Dupage Property Tax Lookup

Welcome to the comprehensive guide on the DuPage Property Tax Lookup system, an essential tool for homeowners and investors in DuPage County, Illinois. In this article, we will delve into the intricacies of the property tax assessment and payment process, offering valuable insights and practical tips. As an expert in real estate and local governance, I will provide an in-depth analysis to help you navigate this crucial aspect of property ownership seamlessly.

Understanding the DuPage Property Tax System

DuPage County, located in the heart of Illinois, prides itself on its efficient and transparent property tax system. The county’s commitment to maintaining a fair and equitable tax assessment process ensures that property owners receive accurate and timely information. The DuPage Property Tax Lookup platform is a digital gateway to this process, offering a user-friendly interface for homeowners, investors, and even curious minds to explore the world of property taxes.

The property tax system in DuPage County is a vital component of the local economy, contributing significantly to the funding of essential services like schools, emergency services, and infrastructure development. It's a complex yet crucial mechanism that shapes the financial landscape of the county.

Key Features of the DuPage Property Tax Lookup

The DuPage Property Tax Lookup is designed to be accessible and informative. Here’s a glimpse into some of its standout features:

- Real-time Information: The platform provides up-to-date details on property assessments, tax rates, and payment due dates, ensuring that property owners are always in the know.

- User-Friendly Interface: With a simple search function, users can access property tax information with just a few clicks, making it convenient for busy homeowners and investors.

- Historical Data: It offers a comprehensive record of past tax assessments and payments, allowing users to analyze trends and make informed decisions.

- Payment Portal: Homeowners can conveniently make their tax payments online, eliminating the need for trips to the county office.

- Interactive Maps: The platform integrates interactive maps, providing a visual representation of property boundaries and assessment data.

These features not only enhance transparency but also empower property owners to actively participate in the tax assessment process, fostering a sense of community engagement.

The Assessment Process: Unveiling the Methodology

At the core of the DuPage Property Tax Lookup system is the rigorous assessment process. The county employs a team of highly skilled assessors who are responsible for evaluating each property’s fair market value. This value, in turn, determines the property tax liability.

The assessment process involves a meticulous analysis of various factors, including:

- Market Value: The assessors consider the current market conditions, comparable property sales, and rental income to estimate the property's value.

- Physical Characteristics: The size, age, condition, and any unique features of the property are taken into account.

- Legal Status: The property's legal description, zoning, and any restrictions or easements are factored into the assessment.

- Location: The property's location, neighborhood, and proximity to amenities play a significant role in the assessment.

By combining these factors, the assessors arrive at a fair and accurate assessment, ensuring that property owners pay their fair share of taxes.

The Role of Technology in Assessment

The DuPage County Assessor’s Office leverages cutting-edge technology to streamline the assessment process. They employ Geographic Information Systems (GIS) to create detailed maps and analyze spatial data, ensuring precision in property boundary delineation.

Additionally, the office utilizes advanced data analytics tools to identify trends and anomalies, making the assessment process more efficient and accurate. This technological integration not only saves time but also enhances the overall quality of assessments.

Navigating the DuPage Property Tax Lookup Platform

Now, let’s explore the practical aspects of using the DuPage Property Tax Lookup platform. Whether you’re a seasoned homeowner or a first-time buyer, understanding how to navigate this system is essential.

Step-by-Step Guide

- Access the Platform: Visit the official DuPage County website and navigate to the Property Tax Lookup section.

- Search for Your Property: Enter your property’s address or Parcel ID to retrieve specific details.

- View Assessment Details: The platform will display the property’s assessed value, tax rate, and other relevant information.

- Explore Historical Data: Scroll through the historical records to analyze past assessments and tax payments.

- Make Online Payments: If your property taxes are due, you can conveniently pay them online using secure payment methods.

- Download Reports: Generate and download detailed reports for your records or for use in financial planning.

The platform offers a wealth of information and tools to assist property owners in managing their tax obligations effectively.

Tips for Optimal Use

- Stay Informed: Regularly check the platform for updates, especially during the assessment and payment periods.

- Verify Your Property Details: Ensure that the information displayed on the platform matches your records to avoid any discrepancies.

- Explore Interactive Maps: Utilize the interactive maps to visualize your property’s location and assess its surroundings.

- Contact Support: If you encounter any issues or have specific questions, reach out to the DuPage County Assessor’s Office for assistance.

By familiarizing yourself with the platform and its features, you'll be better equipped to handle your property tax obligations with ease.

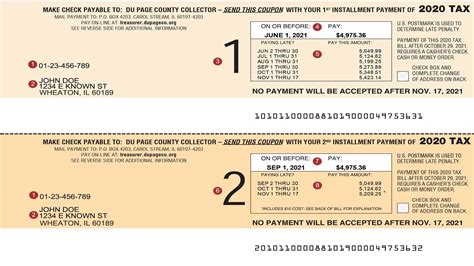

Property Tax Payment Options and Due Dates

Understanding the payment options and due dates is crucial to ensure timely and accurate tax payments. DuPage County offers a range of payment methods to cater to different preferences and needs.

Payment Methods

- Online Payment: The most convenient option, allowing you to pay your taxes securely from the comfort of your home.

- Mail-in Payment: You can send a check or money order to the county office, ensuring you meet the payment deadline.

- In-Person Payment: Visit the county office to make your payment in person.

- Electronic Funds Transfer (EFT): Set up an automatic payment plan to have your taxes deducted directly from your bank account.

Each payment method has its advantages, so choose the one that best suits your needs and preferences.

Due Dates

Property taxes in DuPage County are typically due in two installments, with specific due dates:

- First Installment: Usually due in March, this installment covers a portion of the annual tax bill.

- Second Installment: The remaining balance is due in September, ensuring a balanced payment schedule throughout the year.

Stay vigilant about these due dates to avoid penalties and maintain a good standing with the county.

Dispute Resolution: Addressing Assessment Concerns

While the DuPage County Assessor’s Office strives for accuracy, there may be instances where property owners disagree with the assessed value of their property. In such cases, the county provides a fair and transparent dispute resolution process.

The Appeal Process

- Review Your Assessment: Carefully examine the assessment details and compare them with your records.

- Gather Evidence: Collect relevant documents, such as recent appraisals, sale prices of similar properties, or any other evidence that supports your case.

- File an Appeal: Submit a formal appeal to the DuPage County Board of Review within the specified deadline.

- Attend a Hearing: Present your case and evidence to the Board of Review, who will review your appeal and make a decision.

- Final Decision: The Board’s decision will be communicated to you, and if necessary, you can further appeal to the Property Tax Appeal Board.

The appeal process ensures that property owners have a voice and can challenge assessments they believe are unfair or inaccurate.

Tips for a Successful Appeal

- Act Promptly: Appeals must be filed within a specified timeframe, so it’s crucial to act quickly.

- Be Prepared: Gather compelling evidence to support your case and present it clearly and concisely.

- Seek Professional Advice: Consider consulting a tax professional or attorney who specializes in property tax appeals for expert guidance.

By understanding the appeal process and being proactive, you can effectively address any concerns you may have about your property assessment.

The Impact of Property Taxes on Local Communities

Property taxes are not just a financial obligation for homeowners; they are a vital source of revenue for local communities. The funds generated from property taxes are invested back into the community, funding essential services and infrastructure projects.

How Property Taxes Benefit the Community

- Education: A significant portion of property tax revenue goes towards funding public schools, ensuring that students receive quality education.

- Emergency Services: Property taxes support fire departments, police forces, and emergency medical services, keeping our communities safe.

- Infrastructure Development: From road repairs to public transportation improvements, property taxes contribute to the maintenance and enhancement of our infrastructure.

- Community Programs: Property taxes fund recreational facilities, libraries, and cultural programs, enriching the lives of residents.

By paying property taxes, homeowners and investors play a crucial role in shaping and improving their local communities.

The Relationship Between Property Values and Taxes

It’s important to note that property values and taxes are closely intertwined. As property values increase, so do the tax assessments, reflecting the property’s fair market value. This ensures that the tax burden is distributed equitably among property owners.

However, it's crucial for property owners to stay informed about changes in property values and assessments to ensure they are not overburdened by taxes.

Future Trends and Innovations in Property Tax Assessment

The world of property tax assessment is constantly evolving, driven by advancements in technology and changing market dynamics. Here’s a glimpse into the future of property tax assessment in DuPage County and beyond.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to revolutionize the property tax assessment process. These technologies can analyze vast amounts of data, identify patterns, and make more accurate predictions about property values.

By leveraging AI and ML, assessors can streamline the assessment process, improve accuracy, and enhance transparency.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, has the potential to transform property transactions and assessments. It can provide a secure and transparent record of property ownership and assessments, reducing fraud and ensuring data integrity.

The implementation of blockchain technology in property tax assessment could enhance trust and efficiency in the system.

Data-Driven Assessments

With the abundance of data available, assessors are increasingly relying on data-driven approaches to make more informed decisions. By analyzing market trends, economic indicators, and demographic data, assessors can better understand property values and adjust assessments accordingly.

Data-driven assessments ensure that property taxes remain fair and reflective of the current market conditions.

Conclusion: Empowering Property Owners

The DuPage Property Tax Lookup system is a powerful tool that empowers property owners to actively participate in the tax assessment and payment process. By providing transparent and accessible information, the system fosters trust and engagement within the community.

As we've explored in this comprehensive guide, the DuPage County Assessor's Office is committed to maintaining a fair and efficient property tax system. With the right tools and knowledge, property owners can navigate the assessment and payment process with confidence, contributing to the vitality of their local communities.

Remember, staying informed and proactive is key to a smooth property tax journey. So, whether you're a new homeowner or a seasoned investor, make the most of the resources available to you, and don't hesitate to reach out for assistance when needed.

Frequently Asked Questions

What if I disagree with my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you can file an appeal with the DuPage County Board of Review. Gather evidence, such as recent appraisals or comparable property sales, to support your case. The appeal process is a fair and transparent way to address your concerns.

How often are property assessments conducted in DuPage County?

+Property assessments in DuPage County are conducted every three years. However, the assessor’s office may conduct reassessments if there are significant changes to your property or if there’s a need to update the assessment rolls.

Can I pay my property taxes in installments?

+Yes, DuPage County offers the option to pay your property taxes in two installments. The first installment is typically due in March, and the second installment is due in September. This allows for a more manageable payment schedule.

What happens if I miss the property tax payment deadline?

+If you miss the payment deadline, you may be subject to late fees and penalties. It’s important to stay informed about the due dates and make timely payments to avoid any additional costs or complications.

How can I stay updated on changes to my property’s assessment?

+You can sign up for notification services provided by the DuPage County Assessor’s Office. By subscribing to these services, you’ll receive updates and alerts about changes to your property’s assessment, ensuring you stay informed and proactive.