Poll Tax Definition Us History

The poll tax, a contentious and historically significant aspect of American governance, played a pivotal role in shaping the nation's political and social landscape, particularly during the mid-20th century. Its implementation and eventual abolition provide a fascinating insight into the evolution of democratic principles and the ongoing struggle for equality.

Unveiling the Poll Tax: A Historical Perspective

The poll tax, also known as a head tax or capitation tax, is a type of taxation imposed on individuals, regardless of their income or financial status. It is a fixed amount levied on each eligible person within a jurisdiction, typically for the purpose of funding local government operations and services.

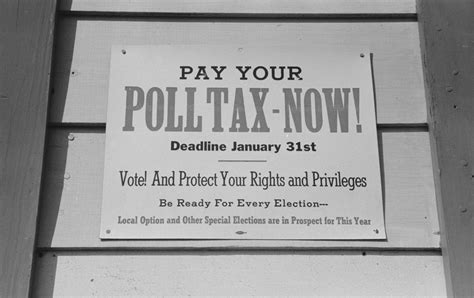

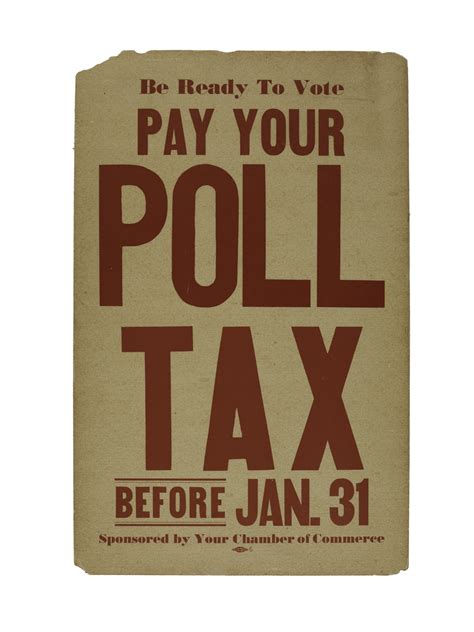

In the context of American history, the poll tax gained prominence during the post-Civil War era, especially in the Southern states. It was initially introduced as a means to generate revenue for local governments and to fund various public projects and services. However, its implementation quickly took on a more sinister tone, becoming a tool of political and social control, particularly in the context of racial discrimination.

One of the most notorious uses of the poll tax was its role in suppressing African American voting rights. Following the abolition of slavery and the passage of the 15th Amendment, which granted African American men the right to vote, many Southern states implemented poll taxes as a way to hinder their ability to exercise this right. By imposing a financial burden on voting, these states effectively disenfranchised a significant portion of the African American population, who often lacked the means to pay the tax.

The poll tax was just one part of a larger web of discriminatory laws and practices known as Jim Crow laws, which aimed to enforce racial segregation and maintain white supremacy in the post-Civil War South. These laws, including literacy tests and the notorious "grandfather clause," were designed to create barriers to voting, ensuring that African Americans, and often poor whites, remained politically marginalized.

The Fight for Equality: Challenging the Poll Tax

Despite the daunting challenges posed by the poll tax and other discriminatory measures, African Americans and their allies mounted a formidable fight for equality. The struggle against the poll tax was a key component of the broader civil rights movement, which gained momentum in the mid-20th century.

One of the most iconic figures in this battle was Dr. Martin Luther King Jr., who, through his leadership in the Southern Christian Leadership Conference (SCLC), played a pivotal role in organizing and mobilizing communities to challenge the poll tax and other forms of racial discrimination. Dr. King's powerful oratory and nonviolent protest strategies inspired and galvanized a generation of activists, fostering a national conversation about racial equality and the importance of voting rights.

The fight against the poll tax extended beyond the streets and protest marches. It also played out in the legal arena, with landmark cases such as Harper v. Virginia Board of Elections (1966) and Harper v. Virginia State Board of Elections (1967) making their way to the Supreme Court. These cases, brought forth by civil rights activists and legal scholars, challenged the constitutionality of the poll tax and its discriminatory impact on voting rights.

The Abolition of the Poll Tax: A Triumph for Democracy

The efforts of civil rights activists and legal advocates bore fruit in 1964 with the passage of the 24th Amendment to the U.S. Constitution. This historic amendment outlawed the use of poll taxes in federal elections, marking a significant victory in the fight for voting rights and racial equality.

The 24th Amendment was a crucial step towards ensuring that all American citizens, regardless of their race or economic status, had an equal opportunity to participate in the democratic process. It eliminated one of the primary barriers to voting, opening the doors for greater political engagement and representation among African Americans and other marginalized communities.

However, the battle against the poll tax was not entirely won with the passage of the 24th Amendment. While it outlawed poll taxes in federal elections, it did not address their use in state and local elections. This left a loophole that some states exploited, particularly in the South, where poll taxes continued to be used as a tool of racial discrimination.

The Legacy of the Poll Tax: A Continual Struggle for Equality

The fight against the poll tax, though largely successful, serves as a reminder of the ongoing struggle for racial equality and the need for continuous vigilance in protecting the rights of all citizens. While the 24th Amendment was a significant step forward, it was not the end of the journey towards a truly equitable and just society.

Today, the legacy of the poll tax lives on in various forms, with modern-day barriers to voting, such as voter ID laws and gerrymandering, continuing to disproportionately impact marginalized communities. The fight for voting rights and equal representation remains a crucial aspect of American democracy, with activists and organizations working tirelessly to ensure that every citizen has an equal voice in the political process.

Conclusion: Reflecting on the Poll Tax’s Impact

The poll tax, a seemingly simple revenue-generating measure, has left an indelible mark on American history. Its implementation and eventual abolition provide a compelling narrative of the nation’s struggle for racial equality and the evolution of democratic principles. Through the efforts of civil rights activists, legal advocates, and everyday citizens, the poll tax was ultimately defeated, paving the way for a more inclusive and just society.

As we reflect on the historical significance of the poll tax, we are reminded of the power of collective action and the resilience of those who fought for a better world. The story of the poll tax serves as a powerful reminder that progress is not always linear, but through perseverance and a commitment to justice, we can continue to move towards a more equitable and democratic future.

Frequently Asked Questions

What was the primary purpose of the poll tax in the post-Civil War era?

+The poll tax was primarily implemented as a revenue-generating measure, designed to fund local government operations and public services. However, it quickly became a tool of racial discrimination, used to suppress the voting rights of African Americans and maintain white supremacy.

How did the poll tax impact African American voting rights?

+The poll tax created a financial barrier to voting, effectively disenfranchising a significant portion of the African American population who lacked the means to pay the tax. This was a deliberate strategy employed by many Southern states to maintain political control and enforce racial segregation.

What was the significance of the 24th Amendment in abolishing the poll tax?

+The 24th Amendment outlawed the use of poll taxes in federal elections, marking a significant victory in the fight for voting rights and racial equality. It ensured that all American citizens had an equal opportunity to participate in federal elections, regardless of their ability to pay a poll tax.

Are there any modern-day equivalents to the poll tax that continue to impact voting rights?

+While the 24th Amendment addressed poll taxes in federal elections, some states continued to use similar measures to suppress voting rights. Modern-day barriers such as voter ID laws and gerrymandering disproportionately impact marginalized communities, echoing the legacy of the poll tax.