Nc Tax Forms

The North Carolina Department of Revenue provides a comprehensive set of tax forms and resources for individuals and businesses operating within the state. These forms are essential for compliance with North Carolina's tax laws and regulations. Let's delve into the world of Nc Tax Forms, exploring their types, purpose, and the steps involved in filing them accurately.

Understanding the Nc Tax Forms Landscape

Nc Tax Forms encompass a wide range of documents required for various tax purposes. These forms are designed to facilitate the collection of taxes, ensure compliance, and provide taxpayers with a structured way to report their income, deductions, and credits. Here’s an overview of the key forms and their significance:

Individual Income Tax Forms

For North Carolina residents, the Individual Income Tax Forms are of utmost importance. The most commonly used form is the NC-40, which is similar to the federal Form 1040. This form is used to report various sources of income, including wages, salaries, business income, investments, and more. It also allows taxpayers to claim deductions and credits, such as the standard deduction, itemized deductions, and various tax credits.

In addition to the NC-40, North Carolina offers specific forms for unique circumstances. For instance, the NC-4EZ is a simplified version of the NC-40, designed for taxpayers with straightforward tax situations. It provides a quicker and easier filing process for those with limited income and deductions.

Business and Corporate Tax Forms

North Carolina businesses have their own set of tax forms to comply with. The NC-250 series of forms is used by corporations, partnerships, and limited liability companies (LLCs) to report their business income and calculate their tax liabilities. These forms cover various business entities and structures, ensuring that each type of business adheres to the state’s tax regulations.

For businesses with complex tax situations, the NC-550 series provides a more detailed reporting mechanism. These forms are used for entities such as S corporations, estates, trusts, and non-resident entities, offering a comprehensive way to report income, expenses, and deductions specific to these business types.

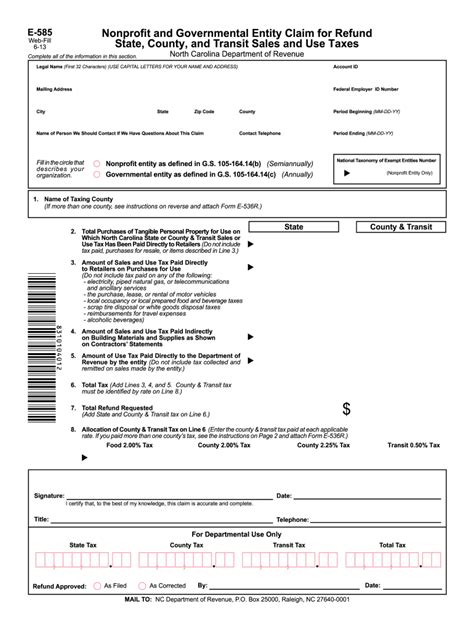

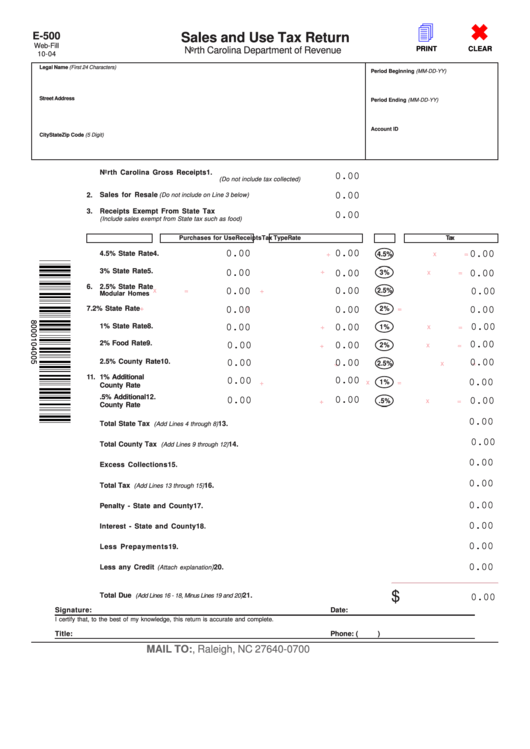

Sales and Use Tax Forms

North Carolina’s sales and use tax forms are crucial for businesses involved in selling goods or providing services. The E-500 series of forms is used for reporting and remitting sales and use taxes. These forms require businesses to report their taxable sales, purchases, and use taxes, ensuring compliance with the state’s sales tax laws.

Additionally, North Carolina provides specific forms for various sales tax scenarios. For example, the E-505 form is used for reporting sales tax on certain direct-pay transactions, while the E-501 form is designed for businesses that collect and remit sales tax on a monthly basis.

Navigating the Nc Tax Forms Process

Filing Nc Tax Forms accurately is a critical task for taxpayers and businesses alike. Here’s a step-by-step guide to help you navigate the process:

-

Determine Your Tax Liability: Before selecting the appropriate forms, understand your tax liability. Calculate your income, deductions, and credits to estimate your tax obligation. This step is crucial for choosing the right forms and ensuring accurate reporting.

-

Choose the Right Forms: Based on your tax situation, select the forms that best fit your needs. Whether you're an individual taxpayer, a business owner, or a representative of a complex business entity, the North Carolina Department of Revenue provides clear guidelines on which forms to use.

-

Gather Necessary Information: Collect all the required documents and information to complete the forms accurately. This includes W-2 forms, 1099 forms, business records, and any other relevant documentation. Ensure that you have the latest versions of the forms to avoid any discrepancies.

-

Complete the Forms: Carefully fill out the chosen forms, providing accurate and complete information. Pay attention to the instructions provided with each form, as they offer valuable guidance on how to report specific items.

-

Calculate Your Taxes: Use the formulas and guidelines provided in the forms to calculate your tax liability. This step is crucial for determining the amount of tax you owe or the refund you're entitled to.

-

Review and Sign: Before submitting your forms, thoroughly review them for accuracy. Ensure that all the information is correct, and sign the forms where required. This step is essential to avoid potential errors and ensure compliance.

-

Submit Your Forms: Finally, submit your completed forms to the North Carolina Department of Revenue according to the instructions provided. You can submit the forms electronically or by mail, depending on your preference and the form's requirements.

By following these steps, you can navigate the Nc Tax Forms process with confidence, ensuring compliance and accurate reporting. Remember, staying informed about the latest tax regulations and forms is essential for a smooth filing experience.

FAQs about Nc Tax Forms

Where can I find the latest versions of Nc Tax Forms?

+The North Carolina Department of Revenue’s official website is the most reliable source for the latest tax forms. You can access them directly from their website or download them as PDF files for offline use.

Are there any deadlines for filing Nc Tax Forms?

+Yes, North Carolina has specific deadlines for filing tax returns. For individual income tax returns, the deadline is typically April 15th. However, it’s crucial to check the official website for any updates or changes to these deadlines, especially during tax season.

Can I file my Nc Tax Forms electronically?

+Absolutely! North Carolina offers electronic filing options for many tax forms. You can use their online filing system or authorized e-file providers to submit your forms securely and efficiently. Electronic filing often provides faster processing and reduced errors.

What if I need assistance with completing my Nc Tax Forms?

+The North Carolina Department of Revenue provides extensive resources and guidance on their website. They offer help articles, tax tips, and even a live chat feature for immediate assistance. Additionally, you can consult a tax professional or accountant for personalized help.

Are there any penalties for late filing or non-compliance with Nc Tax Forms?

+Yes, North Carolina imposes penalties for late filing and non-compliance. These penalties can include interest on unpaid taxes and additional fees. It’s crucial to file your tax forms on time and ensure accuracy to avoid any penalties.