Property Tax Cuyahoga County

Welcome to this comprehensive guide on Property Tax in Cuyahoga County, Ohio. Property taxes are an essential aspect of local government revenue, and understanding how they work and how they impact homeowners is crucial. In this article, we will delve into the specifics of property taxation in Cuyahoga County, providing you with valuable insights and information.

Understanding Property Tax in Cuyahoga County

Property tax, or real estate tax, is a levy imposed on real property by local governments. It is a significant source of funding for various services and infrastructure in the county, including schools, fire departments, police services, and road maintenance. Cuyahoga County, with its diverse neighborhoods and vibrant communities, has a unique property tax system that we will explore in detail.

The Assessment Process

The property tax system in Cuyahoga County begins with the assessment process. The county’s Department of Fiscal Office is responsible for evaluating all real estate properties within its jurisdiction. Assessors determine the taxable value of each property based on its market value, which is influenced by factors such as location, size, improvements, and recent sales of similar properties.

Cuyahoga County utilizes a triennial reappraisal cycle, where properties are reassessed every three years. This ensures that property values remain up-to-date and that the tax burden is distributed fairly among homeowners.

| Assessment Year | Taxable Value Calculation |

|---|---|

| 2023 | 35% of Appraised Value |

| 2024 | 30% of Appraised Value |

| 2025 | 25% of Appraised Value |

Tax Rates and Calculations

Once the taxable value of a property is determined, the property tax amount is calculated using the applicable millage rate. A millage rate represents the tax rate per dollar of taxable value. For instance, a millage rate of 10 mills means that for every 1,000 of taxable value, 10 in taxes is owed.

Cuyahoga County’s tax rates are set by various taxing authorities, including the county government, municipalities, school districts, and special districts. These authorities determine their respective millage rates to fund their operations and services.

The tax rates can vary significantly depending on the location within the county. For example, a property in the city of Cleveland might have a different tax rate compared to a property in a suburban township.

| Taxing Authority | Millage Rate |

|---|---|

| Cuyahoga County | 5.5 mills |

| Cleveland City School District | 8.0 mills |

| Suburban Township | 3.2 mills |

Tax Bill and Payment

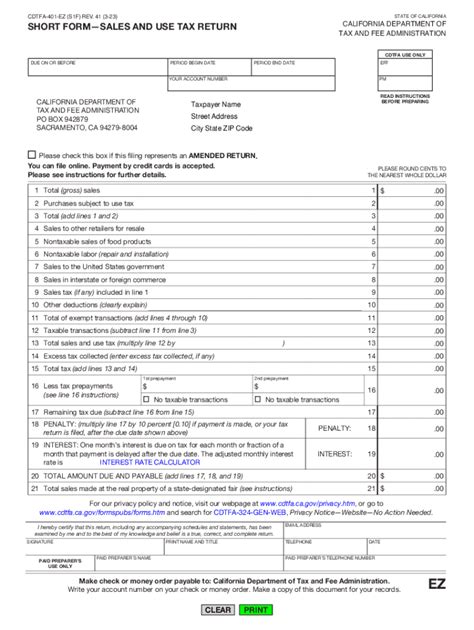

Homeowners in Cuyahoga County receive an annual tax bill, which outlines the calculated tax amount, due dates, and payment options. The tax bill provides a breakdown of the taxes owed to each taxing authority.

Property taxes in Cuyahoga County are typically due in two installments, with the first installment due in January and the second in July. However, the exact due dates and payment terms may vary depending on the municipality.

Cuyahoga County offers various payment methods, including online payments, mail-in payments, and in-person payments at designated locations. Homeowners can also explore tax relief programs and payment plans to manage their tax obligations effectively.

Property Tax Trends and Impact

Understanding the trends and impact of property taxes in Cuyahoga County is essential for homeowners and investors alike. Let’s explore some key aspects:

Historical Tax Rates

Analyzing historical tax rates provides insight into the stability and changes in the tax landscape. Over the past decade, Cuyahoga County has experienced fluctuations in tax rates, with some years seeing slight increases and others witnessing decreases. This is influenced by various factors, including economic conditions, budget constraints, and changes in state funding.

| Year | Average Tax Rate (mills) |

|---|---|

| 2013 | 6.8 |

| 2016 | 6.2 |

| 2019 | 6.5 |

| 2022 | 6.3 |

Impact on Homeownership

Property taxes have a direct impact on homeownership in Cuyahoga County. For many homeowners, property taxes are a significant expense, and understanding their implications is crucial for financial planning.

Higher property taxes can affect affordability, especially for first-time homebuyers or those on a fixed income. However, Cuyahoga County offers tax incentives and homestead exemptions to alleviate the tax burden for certain eligible homeowners.

Additionally, property taxes contribute to the overall health of the real estate market. A stable and predictable tax system can attract buyers and investors, fostering a vibrant housing market.

Comparative Analysis

Comparing Cuyahoga County’s property tax rates with other counties in Ohio provides valuable context. While Cuyahoga County has a diverse range of tax rates due to its many municipalities, it is essential to consider the overall tax landscape.

According to recent data, Cuyahoga County’s average tax rate is slightly higher than the state average. However, it is important to note that this comparison does not account for the varying services and infrastructure offered by each county.

Managing Property Taxes: Tips and Strategies

Navigating the property tax system can be challenging, but there are strategies and resources available to help homeowners manage their tax obligations effectively.

Appealing Your Property Assessment

If you believe your property’s assessed value is inaccurate, you have the right to appeal the assessment. Cuyahoga County provides a formal appeals process, allowing homeowners to challenge their property’s valuation. It is important to gather evidence, such as recent sales data or appraisals, to support your case.

The appeals process typically involves submitting a written request and attending a hearing. Engaging a professional appraiser or tax consultant can provide valuable expertise during the appeal.

Tax Relief Programs

Cuyahoga County offers various tax relief programs to assist eligible homeowners. These programs aim to reduce the tax burden for low-income individuals, seniors, and veterans.

- Homestead Exemption: This program provides a reduction in taxable value for homeowners who meet specific criteria, such as being over 65 or having a disability.

- Senior Citizen Property Tax Abatement: Seniors who meet income requirements may be eligible for a partial or full abatement of their property taxes.

- Veterans’ Property Tax Exemption: Qualified veterans can receive an exemption on a portion of their property’s taxable value.

Tax Planning and Strategies

Effective tax planning can help homeowners optimize their property tax obligations. Here are some strategies to consider:

- Review Assessment Records: Stay informed about your property’s assessed value and ensure it is accurate. Regularly review assessment records and stay updated on any changes.

- Explore Deductions and Credits: Consult a tax professional to identify any deductions or tax credits you may be eligible for. This can include mortgage interest, property taxes paid, or energy-efficient home improvements.

- Consider Payment Options: Explore the various payment methods offered by Cuyahoga County. Online payments, for instance, can provide convenience and potentially save on processing fees.

Conclusion

Property taxes in Cuyahoga County are an essential aspect of the local economy and community development. Understanding the assessment process, tax rates, and available resources empowers homeowners to navigate the tax system effectively. By staying informed and utilizing the strategies outlined above, homeowners can manage their property tax obligations and contribute to the thriving communities within Cuyahoga County.

What is the deadline for paying property taxes in Cuyahoga County?

+The deadline for paying property taxes in Cuyahoga County typically falls in January and July. However, it’s important to check with the county’s official website or contact the Department of Fiscal Office for the exact due dates, as they may vary slightly from year to year.

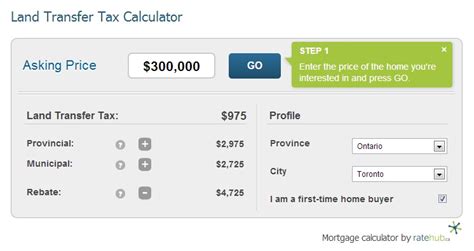

How can I estimate my property tax amount before receiving the official tax bill?

+To estimate your property tax amount, you can use an online property tax calculator provided by the Cuyahoga County Auditor’s Office. This calculator considers factors such as your property’s assessed value and the applicable tax rates. Keep in mind that this is an estimate, and the official tax bill may vary slightly.

Are there any tax breaks or exemptions available for homeowners in Cuyahoga County?

+Yes, Cuyahoga County offers various tax breaks and exemptions to eligible homeowners. These include homestead exemptions, senior citizen property tax abatements, and veterans’ property tax exemptions. It’s advisable to consult with the county’s tax department or a tax professional to determine your eligibility and understand the application process.

Can I appeal my property’s assessed value if I believe it is inaccurate?

+Absolutely! If you disagree with your property’s assessed value, you have the right to appeal. Cuyahoga County provides a formal appeals process, and you can submit a written request for review. It’s beneficial to gather evidence, such as recent sales data or professional appraisals, to support your case.