Nj Senior Property Tax Freeze

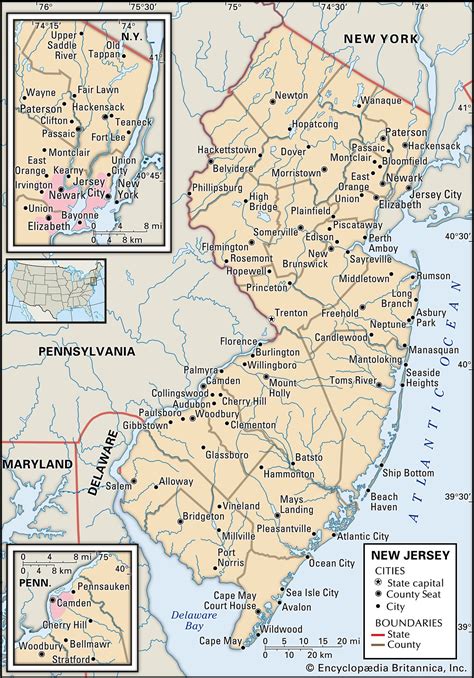

The New Jersey Senior Property Tax Freeze program is a vital initiative aimed at providing much-needed relief to elderly residents of the state. As property taxes continue to rise, this program offers a glimmer of hope to those on fixed incomes, ensuring they can afford to stay in their homes without facing the burden of increasing tax payments. In this article, we delve into the intricacies of the Senior Property Tax Freeze, exploring its benefits, eligibility criteria, and the impact it has on the lives of New Jersey's senior citizens.

Understanding the Senior Property Tax Freeze Program

The Senior Property Tax Freeze, officially known as the Property Tax Reimbursement Program, is a state-funded initiative designed to assist eligible senior citizens and disabled individuals in New Jersey. It aims to stabilize property tax costs for these groups, offering them financial security and peace of mind amidst rising tax rates.

This program, administered by the New Jersey Division of Taxation, is a crucial component of the state's efforts to support its aging population. By implementing a tax freeze, the state ensures that eligible seniors are not priced out of their homes due to escalating property taxes.

How the Property Tax Freeze Works

The Property Tax Freeze effectively caps the taxable value of a senior's property at a specific amount. This means that even if the property's assessed value increases due to market fluctuations or improvements, the tax base for calculating property taxes remains unchanged.

For instance, if a senior's property was valued at $200,000 when they first enrolled in the program, and the assessed value rises to $220,000 the following year, the tax freeze ensures they continue to pay taxes based on the original $200,000 valuation. This protects seniors from sudden and significant increases in their property tax bills.

The program's benefits are calculated annually, taking into account the senior's income, property value, and local property tax rates. Reimbursements are provided directly to the taxpayer, typically as a check or direct deposit, ensuring that eligible seniors receive the full benefit of the tax freeze.

| Program Feature | Description |

|---|---|

| Taxable Value Cap | Locks the taxable value of a senior's property, preventing tax hikes due to increased property assessments. |

| Annual Reimbursement | Seniors receive a reimbursement for any excess taxes paid, ensuring they are not financially burdened. |

| Income-Based Eligibility | The program considers the senior's income, ensuring those with limited means benefit the most. |

Eligibility Criteria

To be eligible for the Senior Property Tax Freeze, individuals must meet certain criteria set by the state. These criteria ensure that the program benefits those who need it most and prevent abuse or misuse of the system.

The primary eligibility factors include:

- Age: Applicants must be 65 years of age or older as of October 1st of the tax year.

- Residency: Individuals must have been residents of New Jersey for at least two consecutive years prior to the tax year.

- Property Ownership: The property for which the tax freeze is sought must be the primary residence of the applicant.

- Income Limits : Gross income limits apply, with adjustments for certain expenses and dependents. For instance, in 2023, the gross income limit was set at $125,920 for a single taxpayer and $150,520 for a married couple.

Additionally, applicants must not have any outstanding property tax payments or be in violation of any local ordinances related to property maintenance.

Application Process

The application process for the Senior Property Tax Freeze is straightforward and designed to be accessible to seniors. Applications are typically available online and can also be obtained from local tax offices or senior centers.

Key steps in the application process include:

- Obtain the Application: Download the application form from the New Jersey Division of Taxation's website or pick up a hard copy from designated locations.

- Complete the Form: Provide accurate and complete information, including personal details, property information, and income documentation.

- Submit Supporting Documents: Along with the completed application, submit required documents such as proof of age, residency, and income.

- Return the Application: Send the application and supporting documents to the address specified on the form before the deadline.

Applications are usually due by February 1st of the tax year. It's crucial to apply promptly, as late applications may result in reduced benefits or disqualification.

Benefits and Impact

The Senior Property Tax Freeze program has had a significant positive impact on the lives of eligible New Jersey seniors. By stabilizing property tax costs, the program allows seniors to budget effectively and plan for their future with greater financial certainty.

The benefits of the program are twofold. Firstly, it provides immediate relief by reducing the financial burden of property taxes. Secondly, it offers long-term security, ensuring that seniors can remain in their homes without the fear of being priced out due to rising property values.

The program's impact extends beyond individual seniors. It contributes to the overall well-being of the community by fostering a sense of stability and continuity. When seniors can afford to stay in their homes, they remain active members of their communities, contributing to social cohesion and reducing the need for institutional care.

Case Studies: Real-Life Impact

To illustrate the tangible benefits of the Senior Property Tax Freeze, let's consider a few case studies:

Case Study 1: The Johnsons

John and Jane Johnson, both 70 years old, have lived in their New Jersey home for over 30 years. As retirees on fixed incomes, they were struggling to keep up with the rising property taxes. The Senior Property Tax Freeze program provided them with a much-needed break, capping their tax liability at a manageable level.

With the tax freeze in place, the Johnsons were able to budget more effectively. They no longer had to worry about unexpected tax hikes, allowing them to plan for other expenses such as healthcare and maintenance costs. The program's benefits gave them peace of mind and a sense of financial security in their golden years.

Case Study 2: Ms. Rodriguez

Maria Rodriguez, a 68-year-old widow, lives alone in a modest apartment in a bustling New Jersey city. With limited income and rising property taxes, she was facing the difficult decision of either moving to a cheaper area or seeking assistance.

Fortunately, Ms. Rodriguez discovered the Senior Property Tax Freeze program. After a simple application process, she was approved and received a reimbursement for the excess taxes she had paid in the previous year. This reimbursement allowed her to catch up on other bills and maintain her standard of living without compromising her health or safety.

Case Study 3: Mr. Lee

Mr. Lee, a 66-year-old veteran, moved to New Jersey after retiring from the military. He purchased a small house in a suburban area, intending to settle down and enjoy his retirement years.

However, the increase in property taxes threatened his ability to stay in his new home. Through the Senior Property Tax Freeze program, Mr. Lee was able to stabilize his tax liability. This relief allowed him to focus on his health and well-being, ensuring he could afford the medications and treatments he needed without worrying about losing his home.

Program Challenges and Future Outlook

While the Senior Property Tax Freeze program has been successful in providing relief to eligible seniors, it is not without its challenges. One of the primary concerns is the program's sustainability in the face of rising property values and increasing demand.

As the population ages and more seniors become eligible, the demand for the program's benefits is expected to grow. This puts pressure on the state's budget, requiring careful planning and resource allocation to ensure the program's longevity.

Furthermore, the program's eligibility criteria and income limits may need periodic adjustments to keep pace with changing economic conditions and inflation. Regular reviews and updates are necessary to ensure the program remains accessible and effective for the seniors who rely on it.

Proposed Solutions

To address these challenges, several strategies can be considered:

- Increased Funding: Allocating more resources to the program can ensure its sustainability and allow for increased benefits or expanded eligibility.

- Income Bracket Adjustments: Regularly reviewing and adjusting income limits can ensure that the program remains accessible to those who need it most, even as the cost of living rises.

- Public-Private Partnerships: Collaborating with private organizations or charities can provide additional support and resources to supplement the program's benefits.

- Community Education: Raising awareness about the program and its benefits can encourage more eligible seniors to apply, ensuring they receive the financial relief they deserve.

Long-Term Implications

The Senior Property Tax Freeze program is not just a short-term solution but a critical component of New Jersey's long-term strategy for supporting its aging population. By providing financial stability and peace of mind to seniors, the program contributes to a healthier, more resilient community.

As the program continues to evolve and adapt, it will play a pivotal role in shaping the future of senior living in New Jersey. With the right support and resources, the program can ensure that seniors can age with dignity and security, knowing they have a place to call home.

Frequently Asked Questions

How do I know if I'm eligible for the Senior Property Tax Freeze program?

+Eligibility for the Senior Property Tax Freeze program is based on several factors, including age, residency, property ownership, and income. You must be 65 years of age or older as of October 1st of the tax year, have resided in New Jersey for at least two consecutive years, own the property as your primary residence, and meet the income limits set by the state. It's recommended to review the official eligibility guidelines on the New Jersey Division of Taxation's website for detailed information.

<div class="faq-item">

<div class="faq-question">

<h3>What documents do I need to provide when applying for the program?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When applying for the Senior Property Tax Freeze program, you will need to provide documentation to support your eligibility. This typically includes proof of age (e.g., birth certificate or driver's license), proof of residency (e.g., utility bills or lease agreement), and proof of income (e.g., tax returns or pension statements). Be sure to review the application guidelines carefully to ensure you have all the required documents.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How long does it take to receive a decision on my application?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The processing time for Senior Property Tax Freeze applications can vary. Generally, it takes several weeks to a few months to receive a decision. Factors such as the volume of applications and the completeness of your submitted documentation can impact the processing time. It's advisable to apply early and ensure your application is accurate and thorough to expedite the process.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I still apply if I missed the deadline?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Missing the application deadline for the Senior Property Tax Freeze program may result in reduced benefits or disqualification. However, it's worth contacting the New Jersey Division of Taxation to inquire about late applications. In certain circumstances, such as extenuating circumstances or hardship, late applications may be considered on a case-by-case basis. It's best to reach out to the relevant authorities to discuss your options.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if my income exceeds the program's limits during the tax year?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If your income exceeds the program's limits during the tax year, you may still be eligible for partial benefits. The program takes into account your income for the entire tax year, and if your income remains within the limits for a certain period, you may still receive a prorated reimbursement. It's important to accurately report your income on your application and any changes in income during the tax year to ensure fair and accurate benefits.</p>

</div>

</div>

</div>