Orange County Property Tax Payment

Welcome to this comprehensive guide on understanding and navigating the process of Orange County property tax payments. Property taxes are an essential aspect of homeownership, and it's crucial to have a clear understanding of how they work, when they're due, and how to manage them effectively. In this article, we will delve into the specifics of Orange County's property tax system, providing you with valuable insights and practical tips to ensure a smooth and stress-free experience.

The Fundamentals of Orange County Property Taxes

Orange County, California, is renowned for its vibrant communities, diverse neighborhoods, and beautiful landscapes. With its thriving real estate market, understanding property taxes is a key component of homeownership in this vibrant region. Here's an overview of the fundamental aspects of Orange County property taxes.

Assessment and Valuation

The property tax system in Orange County operates on an assessment-based model. The Assessor's Office is responsible for evaluating the taxable value of each property within the county. This value is determined through a comprehensive assessment process, considering factors such as:

- Property type (single-family home, condominium, commercial, etc.)

- Size and square footage

- Age and condition of the structure

- Recent sales data and market trends

- Improvements and additions to the property

The Assessor's Office aims to ensure that property values are fair and equitable, taking into account both the current market conditions and the specific characteristics of each property.

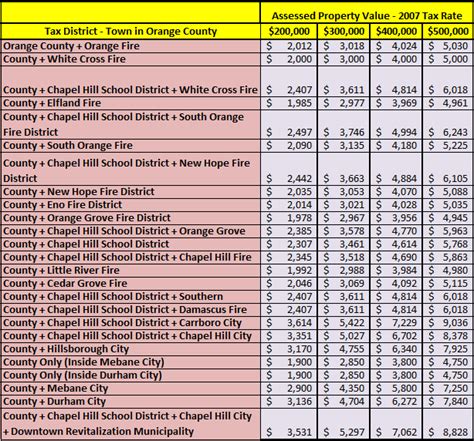

Tax Rates and Calculations

The property tax rate in Orange County is determined by the Board of Supervisors and is applied as a percentage of the assessed value of the property. This rate, often referred to as the tax rate area or tax rate percent, varies across different areas within the county. It is important to note that the tax rate can change annually, reflecting the budgetary needs of the county and its various service areas.

To calculate the property tax liability, the assessed value of the property is multiplied by the applicable tax rate. This calculation results in the total tax amount due for the year. It's worth mentioning that Orange County operates on a fiscal year basis, with the fiscal year running from July 1 to June 30.

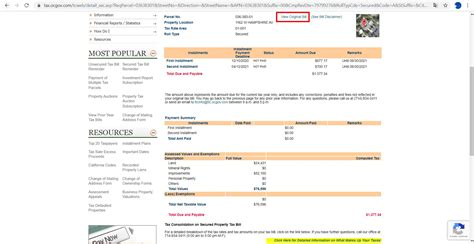

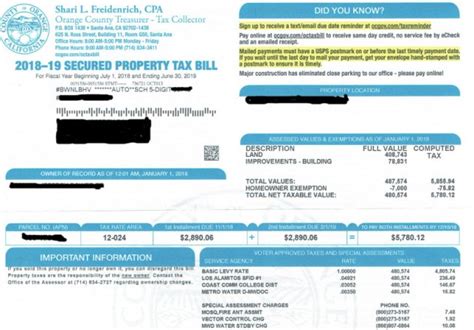

Tax Bills and Payment Options

Property owners in Orange County receive their tax bills, also known as Secure Tax Bills, in the mail. These bills provide detailed information about the assessed value of the property, the applicable tax rate, and the total tax amount due. Tax bills are typically mailed out twice a year, with the first installment due in November and the second installment due in April.

Orange County offers a range of convenient payment options to accommodate different preferences and needs. Property owners can choose to pay their taxes online through the county's secure payment portal, by mail using a provided remittance slip, or in person at designated locations, including the Treasurer-Tax Collector's offices.

| Payment Option | Description |

|---|---|

| Online Payment | Secure and convenient payment method available 24/7. |

| Mail Payment | Use the provided remittance slip and mail to the specified address. |

| In-Person Payment | Visit Treasurer-Tax Collector's offices during specified hours. |

Managing Property Taxes: Strategies and Considerations

Understanding the fundamentals of Orange County property taxes is just the first step. As a responsible homeowner, there are several strategies and considerations to keep in mind when managing your property tax obligations. Let's explore some key aspects to help you navigate this process effectively.

Assessing Your Property's Value

While the Assessor's Office conducts regular assessments, it's beneficial to stay informed about your property's value. You can access your property's assessment information online through the Orange County Property Assessment Viewer. This tool provides detailed information about your property's assessed value, assessment history, and comparable sales data. Regularly reviewing this information allows you to:

- Identify potential discrepancies or errors in the assessment.

- Monitor the market value of your property over time.

- Make informed decisions when considering home improvements or renovations.

Understanding Tax Rate Changes

As mentioned earlier, tax rates in Orange County can change annually. Staying updated on these changes is crucial for effective financial planning. The Orange County Treasurer-Tax Collector provides resources and information about the current tax rate and any proposed changes. By keeping an eye on these updates, you can anticipate potential increases or decreases in your property tax liability.

Exploring Tax Relief Programs

Orange County offers various tax relief programs to assist eligible homeowners. These programs aim to provide financial support and reduce the tax burden for qualifying individuals. Some of the notable programs include:

- Homeowner's Exemption: This program provides a reduction in the assessed value of your property, resulting in lower property taxes. To qualify, you must own and occupy the property as your primary residence.

- Senior Citizen Exemption: Designed for homeowners aged 65 and older, this exemption offers a significant reduction in property taxes. Eligibility requirements include age, income, and residency criteria.

- Disabled Veterans Exemption: Orange County provides property tax exemptions for qualified disabled veterans, offering a reduction in assessed value and, consequently, lower property taxes.

It's essential to research and understand the eligibility criteria for these programs and consult with the appropriate county offices to determine if you qualify.

Appealing Your Property Assessment

In certain situations, you may disagree with the assessed value of your property. If you believe that your property's assessed value is inaccurate or unfair, you have the right to appeal. The Assessment Appeals Board is responsible for reviewing and resolving assessment appeals. Here's a step-by-step guide on how to appeal your property assessment:

- Review your property assessment notice carefully to identify any discrepancies.

- Gather supporting documentation, such as recent sales data, appraisals, or photographs, to support your case.

- File an appeal with the Assessment Appeals Board within the specified deadline. You can find the necessary forms and instructions on the county's website.

- Attend the appeal hearing, where you will have the opportunity to present your case and provide evidence.

- The Assessment Appeals Board will review your appeal and make a determination. If your appeal is successful, your property's assessed value will be adjusted accordingly.

Staying Informed and Connected

Navigating the world of property taxes can be complex, but staying informed and connected to relevant resources can make the process more manageable. Here are some valuable resources and tips to keep you up-to-date and engaged with Orange County's property tax system.

Online Resources and Tools

The Orange County Treasurer-Tax Collector website serves as a comprehensive resource hub for property tax-related information. Here, you can find:

- Detailed explanations of the property tax process, tax rates, and payment options.

- Online payment portal and instructions for secure tax bill payments.

- Information on tax relief programs and how to apply.

- Frequently asked questions (FAQ) section addressing common inquiries.

- Contact information for the Treasurer-Tax Collector's offices and other relevant departments.

Community Engagement and Support

Engaging with your local community and fellow homeowners can provide valuable insights and support when it comes to property taxes. Consider joining or participating in:

- Homeowner associations (HOAs) or neighborhood groups, where property tax discussions are often a topic of interest.

- Community forums or online platforms dedicated to Orange County homeowners, where you can connect with others facing similar tax-related concerns.

- Local real estate or tax workshops and seminars, where experts provide valuable information and guidance.

By actively participating in these communities, you can stay informed about the latest property tax developments, share experiences, and receive practical advice from fellow homeowners.

Professional Guidance and Assistance

While this guide provides a comprehensive overview, seeking professional guidance can be beneficial, especially in complex situations or when navigating unique circumstances. Consider consulting with:

- Property Tax Professionals: Specialists in property tax assessment, appeals, and planning can provide personalized advice and assistance.

- Real Estate Attorneys: Legal experts specializing in real estate matters can offer guidance on property tax laws, appeals, and potential legal implications.

- Financial Advisors: Financial professionals can help you develop a comprehensive financial plan that accounts for property taxes and other expenses associated with homeownership.

FAQs: Addressing Common Property Tax Concerns

What happens if I miss a property tax payment deadline in Orange County?

+Missing a property tax payment deadline can result in penalties and interest charges. It's important to pay your taxes on time to avoid additional costs. If you're facing financial difficulties, consider contacting the Treasurer-Tax Collector's office to explore payment plans or other options.

How can I estimate my property taxes before receiving the official tax bill?

+You can estimate your property taxes by multiplying the assessed value of your property by the current tax rate. This estimation provides a rough idea of your tax liability. However, it's important to note that the official tax bill may include additional assessments or adjustments.

Are there any property tax breaks or exemptions available for military personnel or veterans in Orange County?

+Yes, Orange County offers specific tax relief programs for military personnel and veterans. The Disabled Veterans Exemption provides a reduction in property taxes for eligible disabled veterans. It's advisable to explore these programs and consult with the appropriate county offices to determine eligibility.

Can I pay my property taxes early, and are there any benefits to doing so?

+Yes, you can pay your property taxes early, and it may offer certain advantages. Paying early ensures that you avoid late fees and penalties. Additionally, some lenders may require early tax payments to ensure that taxes are paid on time. However, it's important to consult with your lender and the Treasurer-Tax Collector's office to understand any specific requirements or benefits associated with early payments.

What should I do if I believe my property has been incorrectly assessed, and how do I initiate an appeal?

+If you believe your property has been incorrectly assessed, it's important to act promptly. Follow the steps outlined in the "Appealing Your Property Assessment" section of this guide. Gather supporting evidence, file an appeal with the Assessment Appeals Board, and attend the hearing to present your case. The Assessment Appeals Board will review your appeal and make a determination.

Understanding and managing your Orange County property taxes is an essential part of responsible homeownership. By staying informed, utilizing available resources, and exploring potential tax relief options, you can navigate this process with confidence. Remember, staying proactive, seeking professional guidance when needed, and staying connected to your community can make all the difference in ensuring a smooth and stress-free property tax experience.