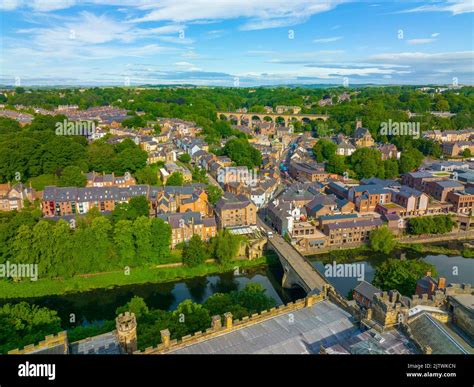

Durham County Nc Tax Records

Exploring tax records can offer a fascinating glimpse into the financial landscape of a region, providing valuable insights into property values, economic trends, and the overall fiscal health of an area. In this comprehensive guide, we delve into the tax records of Durham County, North Carolina, uncovering the data, trends, and stories hidden within these vital records.

The Significance of Durham County Tax Records

Durham County, known for its vibrant culture, thriving academic institutions, and innovative spirit, holds a wealth of information within its tax records. These records serve as a vital tool for homeowners, investors, and researchers, offering a detailed view of property values, tax assessments, and the economic pulse of the county.

Understanding the Tax Assessment Process

The tax assessment process in Durham County is a meticulous endeavor, ensuring fairness and accuracy in property taxation. Each year, the Durham County Tax Office undertakes a comprehensive evaluation of properties, taking into account factors such as location, size, improvements, and market trends.

The assessed value of a property is a critical determinant, as it forms the basis for calculating property taxes. This value, determined by the Durham County Assessor, considers both the property's physical attributes and its market value. The assessment process aims to ensure that each property owner pays their fair share, contributing to the county's overall fiscal health.

For instance, let's consider a residential property in the historic district of Durham. The assessor would evaluate the property's unique features, such as its architectural style, age, and any recent renovations. Additionally, market trends in the area, including recent sales of similar properties, would be taken into account to arrive at an accurate assessed value.

| Assessment Year | Assessed Value ($) | Tax Rate (Millage) | Property Taxes ($) |

|---|---|---|---|

| 2022 | 400,000 | 0.78 | 3,120 |

| 2021 | 380,000 | 0.79 | 2,986 |

| 2020 | 360,000 | 0.80 | 2,880 |

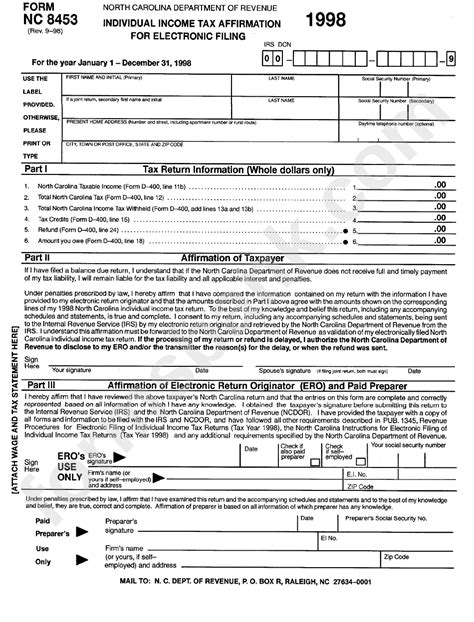

Accessing Tax Records Online

In an era of digital transformation, Durham County has made significant strides in making tax records easily accessible to the public. The Durham County Tax Office provides an online portal, offering a wealth of information at the fingertips of residents and interested parties.

The online platform allows users to search for property records by address, owner name, or parcel number. This search functionality provides a quick and efficient way to access vital information, including the property's assessed value, tax history, and any recent transactions.

For instance, a prospective homeowner searching for a property in the popular Southpoint neighborhood can easily access its tax records. This transparency not only empowers buyers but also fosters trust and understanding of the county's taxation system.

Analyzing Durham County’s Tax Landscape

Durham County’s tax records offer a treasure trove of data, allowing us to delve into the economic dynamics and property trends of the region. Let’s explore some key insights derived from these records.

Residential vs. Commercial Property Taxes

A comparison of tax records reveals interesting trends when analyzing residential and commercial properties. While both categories contribute significantly to the county’s tax base, their assessments and tax rates can vary considerably.

Residential properties often see a steady increase in assessed values, influenced by factors such as population growth, improved infrastructure, and the appeal of neighborhoods. In contrast, commercial properties may experience more volatile assessments, influenced by market fluctuations and economic cycles.

For instance, a commercial property in the downtown area, catering to a thriving tech industry, might see a surge in value due to high demand for office space. On the other hand, a retail property in a less bustling part of town might experience a more stable, but slower, growth in value.

Property Value Trends Over Time

Examining tax records over an extended period provides a bird’s-eye view of Durham County’s property value trends. These trends offer insights into the county’s economic growth, real estate market dynamics, and the overall health of the housing market.

A longitudinal analysis reveals that Durham County has experienced a steady increase in property values over the past decade. This growth is a testament to the region's economic vitality, with factors such as job growth, a thriving tech sector, and an influx of young professionals contributing to the rising property values.

However, it's important to note that not all areas within the county experience uniform growth. Certain neighborhoods, due to their unique characteristics or development plans, may see more pronounced increases or decreases in property values.

| Neighborhood | 5-Year Average Annual Growth (%) |

|---|---|

| Trinity Park | 8.2 |

| Hope Valley | 6.9 |

| South Durham | 6.5 |

The Impact of Economic Cycles

Economic cycles play a significant role in shaping tax records. During periods of economic prosperity, property values tend to rise, leading to increased tax assessments and revenue for the county. Conversely, economic downturns can result in stagnant or declining property values, impacting tax revenues.

Durham County's tax records reflect these economic cycles. For instance, during the recession of 2008-2009, property values dipped, resulting in a temporary slowdown in tax assessments. However, the county's resilient economy and its ability to attract new businesses helped stabilize and eventually recover property values.

The Future of Durham County’s Tax Records

As we look ahead, Durham County’s tax records are poised to continue their evolution, adapting to technological advancements and changing economic landscapes. Here’s a glimpse into the future of tax records in Durham County.

Digital Transformation and Data Analytics

The digital transformation of tax records is an ongoing process, with the potential to revolutionize how tax data is collected, stored, and analyzed. Durham County is committed to staying at the forefront of this transformation, investing in advanced data analytics tools to enhance the efficiency and accuracy of tax assessments.

By leveraging big data analytics, the county can identify patterns and trends more effectively, leading to fairer and more accurate assessments. This technology can also assist in identifying potential errors or inconsistencies, ensuring that tax records remain a reliable source of information.

Community Engagement and Transparency

Durham County recognizes the importance of community engagement and transparency in the tax assessment process. The county strives to foster an environment where residents feel informed and involved in the taxation system.

To achieve this, the Durham County Tax Office hosts regular community meetings and workshops, providing residents with an opportunity to understand the assessment process, ask questions, and provide feedback. This open dialogue not only builds trust but also ensures that the tax system remains responsive to the needs and concerns of the community.

Conclusion: Empowering Durham County Through Tax Records

Durham County’s tax records are more than just a collection of numbers and data. They tell a story of the county’s economic growth, real estate trends, and the resilience of its communities. By understanding these records, residents, businesses, and policymakers can make informed decisions, contributing to the continued prosperity of Durham County.

As we've explored, tax records offer a unique lens through which to view the county's past, present, and future. With continued investment in technology and community engagement, Durham County is poised to leverage its tax records as a powerful tool for economic development and community empowerment.

How often are tax assessments conducted in Durham County?

+Tax assessments in Durham County are typically conducted annually, with the goal of ensuring that property values and tax assessments remain current and accurate. This annual review process allows the county to account for changes in the real estate market, property improvements, and other factors that may impact a property’s value.

What happens if I disagree with my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. The Durham County Tax Office provides a formal appeal process, which typically involves submitting evidence and supporting documentation to justify your claim. It’s important to note that appeals should be based on factual information and not personal opinions.

How can I access my property’s tax records online?

+To access your property’s tax records online, you can visit the Durham County Tax Office’s official website. The online portal allows you to search for records by address, owner name, or parcel number. Once you locate your property, you’ll be able to view detailed information, including the assessed value, tax history, and any recent transactions.

Are there any tax incentives or exemptions available in Durham County?

+Yes, Durham County offers a variety of tax incentives and exemptions to eligible property owners. These may include homestead exemptions for primary residences, agricultural land use exemptions, and incentives for historic preservation. It’s advisable to consult with the Durham County Tax Office or a tax professional to determine your eligibility and understand the application process.