Orange County Sales Tax

Understanding the intricacies of sales tax can be crucial for businesses and individuals alike, especially when operating within specific jurisdictions like Orange County. This article aims to provide an in-depth exploration of Orange County's sales tax, shedding light on its unique characteristics, applicable rates, and its impact on various industries and consumers within the county.

A Comprehensive Guide to Orange County Sales Tax

Orange County, located in the heart of California, boasts a vibrant economy and a diverse range of industries, from tourism and hospitality to technology and manufacturing. With a robust sales tax system in place, it is essential to delve into the specifics to ensure compliance and make informed financial decisions.

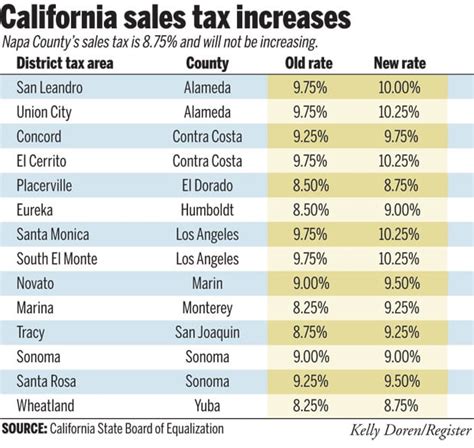

The sales tax landscape in Orange County is shaped by a combination of state, county, and city-level taxes, each contributing to the overall rate that businesses and consumers encounter. Let's break down these components to gain a clearer understanding.

State Sales Tax

The foundation of sales tax in Orange County, as in the rest of California, is the state sales tax. As of [Current Year], the state sales tax rate stands at 7.25%. This rate is applied uniformly across the state and forms the base for the overall sales tax calculation.

| State Sales Tax | Rate |

|---|---|

| California State Sales Tax | 7.25% |

County Sales Tax

On top of the state sales tax, Orange County imposes an additional county-wide sales tax. This supplemental tax is utilized to fund various county initiatives and services. As of our latest data, the Orange County sales tax stands at 1.25%, bringing the total county-wide sales tax to 8.50%.

| Orange County Sales Tax | Rate |

|---|---|

| County Supplemental Sales Tax | 1.25% |

| Total County-wide Sales Tax | 8.50% |

City Sales Tax

In addition to state and county sales taxes, several cities within Orange County impose their own city-specific sales taxes. These taxes vary from city to city and are typically used to support local infrastructure, community projects, and other city-level initiatives.

Here's a glimpse at some of the city sales tax rates in Orange County:

| City | Sales Tax Rate |

|---|---|

| Anaheim | 0.50% |

| Garden Grove | 0.50% |

| Santa Ana | 1.00% |

| Irvine | 0.50% |

| Newport Beach | 1.00% |

| Huntington Beach | 0.50% |

It's important to note that these city-specific sales tax rates are subject to change, and certain cities may have additional taxes or exemptions in place. Businesses operating in multiple cities within Orange County should be aware of these variations to ensure accurate tax collection and reporting.

Sales Tax Exemptions and Special Considerations

While the sales tax rates provide a general framework, it's crucial to acknowledge that certain goods and services may be exempt from sales tax or subject to special tax treatments. These exemptions can vary depending on the nature of the product, the industry, or even the location of the transaction.

For instance, in Orange County, the following categories often enjoy sales tax exemptions or reduced rates:

- Groceries and Food: Certain food items, especially staples like bread, milk, and eggs, are typically exempt from sales tax.

- Prescription Medications: Sales tax is often waived for pharmaceutical products prescribed by licensed medical professionals.

- Manufacturing Equipment: Businesses involved in manufacturing may qualify for tax exemptions or reduced rates on specific machinery and equipment purchases.

- Construction Materials: Sales tax exemptions or reduced rates may apply to construction materials used in new construction or substantial renovations.

- Certain Services: Services such as legal, accounting, and architectural services are often exempt from sales tax.

It's essential for businesses to stay informed about these exemptions and consult with tax professionals to ensure compliance and maximize tax benefits.

Impact on Industries and Consumers

The sales tax landscape in Orange County can significantly influence both industries and consumers. For businesses, understanding the sales tax rates and exemptions is crucial for accurate pricing strategies, tax compliance, and maintaining a competitive edge in the market.

From a consumer perspective, the sales tax can impact purchasing decisions, especially for big-ticket items. Understanding the total sales tax rate in a specific city or county can help consumers budget effectively and make informed choices. Additionally, for online retailers, knowing the sales tax rates in various jurisdictions is essential for accurate shipping and order fulfillment.

Compliance and Reporting

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Orange County. Businesses are responsible for collecting, reporting, and remitting sales tax to the appropriate tax authorities. Failure to comply can result in penalties, interest charges, and legal consequences.

To streamline the compliance process, businesses can utilize sales tax software and tools that integrate with their accounting systems. These solutions automate tax calculation, reporting, and filing, reducing the risk of errors and ensuring timely compliance.

Future Trends and Considerations

The sales tax landscape is subject to change, and Orange County is no exception. As economic conditions evolve, tax policies may be revised to meet new demands or address budgetary concerns. Businesses and consumers should stay informed about any potential changes to sales tax rates or exemptions to adapt their strategies accordingly.

Additionally, with the rise of e-commerce and online sales, the collection and remittance of sales tax for online transactions have become increasingly complex. Orange County, like many other jurisdictions, is navigating these challenges to ensure fair taxation for online retailers and maintain a level playing field for local businesses.

Frequently Asked Questions

What is the total sales tax rate in Orange County, including city-specific taxes?

+

The total sales tax rate in Orange County varies depending on the specific city. On average, the combined rate ranges from 8.50% to 9.50%. However, it’s essential to check the sales tax rate for the specific city where a transaction takes place, as city-specific taxes can vary.

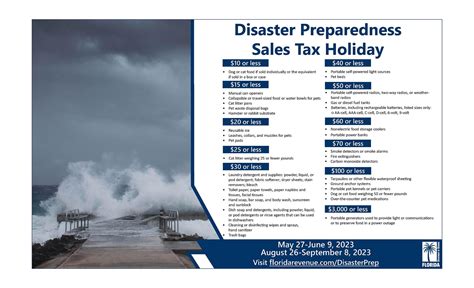

Are there any sales tax holidays in Orange County?

+

Currently, there are no official sales tax holidays in Orange County. However, certain retailers may offer promotional discounts or sales events throughout the year, providing consumers with opportunities to save on specific items.

How often do sales tax rates change in Orange County?

+

Sales tax rates in Orange County can change periodically, typically as a result of legislative decisions or budget considerations. While it’s challenging to predict exact timing, businesses and consumers should stay updated through official channels and tax resources to stay informed about any changes.

Are there any resources available to help businesses calculate and manage sales tax obligations in Orange County?

+

Yes, the California Department of Tax and Fee Administration provides comprehensive resources and tools to assist businesses in calculating and managing their sales tax obligations. These resources include tax rate lookup tools, tax guides, and online filing systems to streamline the compliance process.

Can individuals claim a refund for overpaid sales tax in Orange County?

+

Individuals who believe they have overpaid sales tax in Orange County can file a claim for a refund. The process typically involves completing a refund application and providing supporting documentation. It’s essential to consult the official guidelines and seek professional advice to ensure a successful refund claim.