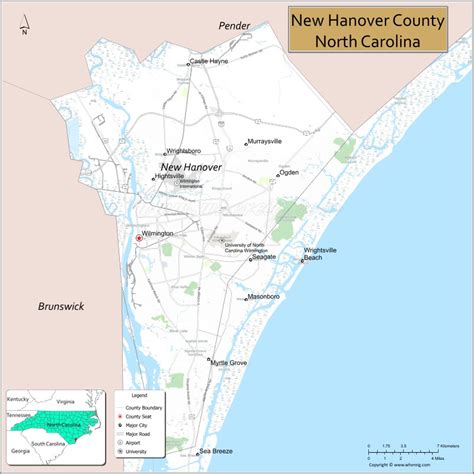

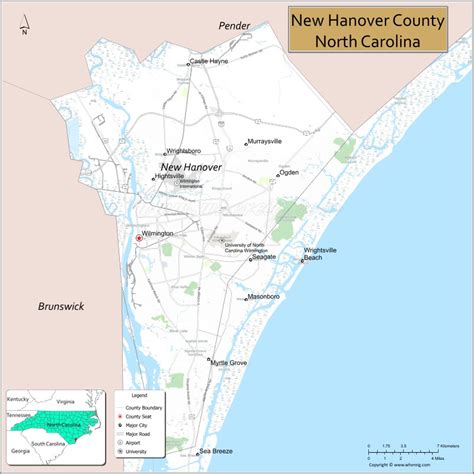

New Hanover County Tax Records

Welcome to the in-depth exploration of New Hanover County's tax records, a vital administrative function that impacts every property owner in the region. In this article, we delve into the intricacies of the tax system, its historical evolution, and its current practices. From understanding the assessment process to navigating the online resources available, this guide aims to provide a comprehensive understanding of the tax landscape in New Hanover County.

The Evolution of New Hanover County’s Tax System

The tax system in New Hanover County has undergone significant transformations over the years, adapting to changing economic landscapes and technological advancements. While the concept of property taxation has deep historical roots, the modern system has evolved to become a complex yet efficient mechanism for funding public services and infrastructure.

Initially, the county's tax system was predominantly based on ad valorem taxes, which are levied on the value of property, typically assessed annually. This traditional approach, though simple in principle, required extensive manual effort and was susceptible to errors and inconsistencies. Recognizing the need for a more accurate and streamlined process, the county embarked on a journey of modernization.

The turning point came with the introduction of advanced technology and digital solutions. New Hanover County invested in sophisticated software systems that revolutionized the assessment and collection process. These systems, designed specifically for the complex task of property taxation, brought about a new era of efficiency and transparency.

Today, the county's tax system is a finely tuned machine, utilizing advanced algorithms and data analytics to determine property values. This technological advancement has not only reduced the margin of error but has also expedited the entire process, allowing for more timely assessments and efficient revenue collection.

Understanding the Assessment Process

The assessment process in New Hanover County is a meticulous endeavor, ensuring that every property is valued fairly and accurately. It begins with the collection of extensive data, including physical characteristics, location, and recent sales of comparable properties.

Trained assessors then analyze this data, applying complex valuation models to determine the market value of each property. This process, while intricate, is designed to ensure that the assessed value aligns closely with the property's true market worth.

Once the initial assessment is complete, property owners have the opportunity to review and, if necessary, appeal the assessed value. This transparency and the right to challenge ensure that the system remains fair and unbiased.

The county's commitment to transparency is further evident in its online resources. Property owners can now access their assessment details and historical data with just a few clicks, providing an unprecedented level of clarity and accessibility.

Online Resources and Tools for Property Owners

In an effort to enhance convenience and accessibility, New Hanover County has developed a comprehensive online platform, offering a wealth of resources and tools for property owners.

The platform, accessible via the county's official website, provides a user-friendly interface that allows property owners to:

- View Property Details: Obtain comprehensive information about their property, including assessment history, tax rates, and any applicable exemptions.

- Track Payment Status: Monitor the status of their tax payments, receive reminders, and access payment history.

- Appeal Assessments: Initiate the appeal process online, providing a convenient and efficient way to challenge assessed values.

- Access Tax Documents: Download and print relevant tax forms and documents, ensuring easy access to all necessary paperwork.

- Explore Tax Relief Programs: Discover and apply for various tax relief programs offered by the county, such as the Homestead Exemption and Senior Citizen Relief.

The online platform also features an interactive map, allowing users to visually explore tax information for any property in the county. This innovative tool provides a unique perspective, offering insights into neighborhood tax landscapes and property value trends.

Tax Rates and Exemptions

New Hanover County operates under a progressive tax rate structure, which means that the tax rate increases with the assessed value of the property. This approach ensures that higher-value properties contribute proportionally more to the county’s revenue.

The county also offers a range of exemptions and relief programs to ease the tax burden on certain property owners. These include:

- Homestead Exemption: A reduction in the taxable value of a primary residence for qualifying homeowners.

- Senior Citizen Relief: Provides relief to seniors by reducing the taxable value of their property based on certain criteria.

- Veteran's Exemption: Offers tax relief to honorably discharged veterans, reducing the taxable value of their primary residence.

- Disabled Veteran's Exemption: Extends additional tax relief to veterans with service-connected disabilities.

The availability and specifics of these exemptions vary based on individual circumstances, and property owners are encouraged to explore their eligibility and apply through the county's online portal.

Navigating the Appeal Process

While the assessment process aims for accuracy, property owners may find occasions where they wish to challenge the assessed value of their property. New Hanover County has established a fair and structured appeal process to address such situations.

The appeal process typically involves the following steps:

- Review the Assessment: Property owners should first carefully review their assessment notice, ensuring they understand the valuation and any changes from the previous year.

- Gather Evidence: If there are discrepancies or concerns, property owners should gather supporting evidence, such as recent appraisals, sales data of comparable properties, or any other relevant information.

- Initiate the Appeal: Appeals can be submitted online through the county's website or by visiting the Assessor's Office in person. The appeal must be filed within a specified timeframe, usually within 30 days of receiving the assessment notice.

- Present Your Case: During the appeal process, property owners have the opportunity to present their case, providing detailed explanations and evidence to support their claim for a revised assessment.

- Final Determination: The county's Board of Equalization and Review will carefully consider the appeal, taking into account all presented evidence. They will then issue a final determination, which can either uphold or adjust the assessed value.

It is important for property owners to approach the appeal process with a thorough understanding of the assessment process and the supporting evidence. This ensures a fair and efficient resolution.

The Impact of Tax Records on the Community

Beyond their administrative function, tax records play a crucial role in shaping the community’s development and future. They provide a financial foundation for essential public services, including education, healthcare, infrastructure, and public safety.

The tax system in New Hanover County is carefully designed to ensure that these vital services are adequately funded, while also promoting economic growth and maintaining a high quality of life for residents.

Furthermore, the transparency and accessibility of tax records foster a sense of community engagement and empowerment. Property owners can actively participate in the decision-making process, influencing how their tax dollars are allocated and ensuring that their voices are heard.

Conclusion

New Hanover County’s tax records are more than just administrative documents; they are a reflection of the community’s growth, progress, and aspirations. The county’s commitment to modernization and transparency has resulted in a robust and efficient tax system, benefiting both property owners and the wider community.

As we conclude this comprehensive exploration, we hope to have provided valuable insights into the intricate world of New Hanover County's tax records. For further information and updates, we encourage you to explore the county's official website and stay engaged with the ongoing developments in this dynamic field.

How often are property assessments conducted in New Hanover County?

+Property assessments in New Hanover County are typically conducted annually. This ensures that the assessed value of properties remains up-to-date and reflects any changes or improvements made to the property.

Can I access my property’s tax records online?

+Absolutely! New Hanover County offers an online platform where property owners can access their tax records, including assessment details, payment history, and applicable exemptions. This platform provides a convenient and secure way to manage your property’s tax information.

What are the criteria for qualifying for the Homestead Exemption?

+The Homestead Exemption is available to homeowners who meet specific criteria, such as owning and occupying the property as their primary residence and meeting certain income requirements. It is recommended to review the county’s official guidelines for a detailed understanding of the eligibility criteria.

How can I initiate an appeal for my property’s assessed value?

+To initiate an appeal, property owners can visit the county’s website or the Assessor’s Office in person. The appeal process typically involves submitting a formal request, providing supporting evidence, and attending a hearing to present your case. It is advisable to familiarize yourself with the appeal guidelines and seek professional advice if needed.

Are there any resources available to help me understand the tax system better?

+Absolutely! New Hanover County provides a wealth of resources, including informative guides, webinars, and workshops, to help property owners navigate the tax system. These resources cover a range of topics, from understanding tax rates to exploring available exemptions and relief programs. You can access these resources through the county’s official website or by contacting the Assessor’s Office.