Oc Sales Tax Rate

The OC Sales Tax Rate refers to the combined sales and use tax rates applicable to Orange County, California. As of [date of publication], the OC Sales Tax Rate is a critical consideration for businesses and consumers alike, as it impacts the cost of goods and services within the county. This article aims to provide a comprehensive guide to understanding and navigating the OC Sales Tax Rate, offering insights into its structure, calculation, and implications for various stakeholders.

Understanding the OC Sales Tax Rate

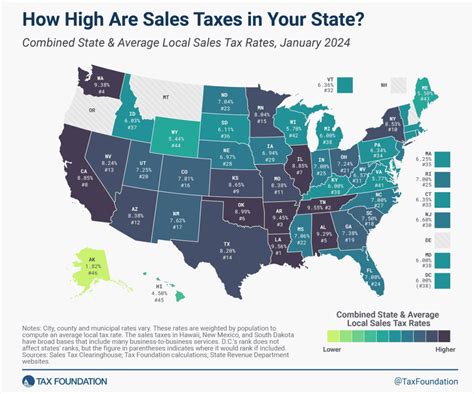

The OC Sales Tax Rate is a combination of several tax components, including the state sales tax, local district tax, and any applicable city taxes. In Orange County, the state sales tax rate is a fixed 7.25%, which serves as the base rate for all sales tax calculations. However, the total sales tax rate varies across different areas within the county due to the additional local and city taxes that are levied.

The local district tax is imposed by the County of Orange to fund various services and infrastructure projects. This tax rate can vary from one district to another, with some areas having a higher rate to support specific community needs. Additionally, city taxes are levied by individual cities within Orange County, further contributing to the overall sales tax rate.

For example, let's consider the city of Irvine, which is known for its thriving business community and diverse retail options. In Irvine, the total sales tax rate as of [date of publication] is 9.75%, comprising the state sales tax rate of 7.25%, a local district tax of 1.0%, and a city tax of 1.5%. This means that for every $100 spent on taxable goods or services in Irvine, $9.75 is collected as sales tax.

Calculation of the OC Sales Tax Rate

Calculating the OC Sales Tax Rate involves adding up all the applicable tax rates for a specific location within the county. Here’s a step-by-step breakdown of the calculation process:

- Identify the State Sales Tax Rate: As mentioned earlier, the state sales tax rate is a fixed 7.25% across California. This serves as the foundation for the total sales tax calculation.

- Determine the Local District Tax Rate: The local district tax rate can vary based on the specific district within Orange County. This information is typically available from the County of Orange's official website or tax authorities.

- Find the City Tax Rate: Each city in Orange County may impose its own sales tax rate. These rates can be obtained from the city's official website or through communication with the city's tax office.

- Sum up the Rates: Add the state sales tax rate, local district tax rate, and city tax rate to determine the total OC Sales Tax Rate for a particular location.

It's important to note that certain goods and services may be exempt from sales tax or have reduced tax rates. These exemptions and special tax treatments vary depending on the nature of the transaction and the specific regulations in place. Businesses and consumers should consult the California Board of Equalization's website or seek professional advice to understand the tax implications of their transactions.

| City | OC Sales Tax Rate |

|---|---|

| Anaheim | 9.75% |

| Irvine | 9.75% |

| Santa Ana | 9.00% |

| Newport Beach | 9.75% |

| Huntington Beach | 9.75% |

Implications for Businesses

The OC Sales Tax Rate has significant implications for businesses operating within Orange County. Here are some key considerations:

Pricing Strategies

Businesses must incorporate the OC Sales Tax Rate into their pricing strategies to ensure that their offerings remain competitive and attract customers. By understanding the total sales tax rate for their specific location, businesses can set prices that reflect the true cost of goods or services to consumers.

For instance, a restaurant in Orange County may choose to include the sales tax in its menu prices to provide transparency to customers. Alternatively, a retail store may decide to exclude the sales tax from its shelf prices, offering customers a clear understanding of the pre-tax cost of items.

Tax Compliance

Ensuring tax compliance is a critical responsibility for businesses. They must accurately calculate and remit the appropriate sales tax to the relevant tax authorities. This involves maintaining detailed records of sales transactions, including the breakdown of sales tax components, to facilitate audits and ensure compliance with tax laws.

Businesses should also stay informed about any changes in the OC Sales Tax Rate to adjust their pricing and tax collection processes accordingly. Failure to comply with tax regulations can result in penalties and legal consequences.

Impact on Business Operations

The OC Sales Tax Rate can influence various aspects of business operations, including inventory management, supply chain logistics, and financial planning. Businesses may need to adjust their procurement strategies to account for the sales tax implications on incoming goods or services. Additionally, the sales tax rate can impact the cost of doing business, affecting profit margins and overall financial performance.

Impact on Consumers

Consumers in Orange County are directly affected by the OC Sales Tax Rate. Here’s how it influences their purchasing decisions and experiences:

Cost of Goods and Services

The OC Sales Tax Rate adds to the final cost of goods and services purchased by consumers. This additional tax burden can significantly impact consumers’ purchasing power, especially for essential items or large-ticket purchases. Understanding the sales tax rate helps consumers make informed choices and budget accordingly.

Comparison Shopping

Consumers often engage in comparison shopping to find the best deals and save money. The OC Sales Tax Rate plays a role in this process, as consumers may consider not only the pre-tax price of goods but also the total cost, including sales tax, when making purchasing decisions. This practice can drive competition among businesses, leading to more attractive pricing strategies.

Online Shopping Considerations

With the rise of e-commerce, consumers can now access a wide range of products and services from businesses both within and outside Orange County. When shopping online, consumers should be aware of the sales tax implications. Some online retailers may display prices excluding sales tax, which can lead to surprises at checkout. It’s important for consumers to factor in the OC Sales Tax Rate when comparing prices across different platforms or retailers.

Future Implications and Potential Changes

The OC Sales Tax Rate is subject to potential changes and future developments that can impact businesses and consumers. Here are some key considerations:

Economic Factors

Economic conditions, such as inflation, recessions, or periods of economic growth, can influence the need for tax adjustments. During economic downturns, there may be calls for tax relief to stimulate consumer spending, while periods of prosperity could lead to discussions about increasing tax rates to fund infrastructure or public services.

Political Landscape

The political climate and leadership in Orange County can shape the future of the OC Sales Tax Rate. Elected officials and policymakers may propose changes to the tax structure, either to address budgetary concerns or to implement specific community initiatives. Staying informed about local politics and tax proposals is crucial for both businesses and consumers.

Community Needs

The OC Sales Tax Rate can be a tool to address specific community needs and fund essential services. For example, higher tax rates in certain areas may be directed towards improving public transportation, enhancing public safety, or supporting education initiatives. Understanding the allocation of sales tax revenue can provide insights into the priorities and goals of the community.

Conclusion

The OC Sales Tax Rate is a dynamic component of the business and consumer landscape in Orange County. Understanding its structure, calculation, and implications is crucial for businesses to remain competitive and compliant, and for consumers to make informed purchasing decisions. By staying informed about changes and developments, stakeholders can navigate the OC Sales Tax Rate effectively and contribute to the economic vitality of the county.

How often does the OC Sales Tax Rate change?

+The OC Sales Tax Rate can change periodically, typically in response to economic conditions, community needs, or legislative decisions. While there is no set schedule for changes, businesses and consumers should stay informed about any proposed or implemented tax adjustments through local news sources and official government websites.

Are there any tax exemptions or special rates for specific goods or services in Orange County?

+Yes, there are certain goods and services that may be exempt from sales tax or have reduced tax rates. These exemptions vary depending on the nature of the transaction and the regulations in place. It’s essential for businesses and consumers to consult the California Board of Equalization’s website or seek professional advice to understand these exemptions.

How can businesses ensure they are collecting and remitting the correct sales tax amount?

+Businesses should stay updated on the OC Sales Tax Rate and its components for their specific location. They should also maintain accurate records of sales transactions, including the breakdown of sales tax components. Regular audits and consultations with tax professionals can help ensure compliance and accuracy in sales tax collection and remittance.