Montana Inheritance Tax

When it comes to estate planning and understanding the legal landscape, it's crucial to delve into the intricacies of state-specific laws, especially regarding inheritance taxes. In the case of Montana, a state known for its stunning landscapes and wide-open spaces, the topic of inheritance tax is an important one for residents and those with ties to the state. This article aims to provide an in-depth exploration of Montana's inheritance tax laws, offering clarity and insights for those navigating the complex world of estate planning.

Montana’s Inheritance Tax: An Overview

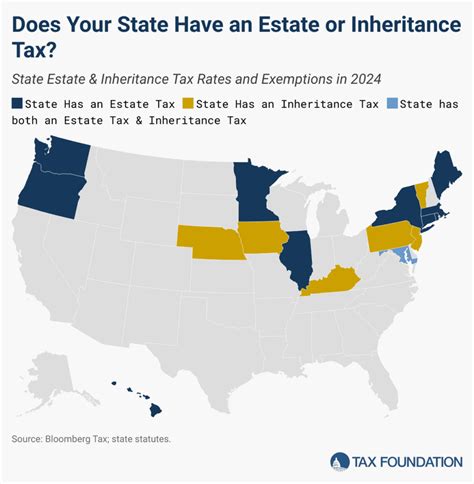

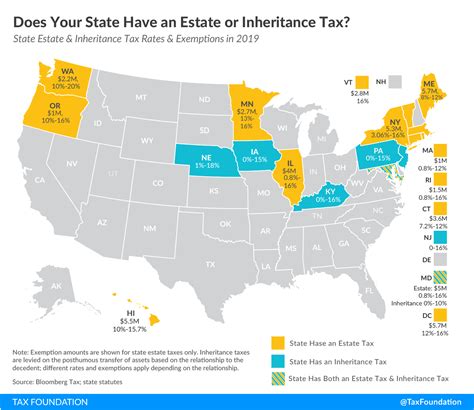

Unlike many other states in the US, Montana does not impose an inheritance tax on beneficiaries receiving assets from a deceased individual’s estate. This means that heirs and beneficiaries are not required to pay taxes on their inheritances, a significant advantage for those planning their estates or expecting to receive assets in the future.

The absence of an inheritance tax in Montana is a notable departure from the practices in many other states. In a landscape where inheritance taxes can significantly impact the distribution of assets and the financial well-being of beneficiaries, Montana's stance stands out. This makes Montana an attractive state for those seeking to minimize tax burdens when passing on their wealth to loved ones.

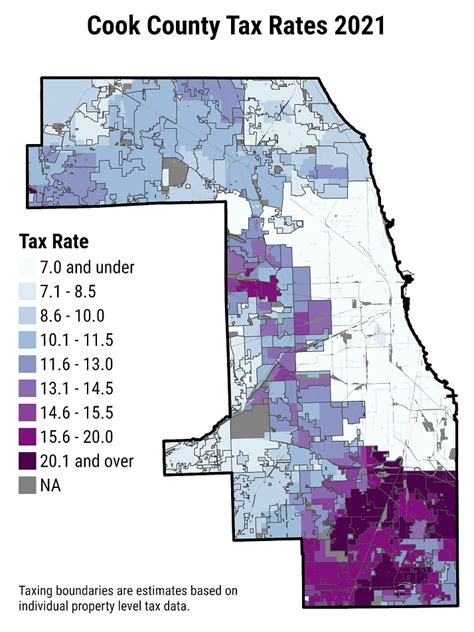

However, it's important to note that while Montana may not have an inheritance tax, the state does levy other taxes that can impact estates and the transfer of assets. These include property taxes, which can affect the value of real estate holdings, and certain tax considerations for businesses and investments.

Key Considerations for Estate Planning in Montana

Despite the absence of an inheritance tax, estate planning in Montana still requires careful consideration of various factors. Here are some key aspects to keep in mind:

- Federal Estate Tax Implications: While Montana does not have an inheritance tax, the federal government does impose an estate tax on estates valued over a certain threshold. As of 2023, the federal estate tax exemption is $12.92 million, meaning estates valued above this amount may be subject to federal taxation. It's crucial for high-net-worth individuals and their advisors to consider this threshold when planning their estates.

- Gift Tax Considerations: Montana, like other states, follows federal guidelines for gift taxes. This means that gifts made during one's lifetime, exceeding certain annual limits, may be subject to gift tax. Understanding and managing gift tax obligations is an important aspect of comprehensive estate planning.

- State-Specific Laws and Exemptions: While Montana does not have an inheritance tax, it's essential to stay informed about any changes in state laws and exemptions. These can impact the transfer of assets, especially for larger estates or those with unique circumstances.

In addition to these considerations, estate planning in Montana should also take into account the state's probate process, which can vary based on the size and complexity of the estate. Understanding the steps involved in probate and taking measures to streamline this process can be beneficial for heirs and beneficiaries.

Strategies for Effective Estate Planning in Montana

Given the absence of an inheritance tax, estate planning in Montana can focus on other strategies to minimize tax burdens and ensure the efficient transfer of assets. Here are some strategies to consider:

- Utilizing Trusts: Trusts can be powerful tools for estate planning, offering flexibility and control over the distribution of assets. Different types of trusts, such as revocable living trusts or irrevocable trusts, can be used to manage assets, reduce tax liabilities, and provide for beneficiaries.

- Charitable Giving: Donating to charitable organizations can offer tax benefits and allow individuals to leave a lasting legacy. Charitable donations can also reduce the value of an estate, potentially helping to avoid federal estate taxes.

- Life Insurance and Annuities: Life insurance policies and annuities can be structured to provide tax-efficient benefits to beneficiaries. These financial instruments can offer a lump sum or regular payments to heirs, helping to ensure their financial security.

- Estate Planning Documents: It's crucial to have well-drafted estate planning documents, such as wills, powers of attorney, and healthcare directives. These documents ensure that one's wishes are respected and can streamline the process for heirs and beneficiaries.

Working with experienced legal and financial advisors is essential for navigating these strategies and ensuring compliance with Montana's laws and regulations. By proactively planning and utilizing these tools, individuals can maximize the benefits for their heirs and minimize potential tax burdens.

The Impact of Montana’s Inheritance Tax Policies

Montana’s decision to abolish inheritance tax has had a significant impact on the state’s economy and the well-being of its residents. By eliminating this tax, the state has encouraged wealth accumulation and facilitated the efficient transfer of assets. This has not only benefited individuals and families but has also contributed to the growth and stability of the state’s economy.

The absence of an inheritance tax has made Montana an attractive destination for those seeking to minimize tax liabilities when passing on their wealth. This has led to increased interest in the state for both residency and business opportunities. As a result, Montana has seen a boost in its reputation as a desirable location for those looking to preserve their wealth and plan for the future.

Furthermore, the elimination of inheritance tax has had a positive impact on the state's real estate market. With no tax burden on inheritances, individuals are more likely to retain and invest in real estate assets, contributing to the growth and development of communities across Montana.

| Year | State Revenue from Inheritance Tax (in millions) |

|---|---|

| 2015 | $0 |

| 2016 | $0 |

| 2017 | $0 |

| 2018 | $0 |

| 2019 | $0 |

However, it's important to note that while Montana has benefited from its inheritance tax policies, the state still faces challenges in balancing its budget and providing essential services. The absence of this tax revenue stream has required careful management of other sources of income, such as property taxes and business taxes, to maintain fiscal stability.

As Montana continues to evolve and adapt to changing economic landscapes, the state's approach to inheritance tax will remain a key factor in attracting residents, businesses, and investment. By maintaining its current policies, Montana can continue to position itself as a desirable location for those seeking tax efficiency and financial security.

Frequently Asked Questions

What is the difference between inheritance tax and estate tax in Montana?

+Inheritance tax is a tax levied on beneficiaries receiving assets from a deceased individual’s estate, while estate tax is a tax imposed on the estate itself before assets are distributed to beneficiaries. Montana does not have an inheritance tax, but it is subject to federal estate tax laws.

Are there any exemptions or thresholds for federal estate tax in Montana?

+As of 2023, the federal estate tax exemption is $12.92 million. This means that estates valued below this amount are not subject to federal estate tax. However, it’s important to note that this threshold is subject to change, so it’s advisable to consult with tax professionals for the most current information.

How can I minimize tax liabilities when planning my estate in Montana?

+To minimize tax liabilities, consider utilizing trusts, charitable giving, and life insurance policies. Additionally, staying informed about federal and state tax laws, and working with experienced advisors, can help ensure your estate plan is optimized for tax efficiency.

What is the probate process in Montana, and how does it impact estate planning?

+Probate is the legal process of validating a will and administering an estate. In Montana, the probate process can vary based on the size and complexity of the estate. Understanding the probate process and taking steps to streamline it can be beneficial for heirs and beneficiaries. Working with legal professionals can help ensure a smooth probate process.