Cook County Il Sales Tax

Welcome to an in-depth exploration of the Cook County, Illinois, sales tax system. This comprehensive guide aims to provide a clear understanding of how sales tax operates in one of the most populous counties in the United States. With its complex tax structure and unique policies, Cook County's sales tax system presents an intriguing subject for those interested in finance, economics, and local governance.

Understanding the Cook County Sales Tax

Cook County’s sales tax is a vital component of the county’s revenue generation strategy, contributing significantly to the funding of various public services and infrastructure projects. The tax is imposed on the sale of goods and services within the county’s jurisdiction, with rates varying based on several factors.

The sales tax in Cook County is not a flat rate but rather a combination of state, county, and municipal taxes. This layered structure adds complexity to the system, as it requires businesses and consumers to navigate different tax rates depending on their location and the nature of the transaction.

State Sales Tax

Illinois, the state in which Cook County is located, levies a state sales tax rate of 6.25%. This rate applies uniformly across the state, including Cook County. The state sales tax contributes to funding essential state-wide services and initiatives.

Cook County Sales Tax

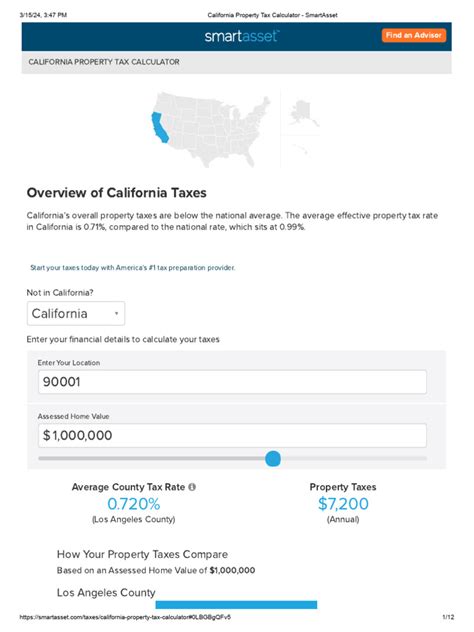

On top of the state sales tax, Cook County imposes its own additional sales tax to support county-specific projects and operations. The Cook County sales tax rate currently stands at 1.25%, making the total sales tax rate in the county 7.5% when combined with the state tax.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.25% |

| Cook County Sales Tax | 1.25% |

| Total Sales Tax | 7.5% |

The revenue generated from the Cook County sales tax is allocated to critical areas such as public safety, healthcare, education, and transportation. This funding ensures the county can provide essential services to its residents and maintain its infrastructure.

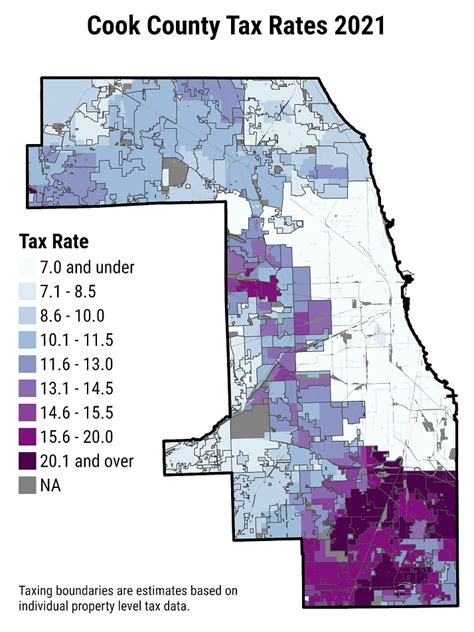

Municipal Sales Taxes

Within Cook County, there are several municipalities, each with their own sales tax jurisdictions. These municipalities have the authority to impose additional sales taxes to support their local operations and projects. As a result, the total sales tax rate can vary depending on the specific location within the county.

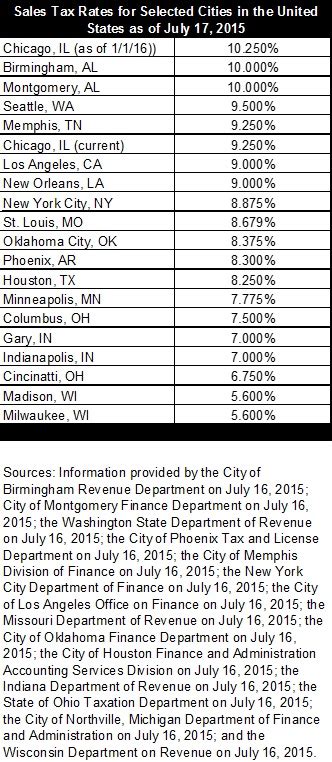

For instance, the city of Chicago, which is a major municipality within Cook County, levies an additional 1.25% sales tax on top of the state and county rates, resulting in a total sales tax of 8.75% within the city limits. Other municipalities may have different rates, leading to a patchwork of sales tax rates across the county.

Sales Tax Exemptions and Special Considerations

Cook County’s sales tax system is not a straightforward one-size-fits-all approach. It incorporates various exemptions and special considerations that can impact the tax liability of both businesses and consumers.

Exemptions for Essential Goods and Services

Certain goods and services are exempt from sales tax in Cook County. These exemptions are designed to reduce the tax burden on essential items and services, making them more affordable for residents. Some common exemptions include:

- Prescription medications

- Certain medical devices

- Food for home consumption

- Clothing and footwear (up to a certain value)

- Educational materials

- Residential utility services

By exempting these items, Cook County aims to alleviate the financial strain on residents, particularly those with lower incomes, and ensure that essential goods and services remain accessible.

Special Considerations for Tourism and Hospitality

The county’s sales tax system also recognizes the importance of the tourism and hospitality industries. To support these sectors, Cook County has implemented a hotel occupancy tax and a restaurant tax in addition to the standard sales tax.

The hotel occupancy tax is imposed on the rent or lease of a hotel room, with the rate varying depending on the municipality. Similarly, the restaurant tax is levied on the sale of prepared meals and beverages, providing additional revenue to support the hospitality industry and promote tourism within the county.

Compliance and Administration of Sales Tax

Ensuring compliance with the Cook County sales tax system is a complex task that involves various stakeholders, including businesses, consumers, and government agencies.

Responsibilities of Businesses

Businesses operating within Cook County are responsible for collecting and remitting the appropriate sales taxes to the relevant authorities. This includes calculating the correct tax rate based on the location of the sale and the nature of the transaction.

Businesses must also maintain accurate records of sales transactions, including the breakdown of taxable and exempt items. These records are crucial for audits and ensuring compliance with tax laws.

Consumer Awareness and Education

Consumers in Cook County play a vital role in the sales tax system by understanding their tax obligations and rights. It is essential for consumers to be aware of the applicable sales tax rates and to ensure that businesses are charging the correct rates.

Consumer education also extends to understanding their rights when it comes to sales tax exemptions and special considerations. By being informed, consumers can advocate for themselves and ensure they are not overcharged or subjected to unfair tax practices.

Role of Government Agencies

Government agencies, particularly the Illinois Department of Revenue and the Cook County Department of Revenue, play a crucial role in administering and enforcing the sales tax system. These agencies are responsible for setting tax rates, providing guidance to businesses and consumers, conducting audits, and resolving disputes.

The Illinois Department of Revenue, in particular, oversees the collection and distribution of state sales tax, while the Cook County Department of Revenue focuses on the county and municipal sales taxes. Both agencies work together to ensure a fair and efficient sales tax system in the county.

Impact of Sales Tax on the Local Economy

The Cook County sales tax system has a significant impact on the local economy, influencing consumer behavior, business operations, and overall economic growth.

Consumer Spending and Tax Burden

The sales tax rate in Cook County can directly affect consumer spending habits. Higher tax rates can lead to a reduction in discretionary spending, as consumers may opt to reduce their purchases or seek out lower-taxed alternatives. This dynamic can impact local businesses, particularly those in the retail and hospitality sectors.

Additionally, the sales tax burden can disproportionately affect lower-income households, as a larger portion of their income may be spent on sales-taxable items. This can contribute to economic disparities within the county.

Business Operations and Competitiveness

For businesses, the sales tax system in Cook County can present both challenges and opportunities. Higher tax rates can increase the cost of doing business, particularly for small and medium-sized enterprises (SMEs), potentially impacting their profitability and competitiveness.

However, the sales tax system also provides a stable source of revenue for the county, which can be reinvested into public services and infrastructure, creating a more attractive business environment in the long term. Additionally, the various exemptions and special considerations can benefit certain sectors, promoting economic growth and innovation.

Economic Growth and Development

The revenue generated from the Cook County sales tax is a crucial component of the county’s economic development strategy. It allows for the funding of essential services and infrastructure projects, which can enhance the quality of life for residents and attract new businesses and investments.

Furthermore, the sales tax system can incentivize certain economic activities. For instance, the tourism and hospitality sectors may benefit from the additional taxes levied on hotel stays and restaurant meals, encouraging further investment and growth in these industries.

Future Implications and Potential Reforms

As with any tax system, the Cook County sales tax is subject to ongoing evaluation and potential reforms. As economic conditions change and new challenges arise, the county may need to adapt its tax policies to remain effective and equitable.

Potential Reforms and Modernization

One potential area of reform is the simplification of the sales tax system. With multiple tax rates and jurisdictions, the current system can be complex and confusing for both businesses and consumers. Simplifying the tax structure could improve compliance, reduce administrative burdens, and enhance overall efficiency.

Additionally, as e-commerce continues to grow, there may be a need to update the sales tax system to accommodate online sales and ensure that all transactions are taxed fairly. This could involve exploring new technologies and partnerships to streamline the collection and remittance of sales taxes for online businesses.

Balancing Revenue Generation and Economic Impact

When considering reforms, it is essential to balance the need for revenue generation with the potential economic impact of tax changes. While higher tax rates can generate more revenue, they may also deter consumer spending and impact the competitiveness of local businesses. Finding the right balance is crucial for maintaining a healthy and vibrant local economy.

Moreover, any reforms should aim to promote equity and fairness. This could involve reevaluating the distribution of tax burdens, ensuring that all residents and businesses contribute fairly to the county's revenue stream, and that the benefits of tax revenue are distributed equitably across the community.

Conclusion

The Cook County sales tax system is a complex yet vital component of the county’s financial and economic landscape. It plays a critical role in funding public services, supporting local businesses, and driving economic growth. By understanding the intricacies of this system, businesses, consumers, and policymakers can navigate the tax landscape effectively and contribute to a thriving Cook County economy.

What is the current sales tax rate in Cook County, Illinois?

+

The current sales tax rate in Cook County, Illinois, is 7.5%, which includes the state sales tax rate of 6.25% and the additional Cook County sales tax rate of 1.25%. However, it’s important to note that municipal sales taxes may vary, leading to different total rates within the county.

Are there any sales tax exemptions in Cook County?

+

Yes, Cook County has various sales tax exemptions, including prescription medications, certain medical devices, food for home consumption, clothing and footwear (up to a certain value), educational materials, and residential utility services. These exemptions aim to reduce the tax burden on essential items and services.

How does Cook County’s sales tax impact local businesses and consumers?

+

The sales tax rate can influence consumer spending habits and impact the competitiveness of local businesses. Higher tax rates may reduce discretionary spending and affect lower-income households disproportionately. However, the sales tax system also provides a stable revenue stream for public services and infrastructure development, which can enhance the local economy.

What are the responsibilities of businesses regarding sales tax compliance in Cook County?

+

Businesses in Cook County are responsible for collecting and remitting the appropriate sales taxes to the relevant authorities. This includes calculating the correct tax rate based on the location of the sale and maintaining accurate records of sales transactions. Compliance with tax laws is crucial to avoid penalties and maintain a positive business reputation.

Are there any potential reforms or updates planned for the Cook County sales tax system?

+

Yes, there is ongoing discussion about potential reforms to simplify the sales tax system and adapt it to the growing e-commerce sector. These reforms aim to improve compliance, reduce administrative burdens, and ensure a fair and efficient tax system. It’s essential to stay informed about any updates to navigate the tax landscape effectively.