, and recent sales of similar properties in the area. The assessed value is then calculated as 50% of the TCV, as mandated by Michigan law.

For instance, if a property has a TCV of $200,000, its assessed value would be $100,000.

Step 2: Applying Exemptions and Credits

Once the assessed value is determined, the next step is to apply any applicable exemptions and credits to reduce the taxable value of the property. Michigan offers several such benefits, which can significantly lower property tax bills.

- Homestead Property Tax Credit: This credit reduces the taxable value of a property by up to $4,260 for homeowners who own and occupy their primary residence as of December 31 of the tax year.

- Principal Residence Exemption (PRE): The PRE exempts the first $30,000 of a property's taxable value from the school operating tax levy. This exemption is automatic for primary residences but must be applied for annually for rental properties.

- Poverty Exemption: Low-income homeowners may qualify for a partial or full exemption from property taxes. The amount of the exemption depends on income level and other factors.

- Veterans' Exemptions: Michigan offers various property tax exemptions for veterans, including a full exemption for 100% disabled veterans and a partial exemption for other qualifying veterans.

These exemptions and credits can significantly reduce the taxable value of a property, which in turn lowers the property tax bill. For instance, if a homeowner qualifies for both the Homestead Property Tax Credit and the Principal Residence Exemption, the taxable value of their $100,000 assessed property could be reduced to $60,000 ($100,000 - $4,260 - $30,000) before applying the millage rate.

Step 3: Calculating Taxable Value

After applying all applicable exemptions and credits, the next step is to calculate the taxable value of the property. This is the value that the millage rate will be applied to in order to determine the property tax.

To calculate the taxable value, subtract the total value of all applicable exemptions and credits from the assessed value. For example, if the assessed value of a property is $100,000 and the total value of exemptions and credits is $34,260, the taxable value would be $65,740.

Step 4: Determining Millage Rate

The next step is to determine the millage rate applicable to the property. As mentioned earlier, the millage rate is set by local government bodies and can vary significantly across different localities in Michigan.

To determine the millage rate, homeowners can contact their local tax assessor's office or check their county's website, which often provides information on the current millage rate and any proposed changes. It's important to note that the millage rate can change annually, so it's crucial to obtain the most up-to-date information.

Step 5: Calculating Property Tax

With the taxable value and millage rate determined, the final step is to calculate the property tax. This is done by multiplying the taxable value by the millage rate.

For instance, if the taxable value of a property is $65,740 and the millage rate is 53 mills, the property tax would be calculated as follows: $65,740 x 0.053 = $3,484.18.

Thus, the annual property tax for this property would be $3,484.18.

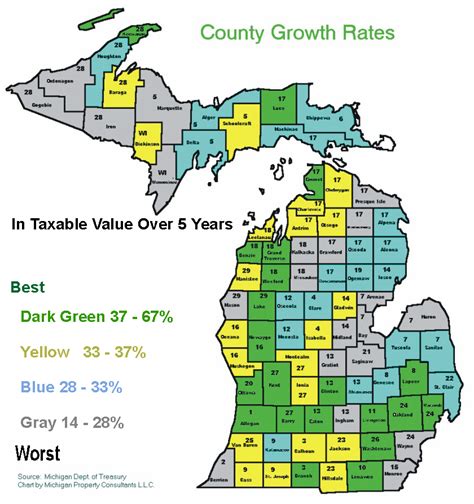

The Impact of Property Tax on Real Estate Decisions

Property tax is a significant consideration for both homeowners and real estate investors in Michigan. For homeowners, it’s a major expense that can influence their decision to purchase a home and their overall financial planning. For investors, property tax can impact the profitability of an investment property, affecting decisions on acquisition, management, and disposition.

High property taxes can be a deterrent for potential homebuyers, especially in areas where the tax burden is significantly higher than the state average. On the other hand, lower property taxes can make an area more attractive, potentially driving up property values and making it a more desirable location for both residents and investors.

For investors, property tax is a crucial component of their overall investment strategy. They must consider the property tax rate when evaluating potential investment properties, as it can significantly impact cash flow and overall returns. Strategies such as applying for tax exemptions or credits, appealing property assessments, or timing purchases to take advantage of certain tax benefits can all play a role in an investor's decision-making process.

Future Implications and Strategies

The property tax landscape in Michigan is likely to continue evolving, influenced by factors such as changes in local government budgets, shifts in the real estate market, and potential amendments to state laws. Homeowners and investors must stay informed about these changes to effectively plan and manage their financial obligations.

One potential strategy for homeowners is to stay engaged with local government bodies, attend public meetings, and voice their concerns or suggestions regarding property tax policies. By doing so, they can potentially influence decisions that impact their tax burden.

For investors, staying abreast of market trends and legislative changes is crucial. They can also benefit from consulting with tax professionals who can provide guidance on strategies to minimize tax liability, such as utilizing tax deferral programs or taking advantage of available exemptions and credits.

Additionally, both homeowners and investors can benefit from regular reviews of their property assessments. If they believe their property is over-assessed, they can appeal the assessment, potentially leading to a reduction in their taxable value and subsequent property tax liability.

Conclusion

Understanding and estimating property tax in Michigan is a complex but essential process for homeowners and investors alike. By following the steps outlined in this guide and staying informed about changes in the property tax landscape, individuals can effectively manage their financial obligations and make informed real estate decisions.

As the property tax system in Michigan continues to evolve, staying proactive and engaged can help individuals navigate this complex landscape and maximize the benefits available to them.

How often do property tax rates change in Michigan?

+Property tax rates in Michigan can change annually. Local government bodies determine the millage rate each year, based on their budget needs and the state’s economic conditions. It’s essential to stay updated with these changes, as they can significantly impact your property tax bill.

Are there any ways to reduce my property tax liability in Michigan?

+Yes, there are several strategies to reduce your property tax liability in Michigan. These include applying for property tax exemptions and credits (such as the Homestead Property Tax Credit and the Principal Residence Exemption), appealing your property assessment if you believe it’s over-assessed, and staying engaged with local government bodies to influence tax policies.

How can I find out the millage rate for my property in Michigan?

+You can contact your local tax assessor’s office or check your county’s website for the current millage rate. These sources will provide you with the most up-to-date information on the millage rate applicable to your property.

What is the Headlee Amendment, and how does it affect property taxes in Michigan?

+The Headlee Amendment is a provision in Michigan’s constitution that limits property tax rates. It caps the property tax rate at the rate in effect when the property was purchased, unless voters approve a higher rate. It also requires a re-vote if a government entity wishes to increase the rate beyond the inflation rate. This amendment helps control property tax increases and provides stability for homeowners.

Are there any online tools to estimate property taxes in Michigan?

+Yes, several online tools and calculators are available to estimate property taxes in Michigan. These tools often require you to input details such as your property’s assessed value, applicable exemptions, and the millage rate. While these tools can provide a quick estimate, it’s important to verify the information with official sources for accuracy.